Domestic Partner Inheritance Tax Exemption for Real Property - Howard County, Maryland

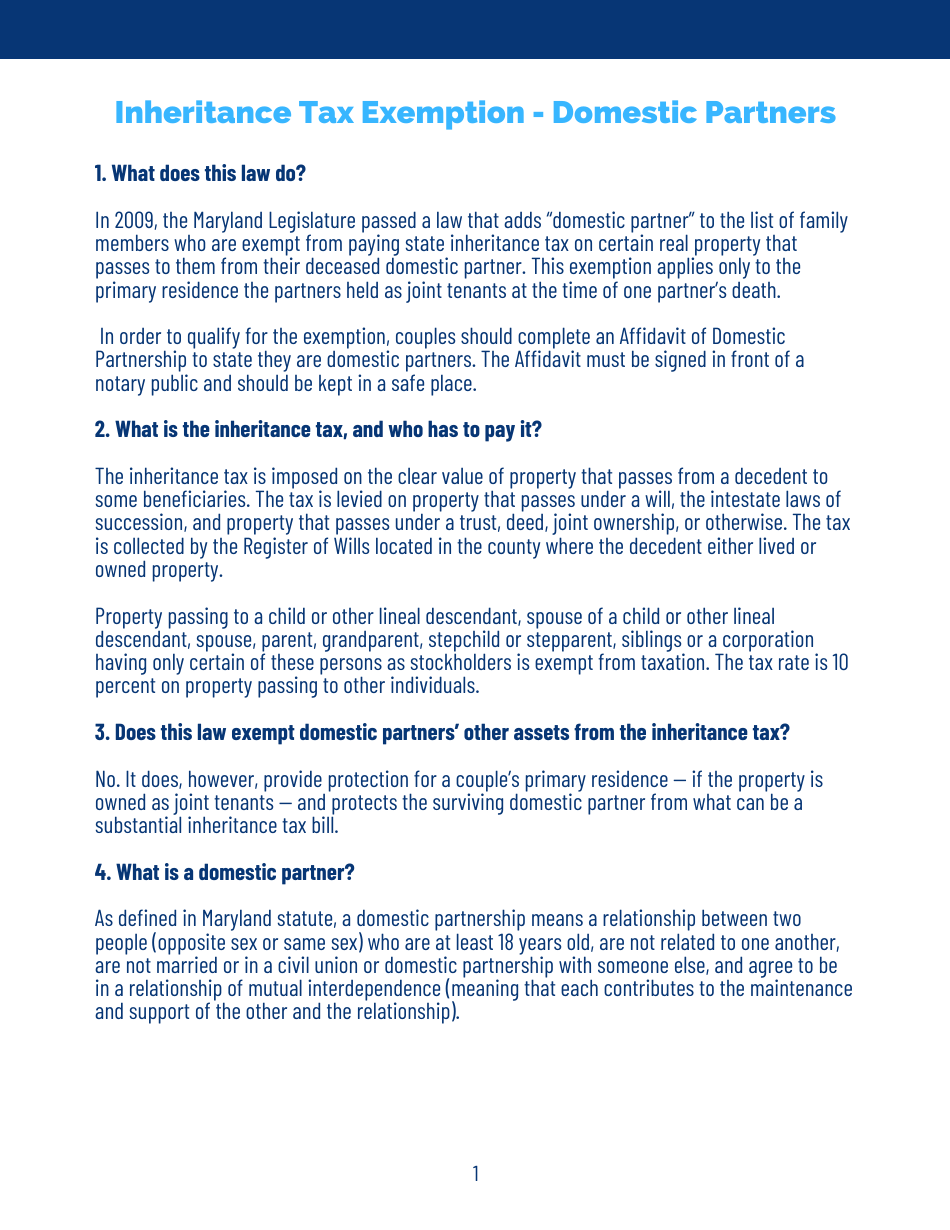

The Domestic Partner Inheritance Tax Exemption for Real Property in Howard County, Maryland is in place to protect domestic partners from facing inheritance tax on real property (real estate including land, buildings, and other improvements) they inherit from each other when one of them dies. Just like spouses, domestic partners are given this exemption to ease the potential financial burden that could arise upon the death of a partner. Therefore, when a domestic partner inherits real property owned by their deceased partner in Howard County, they do not have to pay the standard inheritance tax that would be charged to non-related individuals.

