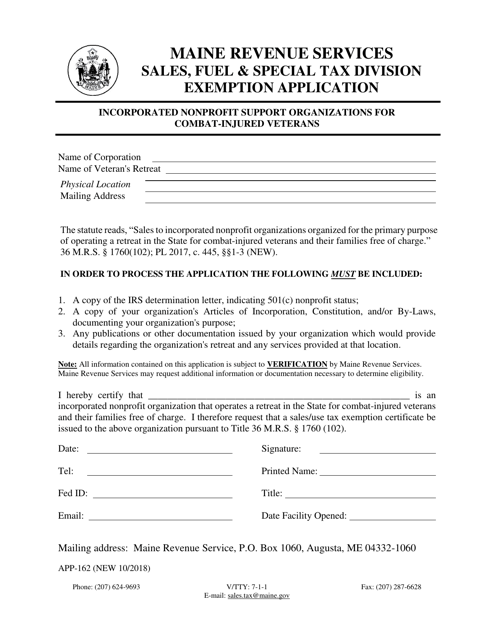

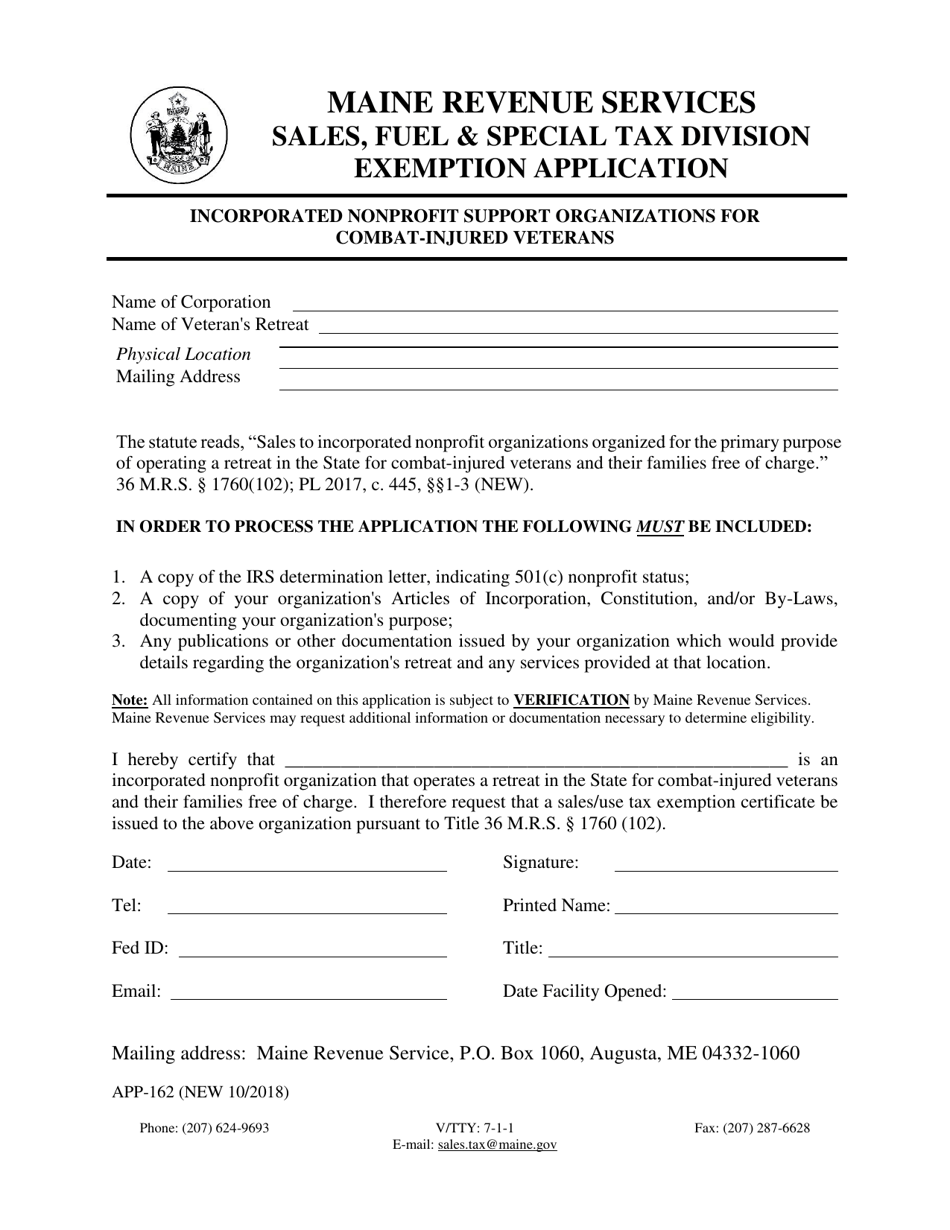

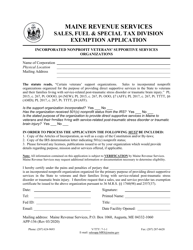

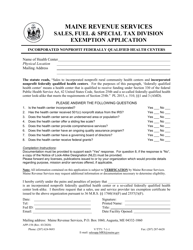

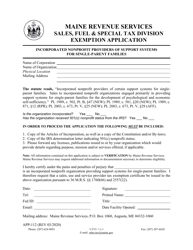

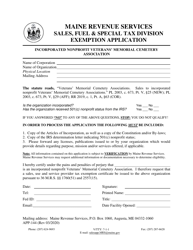

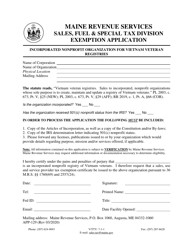

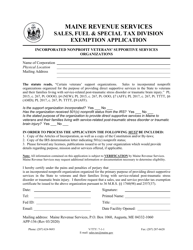

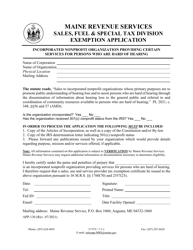

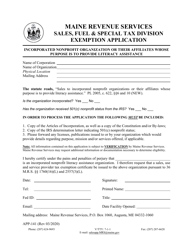

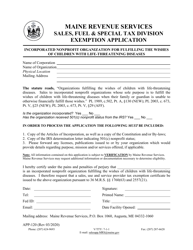

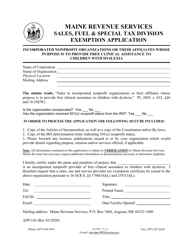

Form APP-162 Incorporated Nonprofit Support Organizations for Combat-Injured Veterans Exemption Application - Maine

What Is Form APP-162?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the APP-162 form?

A: The APP-162 form is the application for the incorporated nonprofit support organizations for Combat-Injured Veterans Exemption in Maine.

Q: Who can file the APP-162 form?

A: Incorporated nonprofit support organizations that are providing assistance to combat-injured veterans in Maine can file the APP-162 form.

Q: What is the purpose of the form?

A: The purpose of the form is to apply for an exemption from property tax for incorporated nonprofit support organizations that assist combat-injured veterans.

Q: What is the eligibility criteria for the exemption?

A: To be eligible for the exemption, the organization must be incorporated, provide support specifically to combat-injured veterans, and meet other requirements specified in the form.

Q: Are there any fees associated with filing the form?

A: There are no fees associated with filing the APP-162 form.

Q: What supporting documents do I need to submit with the form?

A: The specific supporting documents required are listed in the form instructions, but generally, you will need to provide proof of incorporation and documentation regarding support provided to combat-injured veterans.

Q: Is there a deadline for submitting the form?

A: The APP-162 form must be filed on or before April 1st of the tax year for which the exemption is sought.

Q: How long does the exemption last?

A: The exemption is valid for one year and must be renewed annually by filing a new APP-162 form.

Q: Who should I contact for more information?

A: For more information, you can contact the Maine Revenue Services office or refer to the instructions provided with the APP-162 form.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form APP-162 by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.