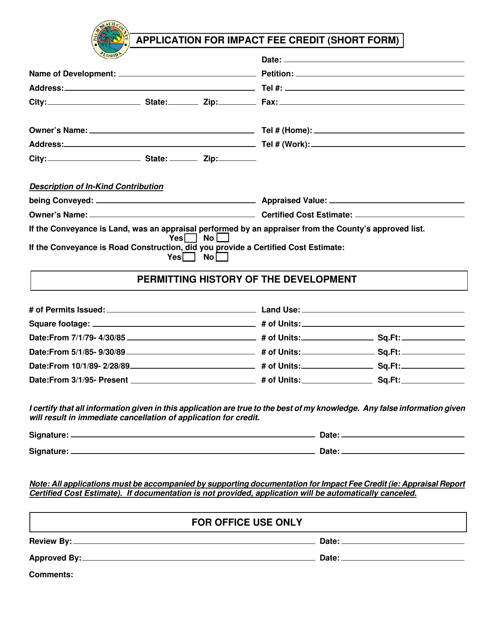

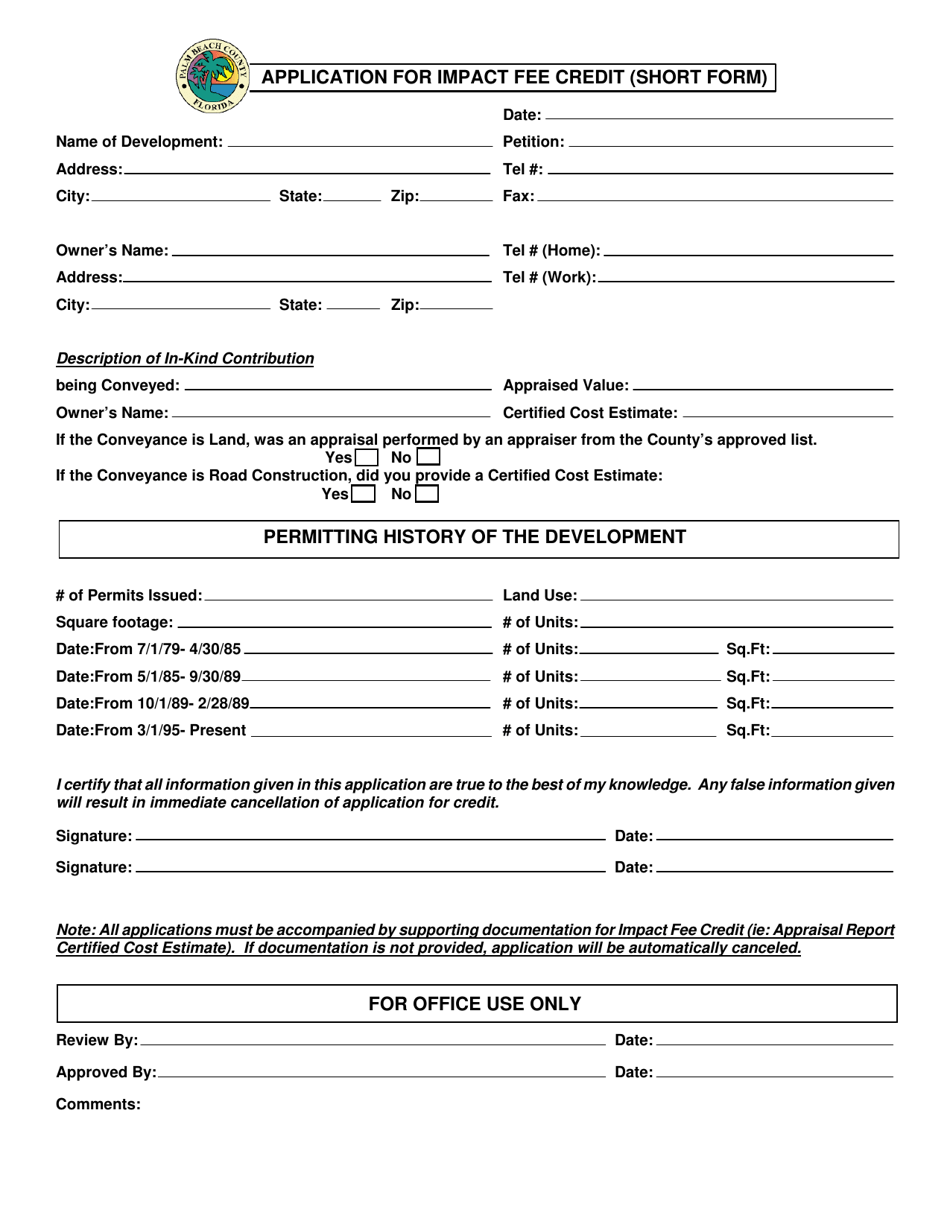

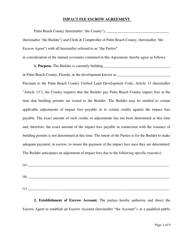

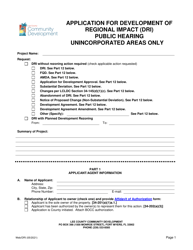

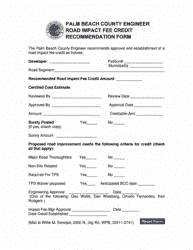

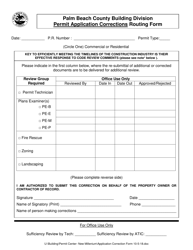

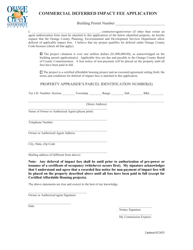

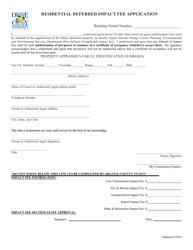

Application for Impact Fee Credit (Short Form) - Palm Beach County, Florida

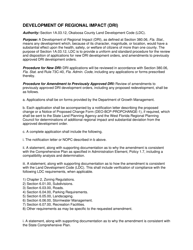

Application for Impact Fee Credit (Short Form) is a legal document that was released by the Planning, Zoning and Building Department - Palm Beach County, Florida - a government authority operating within Florida. The form may be used strictly within Palm Beach County.

FAQ

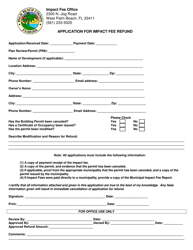

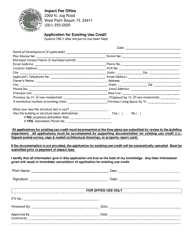

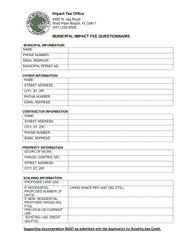

Q: What is the purpose of the Impact Fee Credit application?

A: The purpose of the Impact Fee Credit application is to request a credit for impact fees paid in Palm Beach County, Florida.

Q: Who can submit the Impact Fee Credit application?

A: Anyone who has paid impact fees in Palm Beach County, Florida can submit the Impact Fee Credit application.

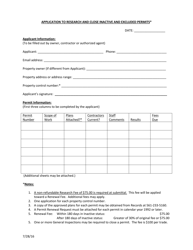

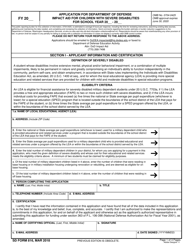

Q: What is the Short Form of the Impact Fee Credit application?

A: The Short Form of the Impact Fee Credit application is used for requesting a credit of $10,000 or less.

