This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form CT-1 X

for the current year.

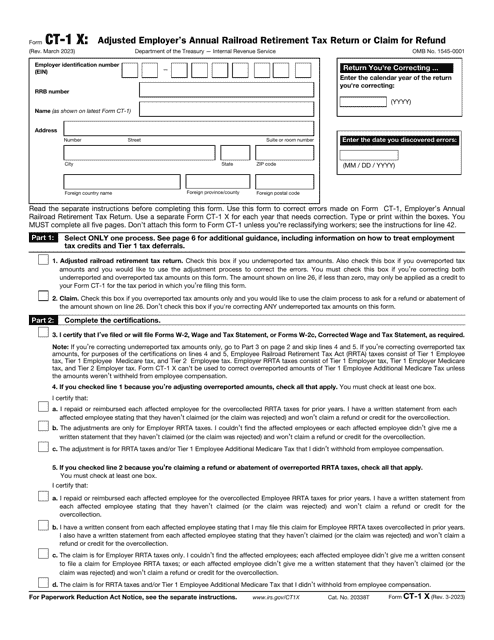

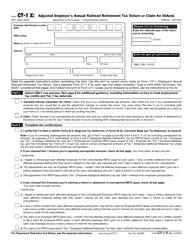

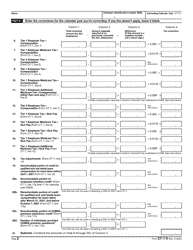

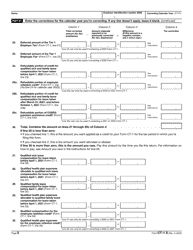

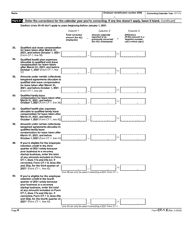

