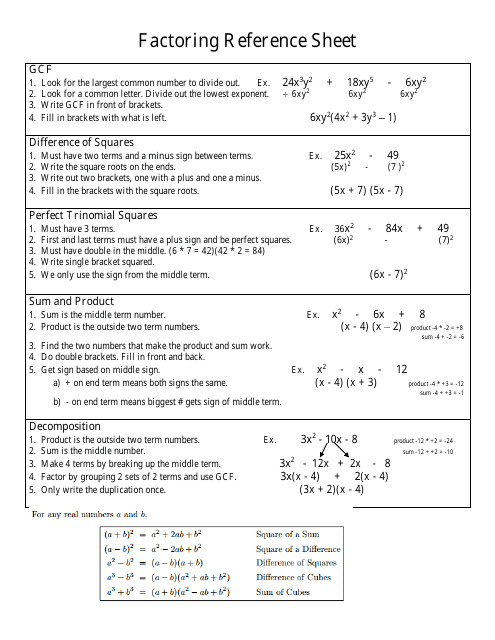

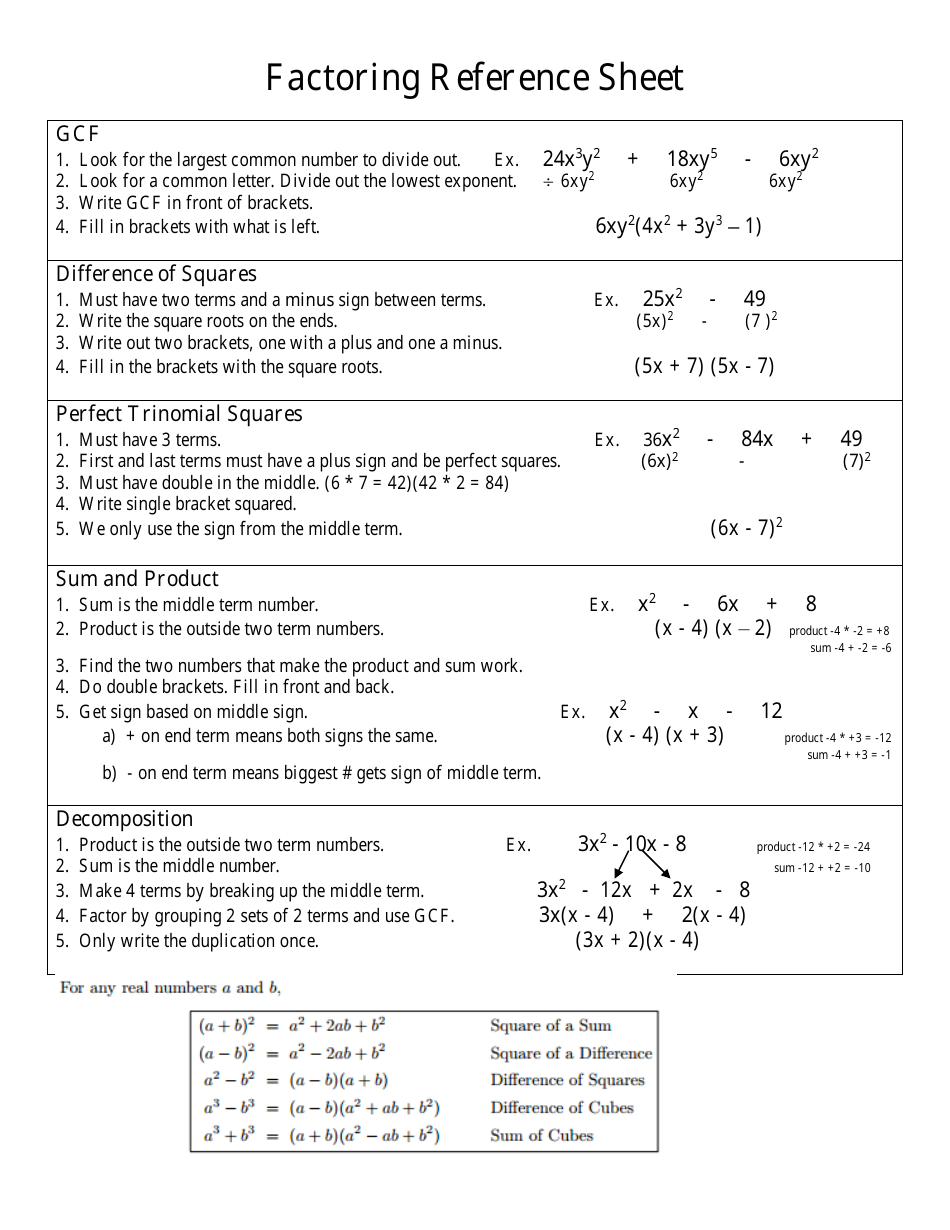

Factoring Reference Sheet

A Factoring Reference Sheet is used as a guide or reference tool that provides information and instructions on how to factor a number. It helps in understanding and implementing the process of breaking down a number into its prime factors.

The factoring reference sheet is usually filed by the company or entity that is conducting the factoring transaction.

FAQ

Q: What is factoring?

A: Factoring is a financing method where a business sells its accounts receivable to a third-party company, known as a factor, in exchange for immediate cash.

Q: How does factoring work?

A: In factoring, the factor buys the accounts receivable at a discounted rate and collects the payments from the customers.

Q: Why would a business use factoring?

A: Businesses use factoring to improve cash flow, access immediate funds, and outsource collections and credit risk.

Q: What are the benefits of factoring?

A: Benefits of factoring include quick access to cash, improved working capital, and reduced administrative burden.

Q: Is factoring the same as a bank loan?

A: No, factoring involves selling accounts receivable, while a bank loan involves borrowing money.

Q: Is factoring a common financing practice?

A: Yes, factoring is a common financing practice, especially among small businesses and those with slow-paying customers.

Q: What is recourse factoring?

A: Recourse factoring is when the business remains responsible for any unpaid invoices or bad debts.

Q: What is non-recourse factoring?

A: Non-recourse factoring is when the factor assumes responsibility for any unpaid invoices or bad debts.

Q: Are there any drawbacks to factoring?

A: Some drawbacks of factoring include higher costs compared to traditional loans and the potential impact on customer relationships.

Q: Can any business use factoring?

A: Most businesses can use factoring, but factors typically prefer to work with businesses that have consistent cash flow and reliable customers.