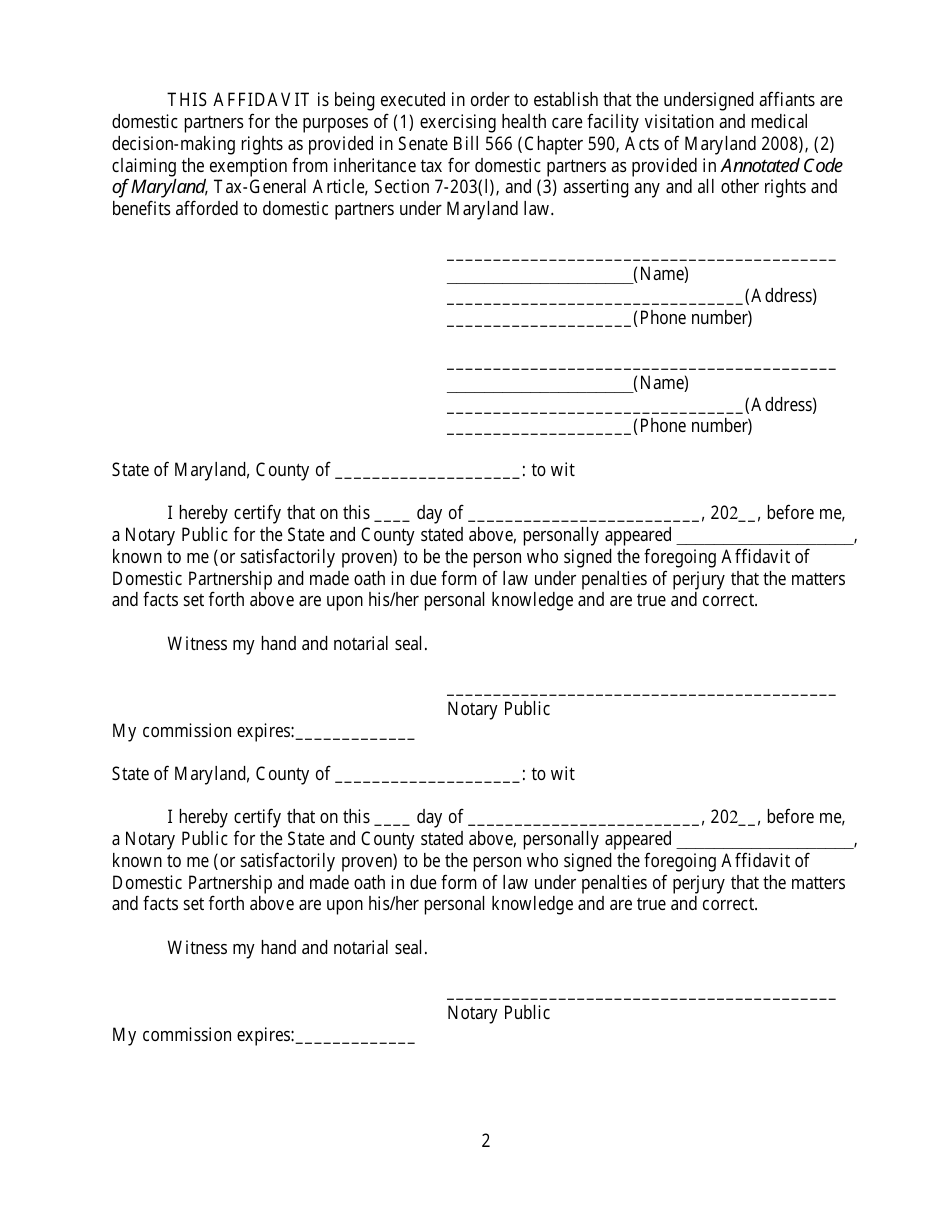

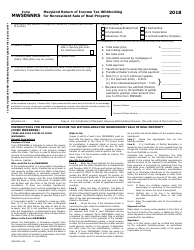

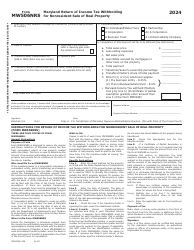

The Domestic Partner Inheritance Tax Exemption for Real Property in Howard County, Maryland, is filed by the surviving domestic partner of the deceased. This is to claim an exemption on inheritance tax for the property they shared with their deceased domestic partner. Before filing, it's advisable that the surviving partner consults with a tax or legal professional to ensure they meet the eligibility criteria. The Maryland Department of Assessments and Taxation will be the agency handling these matters.

FAQ

Q: What is a domestic partner inheritance tax exemption?

A: Domestic partner inheritance tax exemption refers to a legal provision that allows domestic partners to leave their property to each other without their partner having to pay inheritance tax upon receiving it.