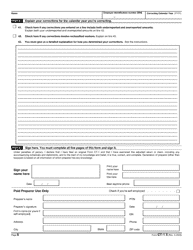

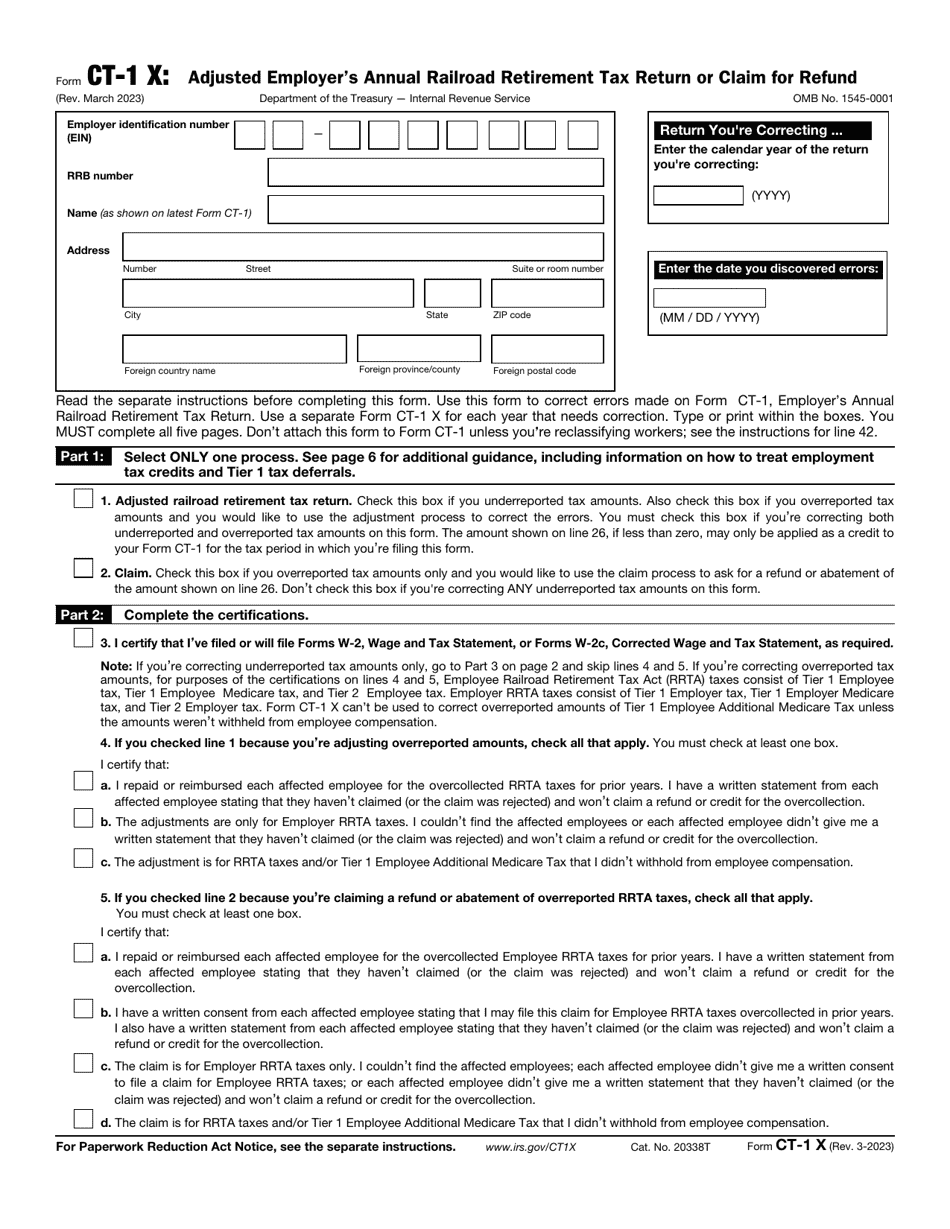

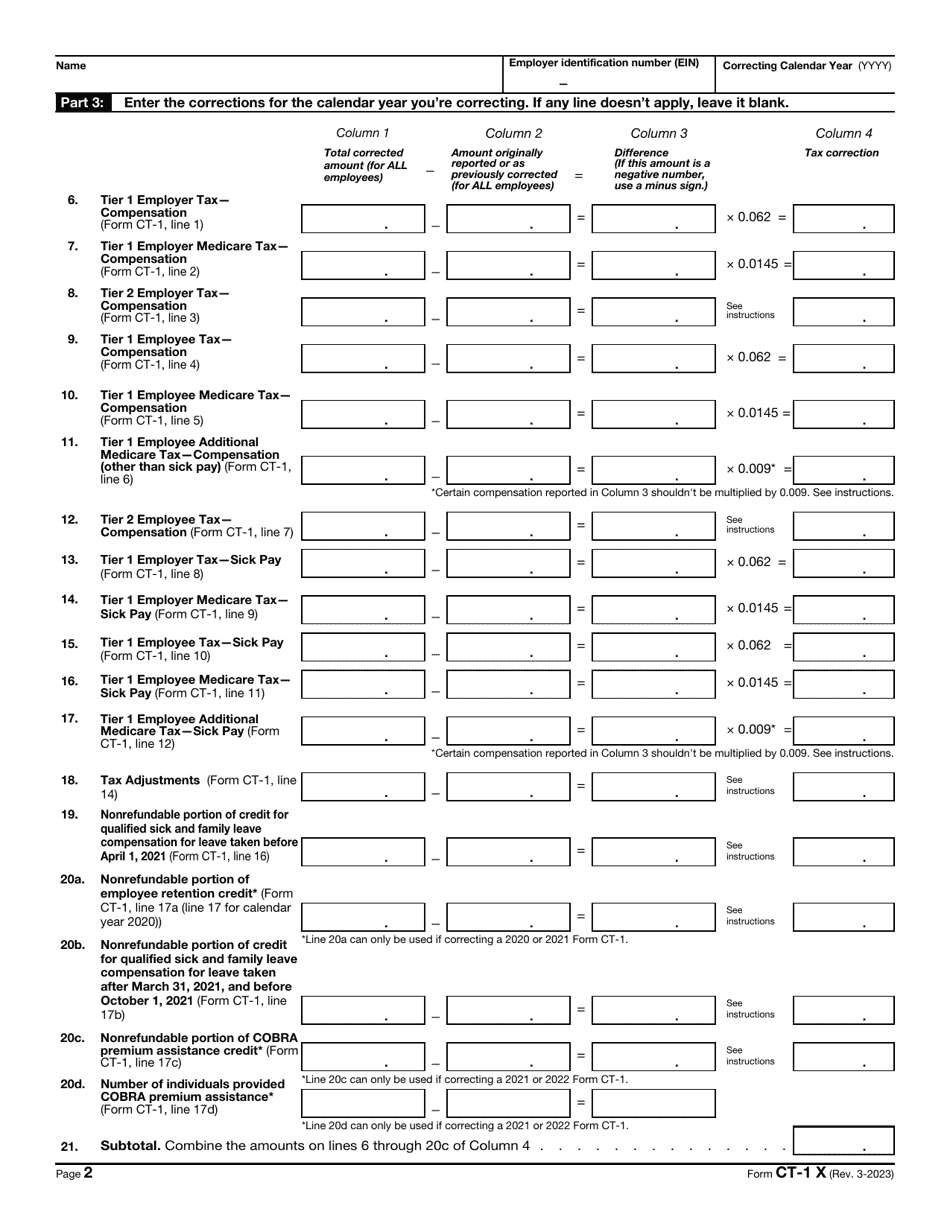

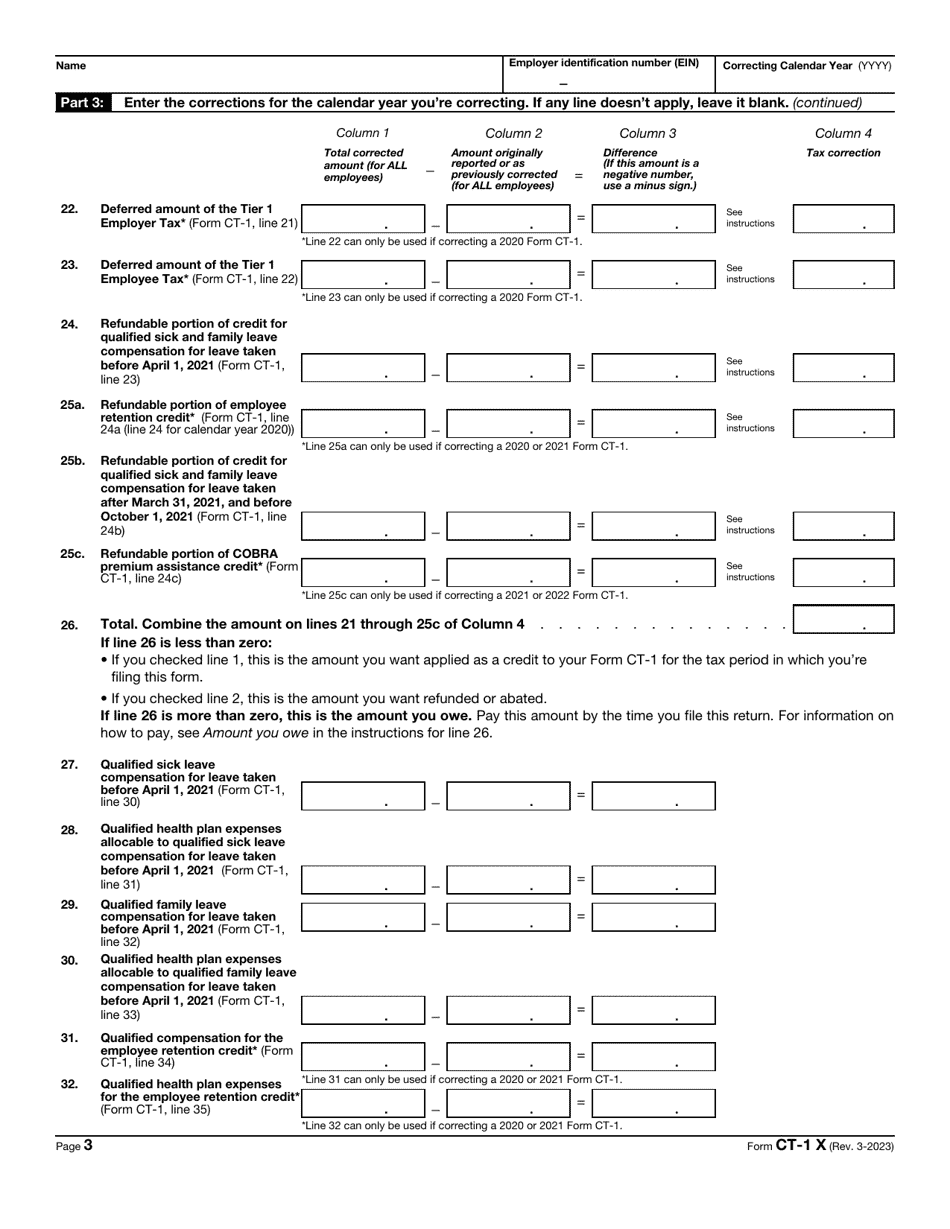

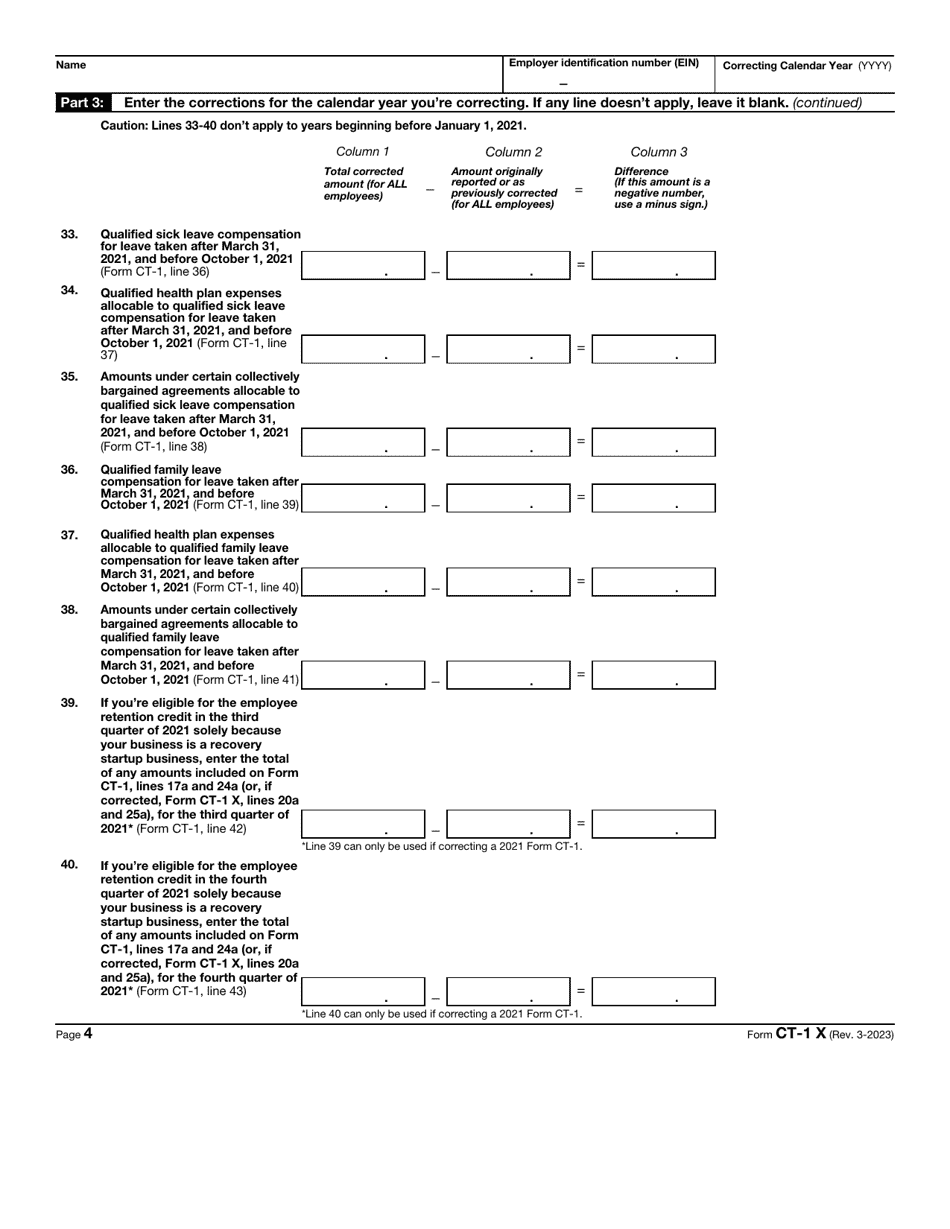

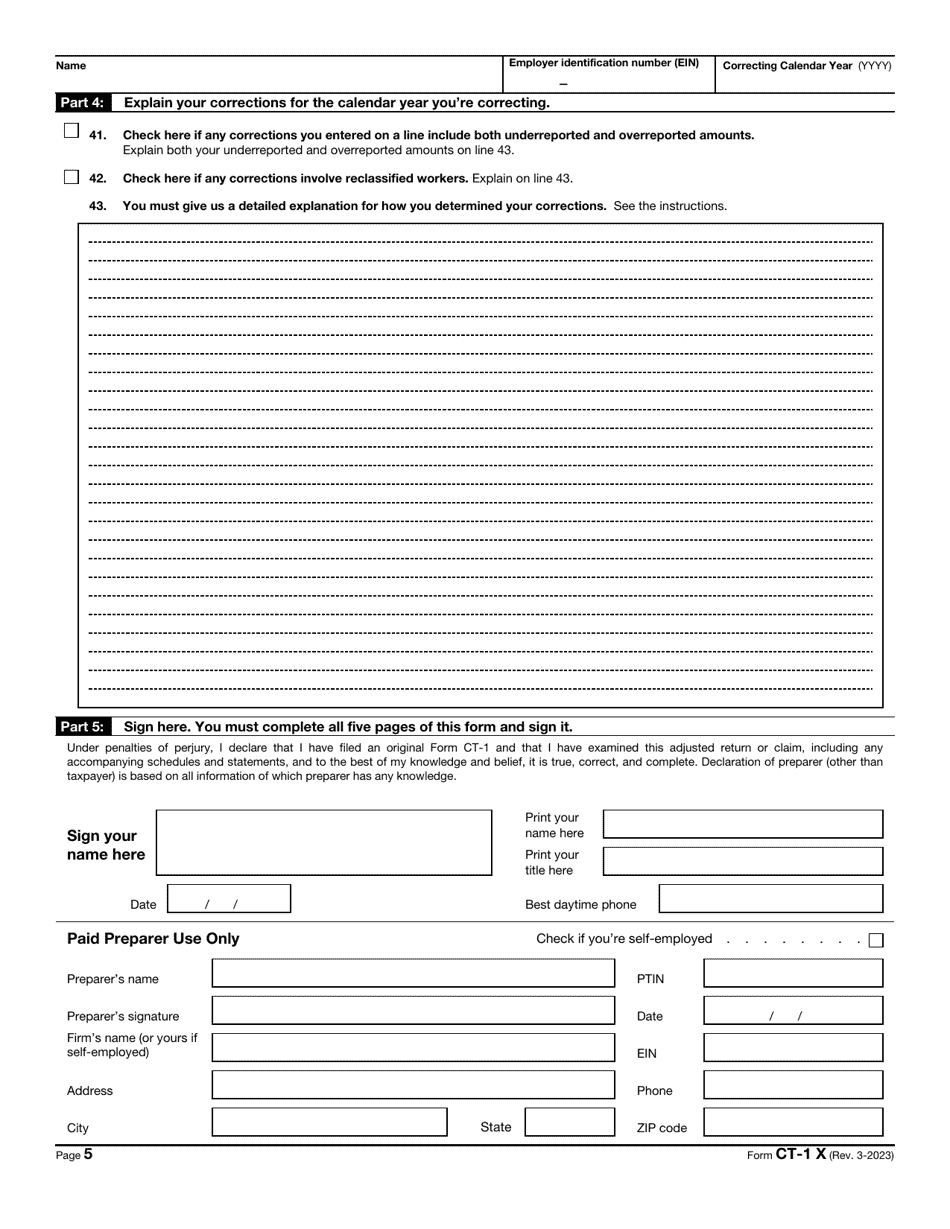

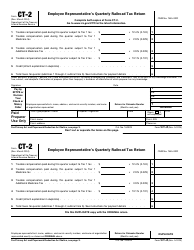

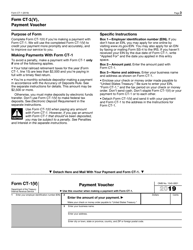

IRS Form CT-1 X Adjusted Employer's Annual Railroad Retirement Tax Return or Claim for Refund

What Is IRS Form CT-1 X?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on March 1, 2023. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form CT-1 X?

A: IRS Form CT-1 X is the Adjusted Employer's Annual Railroad Retirement Tax Return or Claim for Refund.

Q: Who needs to file IRS Form CT-1 X?

A: Employers in the railroad industry need to file IRS Form CT-1 X.

Q: What is the purpose of IRS Form CT-1 X?

A: The purpose of IRS Form CT-1 X is to report and reconcile any adjustments to the employer's annual railroad retirement tax.

Q: Can I claim a refund using IRS Form CT-1 X?

A: Yes, you can claim a refund using IRS Form CT-1 X if you overpaid your railroad retirement tax.

Form Details:

- A 6-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form CT-1 X through the link below or browse more documents in our library of IRS Forms.