This version of the form is not currently in use and is provided for reference only. Download this version of

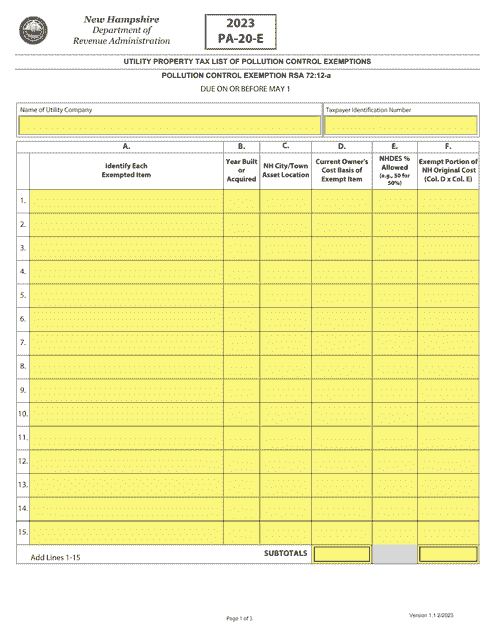

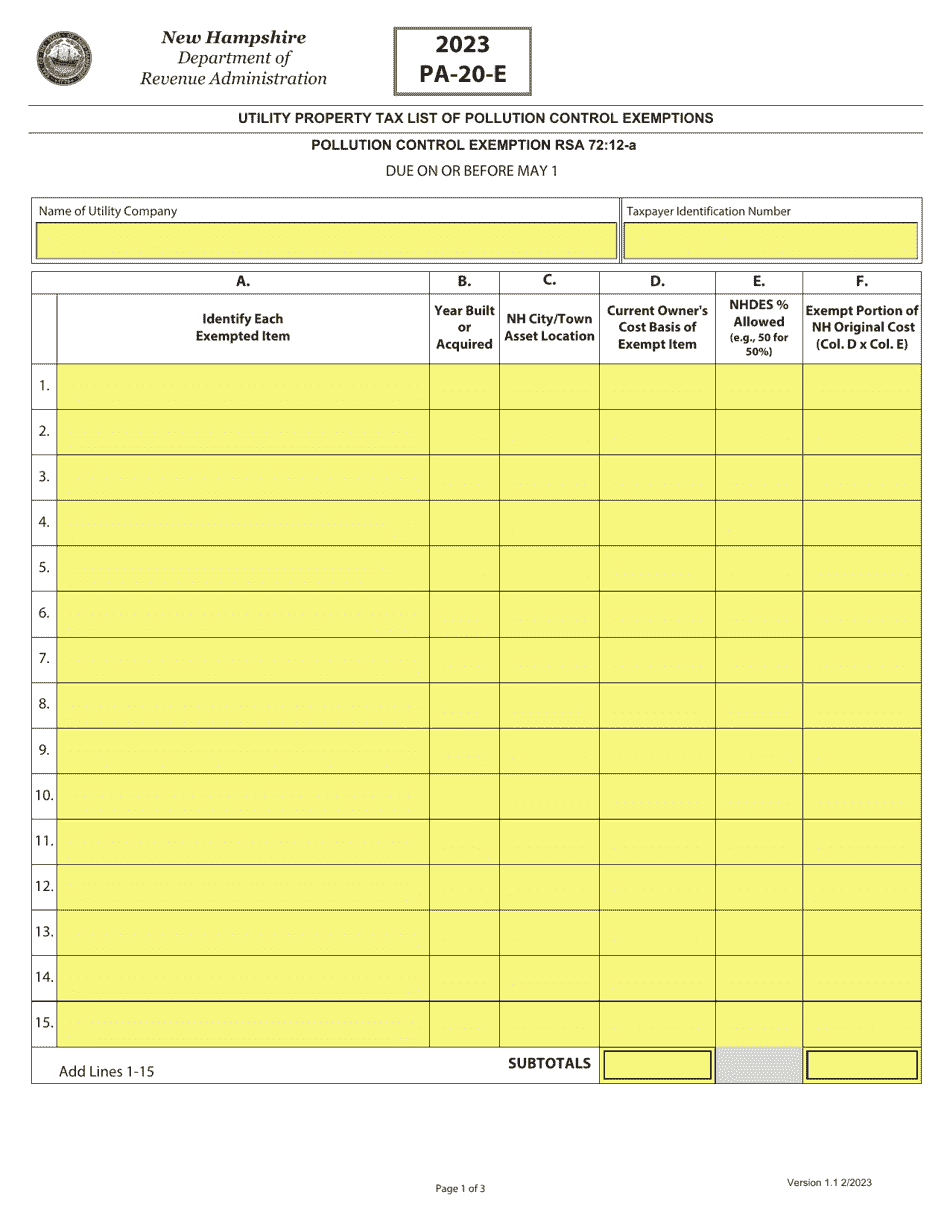

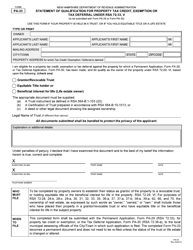

Form PA-20-E

for the current year.

