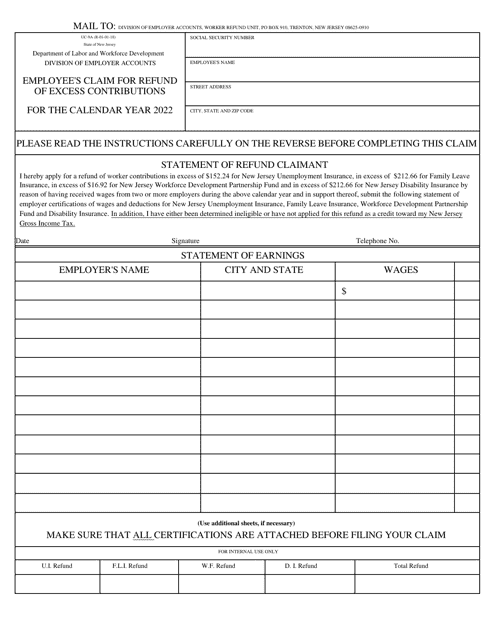

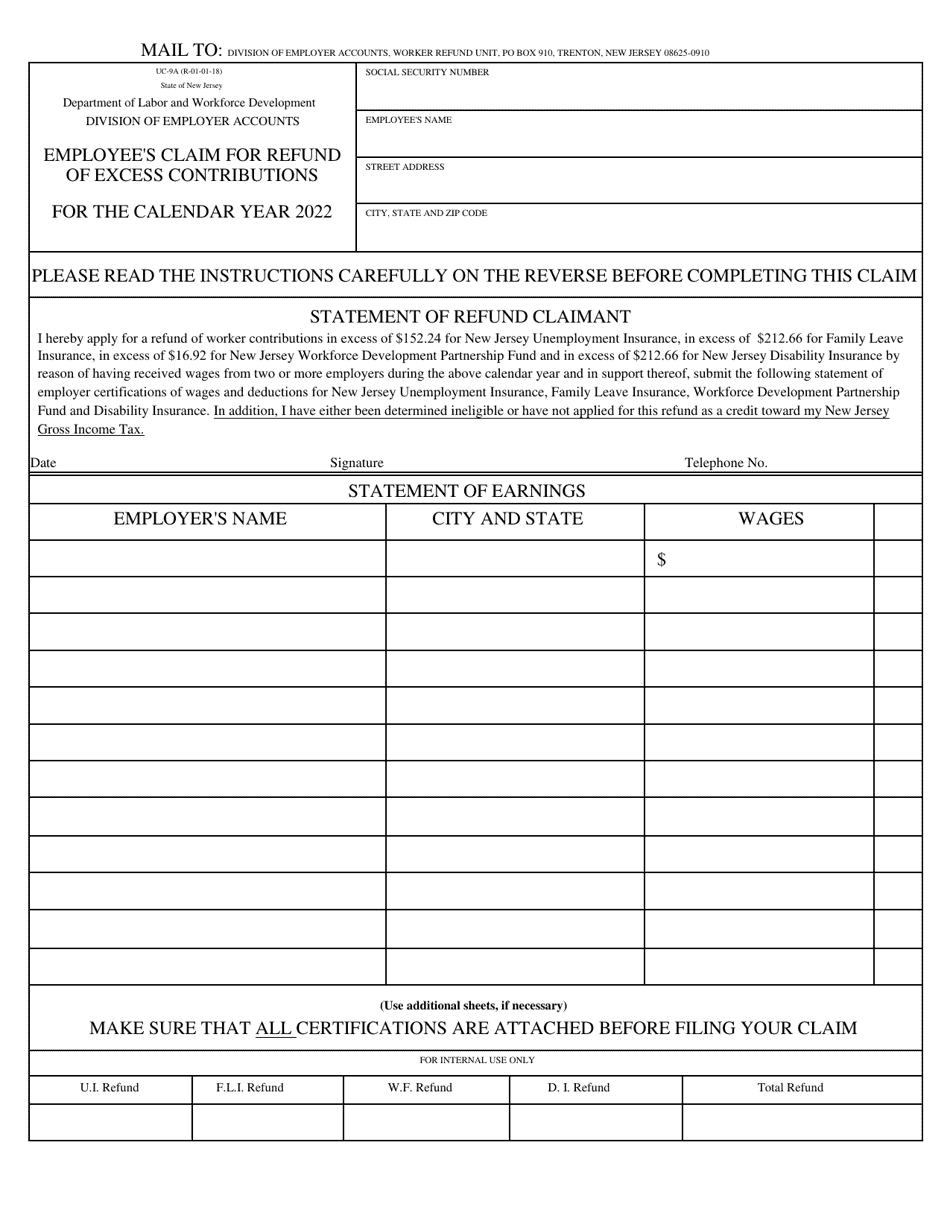

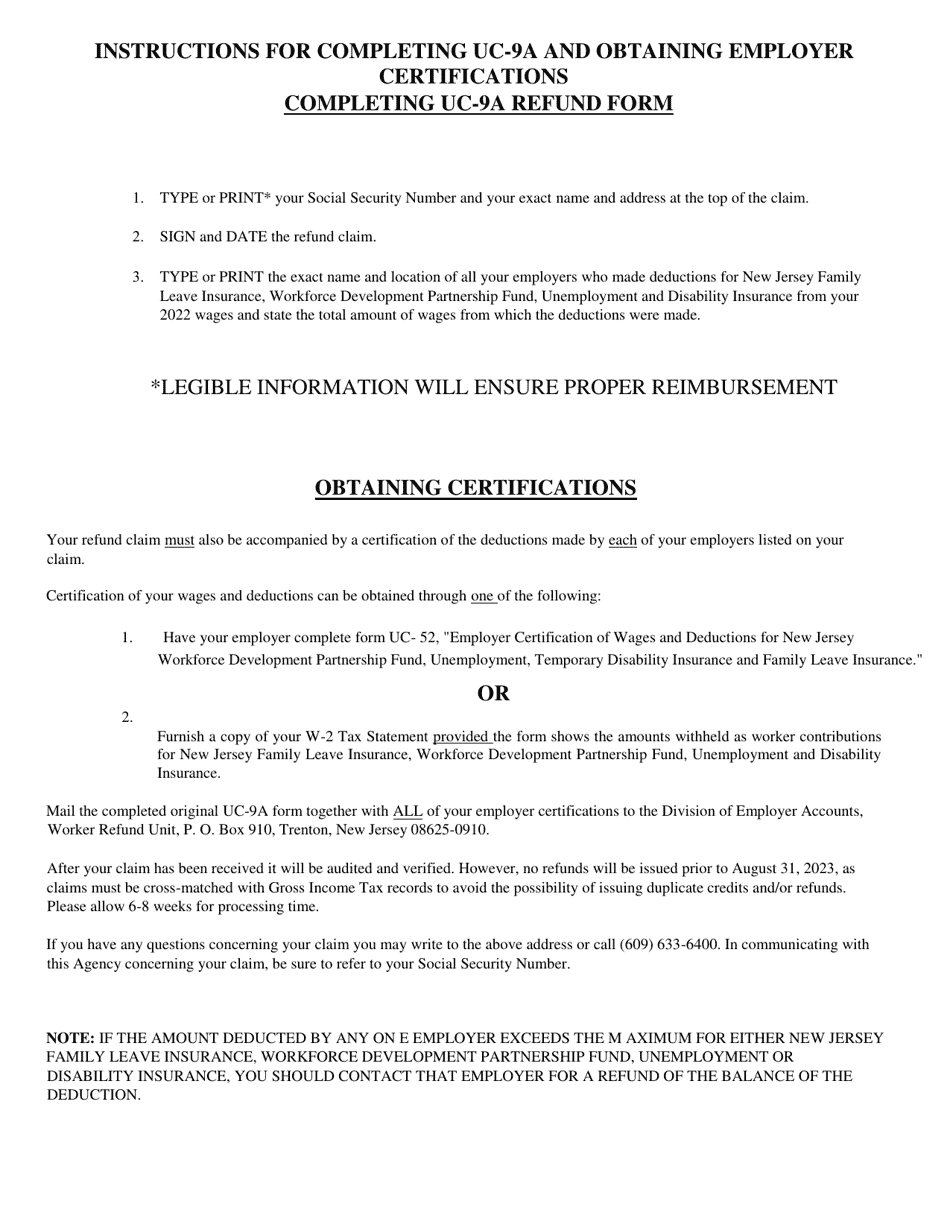

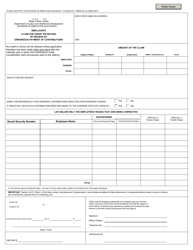

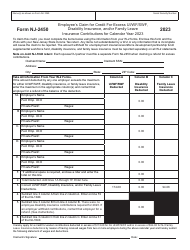

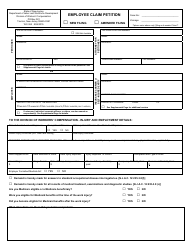

Form UC-9A Employee's Claim for Refund of Excess Contributions - New Jersey

What Is Form UC-9A?

This is a legal form that was released by the New Jersey Department of Labor & Workforce Development - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form UC-9A?

A: Form UC-9A is the Employee's Claim for Refund of Excess Contributions in New Jersey.

Q: Who can use Form UC-9A?

A: Form UC-9A can be used by employees in New Jersey who have made excess contributions to the Unemployment Insurance Fund.

Q: What is the purpose of Form UC-9A?

A: The purpose of Form UC-9A is to claim a refund of excess contributions made to the Unemployment Insurance Fund in New Jersey.

Q: Is there a deadline for filing Form UC-9A?

A: Yes, there is a deadline for filing Form UC-9A. You must file the form within four years from the end of the calendar year in which the excess contributions were made.

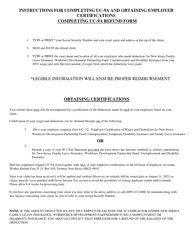

Q: What documents do I need to submit with Form UC-9A?

A: You will need to submit your pay stubs or other proof of excess contributions along with Form UC-9A.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the New Jersey Department of Labor & Workforce Development;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form UC-9A by clicking the link below or browse more documents and templates provided by the New Jersey Department of Labor & Workforce Development.