This version of the form is not currently in use and is provided for reference only. Download this version of

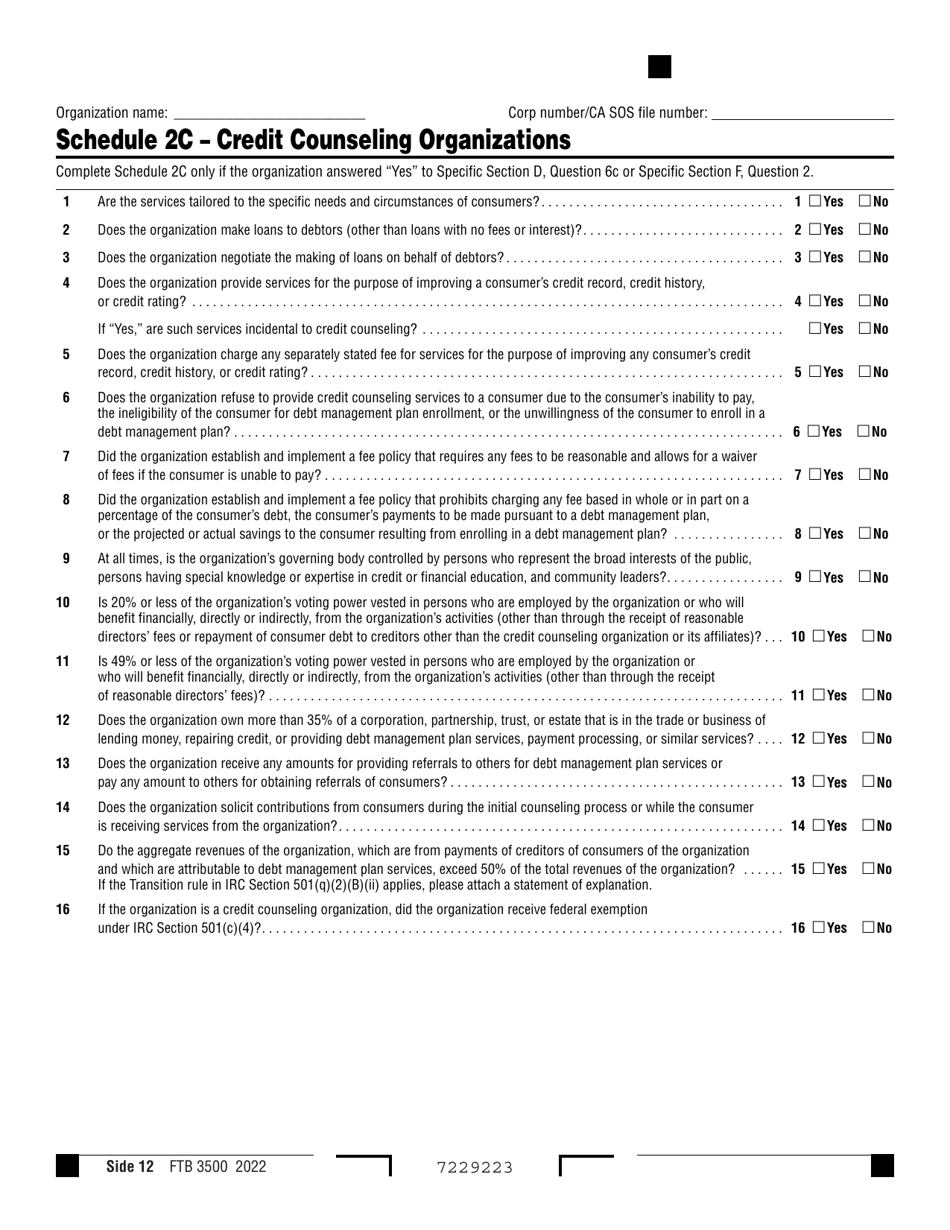