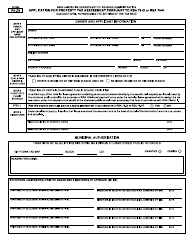

Form PA-20-E Utility Property Tax List of Pollution Control Exemptions - New Hampshire

What Is Form PA-20-E?

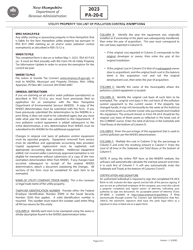

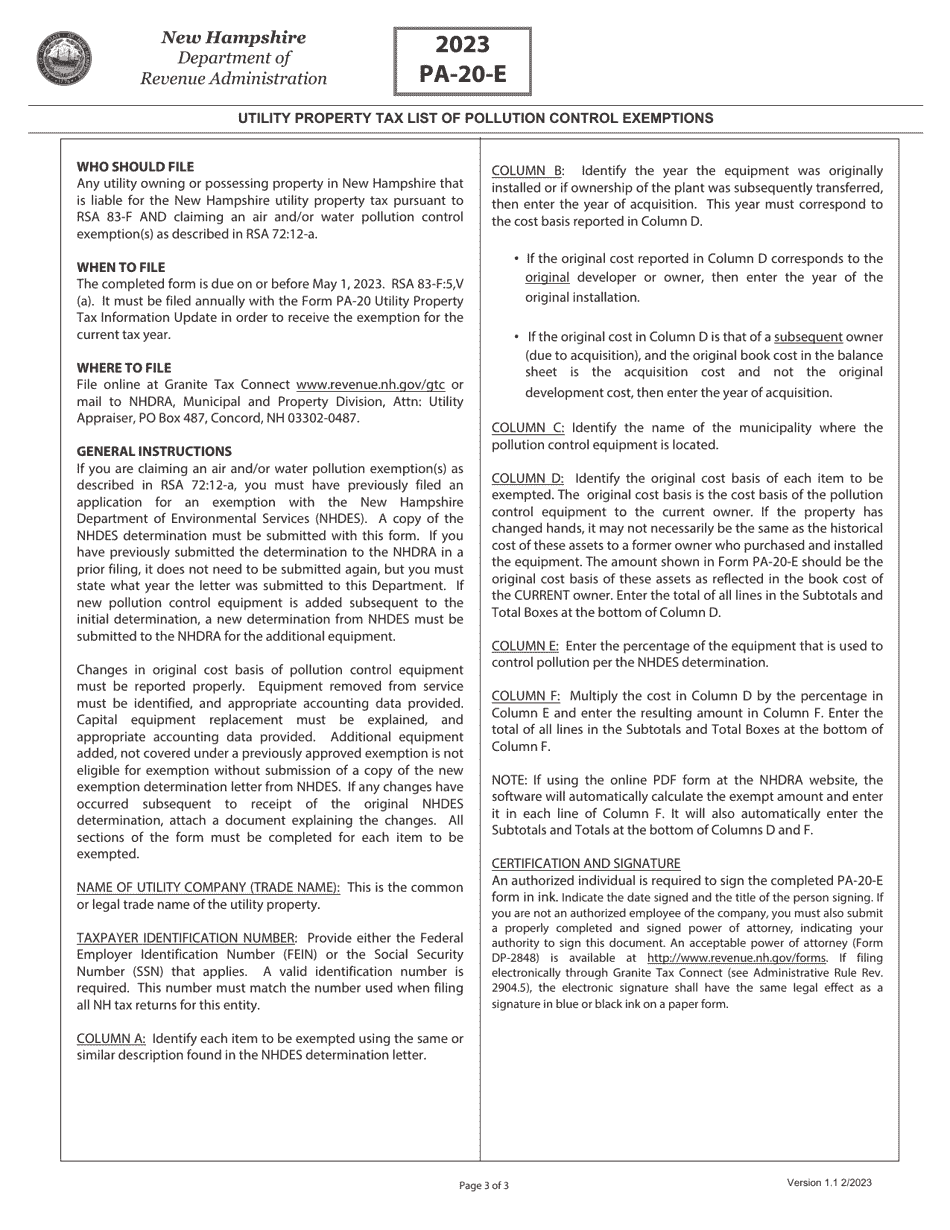

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-20-E?

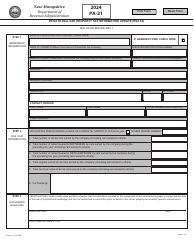

A: Form PA-20-E is a document used in New Hampshire to list pollution control exemptions for utility property tax.

Q: What is a pollution control exemption?

A: A pollution control exemption is a tax exemption granted to properties that engage in activities or own equipment related to pollution control.

