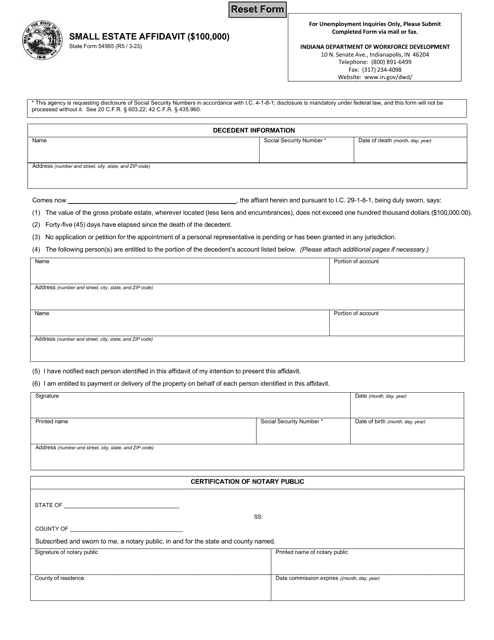

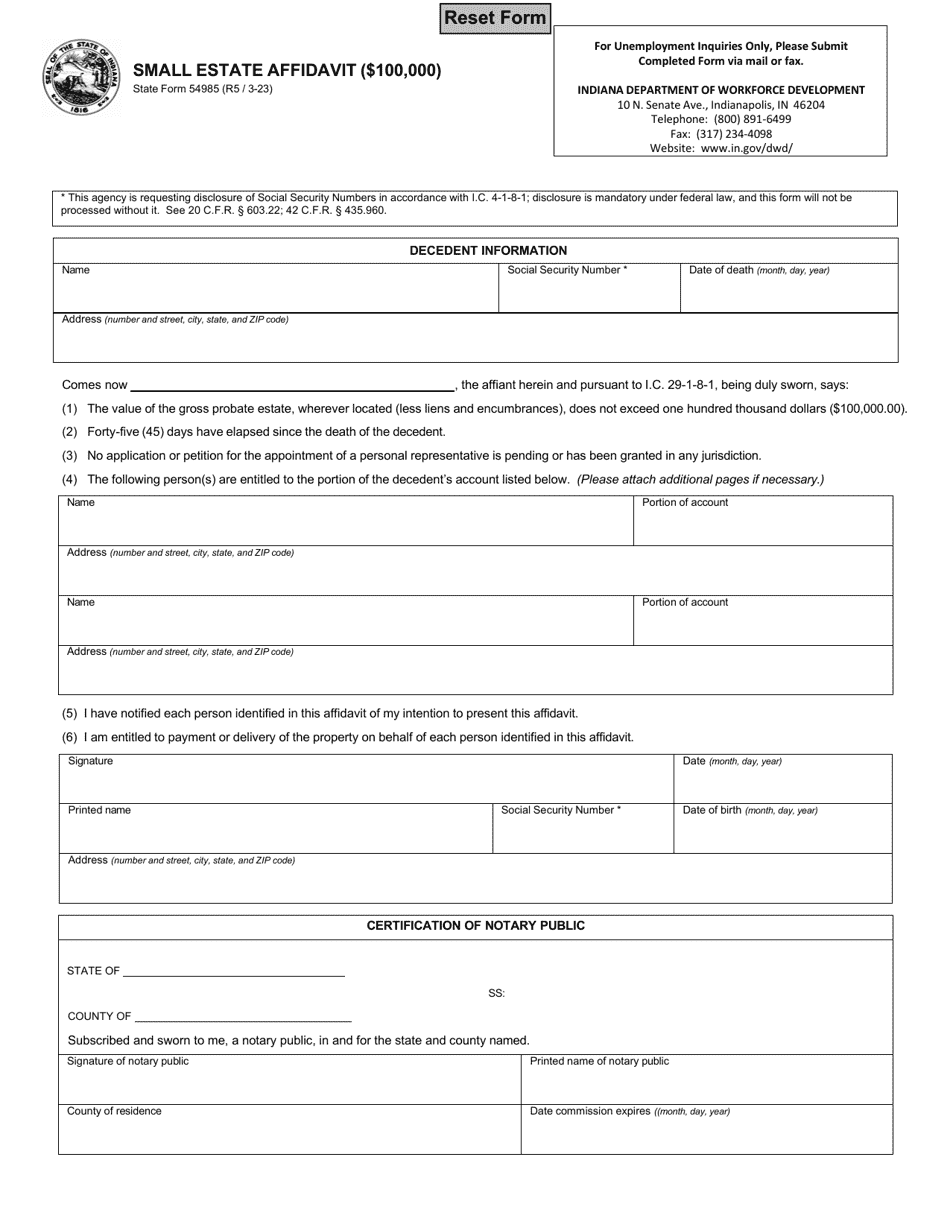

State Form 54985 Small Estate Affidavit ($100,000) - Indiana

What Is State Form 54985?

This is a legal form that was released by the Indiana Department of Workforce Development - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 54985 Small Estate Affidavit?

A: Form 54985 Small Estate Affidavit is a legal document used in Indiana to simplify the transfer of assets of a deceased person with a small estate.

Q: What is considered a small estate in Indiana?

A: In Indiana, a small estate is one that has a value of $100,000 or less.

Q: Who can use Form 54985 Small Estate Affidavit?

A: The form can be used by the legal heirs of the deceased person to transfer the assets without going through a formal probate process.

Q: What information is needed to complete Form 54985?

A: The form requires information about the deceased person, their assets, and the heirs who are entitled to receive the assets.

Q: Do I need a lawyer to complete Form 54985?

A: While it is not required, consulting with a lawyer can ensure that you follow all the necessary legal requirements.

Q: What happens after I submit Form 54985?

A: Once the form is filed with the court, the assets can be transferred to the heirs mentioned in the affidavit.

Q: Can I use Form 54985 for an estate worth more than $100,000?

A: No, this form is only applicable for estates with a value of $100,000 or less in Indiana.

Q: Are there any fees associated with filing Form 54985?

A: Yes, there are filing fees associated with submitting the form to the court. The fees may vary depending on the county.

Q: How long does it take to process Form 54985?

A: The processing time may vary, but it generally takes a few weeks for the court to review and approve the affidavit.

Form Details:

- Released on March 1, 2023;

- The latest edition provided by the Indiana Department of Workforce Development;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 54985 by clicking the link below or browse more documents and templates provided by the Indiana Department of Workforce Development.