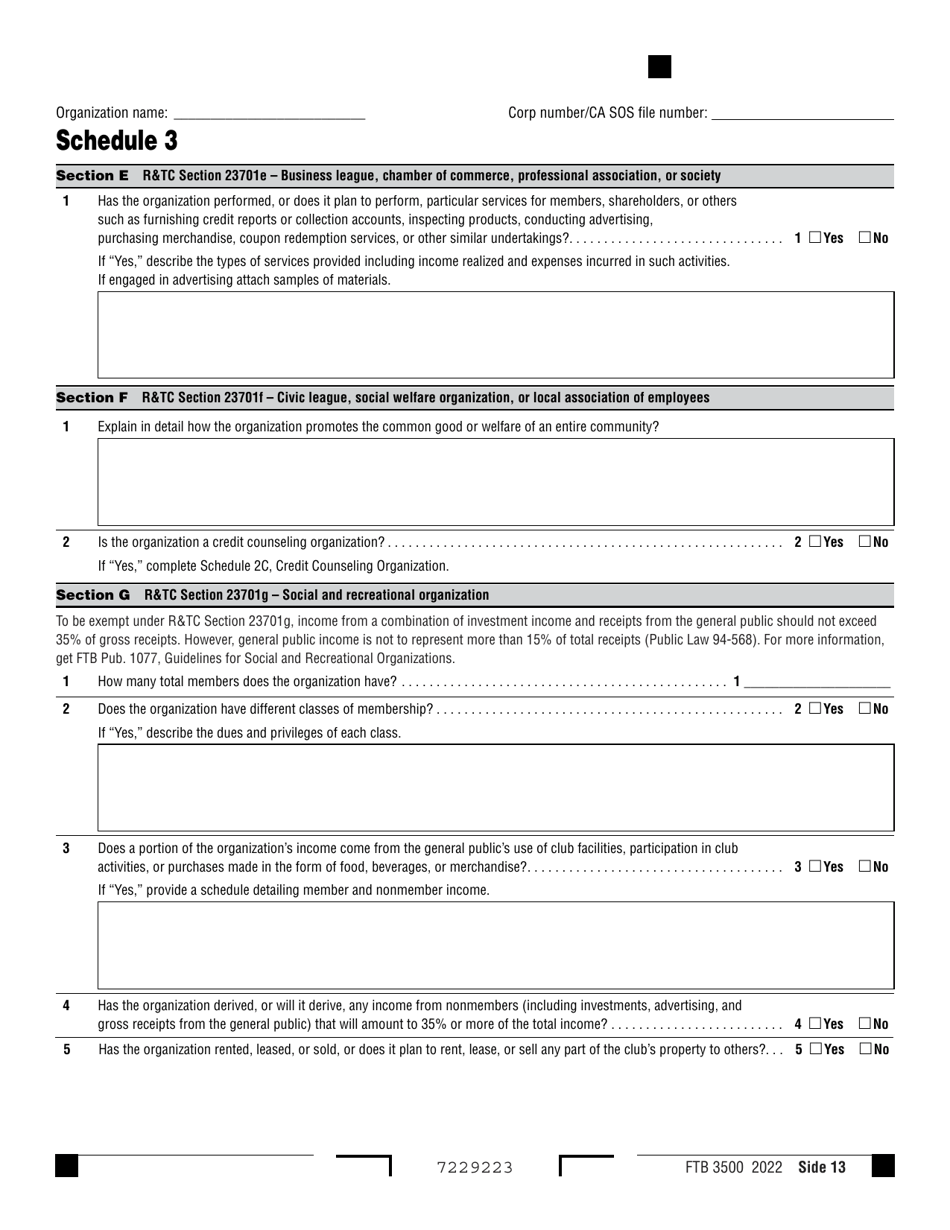

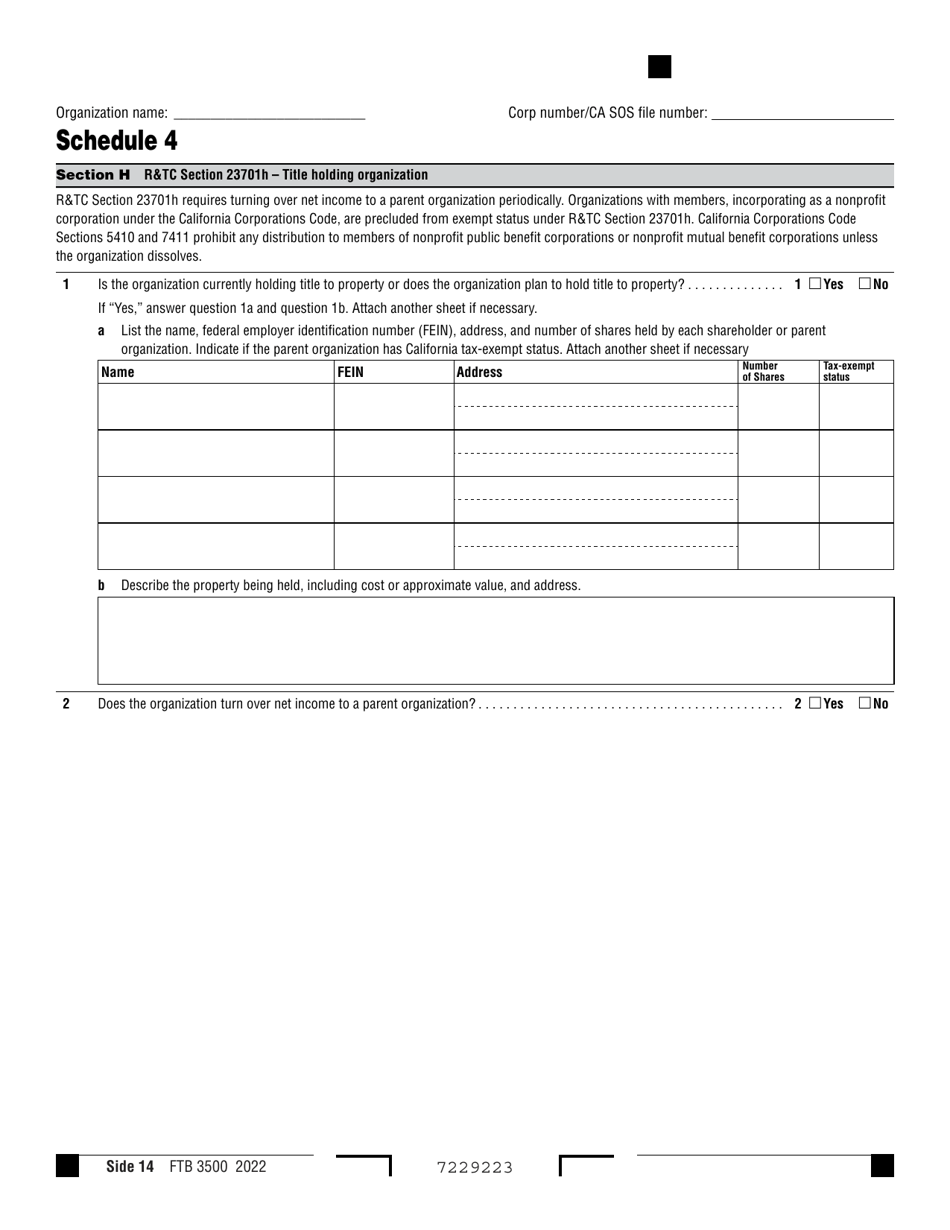

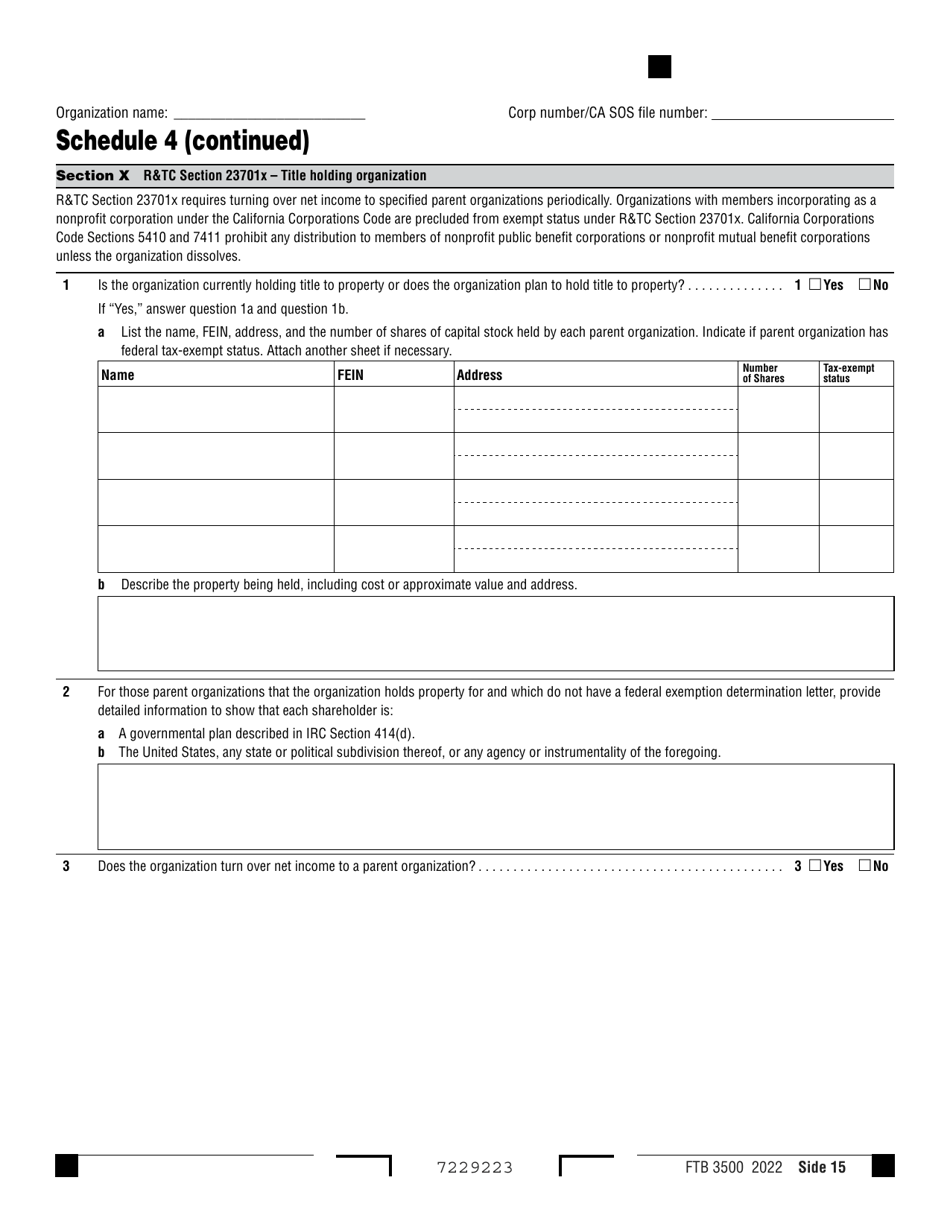

