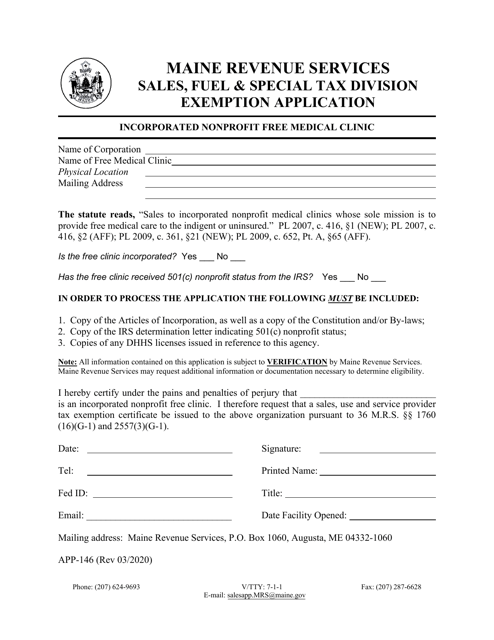

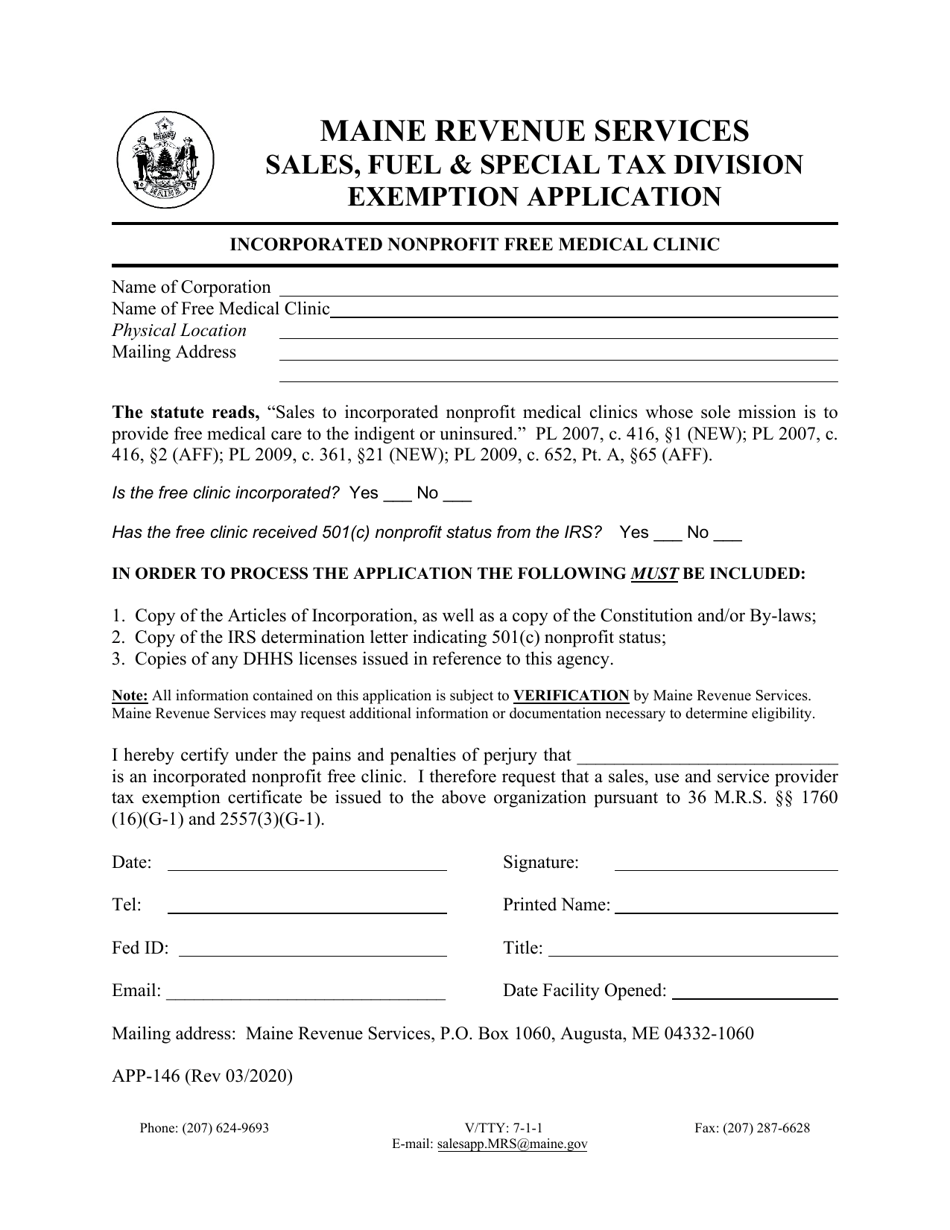

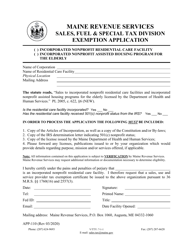

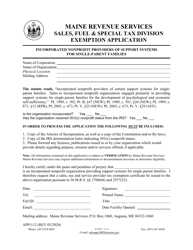

Form APP-146 Incorporated Nonprofit Free Medical Clinic Exemption Application - Maine

What Is Form APP-146?

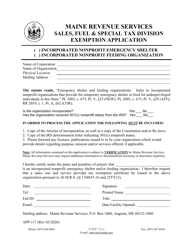

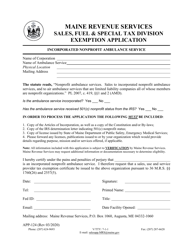

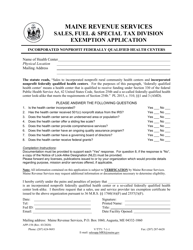

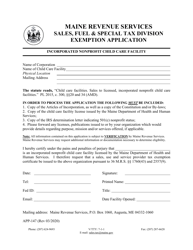

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of Form APP-146?

A: Form APP-146 is used to apply for an exemption for a free medical clinic from certain taxes in Maine.

Q: Who can use Form APP-146?

A: This form can be used by incorporated nonprofit free medical clinics in Maine.

Q: What is the deadline for filing Form APP-146?

A: The form must be filed annually by April 15th.

Q: What taxes does this exemption apply to?

A: This exemption applies to property tax and sales and use tax.

Q: What supporting documents are required with Form APP-146?

A: You must attach financial statements, a copy of your organization's bylaws, and a letter verifying your clinic's nonprofit status.

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form APP-146 by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.