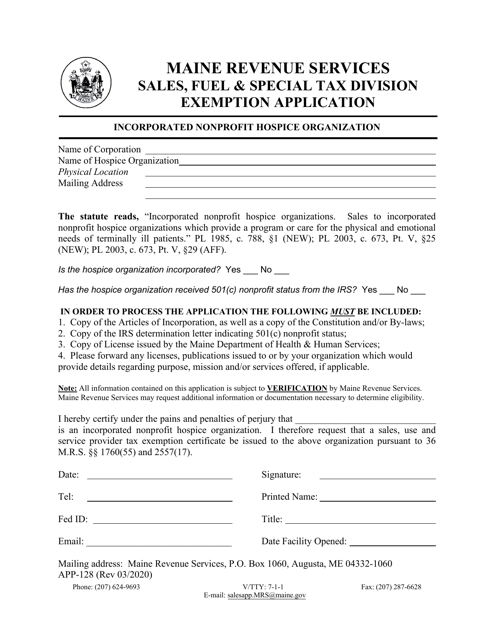

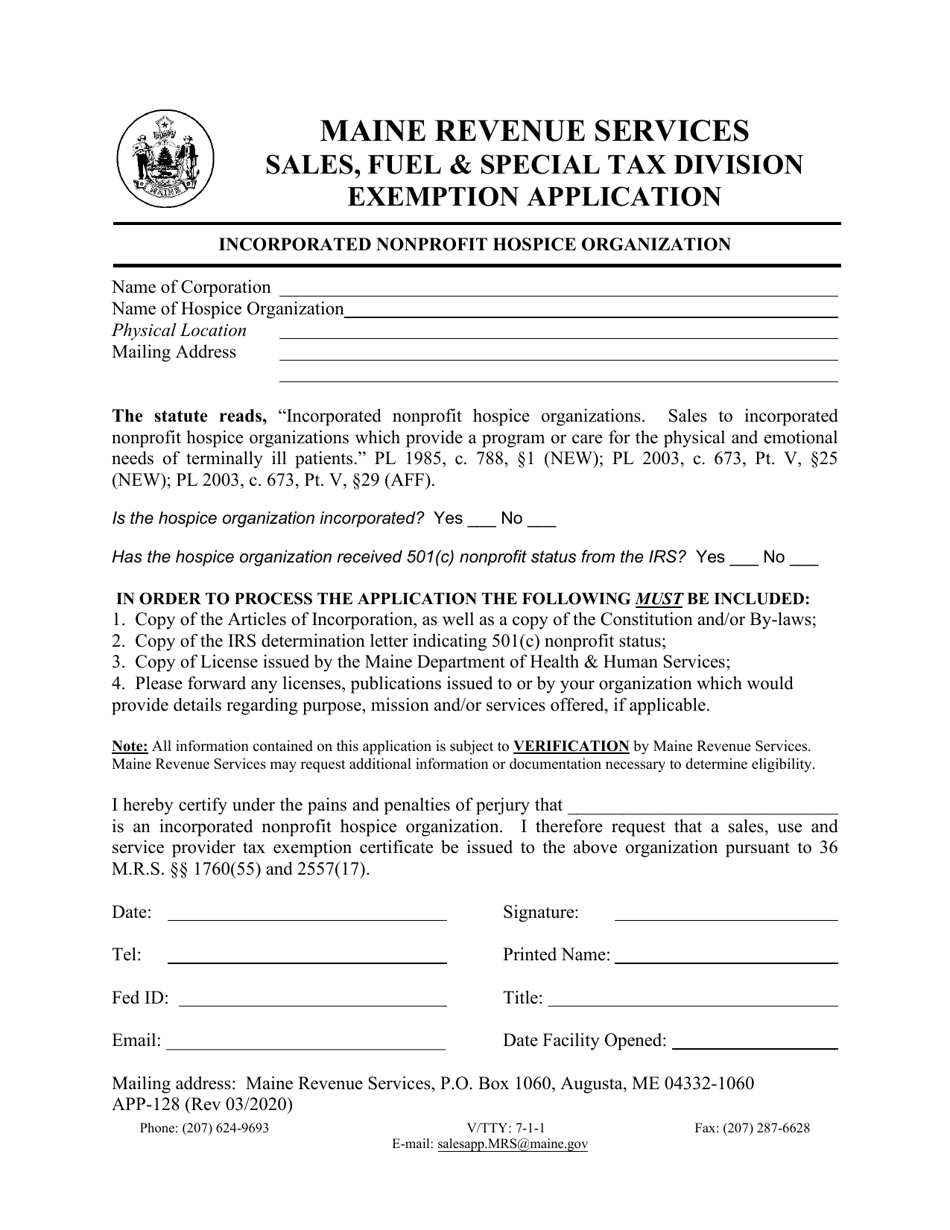

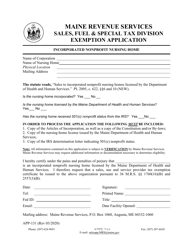

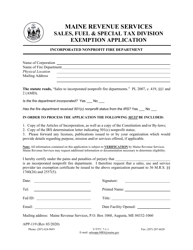

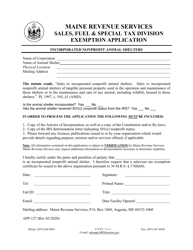

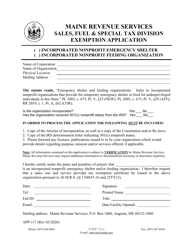

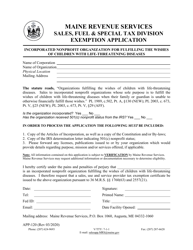

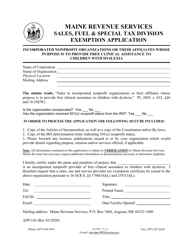

Form APP-128 Incorporated Nonprofit Hospice Organization Exemption Application - Maine

What Is Form APP-128?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form APP-128?

A: Form APP-128 is the application for an exemption for an incorporated nonprofit hospice organization in Maine.

Q: What is an incorporated nonprofit hospice organization?

A: An incorporated nonprofit hospice organization is a hospice that is registered as a nonprofit corporation.

Q: What is the purpose of the exemption application?

A: The purpose of the exemption application is to request an exemption from certain taxes for the incorporated nonprofit hospice organization.

Q: What taxes can be exempted?

A: The exemption application can request exemption from sales tax, use tax, and income tax.

Q: What is the eligibility criteria for the exemption?

A: To be eligible for the exemption, the organization must be incorporated as a nonprofit hospice and meet certain requirements outlined in the application.

Q: Are there any fees associated with the application?

A: Yes, there may be fees associated with the application. It is best to consult the application instructions or contact the Maine Revenue Services for the current fee schedule.

Q: Is there a deadline for submitting the application?

A: The application should be submitted as soon as possible before engaging in any taxable activities. It is recommended to contact the Maine Revenue Services for specific deadline information.

Q: How long does it take to process the application?

A: The processing time for the application varies. It is best to contact the Maine Revenue Services for an estimated processing time.

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form APP-128 by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.