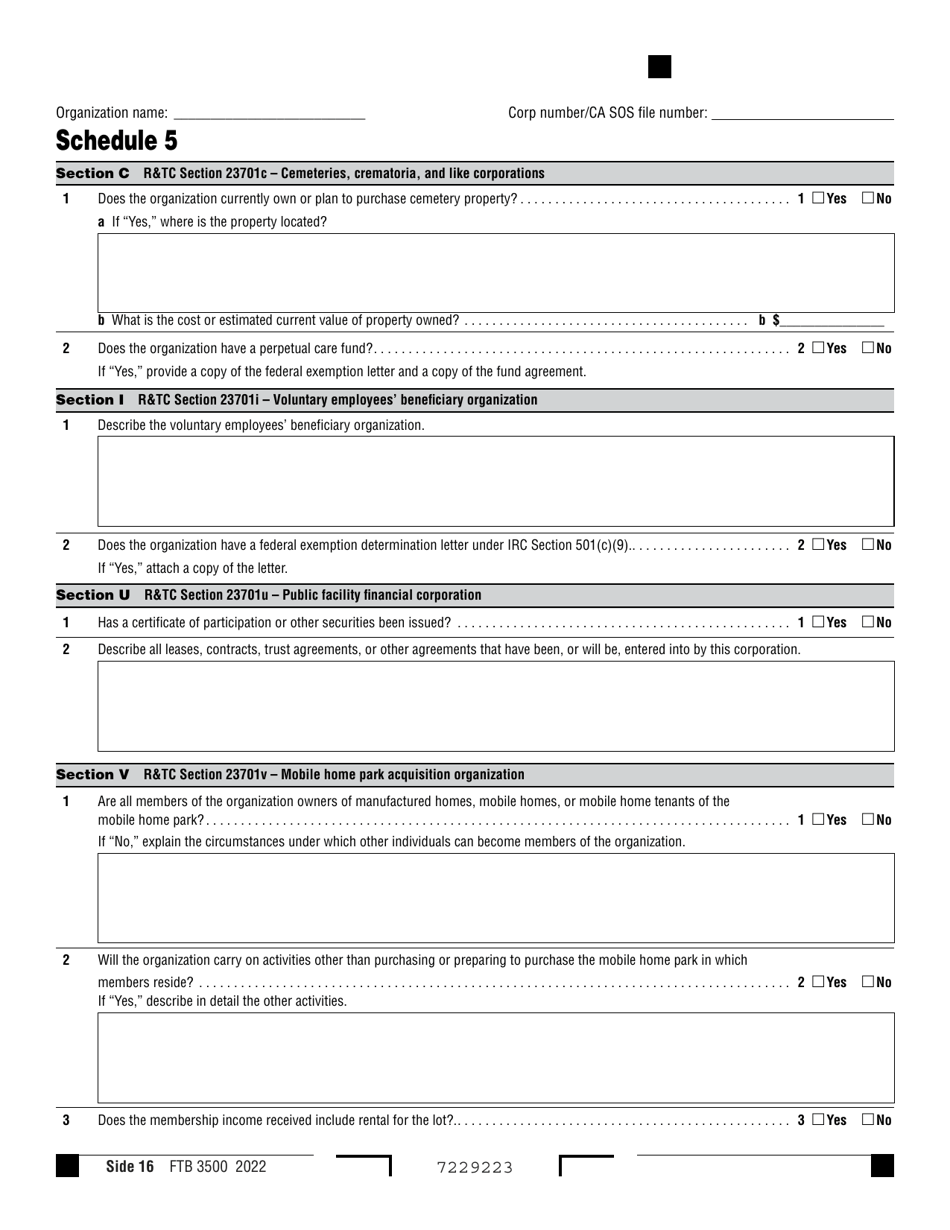

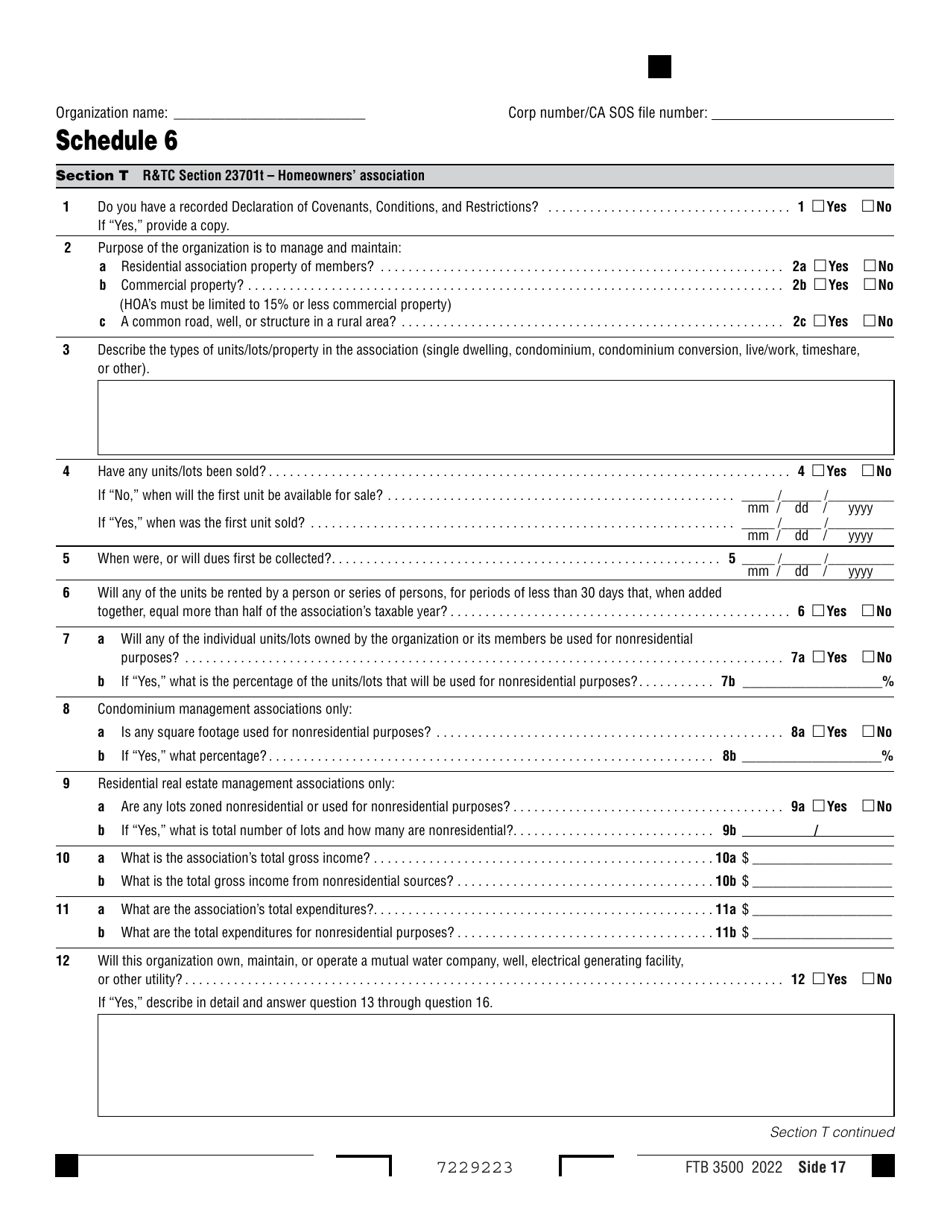

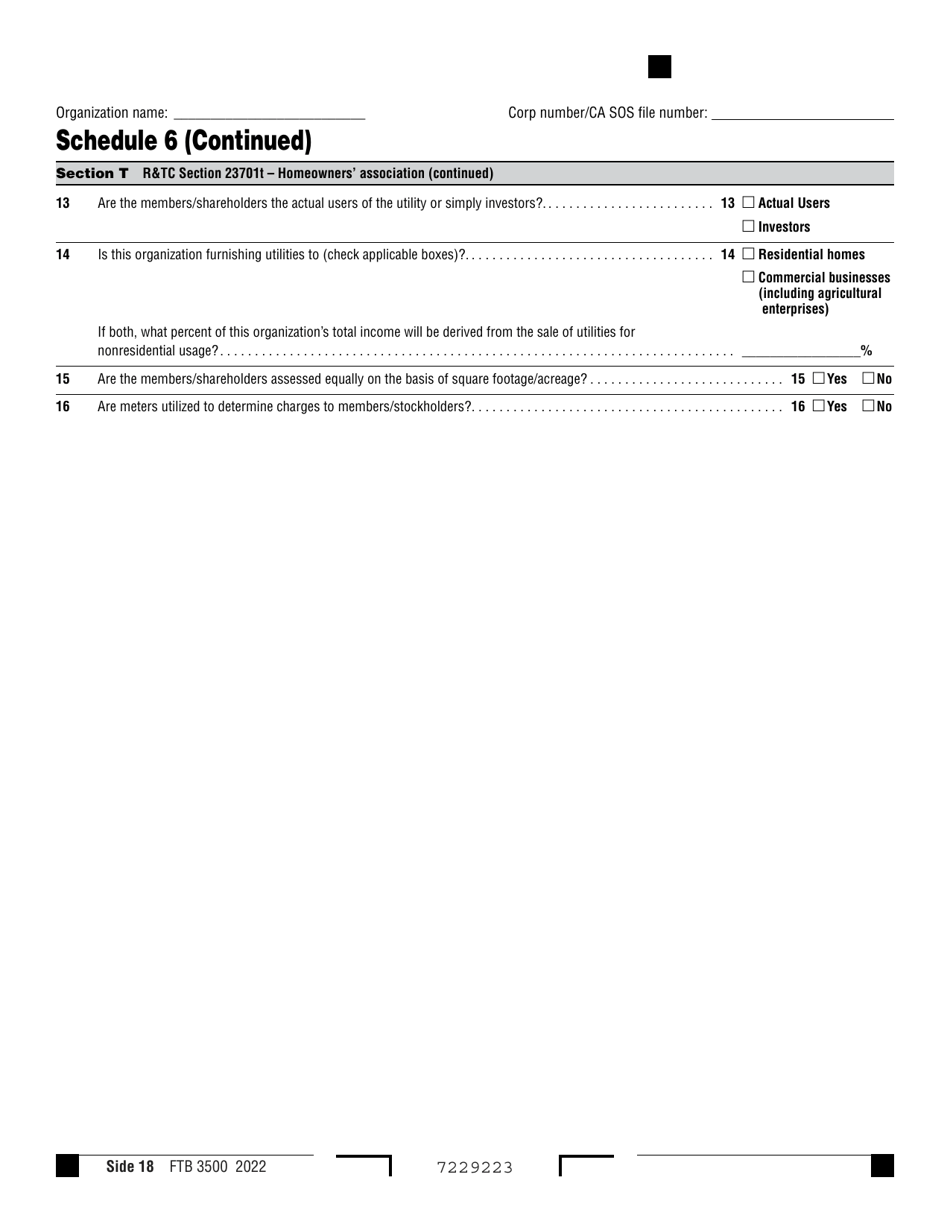

