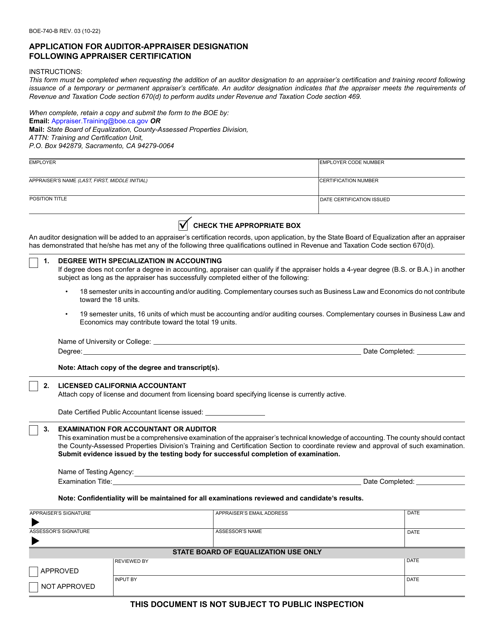

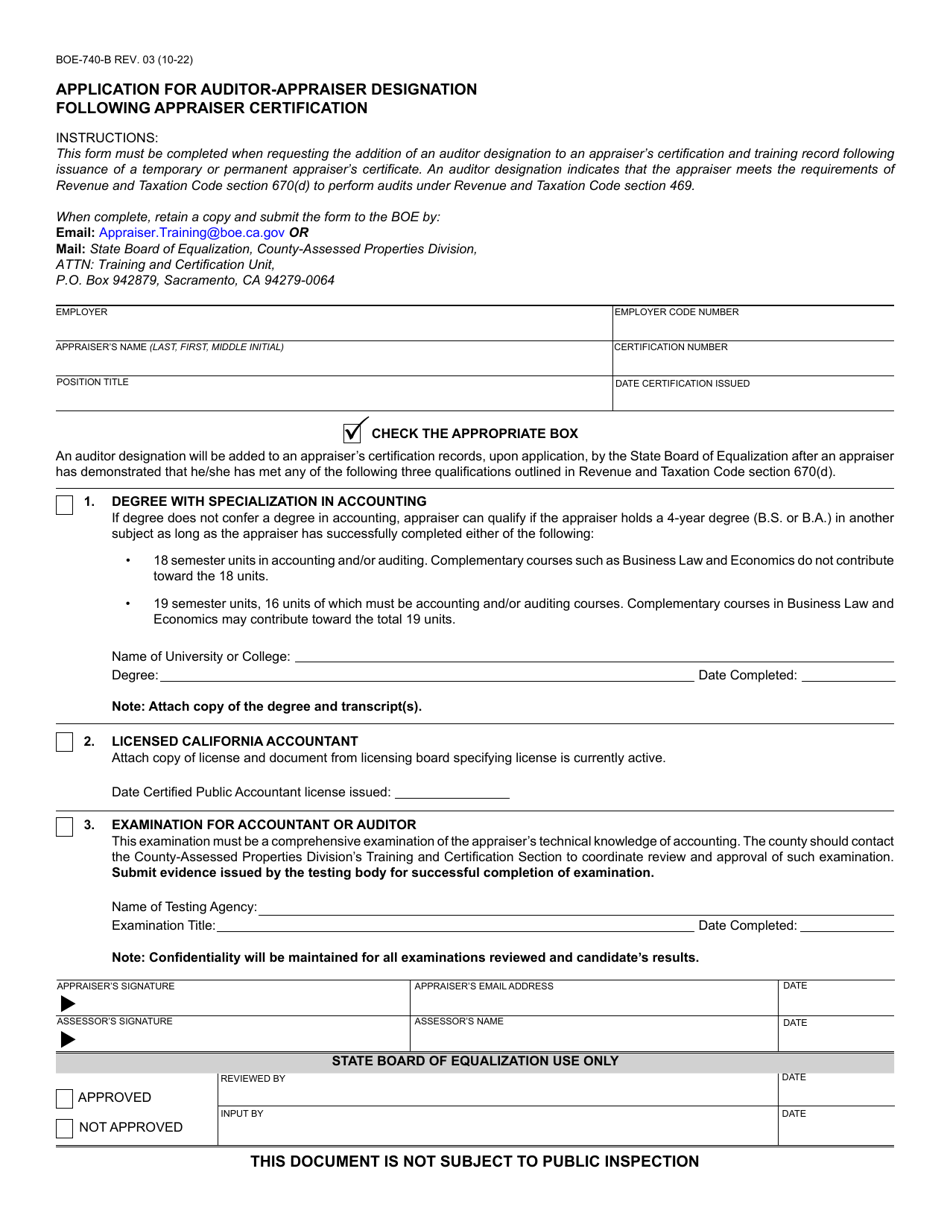

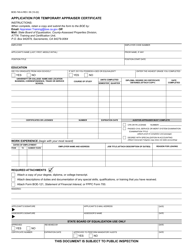

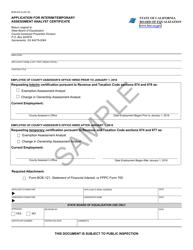

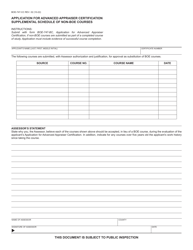

Form BOE-740-B Application for Auditor-Appraiser Designation Following Appraiser Certification - California

What Is Form BOE-740-B?

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

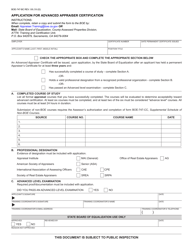

Q: What is the BOE-740-B application for?

A: The BOE-740-B application is for obtaining an Auditor-Appraiser designation following appraiser certification in California.

Q: Who can use the BOE-740-B application?

A: Appraisers in California who want to become Auditor-Appraisers.

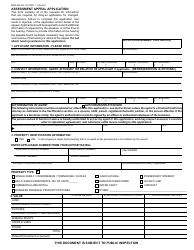

Q: What is an Auditor-Appraiser?

A: An Auditor-Appraiser is a certified appraiser in California who has obtained additional training and certification to conduct property assessments for taxation purposes.

Q: What are the requirements for using the BOE-740-B application?

A: To use the BOE-740-B application, you must be a certified appraiser in California and have completed the necessary coursework and training for Auditor-Appraiser certification.

Q: Are there any fees associated with the BOE-740-B application?

A: Yes, there is a non-refundable application fee that must be submitted along with the BOE-740-B application.

Q: How long does it take to process the BOE-740-B application?

A: The processing time for the BOE-740-B application can vary, but it typically takes several weeks to complete.

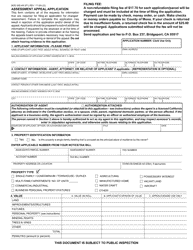

Q: What happens after the BOE-740-B application is approved?

A: After the BOE-740-B application is approved, you will receive your Auditor-Appraiser designation and be eligible to conduct property assessments for taxation purposes in California.

Q: Can I appeal if my BOE-740-B application is denied?

A: Yes, if your BOE-740-B application is denied, you have the right to appeal the decision.

Q: Who should I contact for more information about the BOE-740-B application?

A: For more information about the BOE-740-B application, you should contact the California State Board of Equalization (BOE).

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-740-B by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.