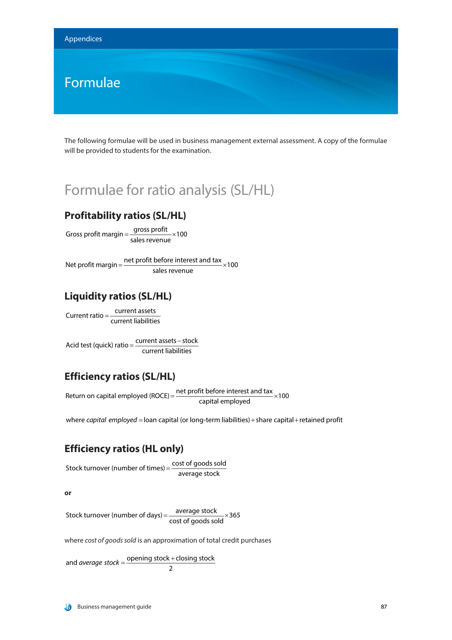

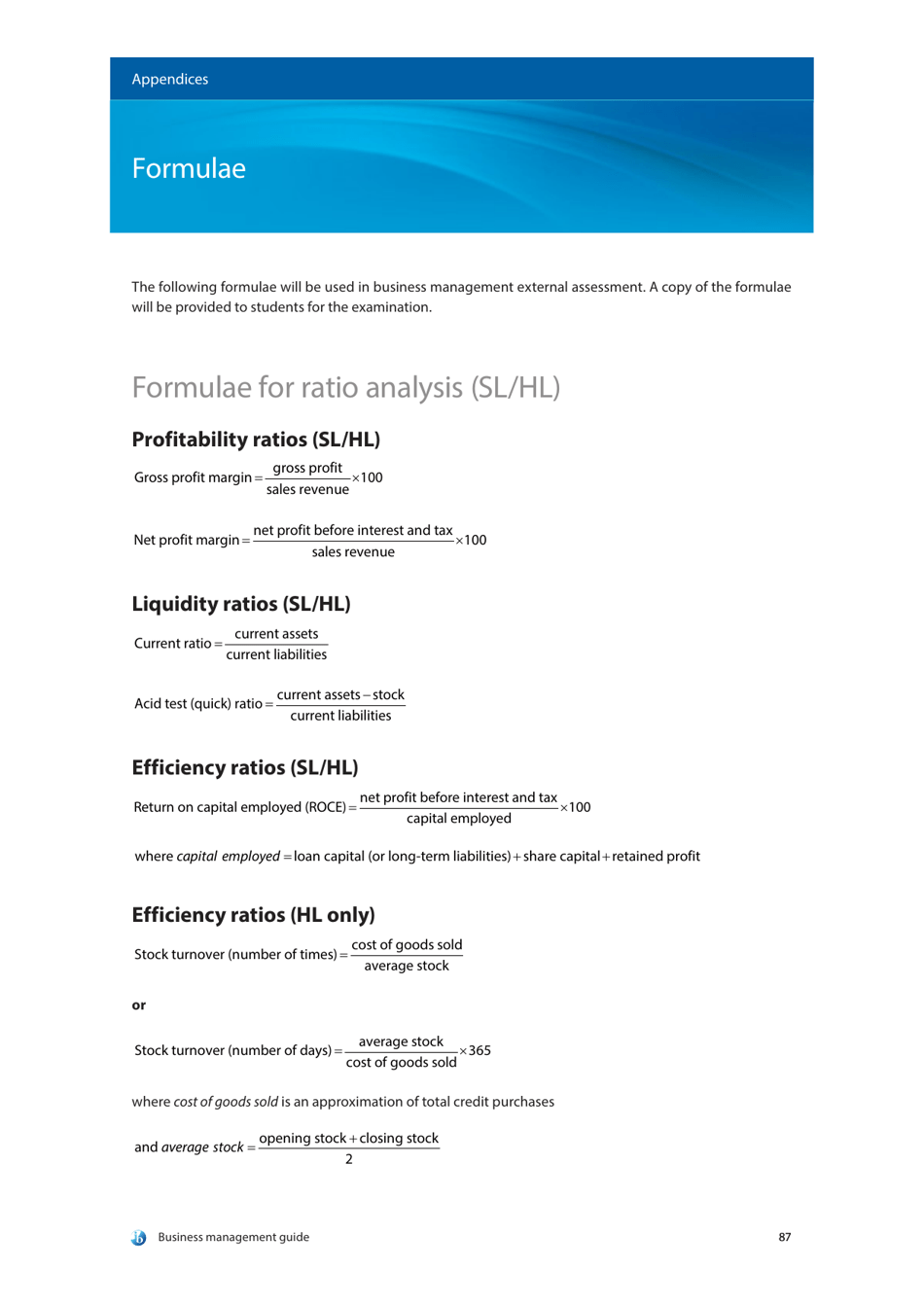

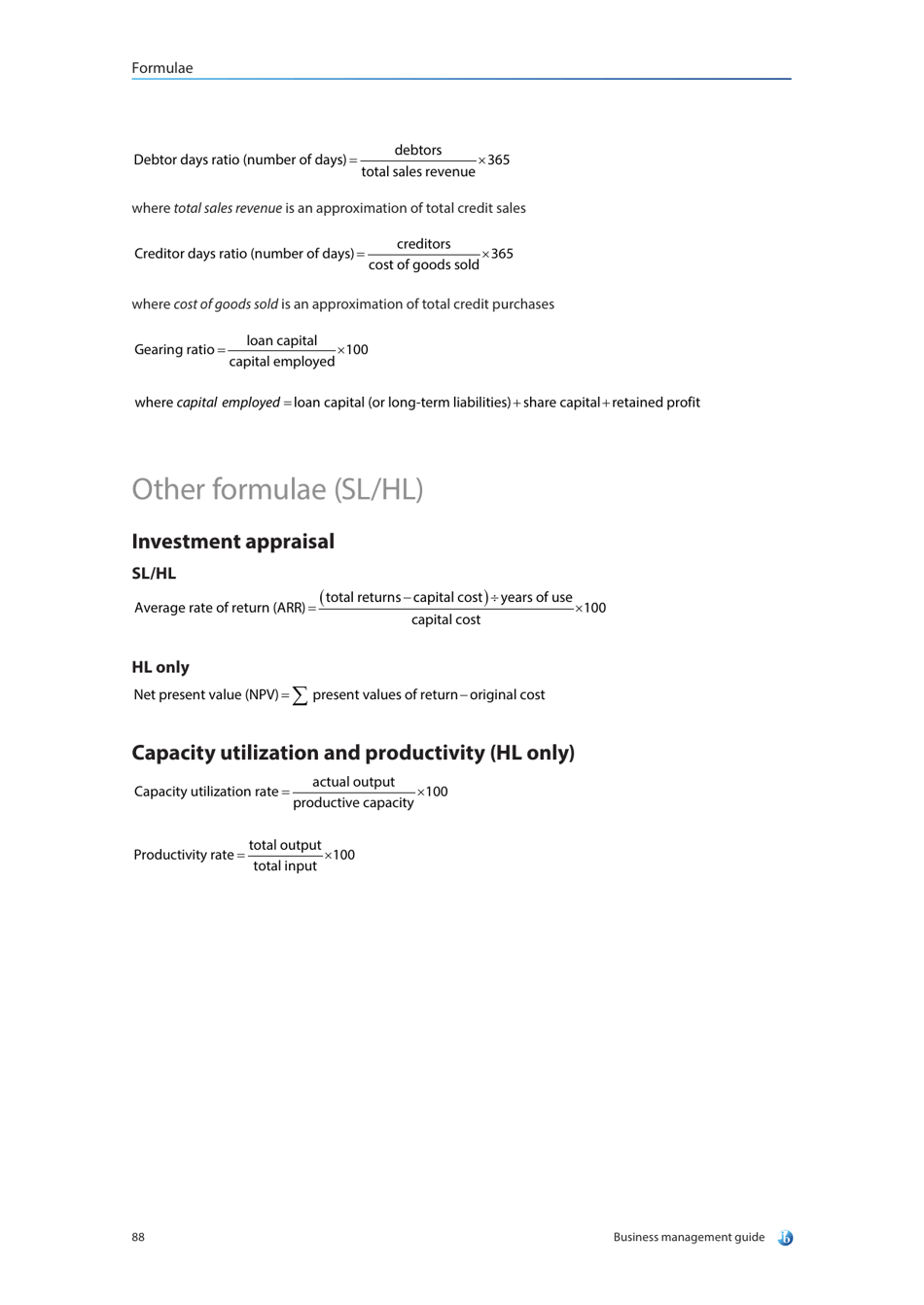

Ratio Analysis (Sl / Hl) Formula Sheet

The Ratio Analysis Formula Sheet is used as a reference tool to calculate various financial ratios that help evaluate the performance and financial health of a company. It provides the formulas used to calculate ratios such as liquidity ratios, profitability ratios, solvency ratios, and efficiency ratios.

FAQ

Q: What is ratio analysis?

A: Ratio analysis is a tool used to evaluate the financial performance of a company by analyzing various financial ratios.

Q: What is the purpose of ratio analysis?

A: The purpose of ratio analysis is to assess the profitability, efficiency, liquidity, and solvency of a company.

Q: What are the common financial ratios used in ratio analysis?

A: Some common financial ratios used in ratio analysis include profitability ratios, liquidity ratios, efficiency ratios, and solvency ratios.

Q: What are profitability ratios?

A: Profitability ratios measure the company's ability to generate profits and include ratios such as gross profit margin, net profit margin, and return on equity.

Q: What are liquidity ratios?

A: Liquidity ratios measure a company's ability to meet short-term obligations and include ratios such as current ratio and quick ratio.

Q: What are efficiency ratios?

A: Efficiency ratios measure how effectively a company utilizes its assets and include ratios such as asset turnover ratio and inventory turnover ratio.

Q: What are solvency ratios?

A: Solvency ratios measure a company's ability to meet long-term obligations and include ratios such as debt-to-equity ratio and interest coverage ratio.

Q: How is ratio analysis helpful?

A: Ratio analysis helps in understanding a company's financial health, identifying trends, making comparisons with industry norms, and making informed decisions related to investments or lending.

Q: Are there any limitations of ratio analysis?

A: Yes, some limitations of ratio analysis include reliance on historical data, not considering qualitative factors, variations in accounting methods, and differences in industry norms.