This version of the form is not currently in use and is provided for reference only. Download this version of

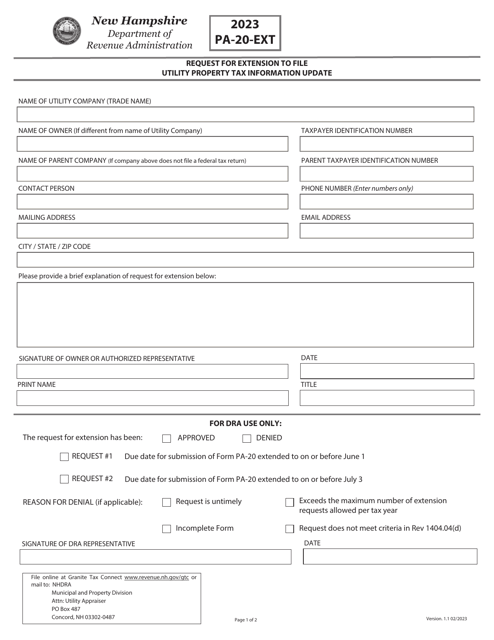

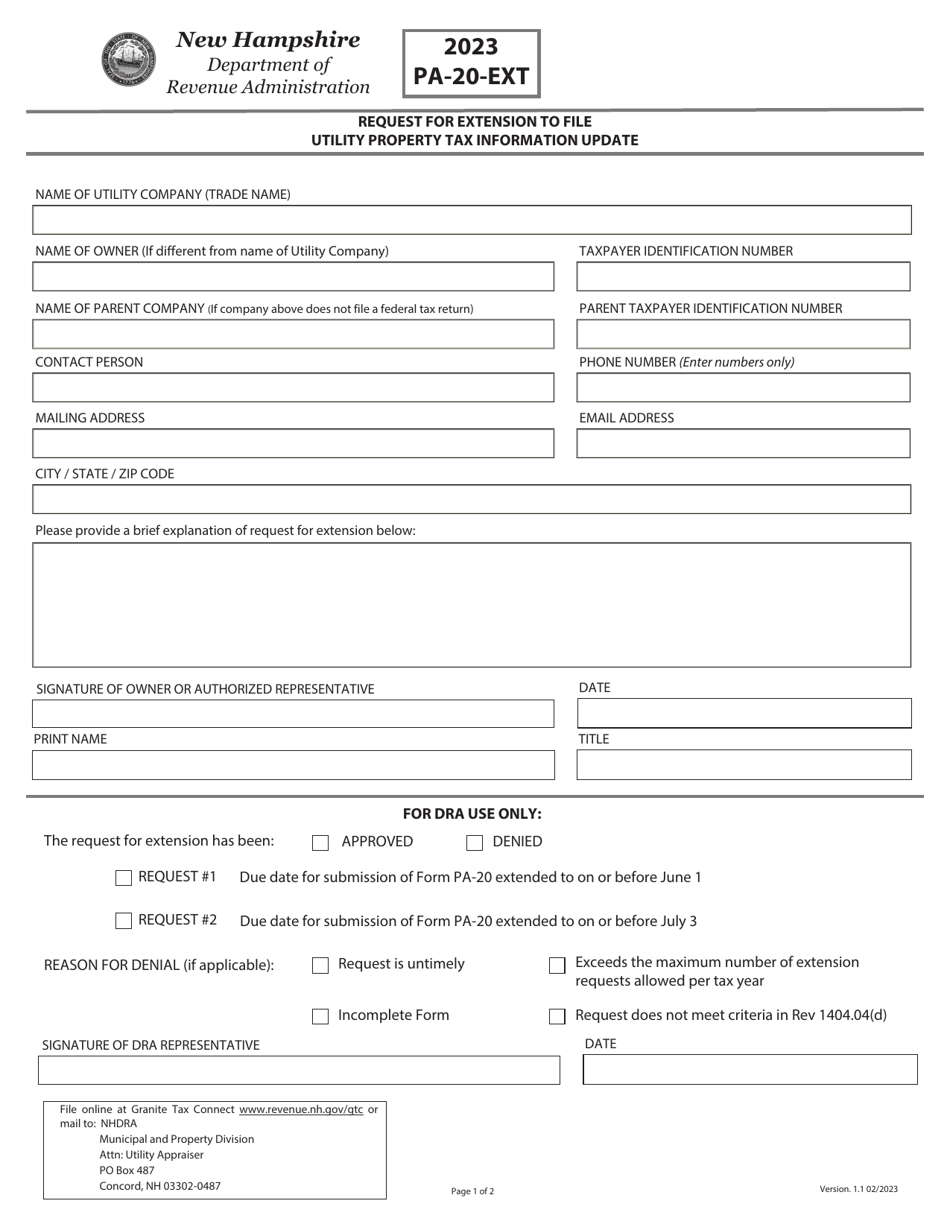

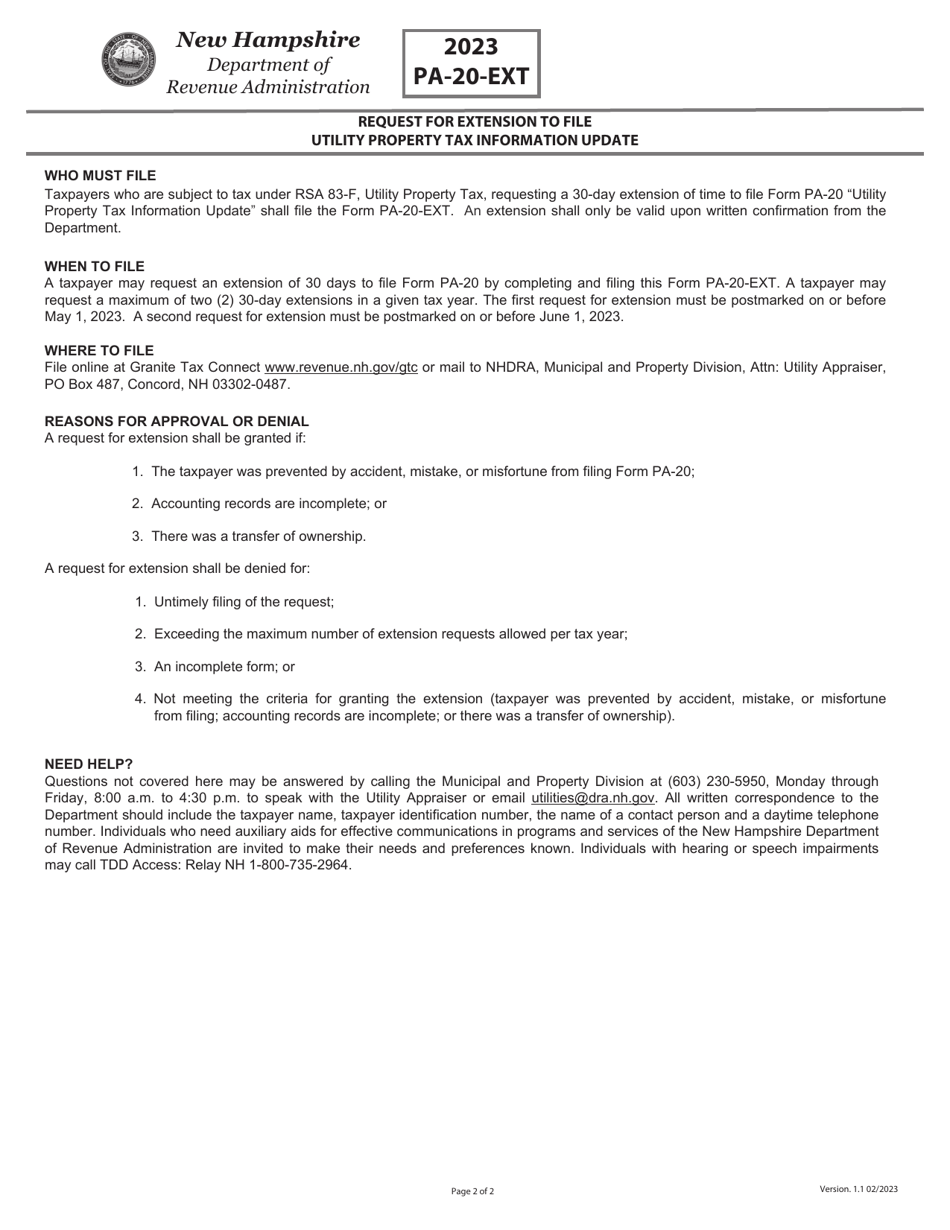

Form PA-20-EXT

for the current year.

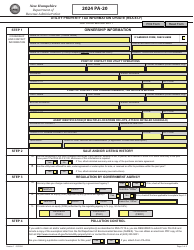

Form PA-20-EXT Request for Extension to File Utility Property Tax Information Update - New Hampshire

What Is Form PA-20-EXT?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-20-EXT?

A: Form PA-20-EXT is a request for an extension to file the utility property tax information update in New Hampshire.

Q: Who should use Form PA-20-EXT?

A: Utility companies in New Hampshire should use Form PA-20-EXT to request an extension to file their property tax information update.

Q: What is the purpose of the utility property tax information update?

A: The utility property tax information update is used to assess the value of utility property for property tax purposes in New Hampshire.

Q: How do I file Form PA-20-EXT?

A: To file Form PA-20-EXT, you must complete the form and submit it to the appropriate authority in New Hampshire before the original due date of the utility property tax information update.

Q: Can I request an extension to file the utility property tax information update?

A: Yes, you can request an extension to file the utility property tax information update by using Form PA-20-EXT.

Q: What happens if I don't file the utility property tax information update?

A: If you don't file the utility property tax information update, you may be subject to penalties or fines imposed by the tax authority in New Hampshire.

Q: Is there a fee for filing Form PA-20-EXT?

A: There is no fee for filing Form PA-20-EXT to request an extension to file the utility property tax information update in New Hampshire.

Form Details:

- Released on February 1, 2023;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-20-EXT by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.