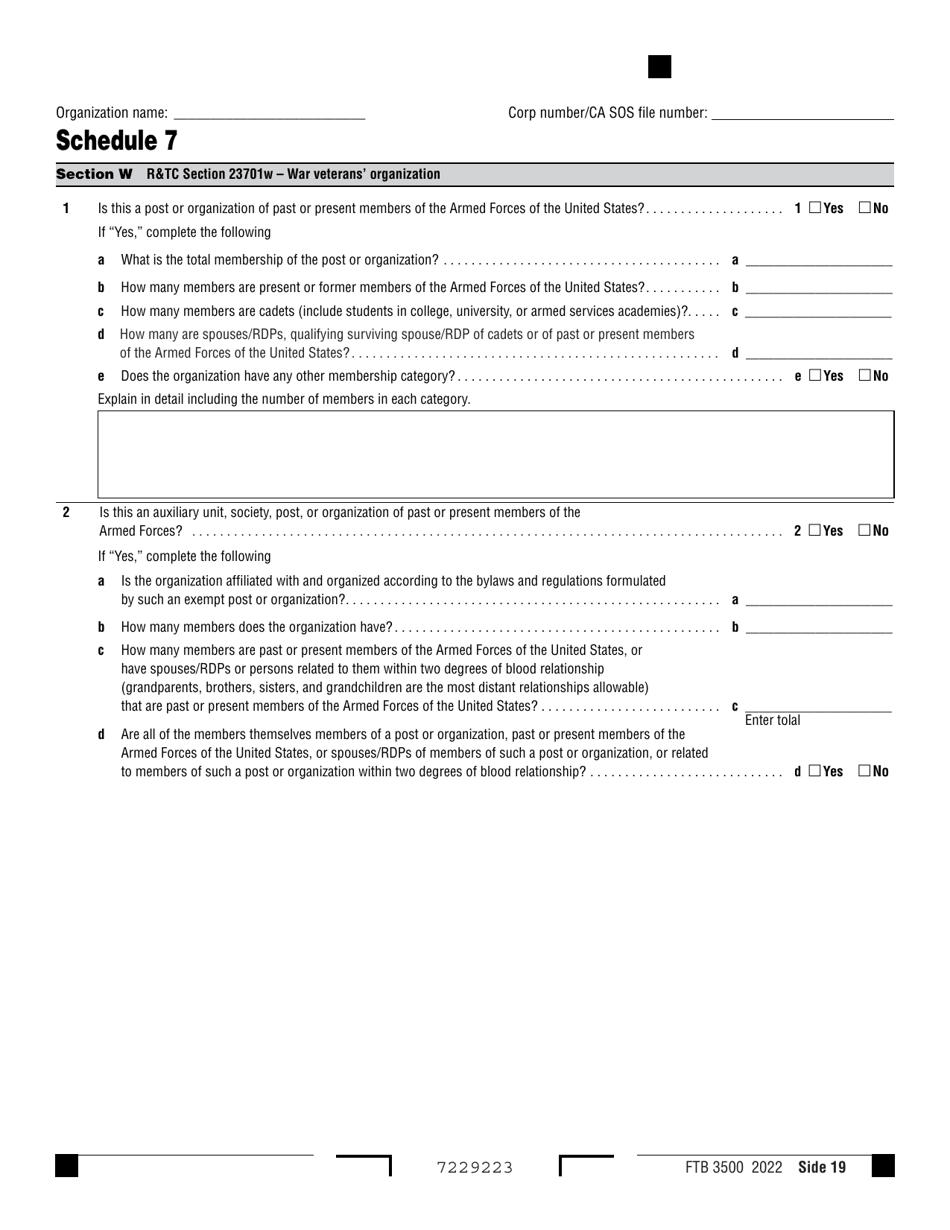

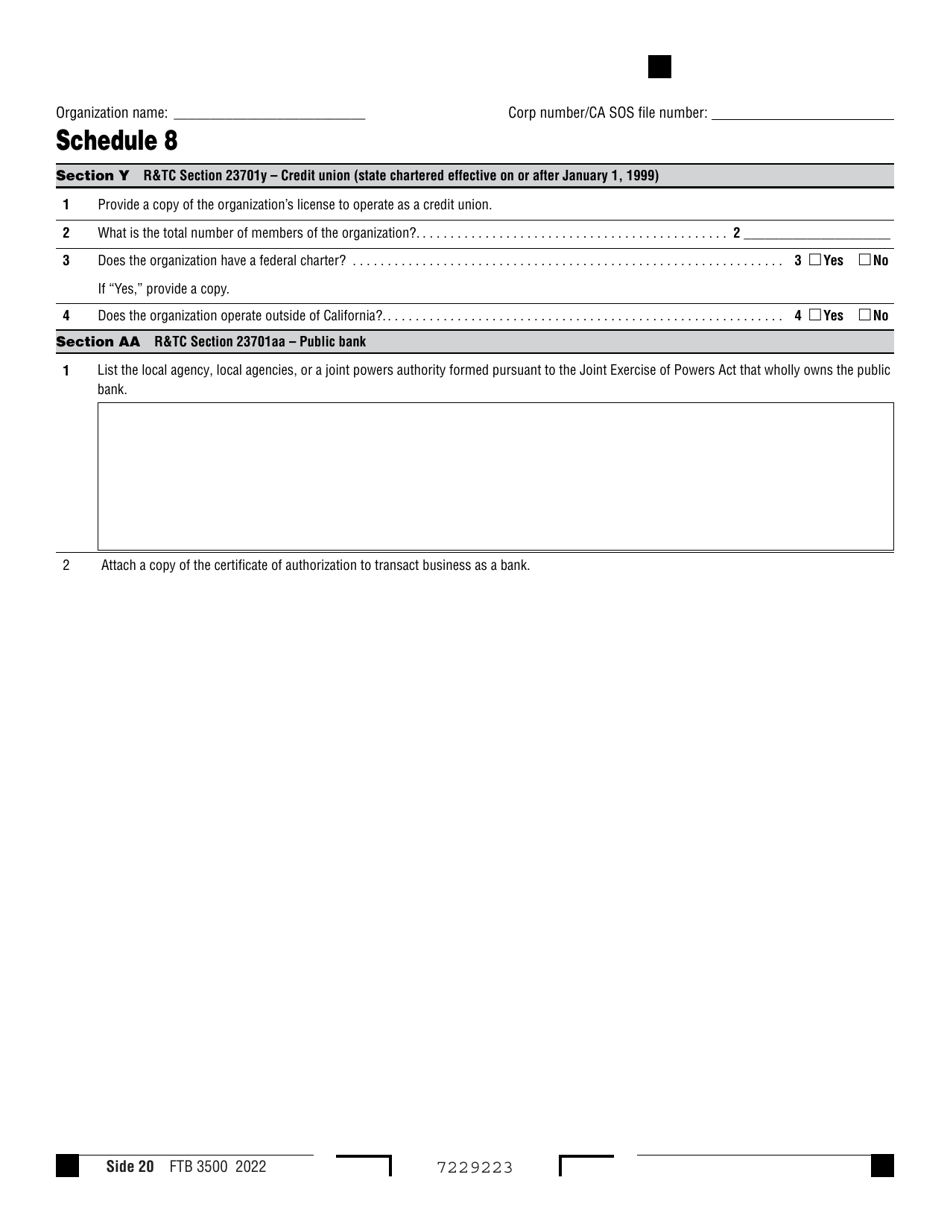

Form FTB3500

for the current year.

