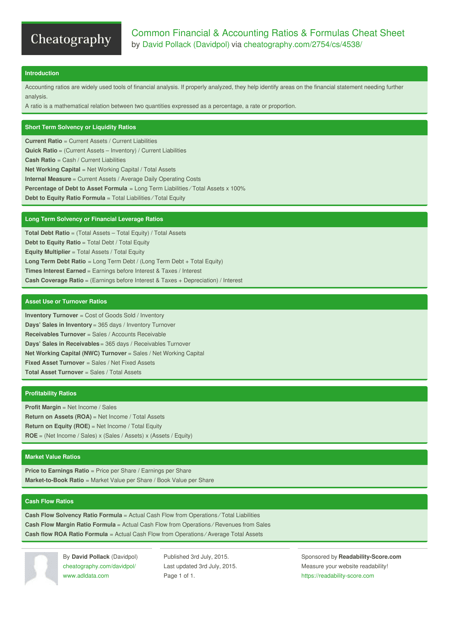

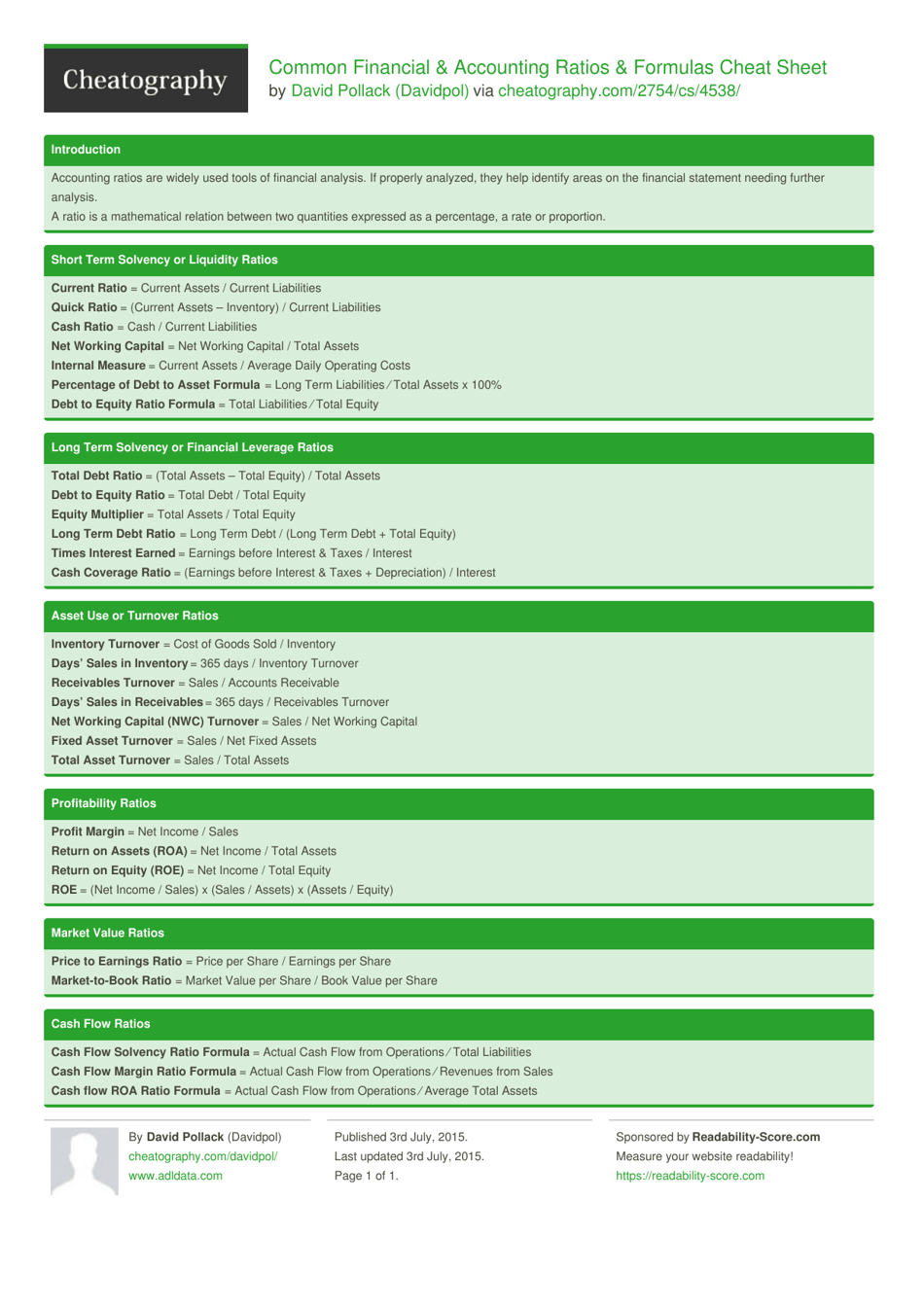

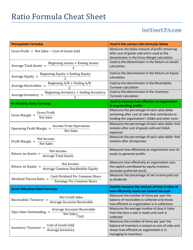

Common Financial & Accounting Ratios & Formulas Cheat Sheet

The Common Financial & Accounting Ratios & Formulas Cheat Sheet is a reference tool used to understand and calculate various financial ratios and formulas. It helps individuals, such as students or professionals, to analyze financial data and make informed decisions about the financial health and performance of a company.

The Common Financial & Accounting Ratios & Formulas Cheat Sheet does not have a specific author or filing entity. It is often created and shared by various financial professionals, educators, or organizations to assist individuals in understanding and applying financial and accounting ratios and formulas.

FAQ

Q: What is a financial ratio?

A: A financial ratio is a measure that indicates the relationship between certain financial figures.

Q: What is the purpose of using financial ratios?

A: Financial ratios are used to analyze a company's performance, financial health, and efficiency.

Q: What is the formula for calculating the current ratio?

A: The current ratio is calculated by dividing current assets by current liabilities.

Q: What does the current ratio indicate?

A: The current ratio indicates a company's ability to pay its short-term obligations.

Q: What is the formula for calculating the debt-to-equity ratio?

A: The debt-to-equity ratio is calculated by dividing total debt by shareholders' equity.

Q: What does the debt-to-equity ratio measure?

A: The debt-to-equity ratio measures a company's leverage and financial risk.

Q: What is the formula for calculating return on investment (ROI)?

A: ROI is calculated by dividing the net profit by the initial investment and multiplying by 100.

Q: What does return on investment (ROI) measure?

A: ROI measures the profitability and efficiency of an investment.

Q: What is the formula for calculating the gross profit margin?

A: The gross profit margin is calculated by dividing gross profit by net sales and multiplying by 100.

Q: What does the gross profit margin indicate?

A: The gross profit margin indicates the profitability of a company's core operations.