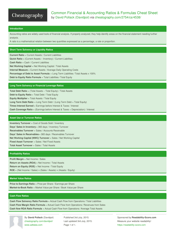

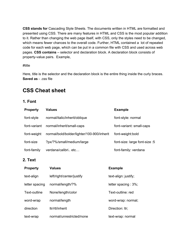

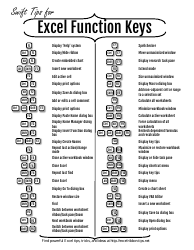

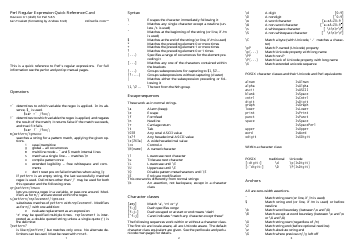

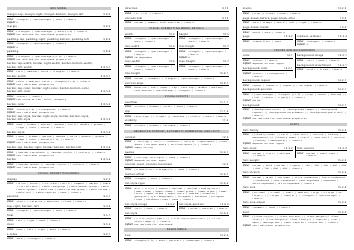

Accounting Dr / Cr Cheat Sheet

An accounting Dr/Cr cheat sheet is a reference tool that provides a quick overview of how debits and credits are used in accounting. It helps individuals understand which accounts are increased (debited) or decreased (credited) in various transactions.

FAQ

Q: What is a debit in accounting?

A: A debit is an entry on the left side of an account that increases assets and decreases liabilities and equity.

Q: What is a credit in accounting?

A: A credit is an entry on the right side of an account that decreases assets and increases liabilities and equity.

Q: How do you determine whether to use a debit or a credit?

A: Debits are used to record increases in assets and expenses, while credits are used to record decreases in assets, liabilities, and equity.

Q: What is the purpose of a cheat sheet?

A: A cheat sheet is a quick reference guide that provides a summary of key concepts or formulas to assist with understanding or memorization.

Q: Are debits always positive and credits always negative?

A: No, debits and credits can be either positive or negative depending on the account type and the nature of the transaction.

Q: How do you know which accounts are debited or credited in a transaction?

A: The accounts that are debited and credited in a transaction are determined by the accounting equation and the specific nature of the transaction.

Q: Can you provide examples of debits and credits?

A: Sure! Examples of debits include cash received, expenses paid, and assets purchased. Examples of credits include cash paid out, revenues earned, and liability repayments.

Q: Why is it important to understand debits and credits in accounting?

A: Understanding debits and credits is essential for maintaining accurate financial records and interpreting financial statements.

![Preview of Accounting Debit Credit Cheat Sheet Template | [Website Name] Accounting Debit Credit Cheat Sheet - Template Preview](https://data.templateroller.com/pdf_docs_html/2639/26394/2639428/accounting-dr-cr-cheat-sheet_big.png)

![Preview of Accounting Debit Credit Cheat Sheet Template | [Website Name] Accounting Debit Credit Cheat Sheet - Template Preview](https://data.templateroller.com/pdf_docs_html/2639/26394/2639428/page_1_thumb_950.png)