Q: Who uses Form PA-20-E?

A: Form PA-20-E is used by utility property owners in New Hampshire to claim pollution control exemptions.

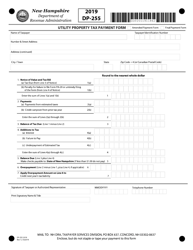

Q: What is utility property tax?

A: Utility property tax refers to taxes levied on properties owned by utility companies for their operations, such as power plants or transmission lines.

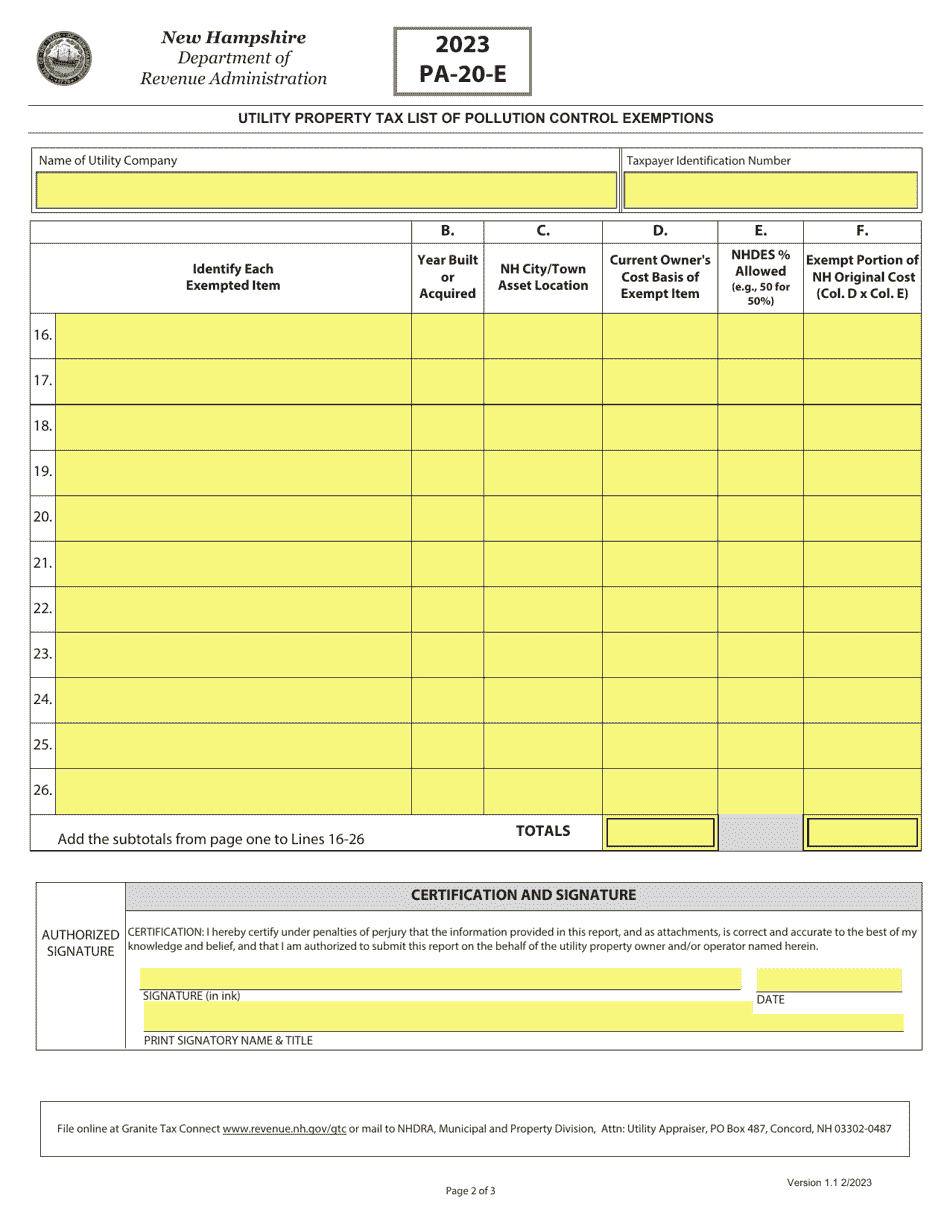

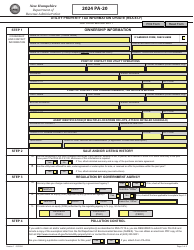

Q: How do I claim a pollution control exemption using Form PA-20-E?

A: To claim a pollution control exemption, utility property owners in New Hampshire must fill out Form PA-20-E and provide relevant details about the exempted equipment or activities.

Q: Are pollution control exemptions applicable to all types of properties?

A: No, pollution control exemptions usually apply to specific types of properties, such as those engaged in electricity generation or water treatment.

Form Details:

- Released on February 1, 2023;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-20-E by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.