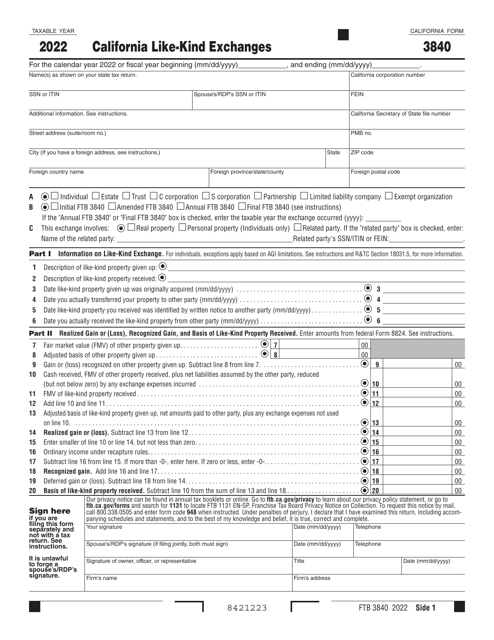

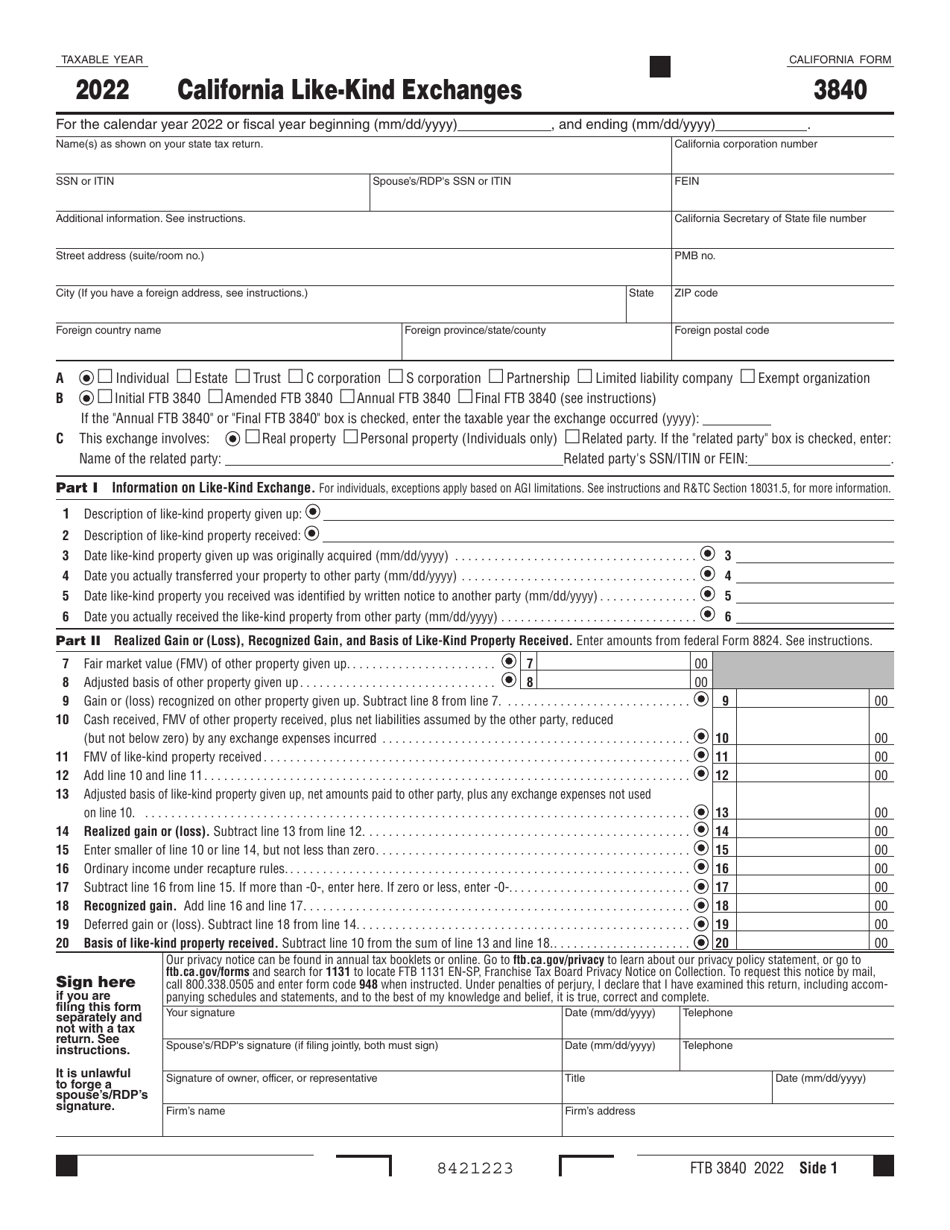

Form FTB3840 California Like-Kind Exchanges - California

What Is Form FTB3840?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB3840?

