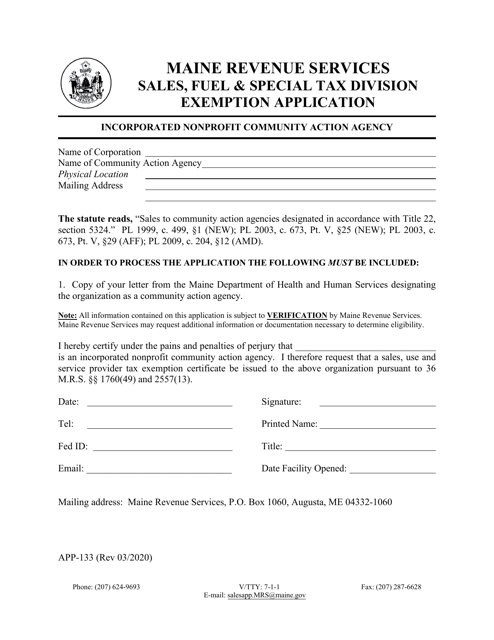

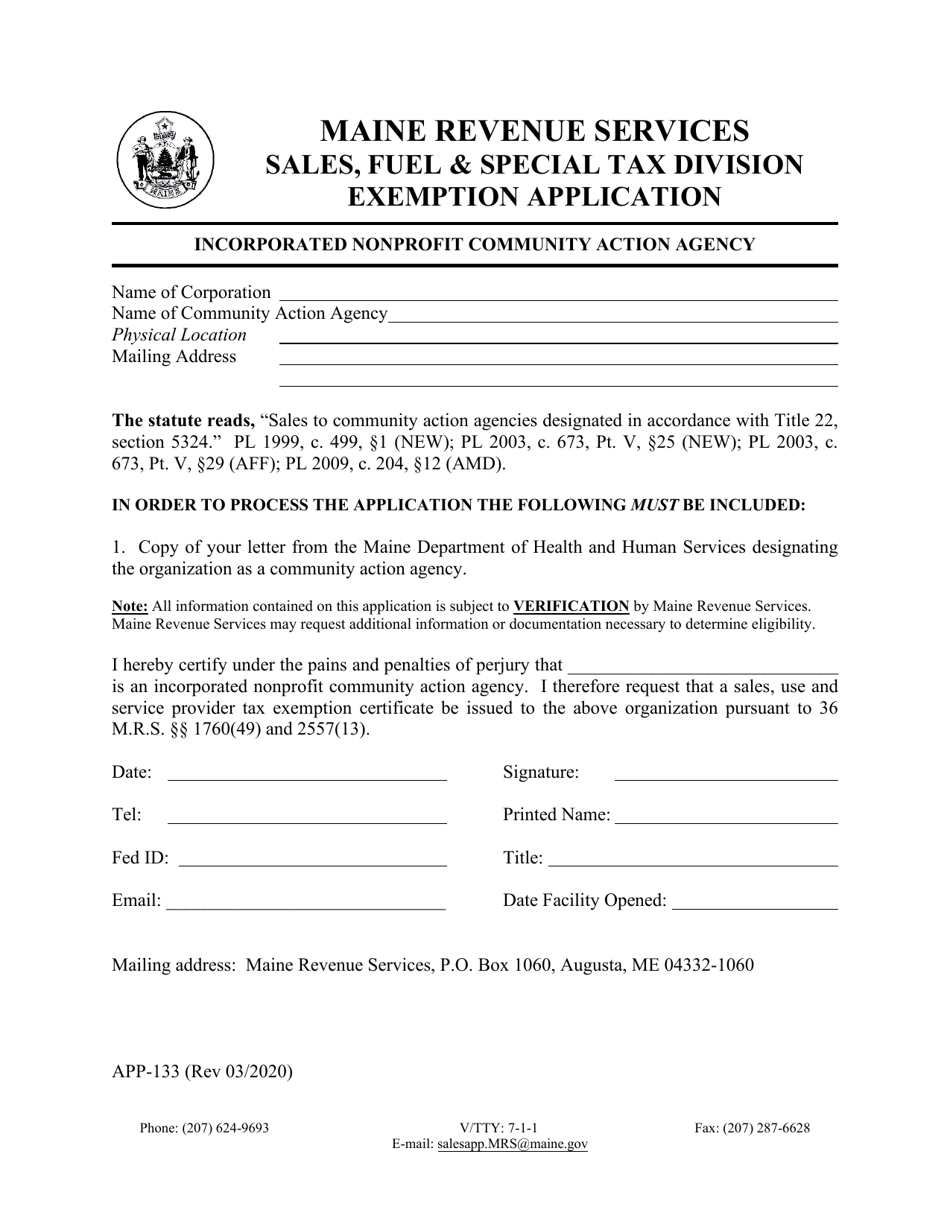

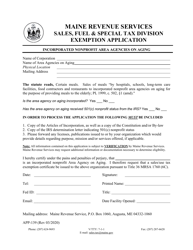

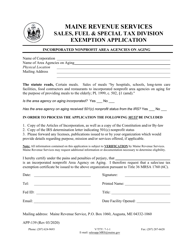

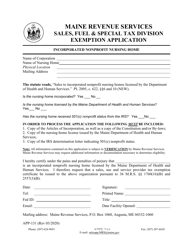

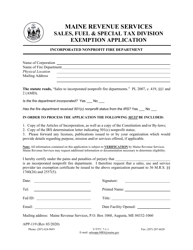

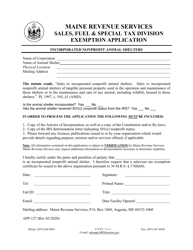

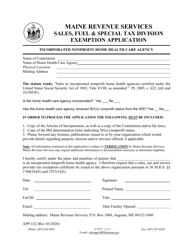

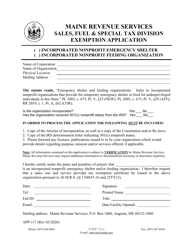

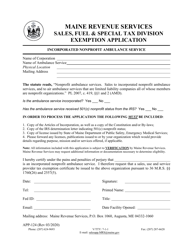

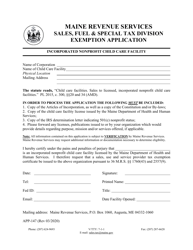

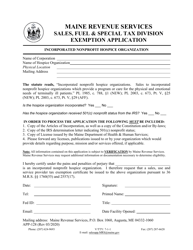

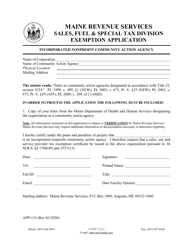

Form APP-133 Incorporated Nonprofit Community Action Agency Exemption Application - Maine

What Is Form APP-133?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

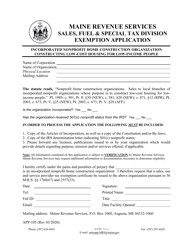

Q: What is the purpose of the APP-133 Incorporated Nonprofit Community Action Agency Exemption Application?

A: The purpose of this application is to apply for exemption from certain taxes for incorporated nonprofit community action agencies in Maine.

Q: Who should use the APP-133 Incorporated Nonprofit Community Action Agency Exemption Application?

A: This application should be used by incorporated nonprofit community action agencies in Maine seeking tax exemption.

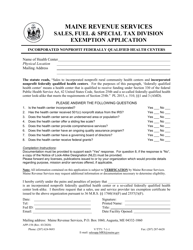

Q: What taxes can be exempted through this application?

A: This application can be used to seek exemption from sales and use tax, excise tax, and property tax.

Q: What documents are required to be submitted with the application?

A: The required documents may vary, but generally include proof of nonprofit status, financial statements, and organizational documents.

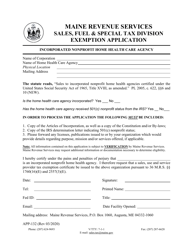

Q: How long does it take to receive a decision on the exemption application?

A: The processing time for the application can vary, but it typically takes several weeks to a few months.

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the Maine Revenue Services;

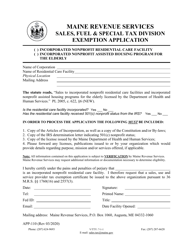

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form APP-133 by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.