Q: Does Domestic Partner Inheritance Tax Exemption apply to real property in Howard County, Maryland?

A: Yes, Domestic Partner Inheritance Tax Exemption does apply to real property in Howard County, Maryland. This exemption allows a domestic partner to inherit real property (such as a house) without having to pay inheritance tax.

Q: Who qualifies as a domestic partner in Howard County, Maryland?

A: In Howard County, Maryland, a domestic partner can be either of the same or opposite sex who shares an intimate and committed relationship, maintains a mutual residence, and shares at least one major life expense that goes beyond the shared residence. Both partners should also be at least 18 years old and not be blood relatives.

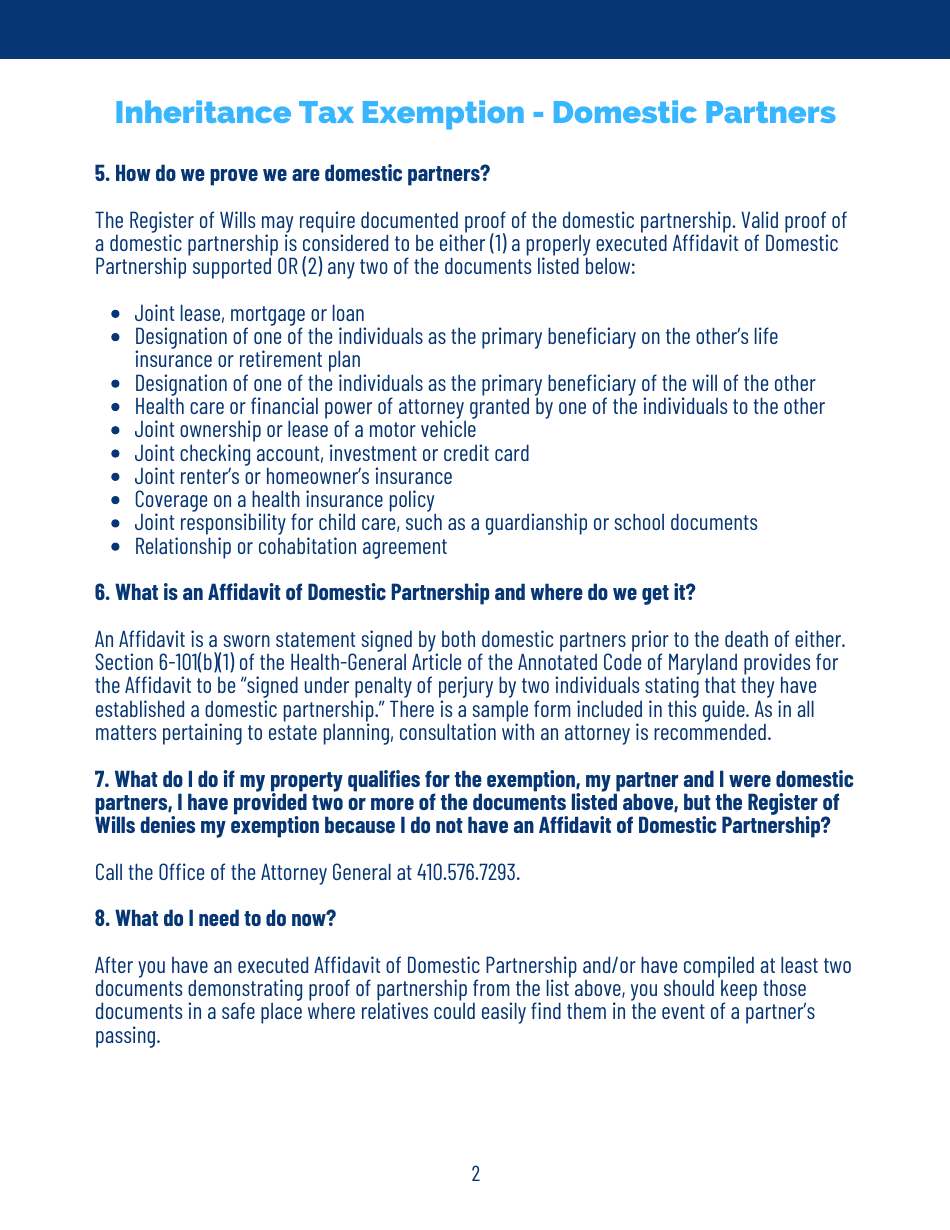

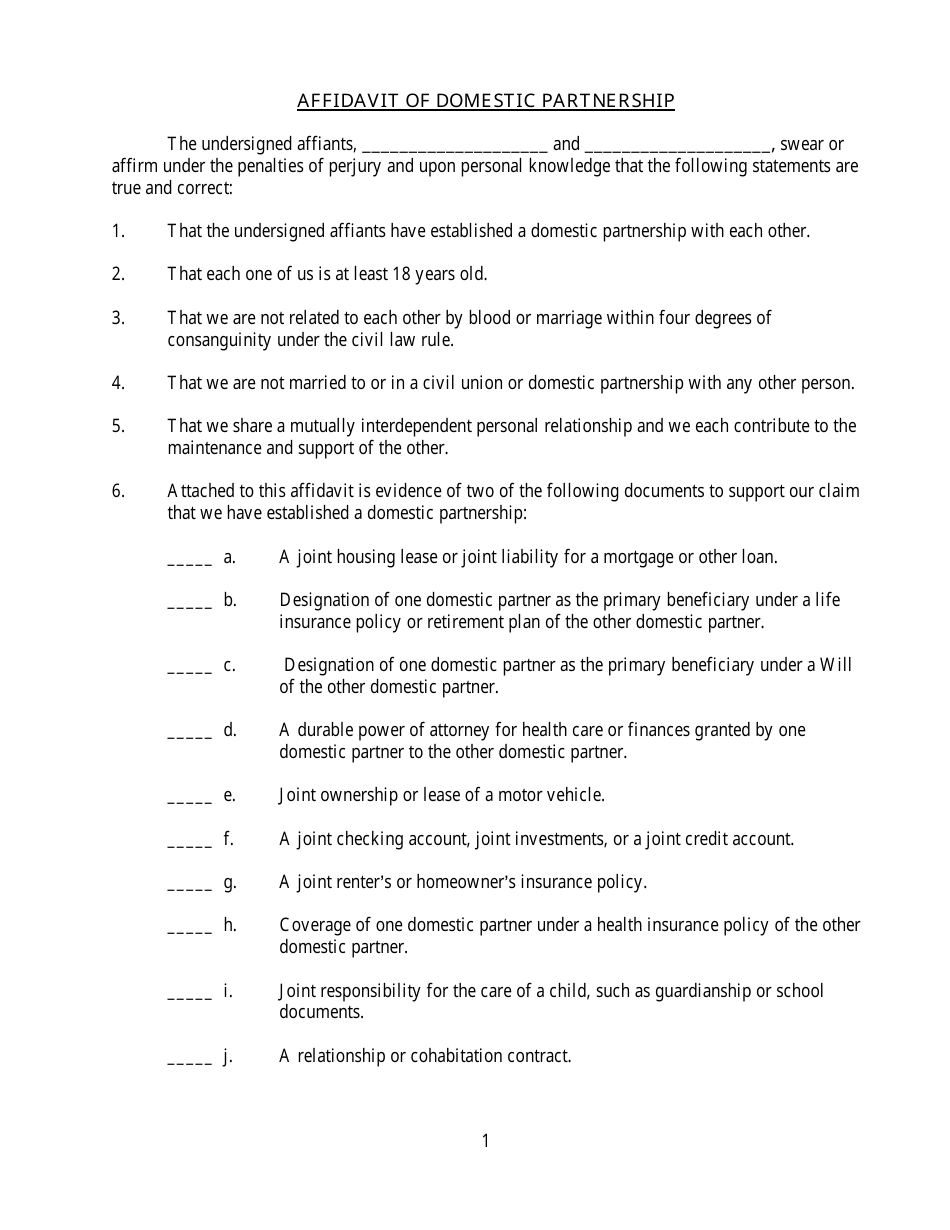

Q: How can I claim the Domestic Partner Inheritance Tax Exemption in Howard County, Maryland?

A: To claim the Domestic Partner Inheritance Tax Exemption in Howard County, Maryland, you generally need to prove your domestic partnership through documentation such as shared bills or a shared lease and provide it to the tax authority when you file your inheritance tax return.

Q: What is the impact of the Domestic Partner Inheritance Tax Exemption in Howard County, Maryland?

A: The Domestic Partner Inheritance Tax Exemption can have substantial financial benefits for domestic partners in Howard County, Maryland. It allows a domestic partner to potentially save thousands of dollars that would have otherwise been payable as inheritance tax.

Q: Is the Domestic Partner Inheritance Tax Exemption applicable to property other than real estate?

A: Yes, the Domestic Partner Inheritance Tax Exemption in Howard County, Maryland typically applies to all forms of property, not just real estates. This includes personal property like vehicles, jewelry, or money in a bank account.