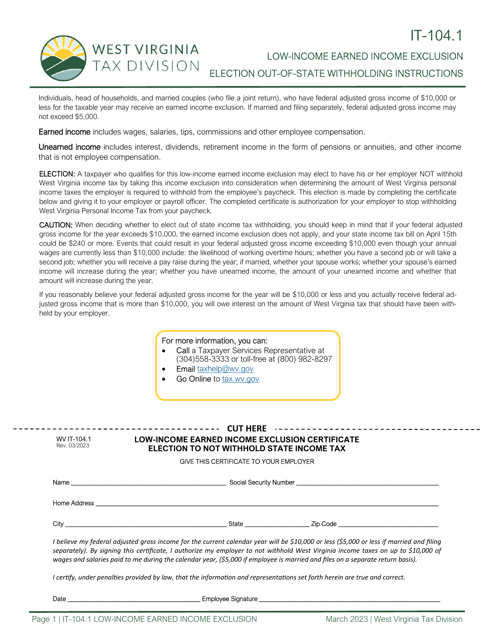

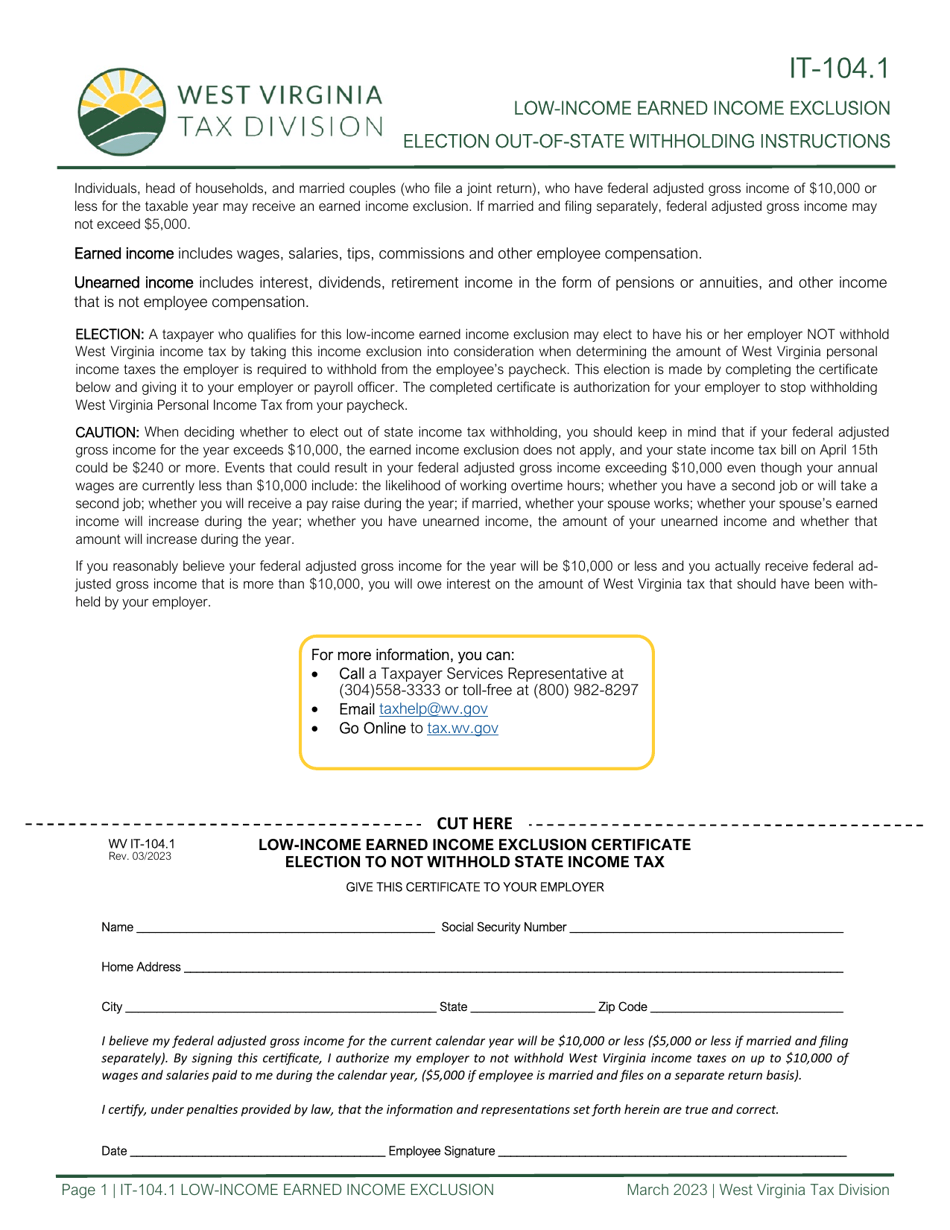

Form IT-104.1 Low-Income Earned Income Exclusion Certificate Election to Not Withhold State Income Tax - West Virginia

What Is Form IT-104.1?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-104.1?

A: Form IT-104.1 is the Low-Income Earned Income Exclusion Certificate Election to Not Withhold State Income Tax form for West Virginia.

Q: Who needs to file Form IT-104.1?

A: Individuals who qualify for the low-income earned income exclusion in West Virginia and do not want to have state income tax withheld from their wages need to file Form IT-104.1.

Q: What is the low-income earned income exclusion in West Virginia?

A: The low-income earned income exclusion in West Virginia allows individuals with qualifying low incomes to exclude a portion of their earned income from state income tax.

Q: What is the purpose of Form IT-104.1?

A: The purpose of Form IT-104.1 is to elect not to have state income tax withheld from wages for individuals who qualify for the low-income earned income exclusion in West Virginia.

Q: Is there a deadline for filing Form IT-104.1?

A: Yes, Form IT-104.1 must be filed by the due date of the individual's West Virginia income tax return for the tax year.

Q: What happens if I don't file Form IT-104.1?

A: If you qualify for the low-income earned income exclusion in West Virginia but do not file Form IT-104.1, state income tax will be withheld from your wages by default.

Form Details:

- Released on March 1, 2023;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IT-104.1 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.