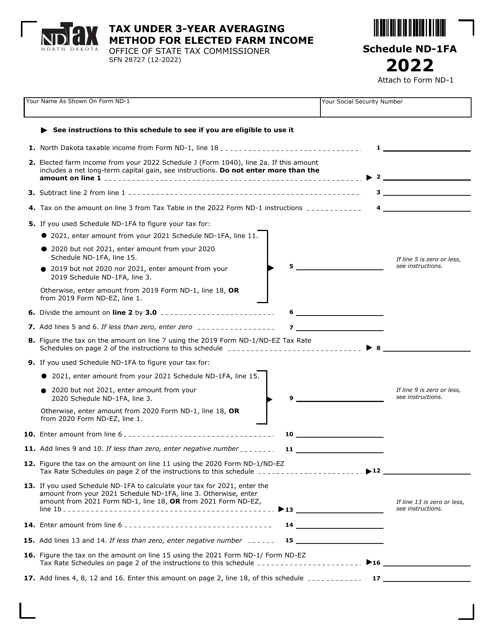

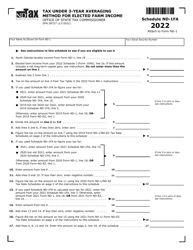

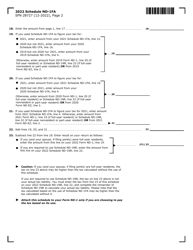

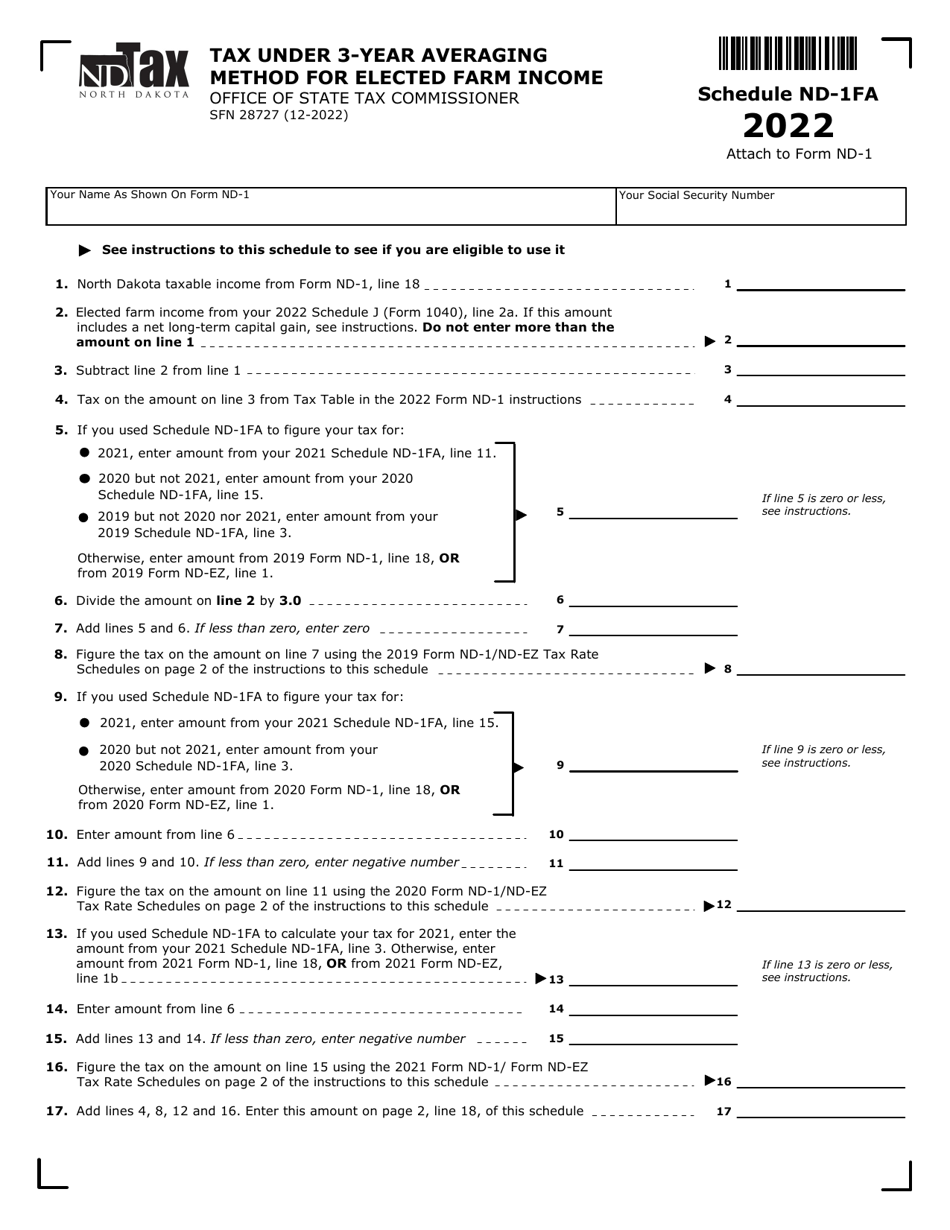

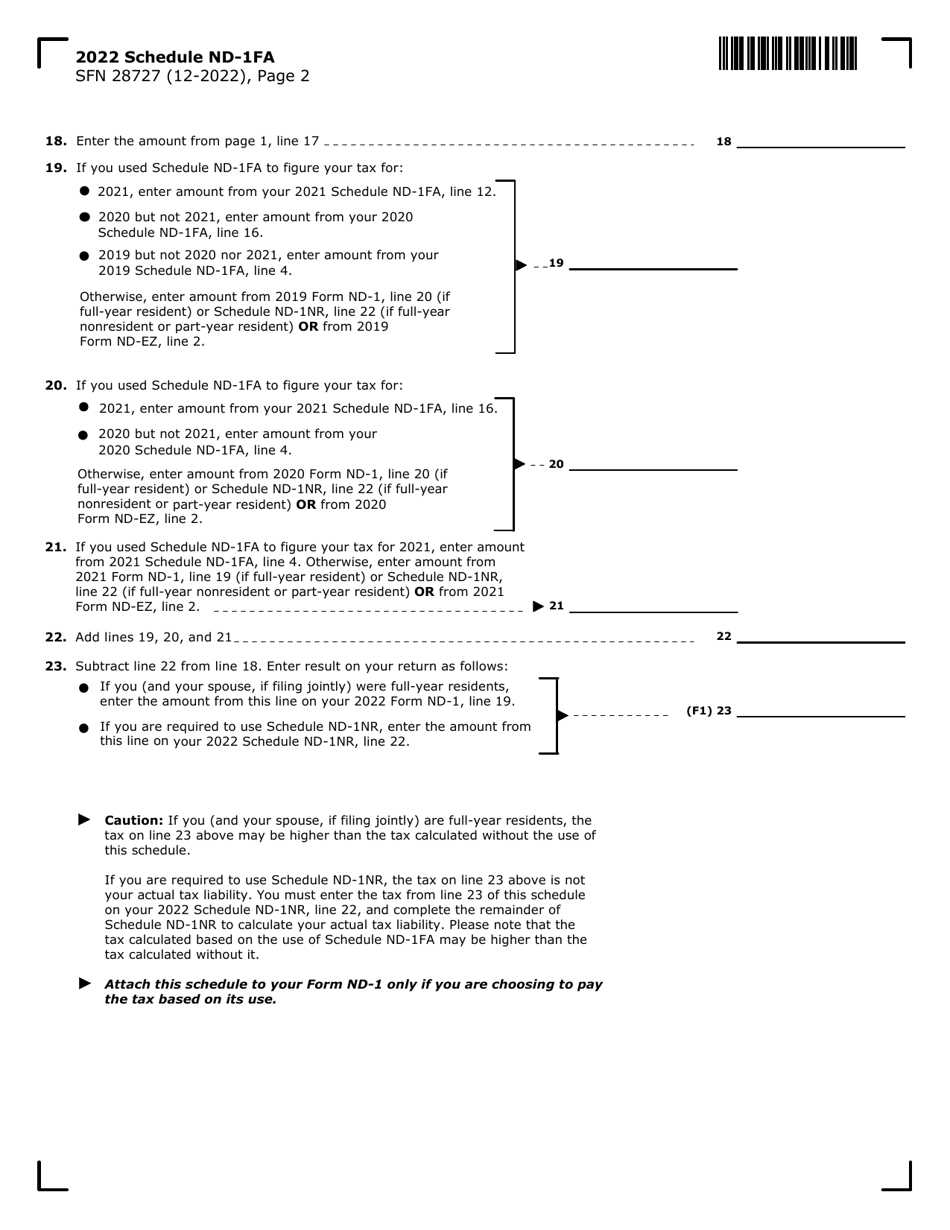

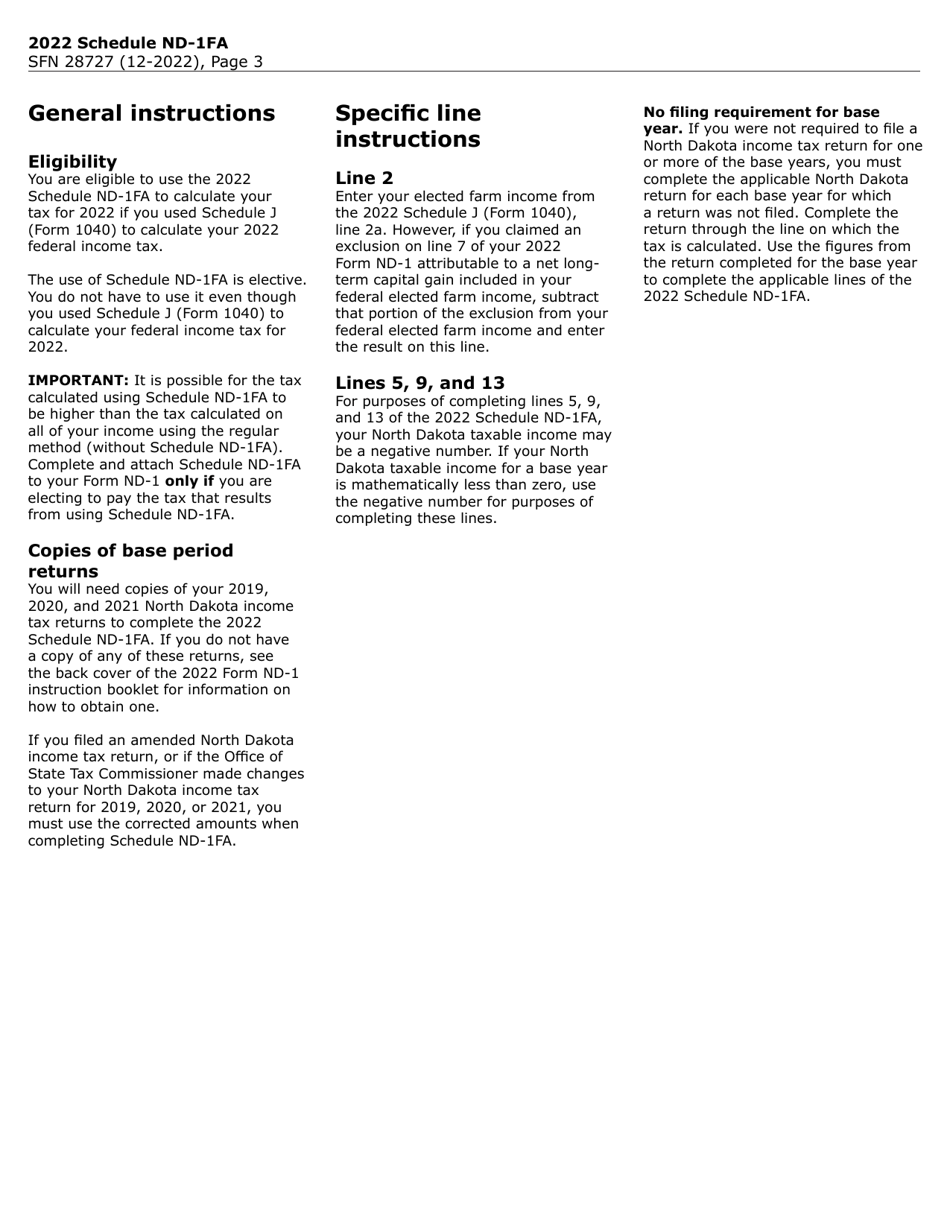

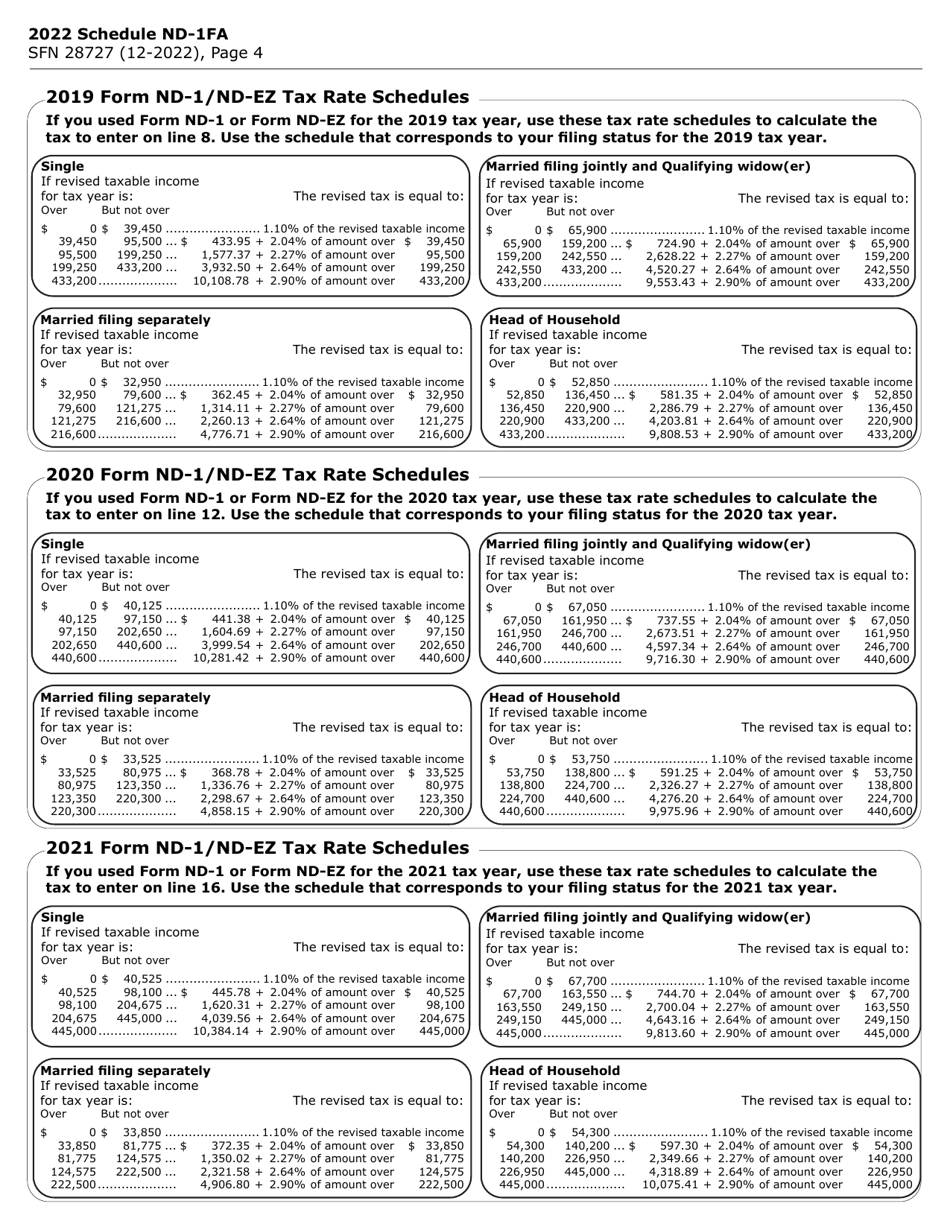

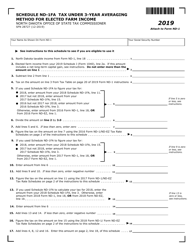

Form SFN28727 Tax Under 3-year Averaging Method for Elected Farm Income - North Dakota

What Is Form SFN28727?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFN28727?

