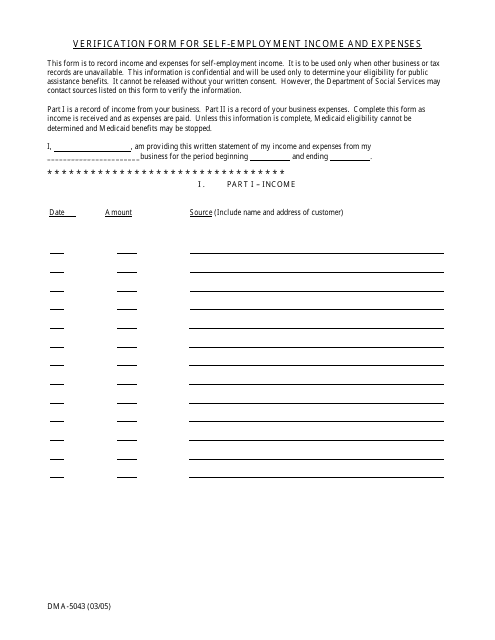

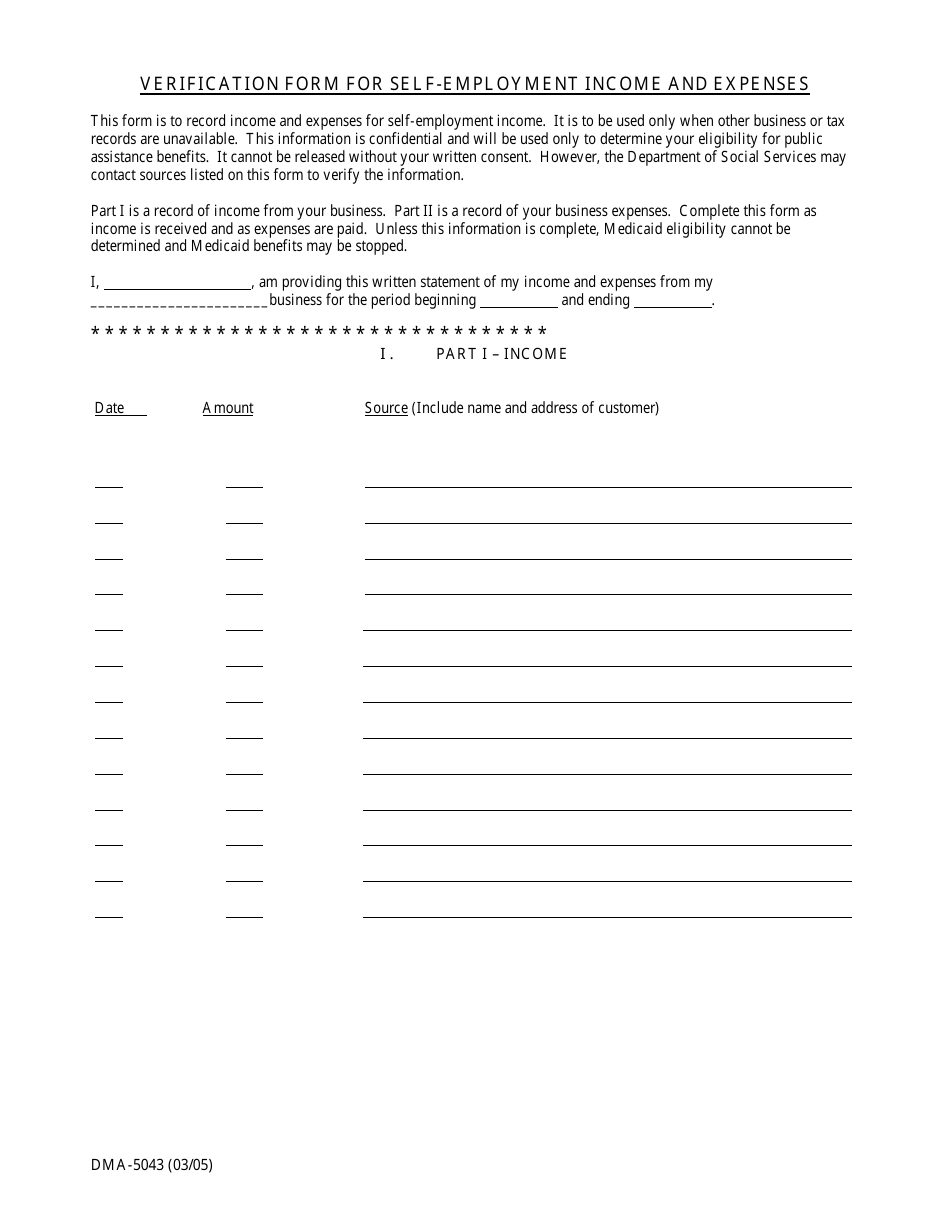

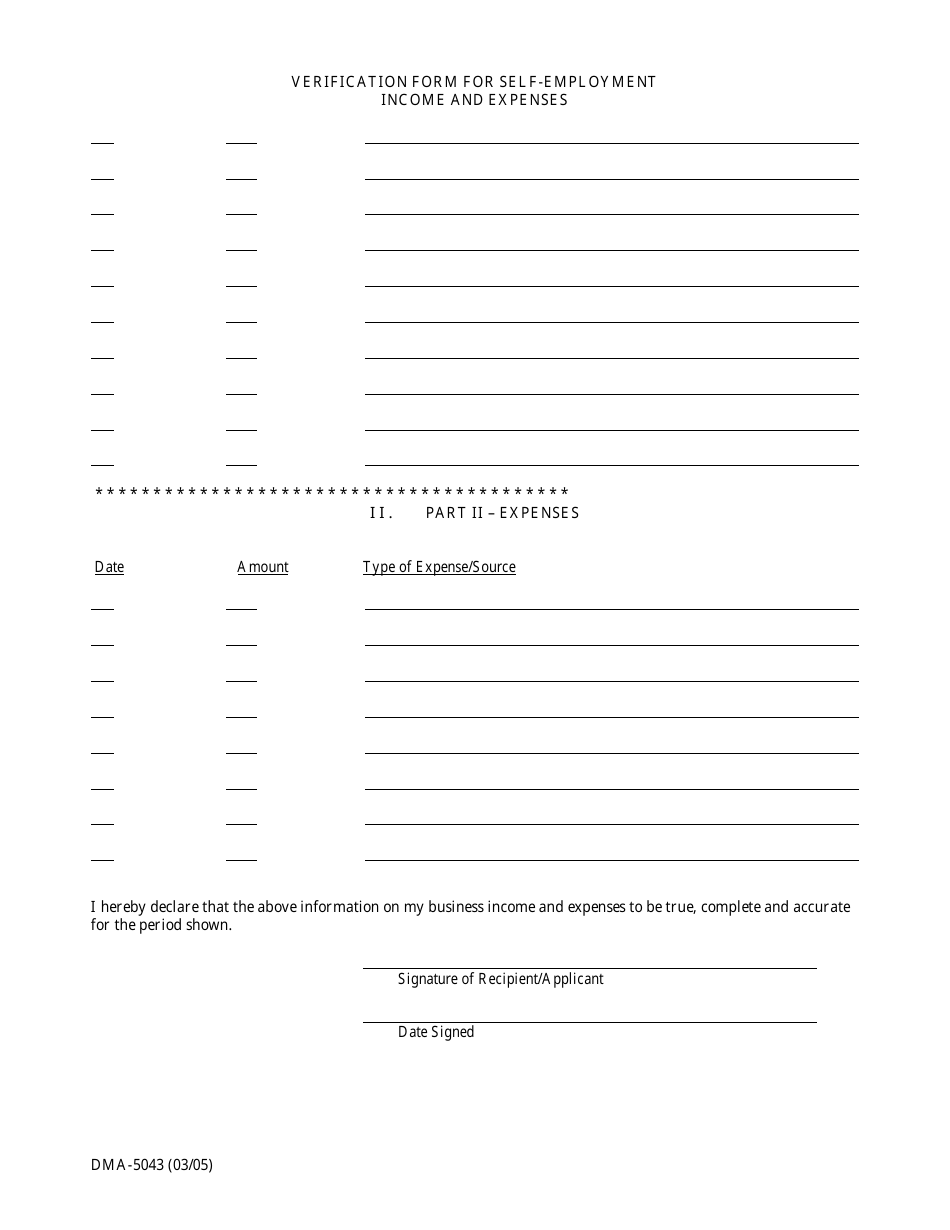

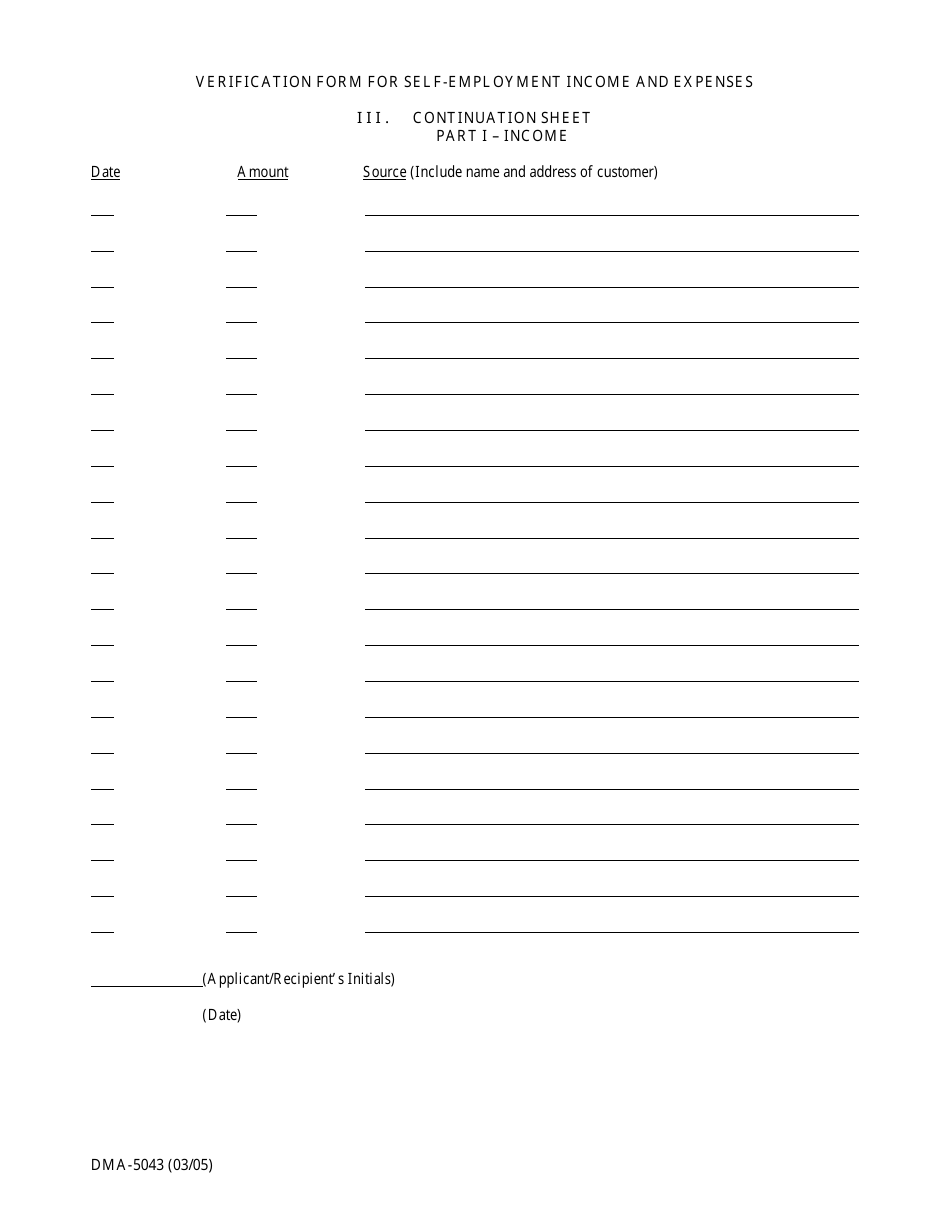

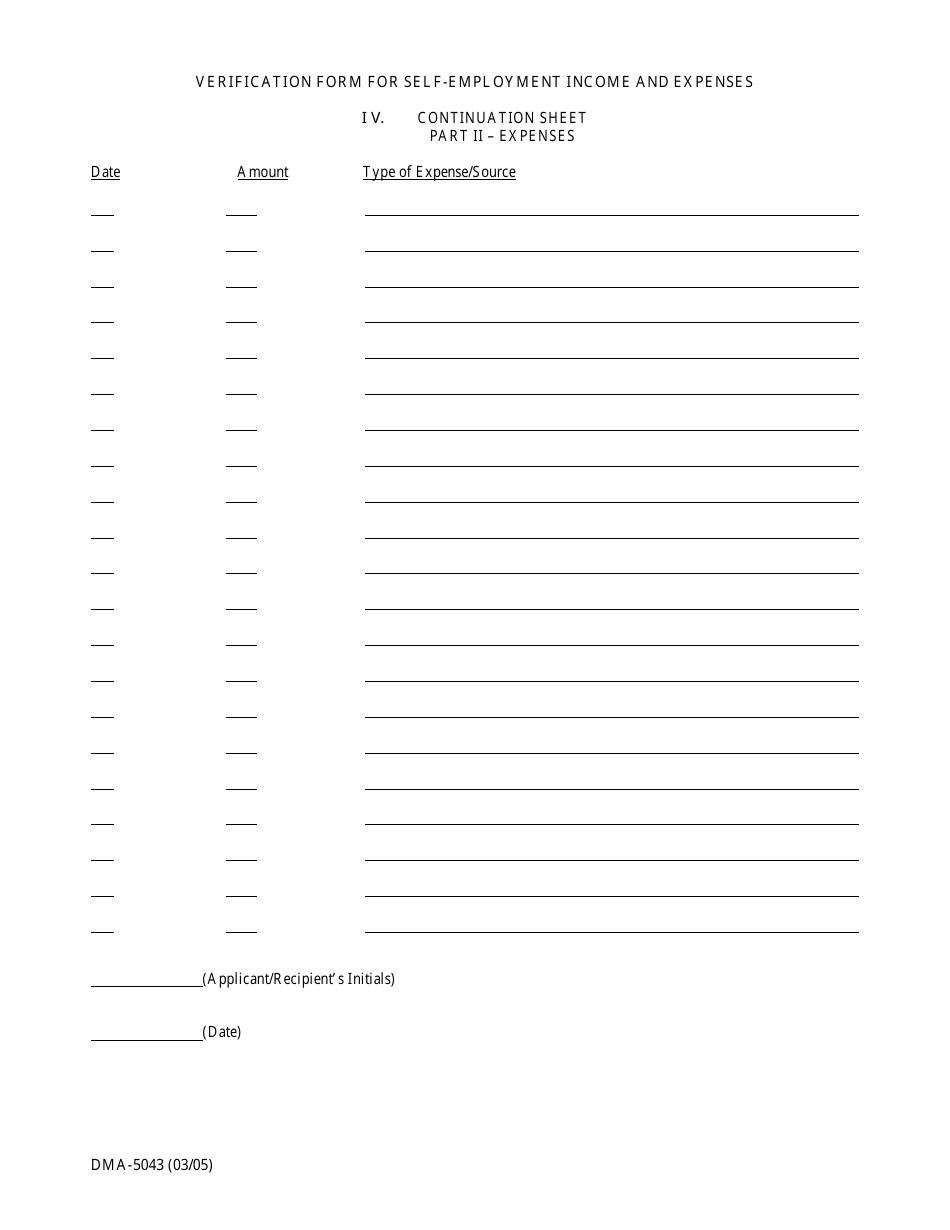

Form DMA-5043 Verification Form for Self-employment Income and Expenses - North Carolina

What Is Form DMA-5043?

This is a legal form that was released by the North Carolina Department of Health and Human Services - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

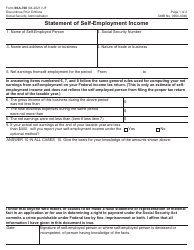

Q: What is the DMA-5043 Verification Form for?

A: The DMA-5043 verification form is used for self-employment income and expenses in North Carolina.

Q: Who needs to complete the DMA-5043 Verification Form?

A: Anyone who is self-employed and needs to report their income and expenses in North Carolina.

Q: What information is required on the DMA-5043 Verification Form?

A: The form requires details of your self-employment income, expenses, and other relevant financial information.

Q: Do I need to submit any supporting documentation with the DMA-5043 Verification Form?

A: Yes, you may be required to provide supporting documents such as bank statements, receipts, and invoices.

Q: When should I submit the DMA-5043 Verification Form?

A: You should submit the form as soon as possible after the end of the reporting period, usually annually or whenever your income or expenses change significantly.

Q: Who should I contact if I have questions about the DMA-5043 Verification Form?

A: For specific questions or assistance, you should contact the North Carolina Department of Health and Human Services or your local county office.

Form Details:

- Released on March 1, 2005;

- The latest edition provided by the North Carolina Department of Health and Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DMA-5043 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Health and Human Services.