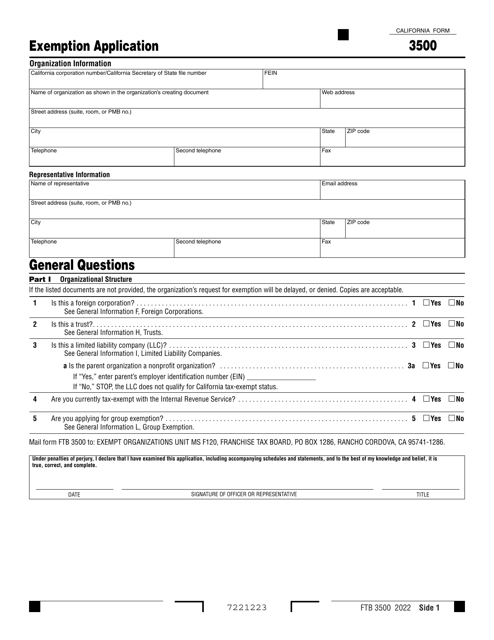

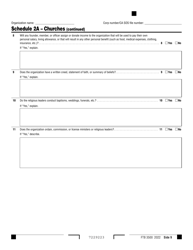

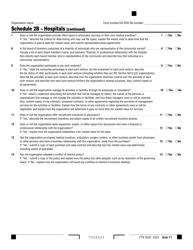

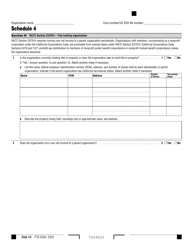

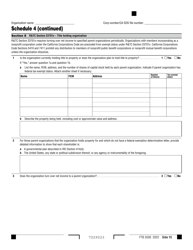

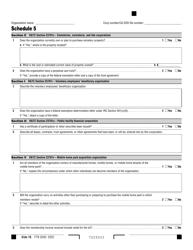

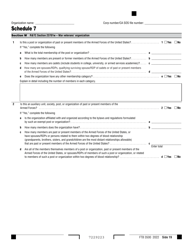

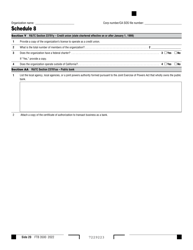

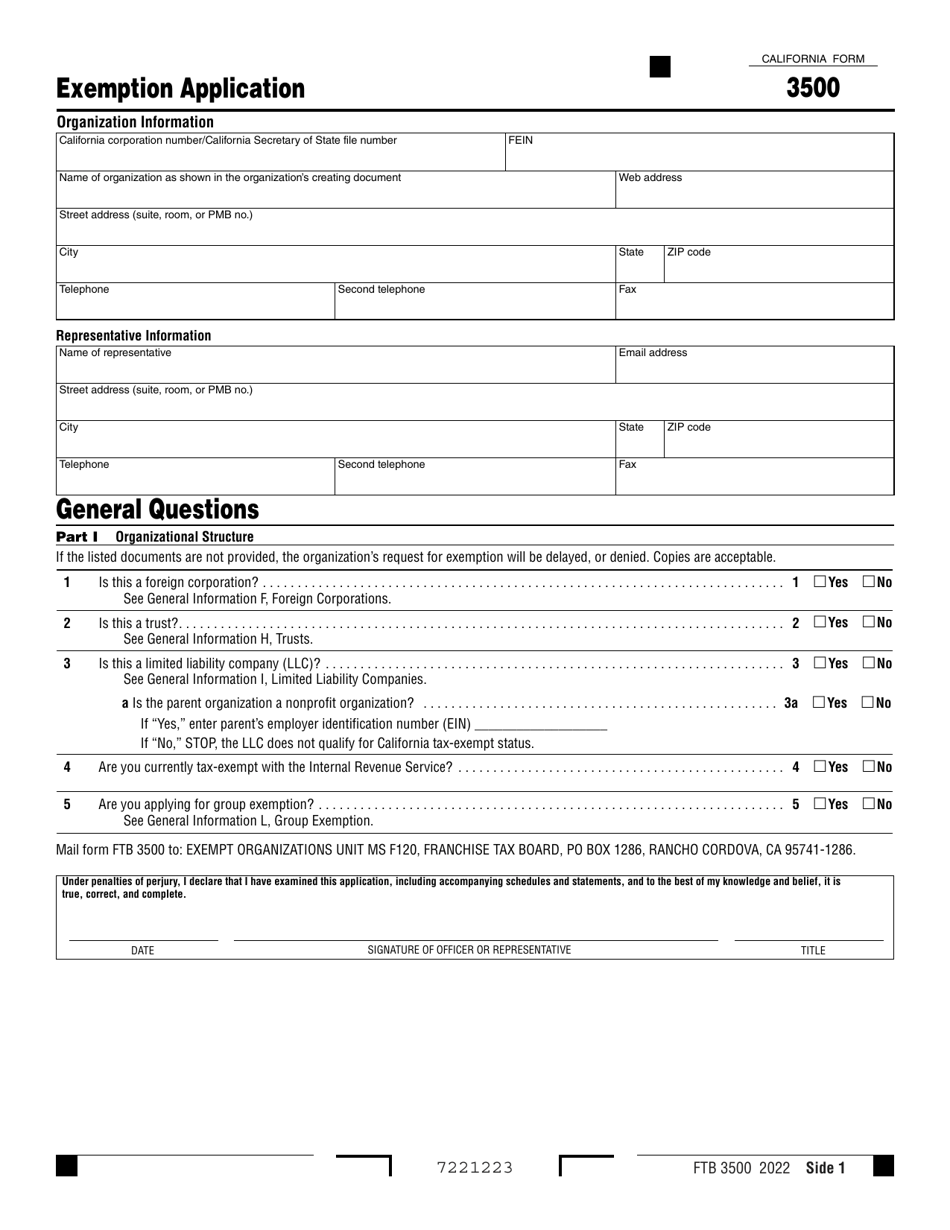

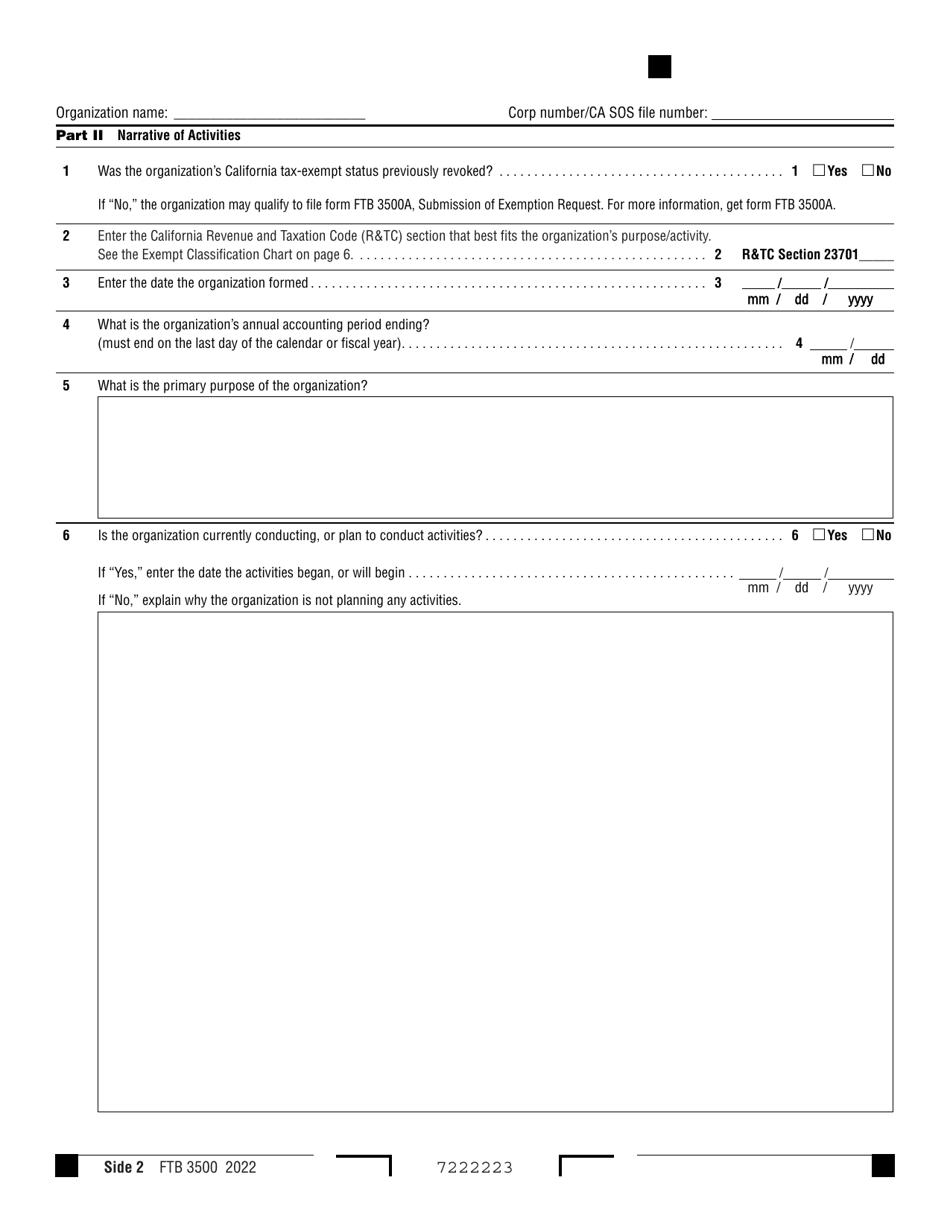

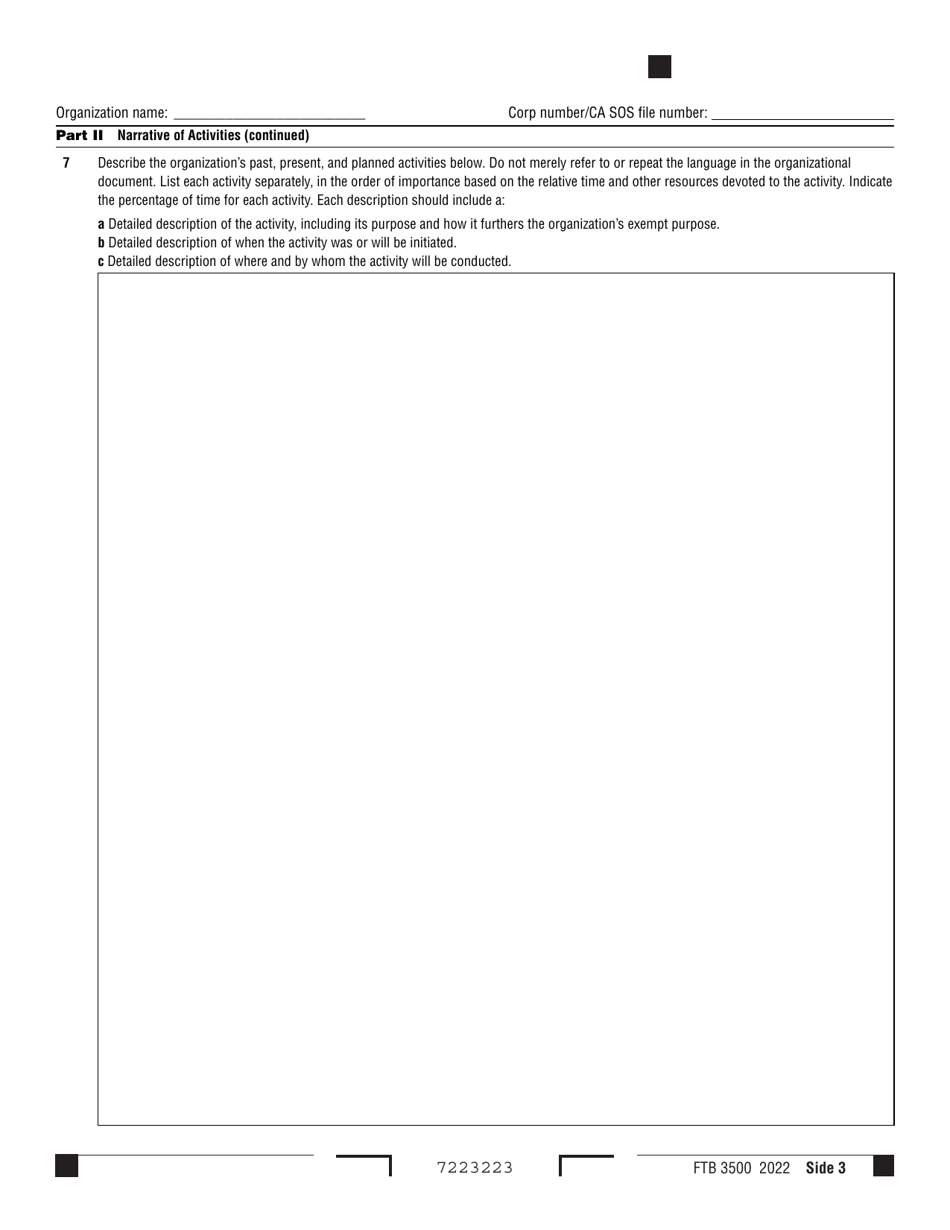

