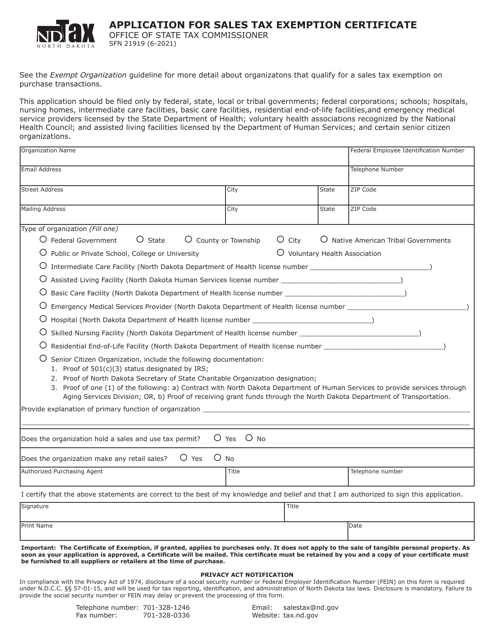

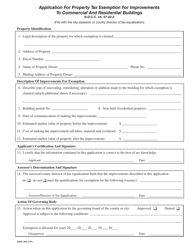

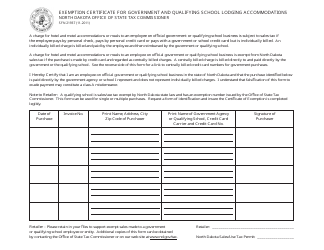

Form SFN21919 Application for Sales Tax Exemption Certificate - North Dakota

What Is Form SFN21919?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

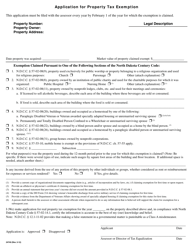

Q: What is Form SFN21919?

A: Form SFN21919 is the application for a Sales Tax Exemption Certificate in the state of North Dakota.

Q: Who needs to fill out Form SFN21919?

A: Any individual or organization seeking sales tax exemption in North Dakota needs to fill out Form SFN21919.

Q: What is the purpose of Form SFN21919?

A: The purpose of Form SFN21919 is to apply for a Sales Tax Exemption Certificate, which allows qualifying individuals or organizations to make purchases without paying sales tax in North Dakota.

Q: What information do I need to provide on Form SFN21919?

A: You will need to provide your personal or organization information, details about your intended use of the purchases, and any supporting documentation as required by the form.

Q: Are there any fees associated with submitting Form SFN21919?

A: No, there are no fees associated with submitting Form SFN21919.

Q: How long does it take to process Form SFN21919?

A: The processing time for Form SFN21919 may vary, but you can expect a response from the North Dakota State Tax Commissioner's office within a reasonable timeframe.

Q: Can I use Form SFN21919 for other states?

A: No, Form SFN21919 is specific to North Dakota. Each state has its own respective form for sales tax exemption.

Q: What should I do if I have questions or need assistance with Form SFN21919?

A: If you have questions or need assistance with Form SFN21919, you should contact the North Dakota State Tax Commissioner's office for guidance and support.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN21919 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.