Real Estate Math Formulas Cheat Sheet

A real estate math formulas cheat sheet is a handy resource that provides quick reference to the various mathematical calculations involved in the real estate industry. It includes formulas related to mortgage payments, property valuation, capitalization rate, and other key calculations frequently used by real estate professionals.

Real estate math formulas cheat sheets are typically filed and used by individuals who are studying or working in the real estate industry. They are not usually filed with any specific authority or organization.

FAQ

Q: What are some common real estate math formulas?

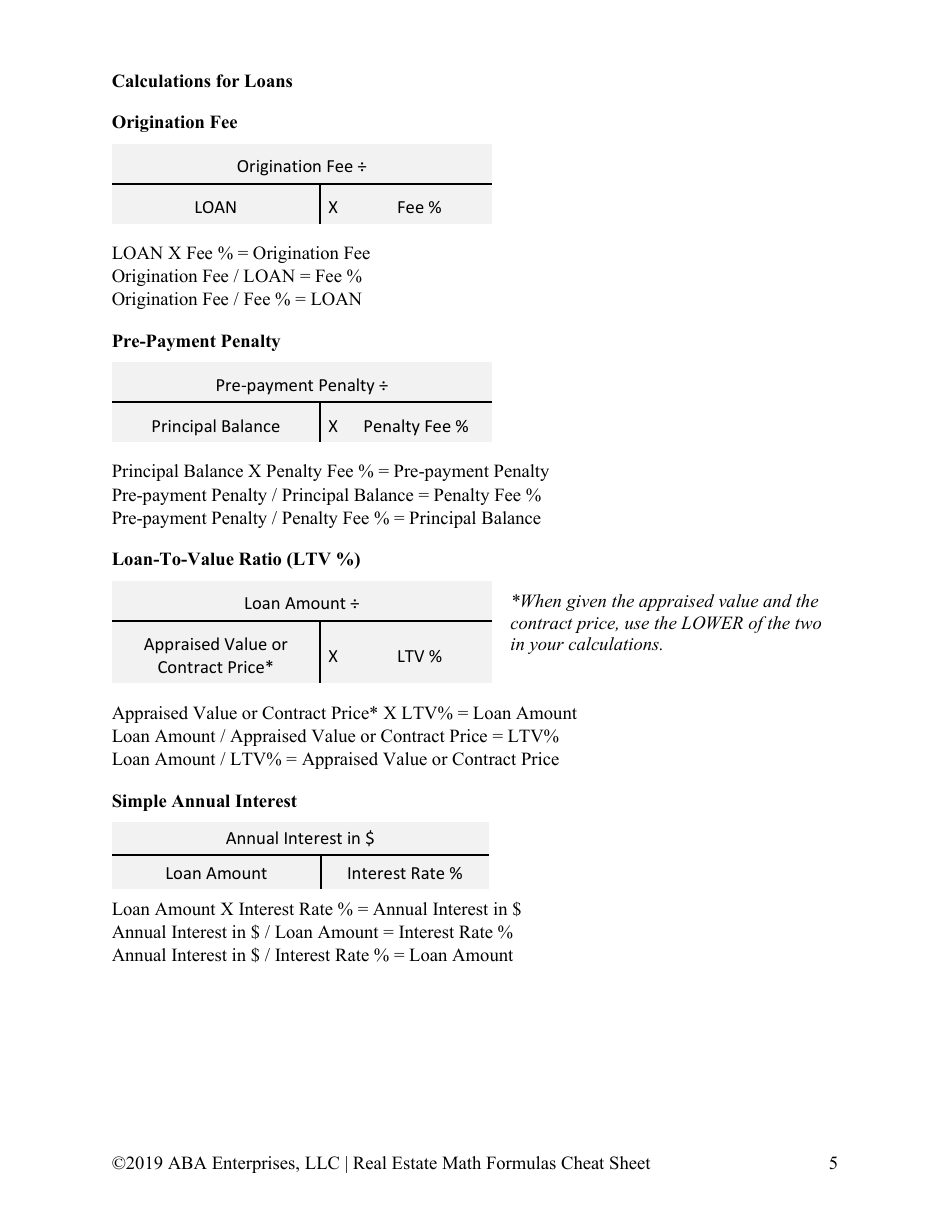

A: Some common real estate math formulas include the formula to calculate mortgage payments, the formula to calculate loan-to-value ratio, and the formula to calculate property appreciation.