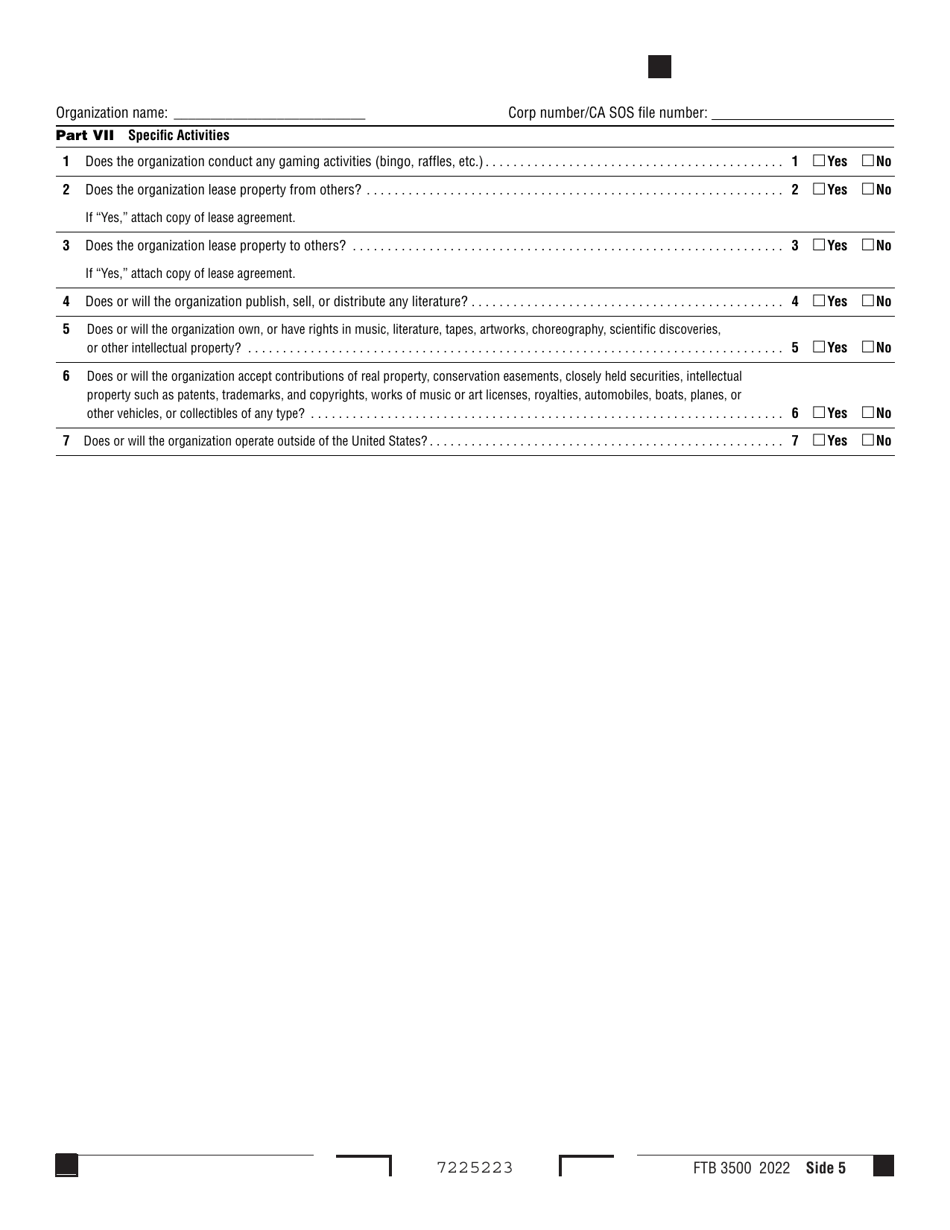

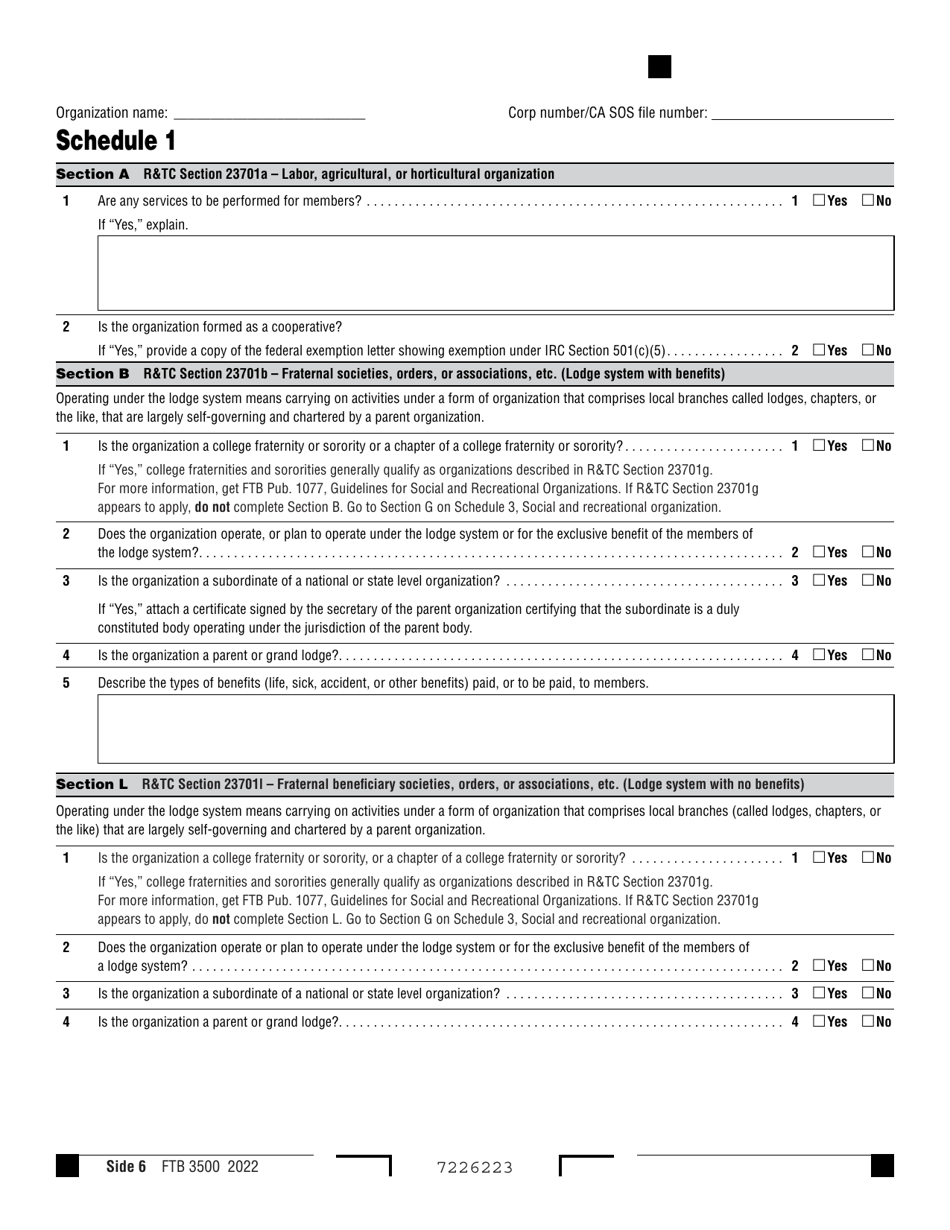

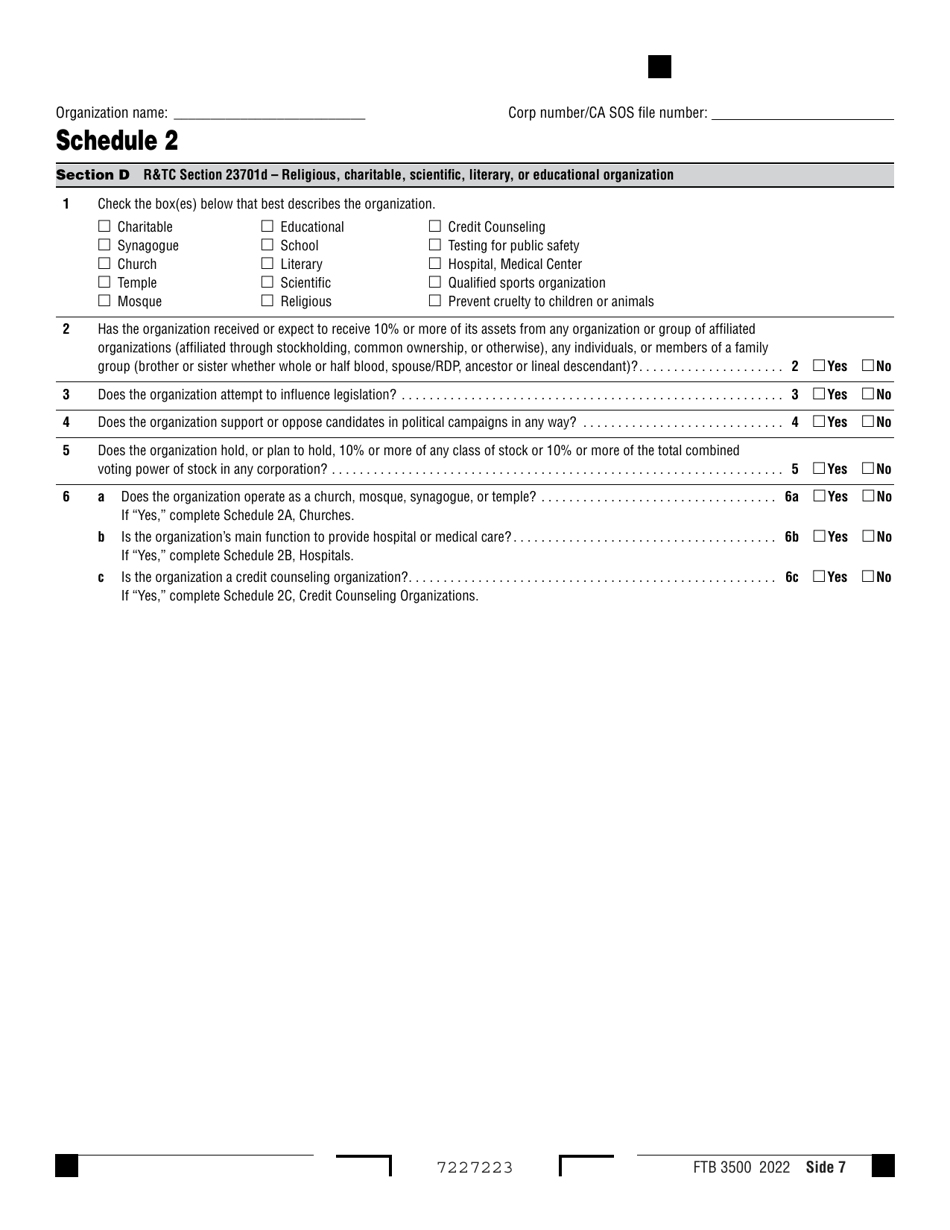

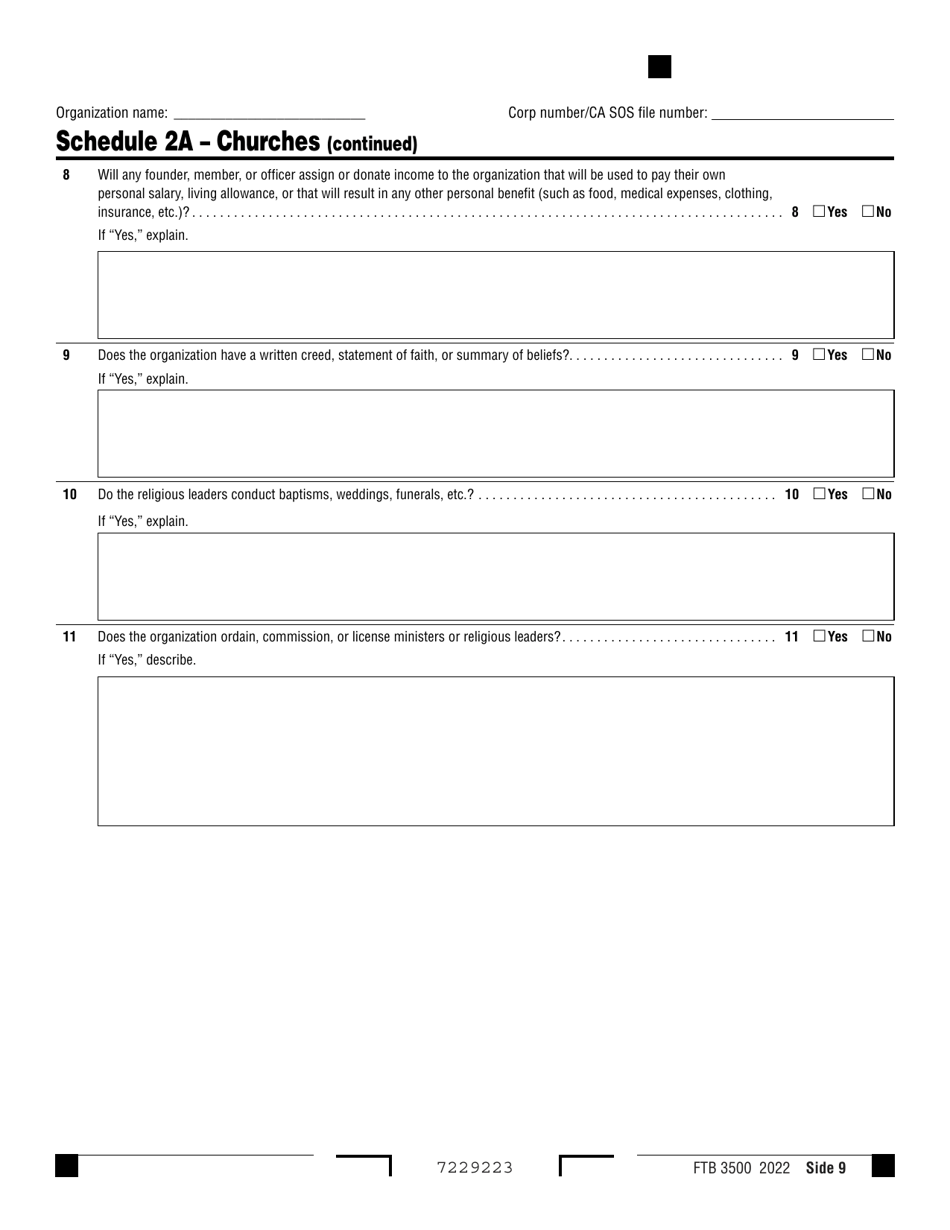

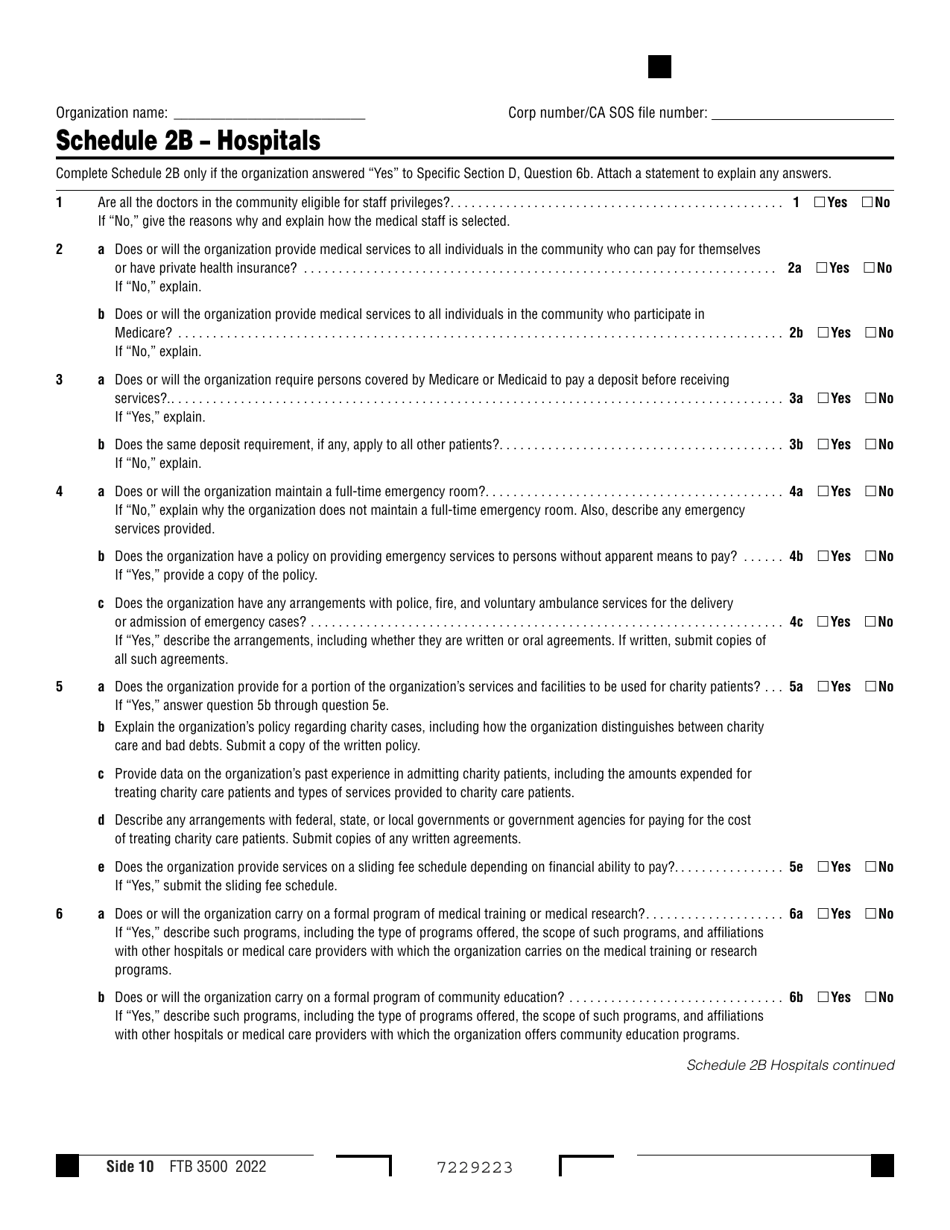

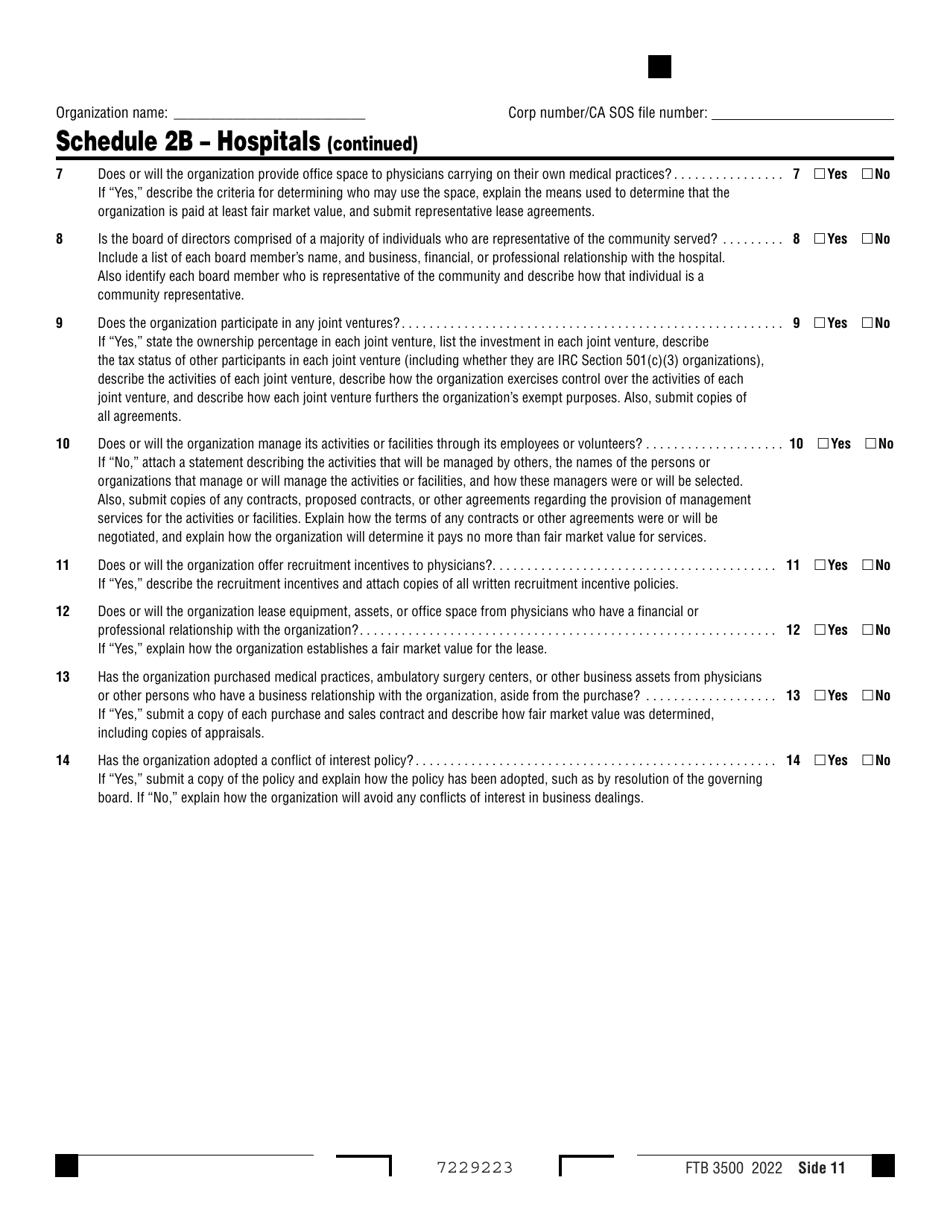

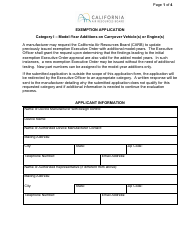

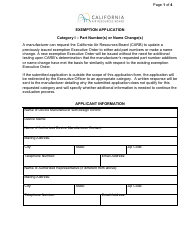

Form FTB3500 Exemption Application - California

What Is Form FTB3500?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB3500?

