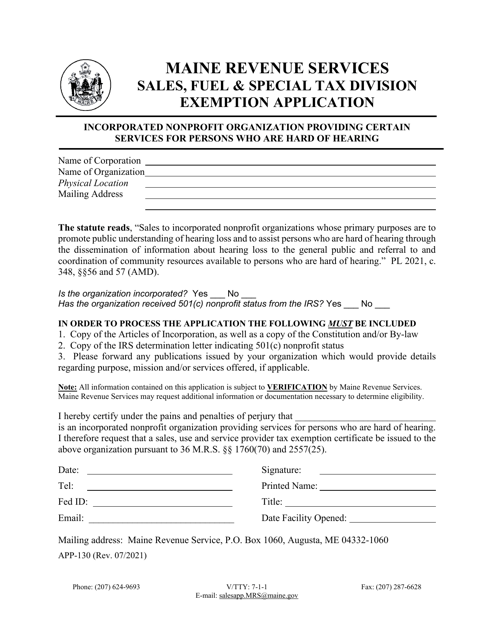

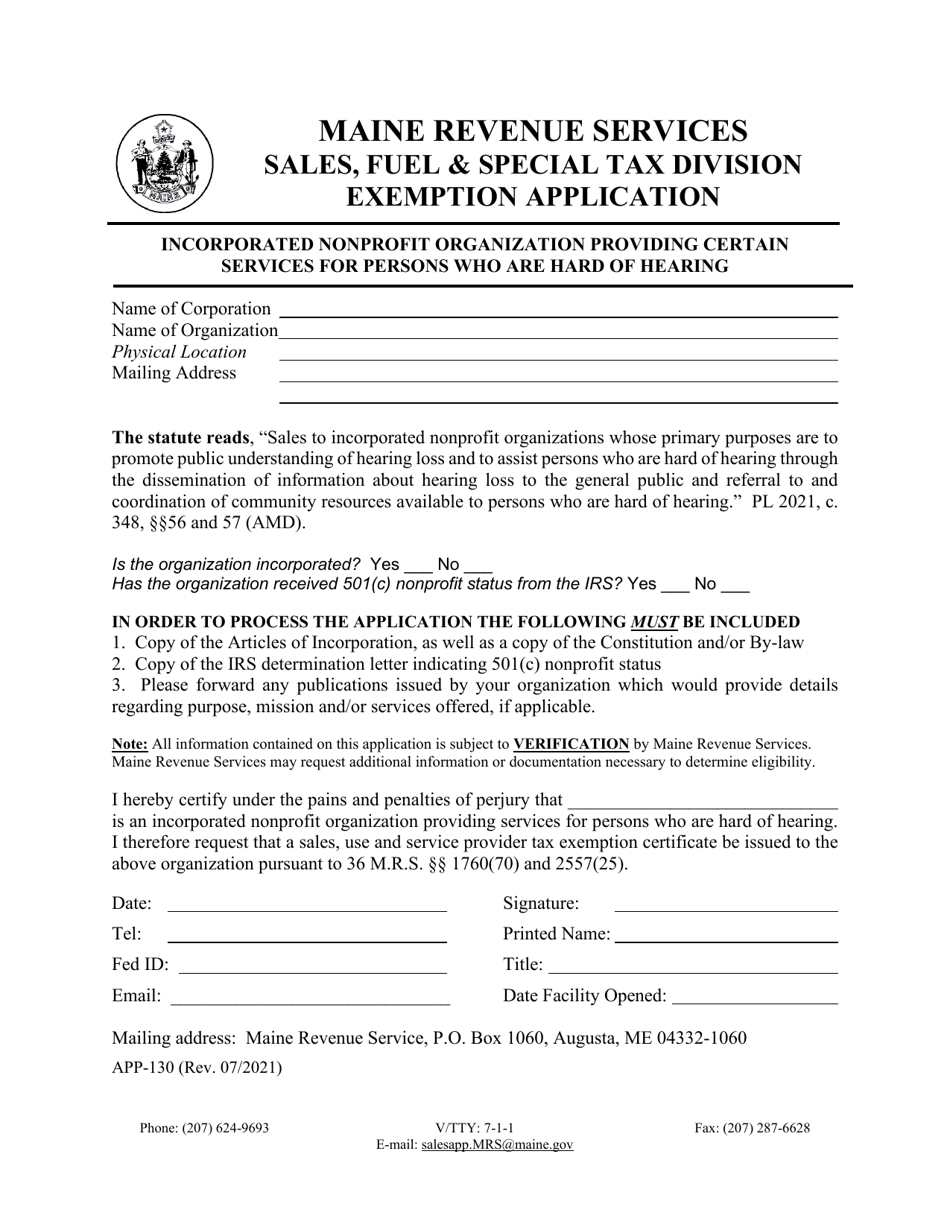

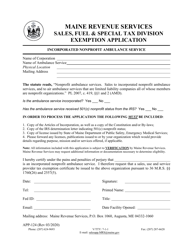

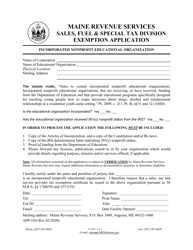

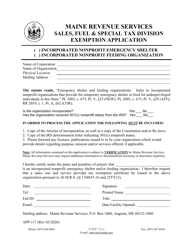

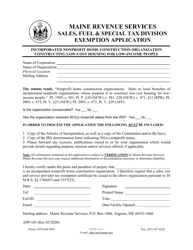

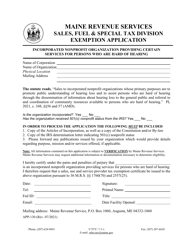

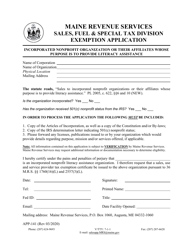

Form APP-130 Incorporated Nonprofit Organization Providing Certain Services for Persons Who Are Hard of Hearing Exemption Application - Maine

What Is Form APP-130?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form APP-130?

A: The Form APP-130 is an application for an exemption for an incorporated nonprofit organization providing certain services for persons who are hard of hearing in Maine.

Q: What is an incorporated nonprofit organization?

A: An incorporated nonprofit organization is a legal entity that has been formed for a nonprofit purpose and has gone through the process of incorporation.

Q: What services does this exemption apply to?

A: This exemption applies to services provided for persons who are hard of hearing.

Q: Who is eligible to apply for this exemption?

A: Incorporated nonprofit organizations providing services for persons who are hard of hearing in Maine are eligible to apply for this exemption.

Q: What is the purpose of this exemption?

A: The purpose of this exemption is to provide a tax exemption for incorporated nonprofit organizations that provide services for persons who are hard of hearing.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form APP-130 by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.