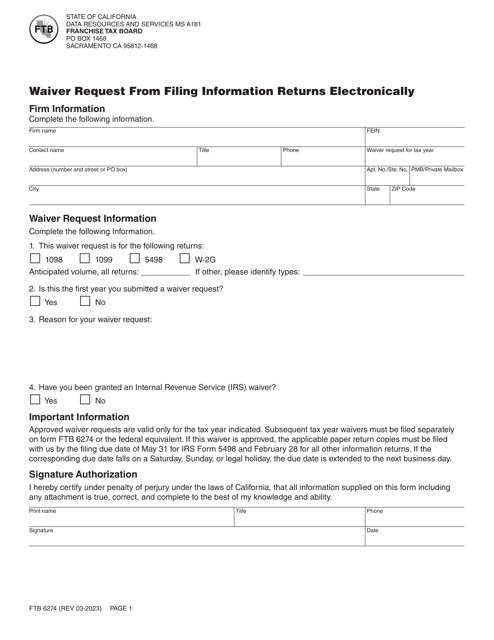

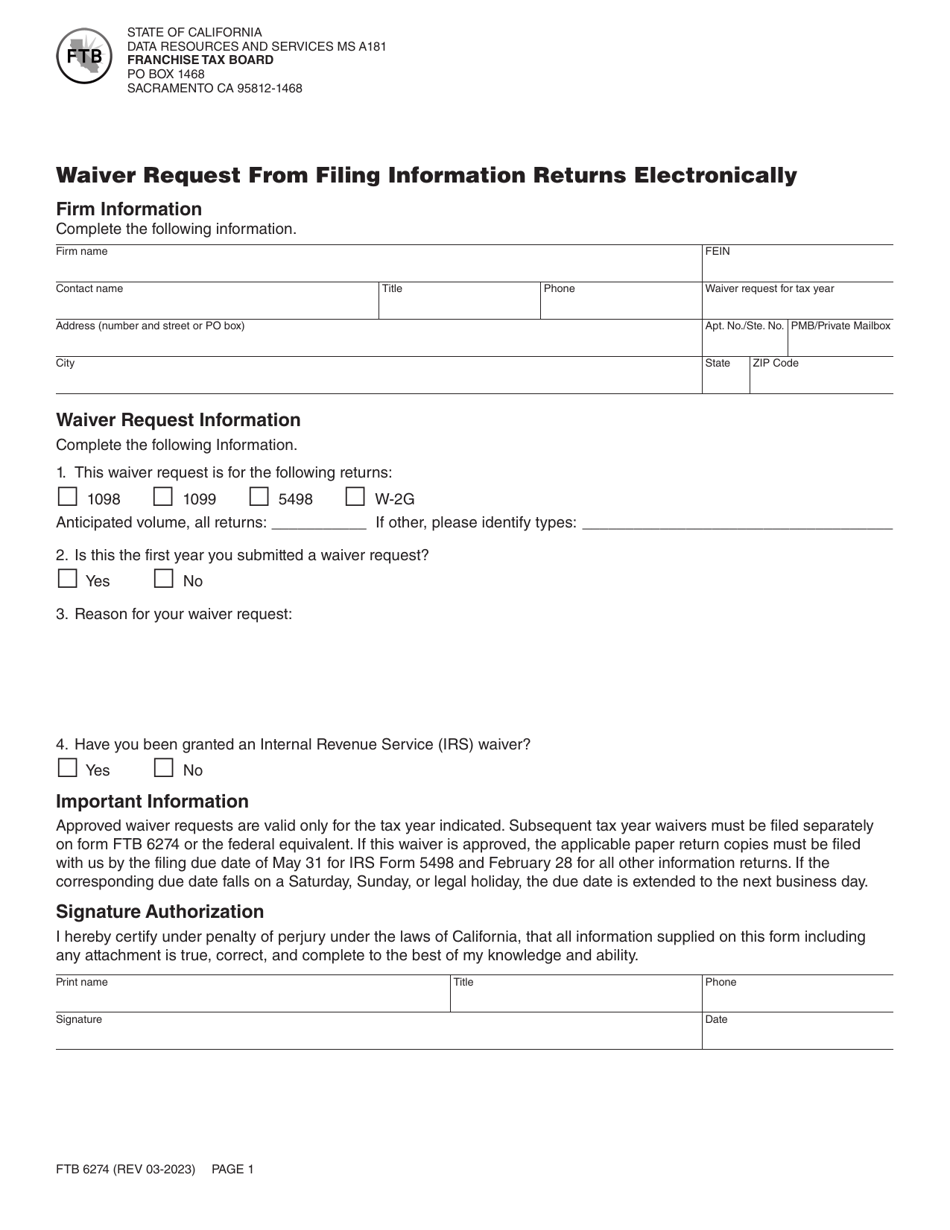

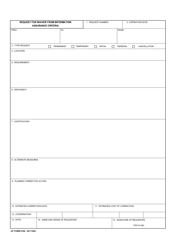

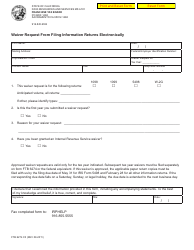

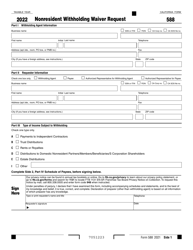

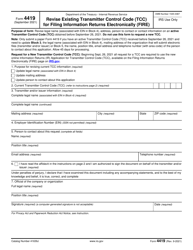

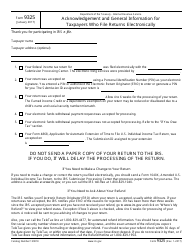

Form FTB6274 Waiver Request From Filing Information Returns Electronically - California

What Is Form FTB6274?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB6274?