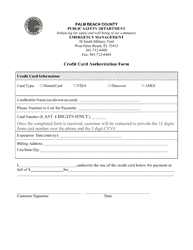

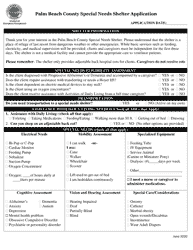

Q: What documentation do I need to include with the Impact Fee Credit application?

A: You may need to include proof of payment for the impact fees, property information, and any supporting documentation to justify the credit request.

Q: Is there a fee for submitting the Impact Fee Credit application?

A: Yes, there is a fee associated with submitting the Impact Fee Credit application. The fee amount can be found on the county's fee schedule.

Q: Who should I contact if I have questions about the Impact Fee Credit application?

A: You can contact the Palm Beach County's Development Services department for assistance with the Impact Fee Credit application.

Q: What is the deadline for submitting the Impact Fee Credit application?

A: The deadline for submitting the Impact Fee Credit application is typically within 180 days of the impact fee payment.

Q: How long does it take to process the Impact Fee Credit application?

A: The processing time for the Impact Fee Credit application can vary, but it is typically within 30 to 60 days.

Form Details:

- The latest edition currently provided by the Planning, Zoning and Building Department - Palm Beach County, Florida;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Planning, Zoning and Building Department - Palm Beach County, Florida.