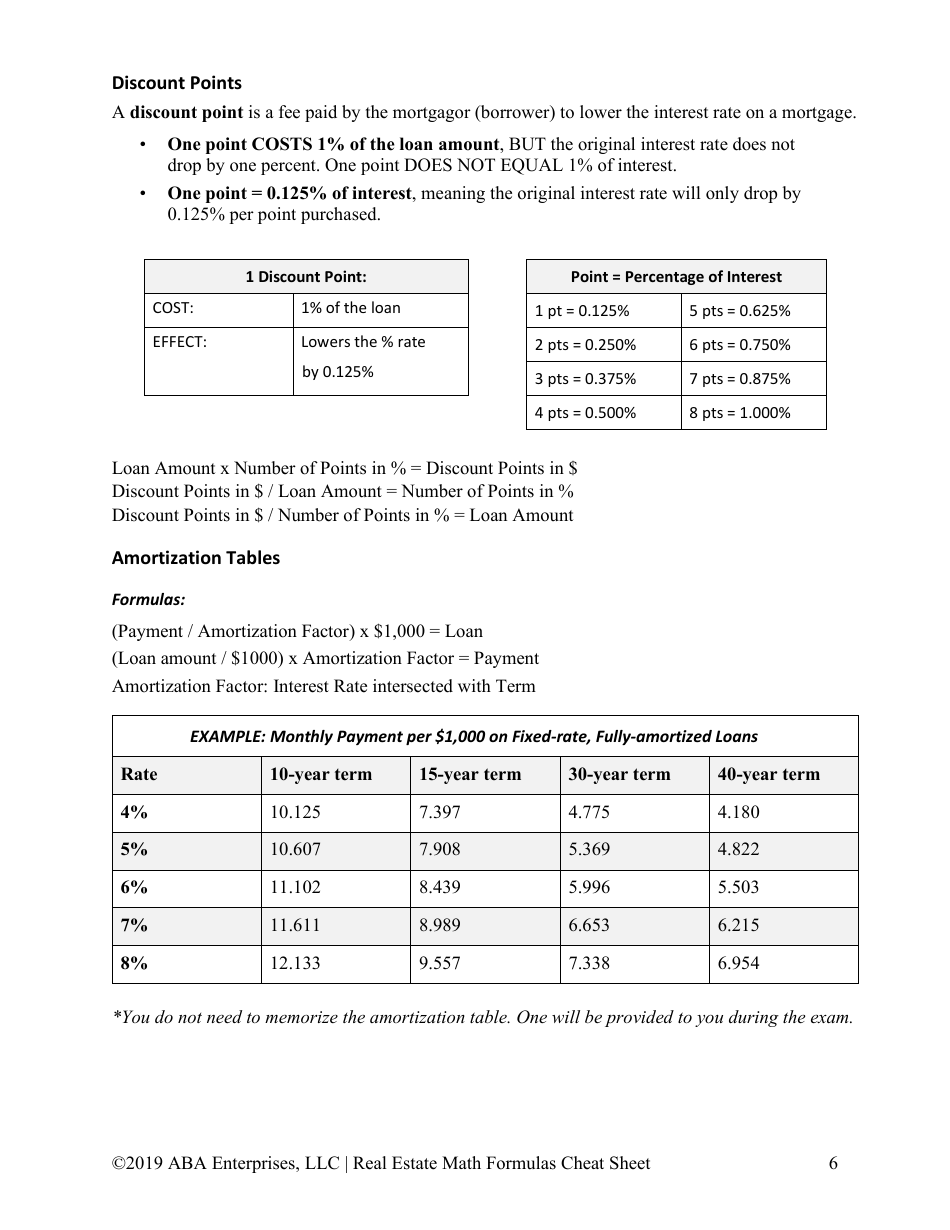

Q: How do you calculate mortgage payments?

A: To calculate mortgage payments, you can use the formula: payment = principal * (rate / (1 - (1 + rate) ^ -n)) where principal is the loan amount, rate is the interest rate, and n is the number of payments.

Q: What is the loan-to-value ratio formula?

A: The loan-to-value ratio formula is calculated by dividing the loan amount by the appraised value of the property and multiplying by 100 to get a percentage.

Q: How do you calculate property appreciation?

A: To calculate property appreciation, subtract the original purchase price from the current market value and divide the result by the original purchase price. Multiply the answer by 100 to get the appreciation as a percentage.