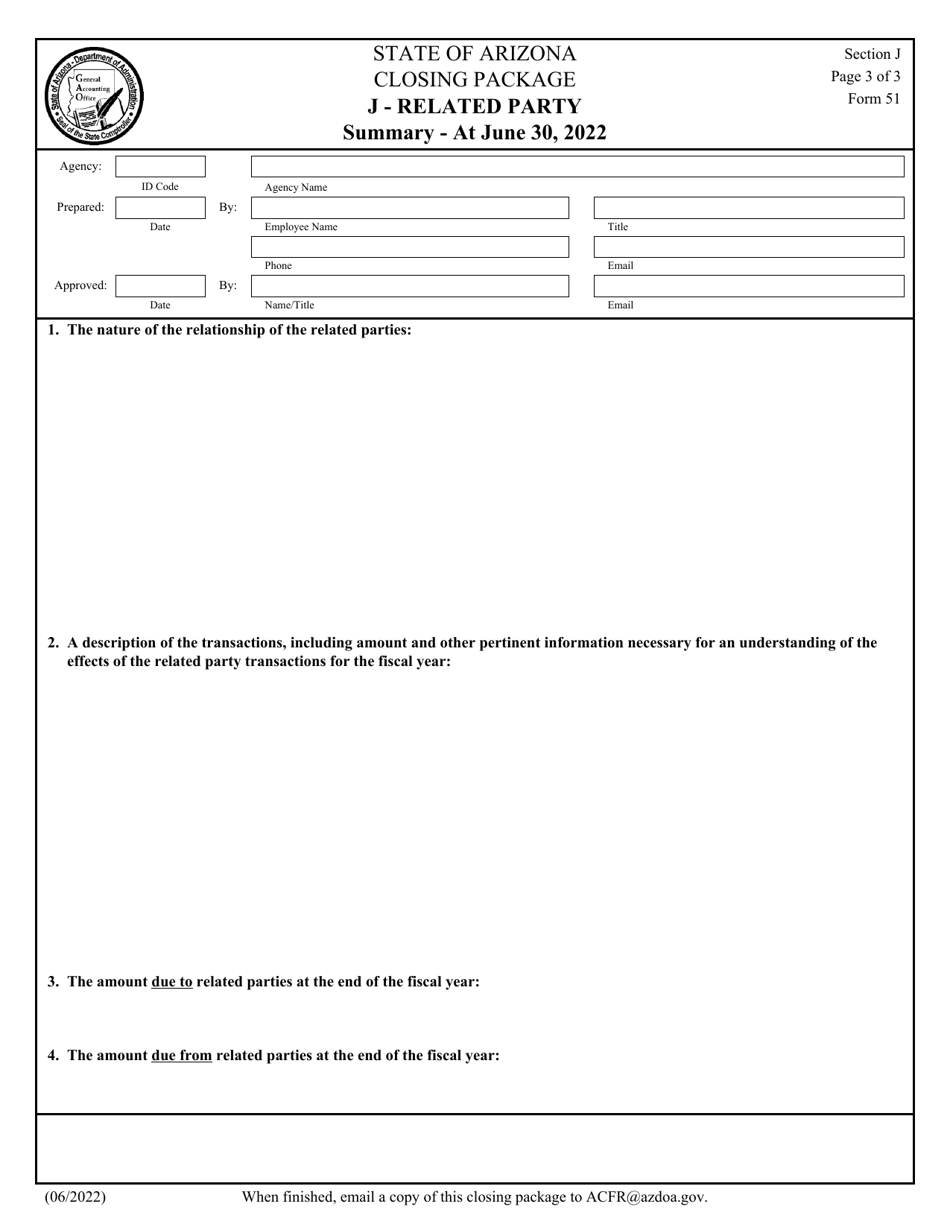

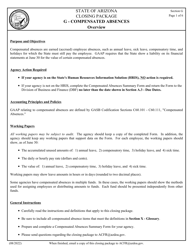

Form 51 Section J Closing Package - Related Party - Arizona

What Is Form 51 Section J?

This is a legal form that was released by the Arizona Department of Administration - General Accounting Office - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 51 Section J Closing Package?

A: Form 51 Section J Closing Package is a set of documents used in real estate transactions to disclose any related party transactions.

Q: What does 'Related Party' mean?

A: In the context of real estate transactions, 'Related Party' refers to anyone who has a personal or financial relationship with the buyer or seller.

Q: What is the purpose of Form 51 Section J Closing Package?

A: The purpose of Form 51 Section J Closing Package is to ensure transparency and disclosure of any related party transactions to protect the interests of the buyer and lender.

Q: Why is it important to disclose related party transactions?

A: Disclosing related party transactions is important to prevent conflicts of interest and to maintain fair dealings in real estate transactions.

Q: What information is typically included in Form 51 Section J Closing Package?

A: Form 51 Section J Closing Package typically includes information about related party transactions, such as the nature of the relationship, the terms of the transaction, and any potential conflicts of interest.

Q: Is Form 51 Section J Closing Package specific to Arizona?

A: Yes, Form 51 Section J Closing Package is specific to Arizona and is used in real estate transactions in the state.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the Arizona Department of Administration - General Accounting Office;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 51 Section J by clicking the link below or browse more documents and templates provided by the Arizona Department of Administration - General Accounting Office.