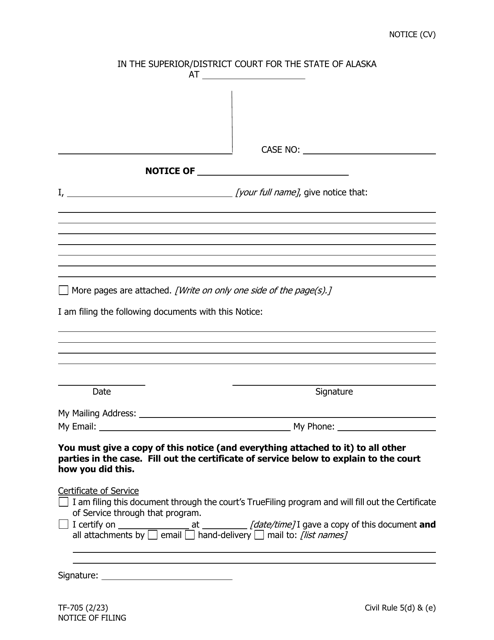

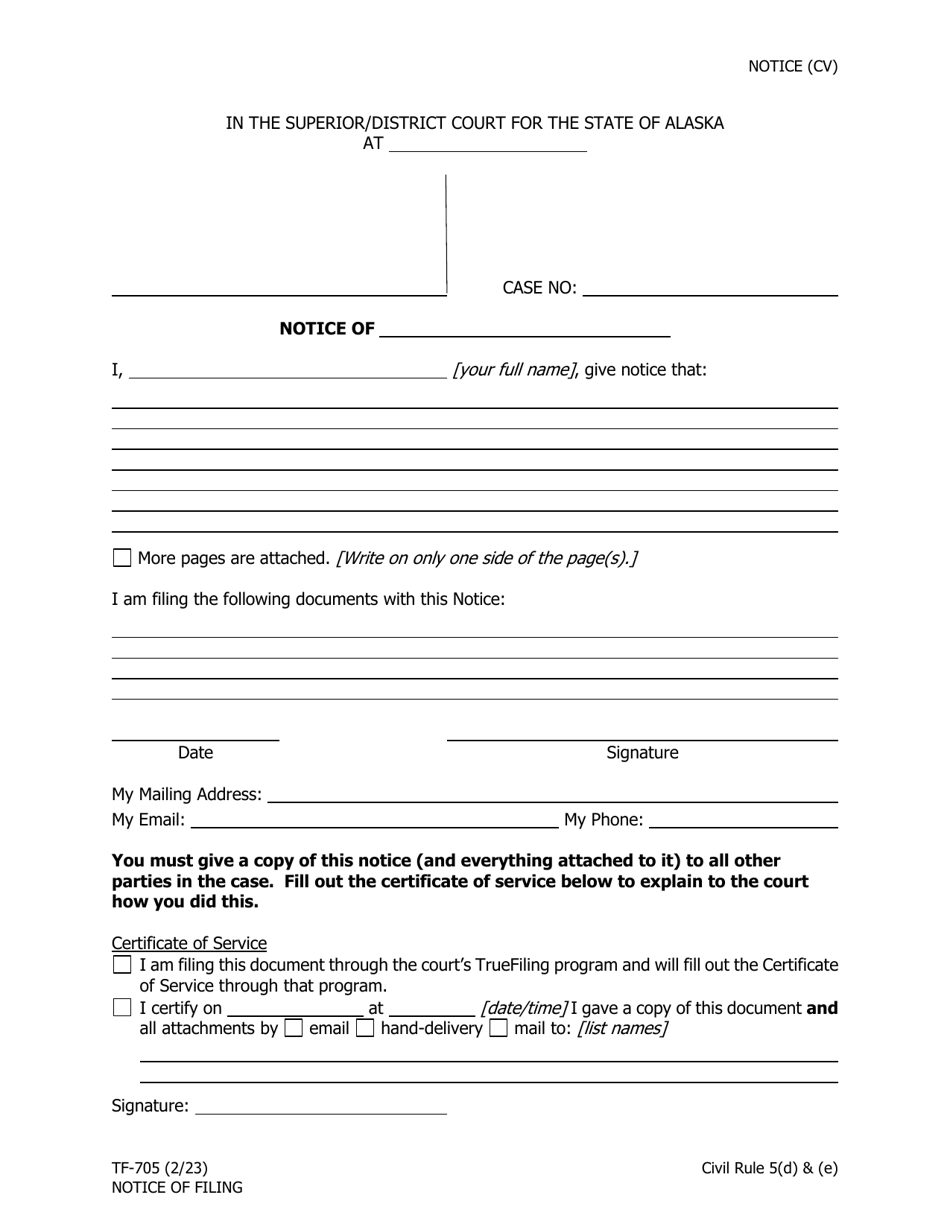

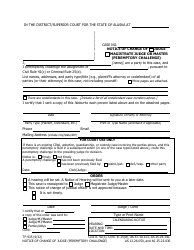

Form TF-705 Notice of Filing - Alaska

What Is Form TF-705?

This is a legal form that was released by the Alaska Court System - a government authority operating within Alaska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TF-705?

A: Form TF-705 is the Notice of Filing form.

Q: What is the purpose of Form TF-705?

A: Form TF-705 is used to notify the Alaska Department of Revenue of the filing of a petroleum or sulfur return.

Q: Who needs to file Form TF-705?

A: Any person who is required to file a petroleum or sulfur return in Alaska needs to file Form TF-705.

Q: Do I need to submit any supporting documentation with Form TF-705?

A: No, supporting documentation is not required to be submitted with Form TF-705.

Q: Is there a deadline for filing Form TF-705?

A: Yes, Form TF-705 must be filed within 45 days of the end of the applicable return period.

Q: What happens if I fail to file Form TF-705?

A: Failure to file Form TF-705 may result in penalties and interest being assessed by the Alaska Department of Revenue.

Q: Can I request an extension to file Form TF-705?

A: Yes, you may request an extension to file Form TF-705 by contacting the Alaska Department of Revenue.

Q: Are there any fees associated with filing Form TF-705?

A: No, there are no fees associated with filing Form TF-705.

Form Details:

- Released on February 1, 2023;

- The latest edition provided by the Alaska Court System;

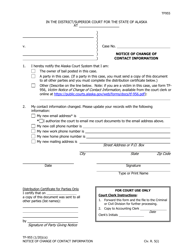

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TF-705 by clicking the link below or browse more documents and templates provided by the Alaska Court System.