A: Form FTB3500 is the exemption application form used in the state of California.

Q: What is the purpose of Form FTB3500?

A: The purpose of Form FTB3500 is to apply for tax-exempt status in California.

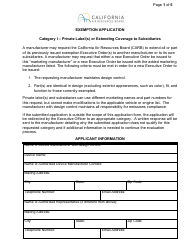

Q: Who needs to complete Form FTB3500?

A: Nonprofit organizations that wish to be exempt from California state taxes need to complete Form FTB3500.

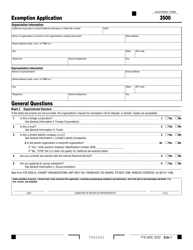

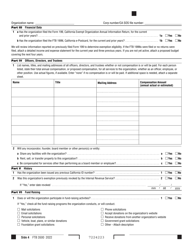

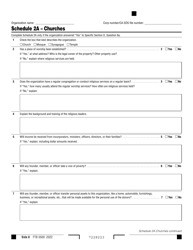

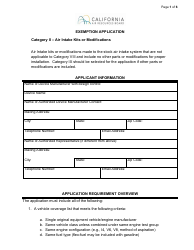

Q: What information is required on Form FTB3500?

A: Form FTB3500 requires information about the organization's purpose, activities, finances, and governance.

Q: Are there any fees associated with filing Form FTB3500?

A: Yes, there is a $25 application fee for filing Form FTB3500.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB3500 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.