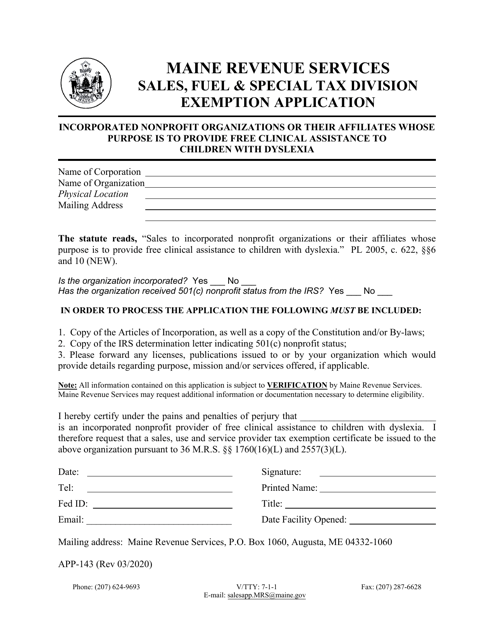

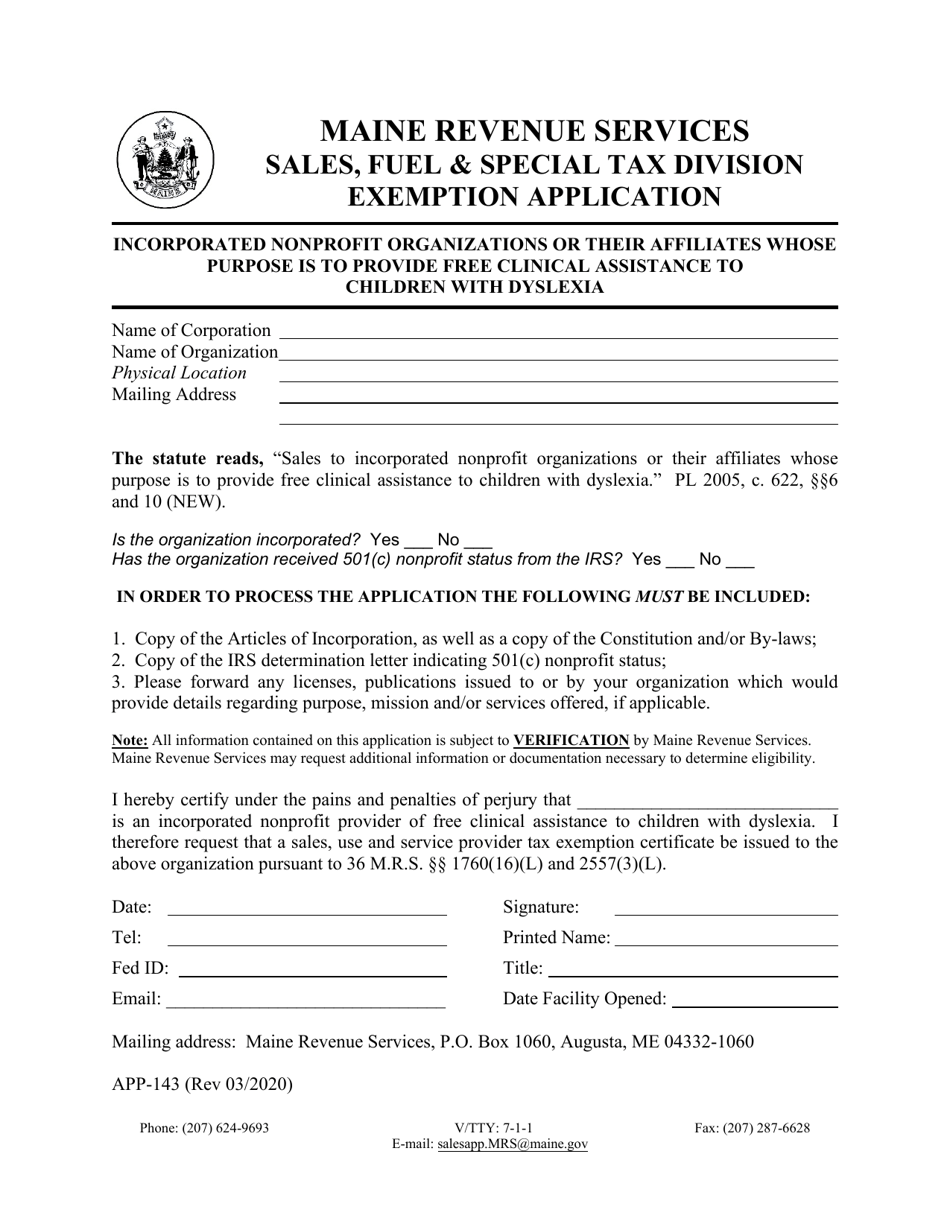

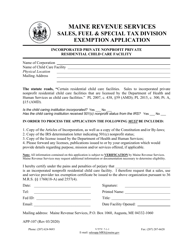

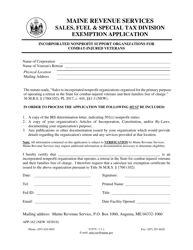

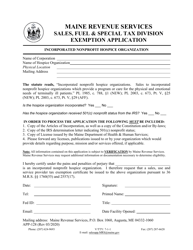

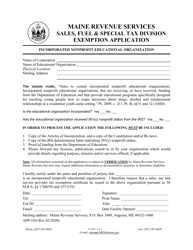

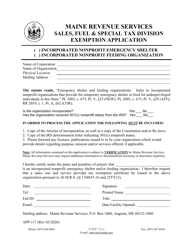

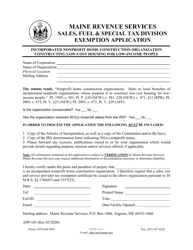

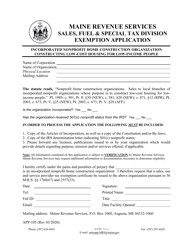

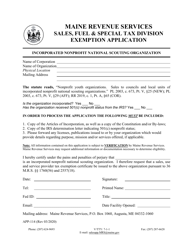

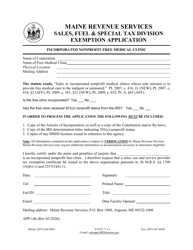

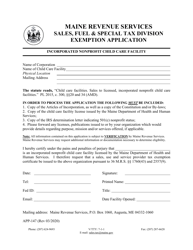

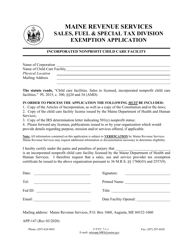

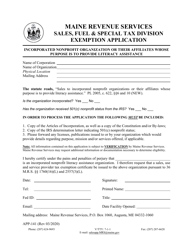

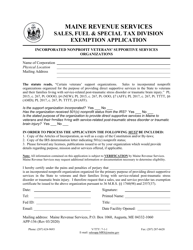

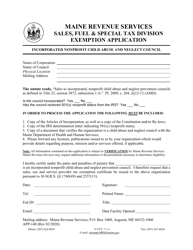

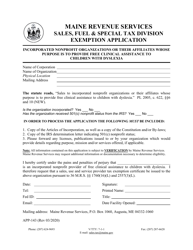

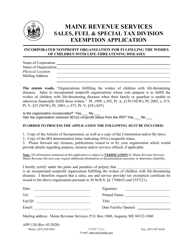

Form APP-143 Incorporated Nonprofit Organizations or Their Affiliates Whose Purpose Is to Provide Free Clinical Assistance to Children With Dyslexia Exemption Application - Maine

What Is Form APP-143?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of form APP-143?

A: The purpose of form APP-143 is to apply for an exemption for incorporated nonprofit organizations or their affiliates whose purpose is to provide free clinical assistance to children with dyslexia in the state of Maine.

Q: What does the exemption application apply to?

A: The exemption application applies to incorporated nonprofit organizations or their affiliates that provide free clinical assistance to children with dyslexia.

Q: Who can apply for the exemption?

A: Incorporated nonprofit organizations or their affiliates that provide free clinical assistance to children with dyslexia can apply for the exemption.

Q: What is the process for applying for the exemption?

A: The process for applying for the exemption involves completing form APP-143 and submitting it to the relevant authorities in Maine.

Q: What is the purpose of the exemption?

A: The purpose of the exemption is to provide financial relief or benefits for organizations or their affiliates that offer free clinical assistance to children with dyslexia.

Q: Is the exemption application specific to Maine?

A: Yes, the exemption application is specific to the state of Maine.

Q: Is there a fee for submitting the exemption application?

A: There may be a fee for submitting the exemption application. Details about any applicable fees can be found in the instructions for form APP-143.

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form APP-143 by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.