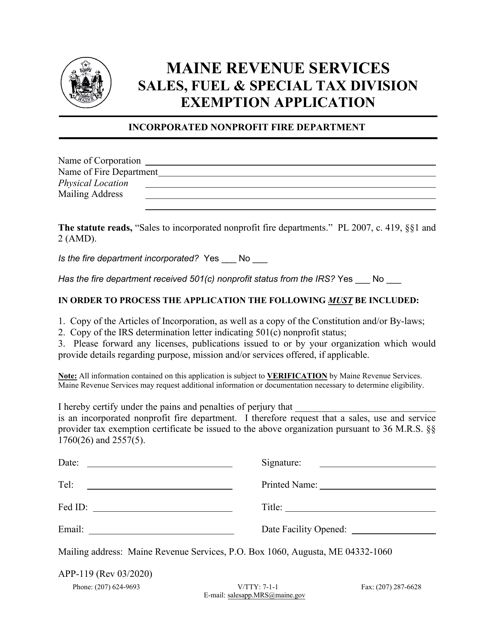

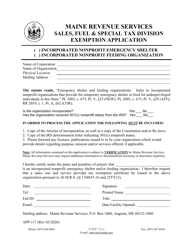

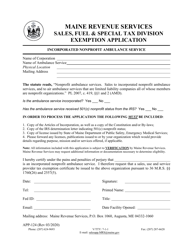

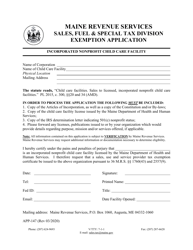

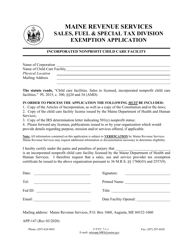

Form APP-119 Incorporated Nonprofit Fire Department Exemption Application - Maine

What Is Form APP-119?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form APP-119?

A: The Form APP-119 is an application for the Incorporated Nonprofit Fire Department Exemption in Maine.

Q: Who is eligible to apply for the Incorporated Nonprofit Fire Department Exemption in Maine?

A: Incorporated nonprofit fire departments in Maine are eligible to apply for this exemption.

Q: What is the purpose of the Incorporated Nonprofit Fire Department Exemption?

A: The purpose of this exemption is to provide tax relief to nonprofit fire departments in Maine.

Q: What information is required on the Form APP-119?

A: The Form APP-119 requires information about the nonprofit fire department, its officers, and its activities.

Q: Is there a deadline for submitting the Form APP-119?

A: Yes, the Form APP-119 must be submitted to the Maine Revenue Services by April 1st of each year.

Q: What are the benefits of the Incorporated Nonprofit Fire Department Exemption?

A: The benefits of this exemption include property tax exemption and sales tax exemption for qualifying purchases.

Q: Are there any fees associated with the Form APP-119?

A: No, there are no fees associated with the Form APP-119 application.

Q: Can a nonprofit fire department appeal if their application for exemption is denied?

A: Yes, a nonprofit fire department has the right to appeal if their application for exemption is denied.

Q: Who should I contact for more information about the Incorporated Nonprofit Fire Department Exemption?

A: You can contact the Maine Revenue Services for more information about this exemption.

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form APP-119 by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.