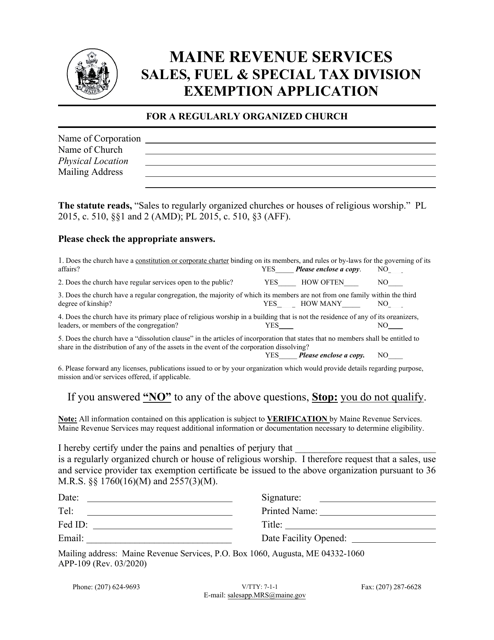

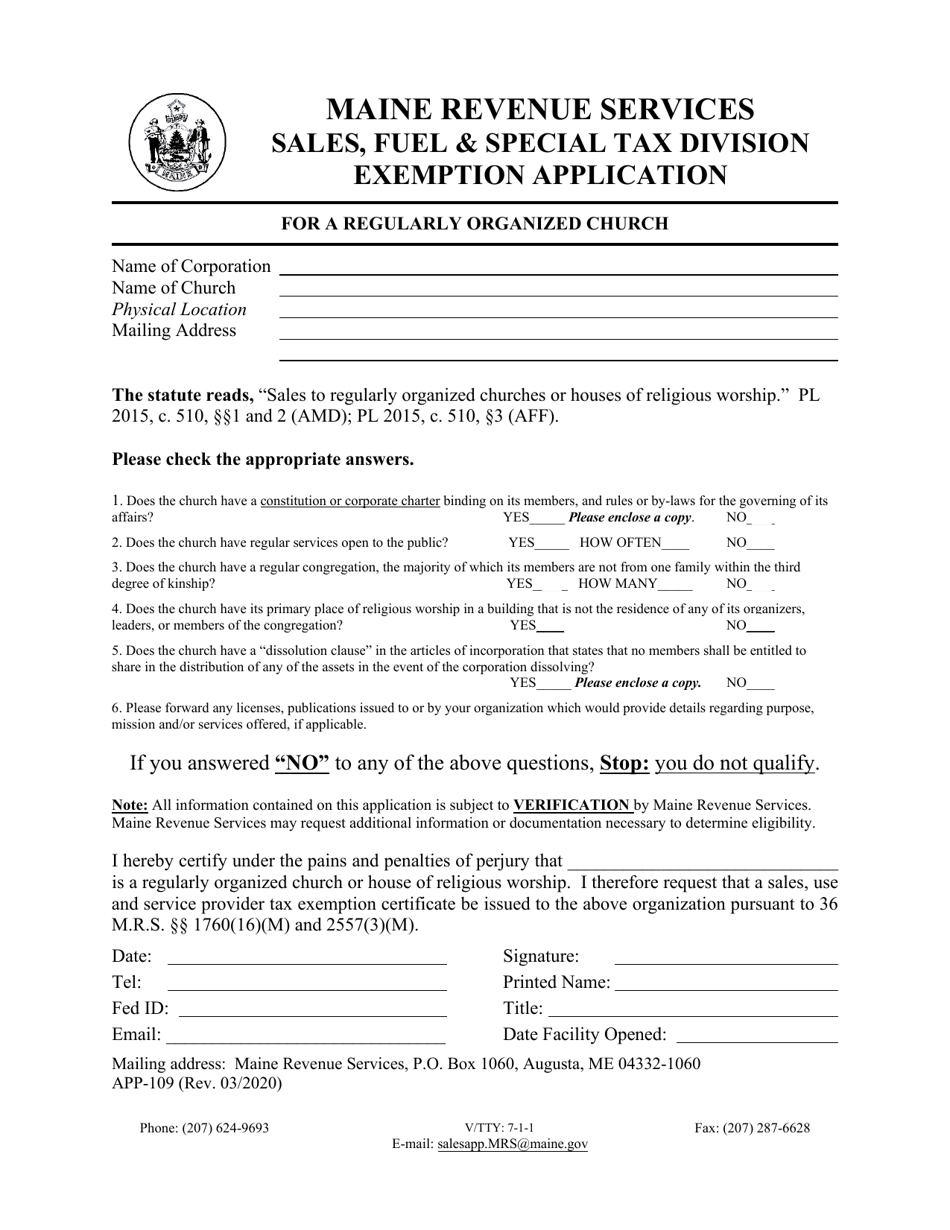

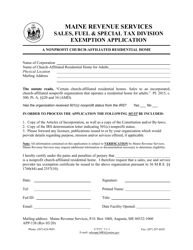

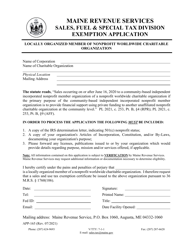

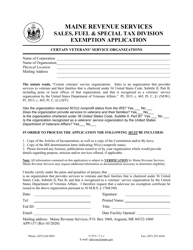

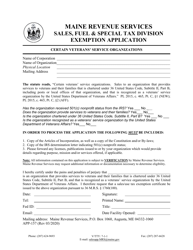

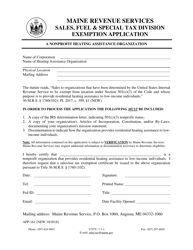

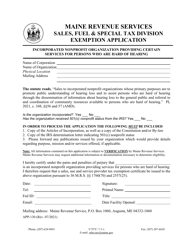

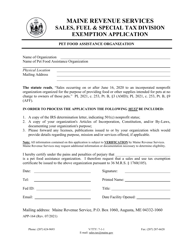

Form APP-109 Exemption Application for a Regularly Organized Church - Maine

What Is Form APP-109?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form APP-109?

A: Form APP-109 is an Exemption Application for a Regularly Organized Church in Maine.

Q: Who needs to file Form APP-109?

A: Regularly organized churches in Maine need to file Form APP-109 to apply for exemption.

Q: What is the purpose of Form APP-109?

A: The purpose of Form APP-109 is to apply for exemption status for a regularly organized church.

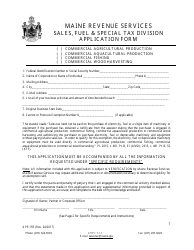

Q: What information is required on Form APP-109?

A: Form APP-109 requires information about the church, its activities, finances, and other related details.

Q: Is there a fee to file Form APP-109?

A: No, there is no fee to file Form APP-109.

Q: What should I do after completing Form APP-109?

A: After completing Form APP-109, you need to submit it to the Maine Department of Revenue Services.

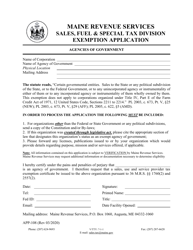

Q: How long does it take to process Form APP-109?

A: The processing time for Form APP-109 may vary, and it is recommended to contact the Maine Department of Revenue Services for more information.

Q: What happens after the exemption application is approved?

A: If the exemption application is approved, the regularly organized church will be granted tax exemption status in Maine.

Q: What happens if the exemption application is denied?

A: If the exemption application is denied, the regularly organized church will not qualify for tax exemption status in Maine.

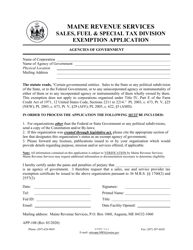

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form APP-109 by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.