A: Form FTB6274 is a Waiver Request From Filing Information Returns Electronically in California.

Q: What is the purpose of Form FTB6274?

A: The purpose of Form FTB6274 is to request a waiver from electronically filing information returns in California.

Q: Who needs to file Form FTB6274?

A: Any taxpayer who is required to file information returns in California, but is unable to do so electronically, may need to file Form FTB6274.

Q: What information is required on Form FTB6274?

A: Form FTB6274 requires the taxpayer's identifying information, reason for requesting the waiver, and any supporting documentation.

Q: Is there a deadline to file Form FTB6274?

A: Yes, Form FTB6274 should be filed before the deadline for filing information returns in California.

Q: Can a waiver from electronically filing information returns be granted?

A: Yes, the Franchise Tax Board (FTB) of California may grant a waiver from electronically filing information returns if the taxpayer meets certain criteria.

Q: What happens if my waiver request is approved?

A: If your waiver request is approved, you will be allowed to file your information returns in California in a non-electronic format.

Q: What happens if my waiver request is denied?

A: If your waiver request is denied, you will be required to electronically file your information returns in California.

Form Details:

- Released on March 1, 2023;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

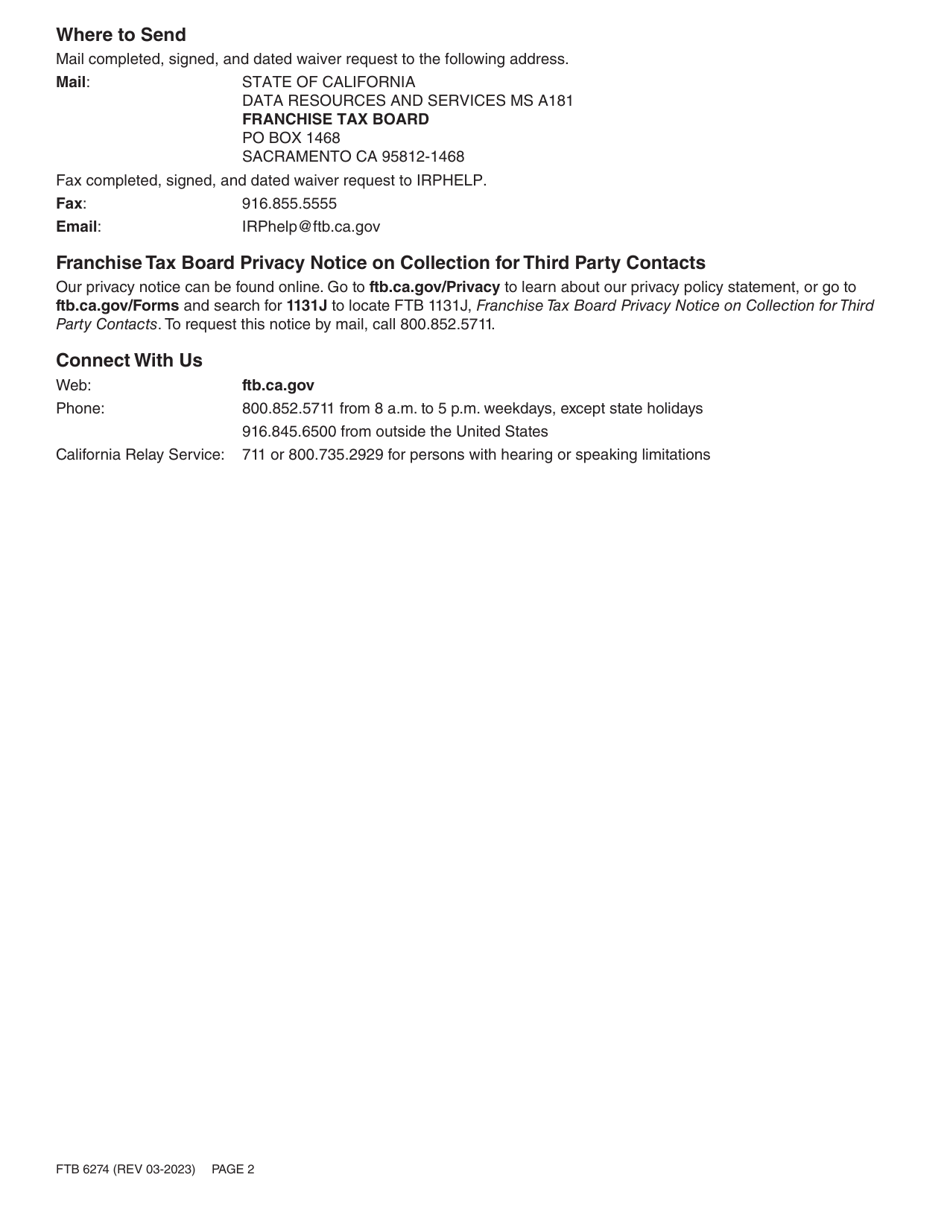

Download a printable version of Form FTB6274 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.