A: Form SFN28727 is a tax form used for the Under 3-year Averaging Method for Elected Farm Income in North Dakota.

Q: What is the purpose of Form SFN28727?

A: The purpose of Form SFN28727 is to report and calculate the tax owed on elected farm income under the 3-year averaging method in North Dakota.

Q: Who needs to file Form SFN28727?

A: Farmers in North Dakota who elect to use the 3-year averaging method for their farm income need to file Form SFN28727.

Q: What is the 3-year averaging method for elected farm income?

A: The 3-year averaging method allows farmers to average their farm income over a three-year period, which may reduce their overall tax liability.

Q: When is Form SFN28727 due?

A: Form SFN28727 is typically due on or before the same deadline as your federal income tax return, which is usually April 15th.

Q: Are there any penalties for late filing of Form SFN28727?

A: Yes, there may be penalties for late filing of Form SFN28727, so it is important to submit it by the due date.

Q: Can I file Form SFN28727 electronically?

A: No, at this time, Form SFN28727 cannot be filed electronically and must be submitted by mail or in person.

Q: Is Form SFN28727 used outside of North Dakota?

A: No, Form SFN28727 is specific to North Dakota and is not used in any other state.

Q: What should I do if I have questions about Form SFN28727?

A: If you have questions about Form SFN28727, you should contact the North Dakota State Tax Commissioner's office for assistance.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN28727 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.