A: Form FTB3840 is the California Like-Kind Exchanges form.

Q: What is a Like-Kind Exchange?

A: A Like-Kind Exchange is a transaction where property held for productive use in a trade or business is exchanged for a similar property without recognizing a gain or loss.

Q: Why do I need to file Form FTB3840?

A: You need to file Form FTB3840 if you participated in a Like-Kind Exchange and want to defer the recognition of any gain or loss.

Q: Who should file Form FTB3840?

A: Anyone who participated in a Like-Kind Exchange and wants to defer the recognition of any gain or loss should file Form FTB3840.

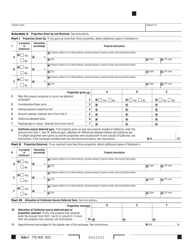

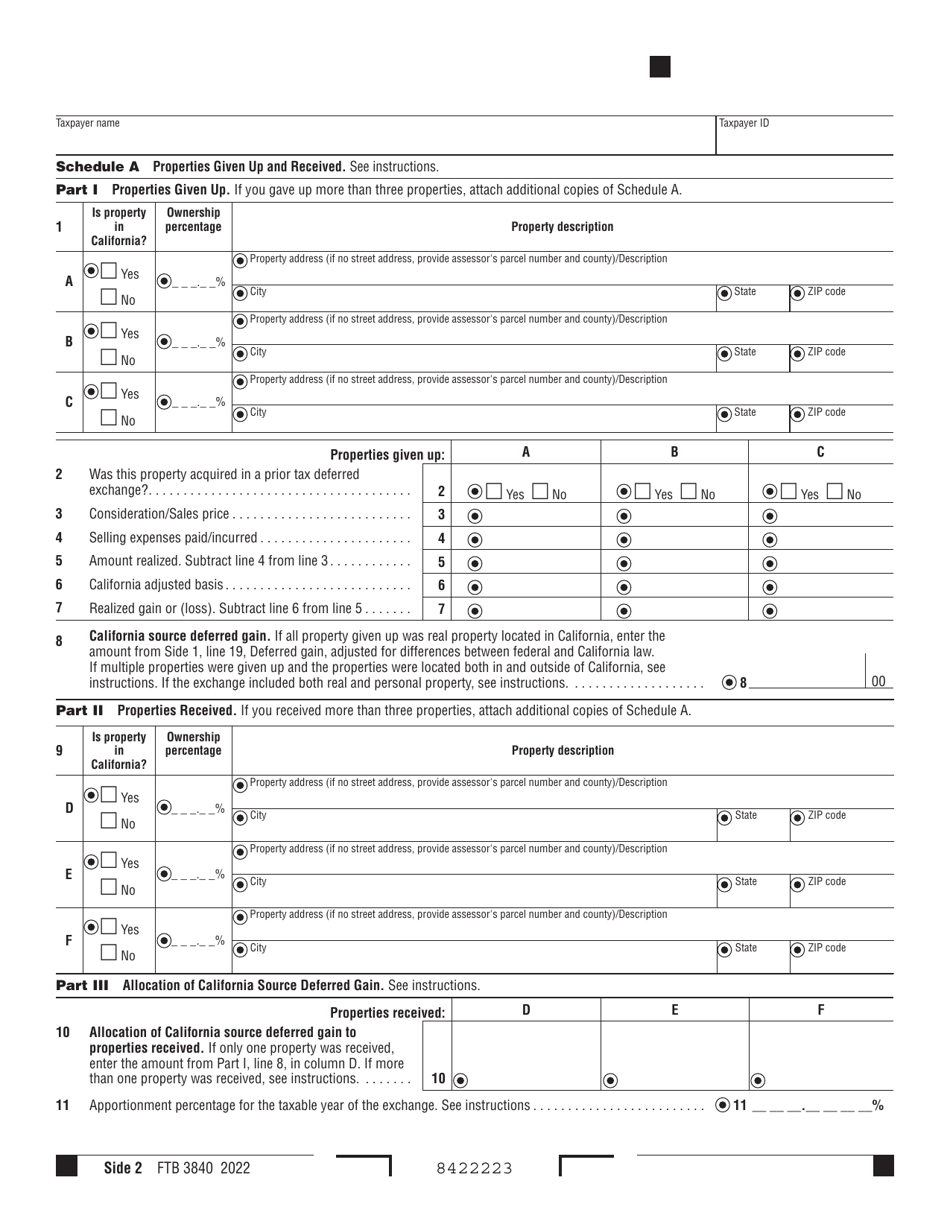

Q: What information is required on Form FTB3840?

A: Form FTB3840 requires information about the exchanged properties, their values, and details of the exchange.

Q: When is Form FTB3840 due?

A: Form FTB3840 is due on or before the original due date of the federal tax return for the year in which the Like-Kind Exchange occurred.

Q: Can I e-file Form FTB3840?

A: No, you cannot e-file Form FTB3840. It must be mailed to the Franchise Tax Board.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB3840 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.