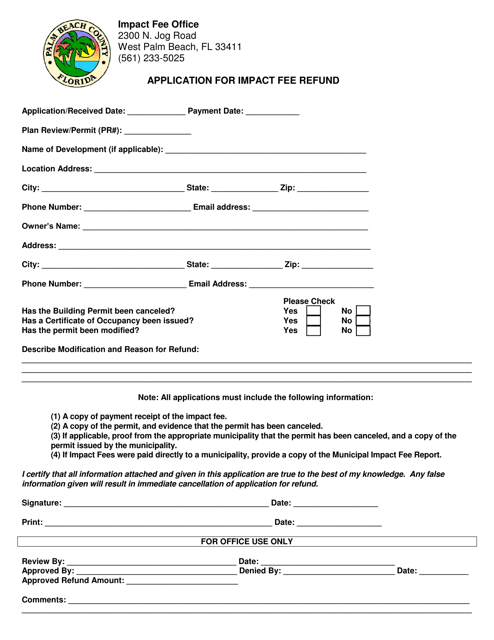

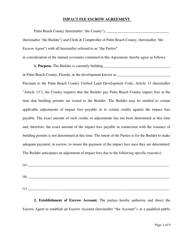

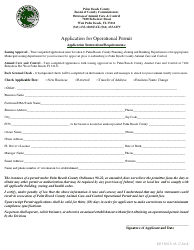

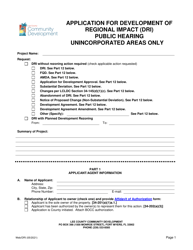

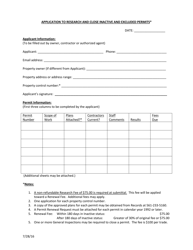

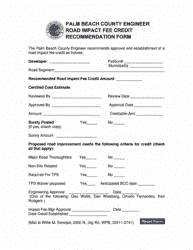

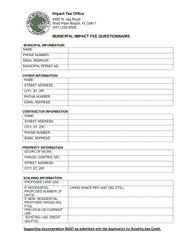

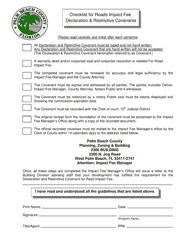

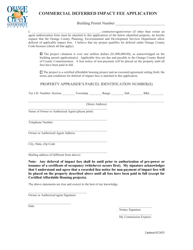

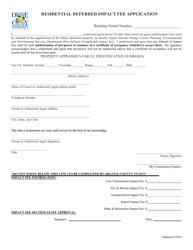

Application for Impact Fee Refund - Palm Beach County, Florida

Application for Impact Fee Refund is a legal document that was released by the Planning, Zoning and Building Department - Palm Beach County, Florida - a government authority operating within Florida. The form may be used strictly within Palm Beach County.

FAQ

Q: What is an impact fee refund?

A: An impact fee refund is a refund of fees paid for impact on public infrastructure and services.

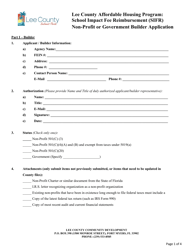

Q: Who is eligible for an impact fee refund in Palm Beach County, Florida?

A: Property owners or developers who have paid impact fees may be eligible for a refund under certain circumstances.

Q: What is the purpose of impact fees?

A: Impact fees are used to fund the construction or improvement of public infrastructure and services, such as roads, schools, parks, and libraries.

Q: What are the requirements for an impact fee refund in Palm Beach County?

A: The requirements for an impact fee refund in Palm Beach County can vary depending on the specific circumstances. It is advisable to consult the county government or relevant department for detailed information.

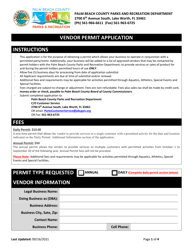

Q: How can I apply for an impact fee refund in Palm Beach County?

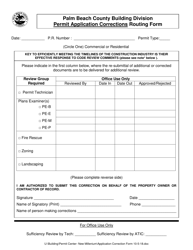

A: To apply for an impact fee refund in Palm Beach County, you will need to complete an application form, provide necessary documentation, and submit it to the appropriate county department.

Q: Is there a time limit for applying for an impact fee refund?

A: Yes, there is usually a time limit for applying for an impact fee refund in Palm Beach County. It is important to submit your application within the specified timeframe.

Q: How long does it take to receive an impact fee refund?

A: The time it takes to receive an impact fee refund can vary. It is advisable to check with the county government or relevant department for estimated processing times.

Q: Can I appeal if my impact fee refund application is denied?

A: Yes, if your impact fee refund application is denied, you may have the option to appeal the decision. This process may involve additional documentation and review.

Q: Are impact fee refunds taxable?

A: It is advisable to consult with a tax professional or the Internal Revenue Service (IRS) regarding the tax implications of impact fee refunds.

Form Details:

- The latest edition currently provided by the Planning, Zoning and Building Department - Palm Beach County, Florida;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Planning, Zoning and Building Department - Palm Beach County, Florida.