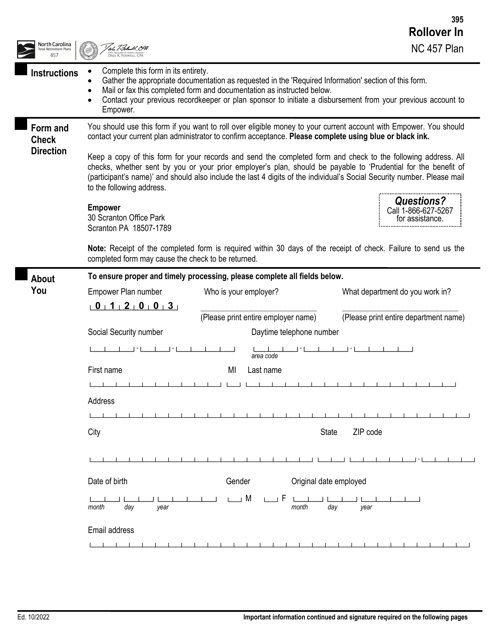

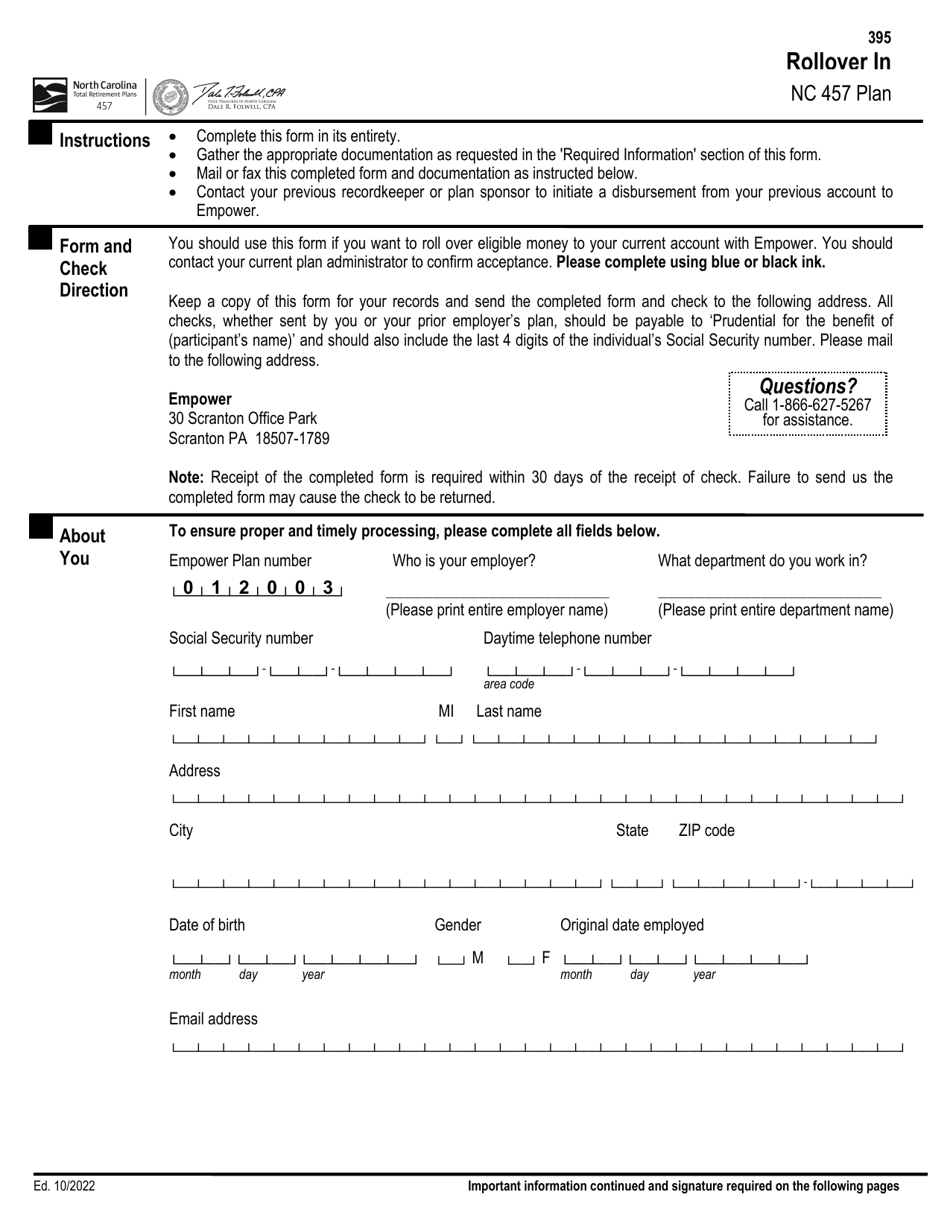

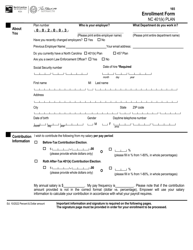

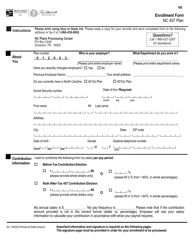

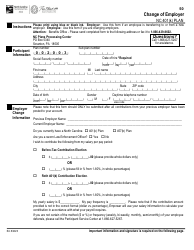

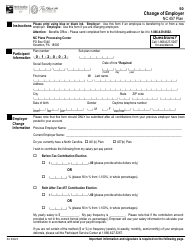

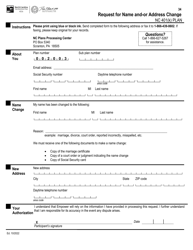

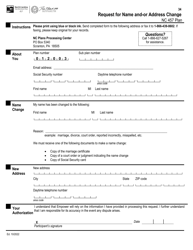

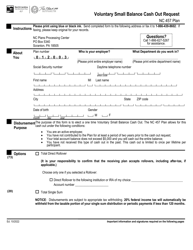

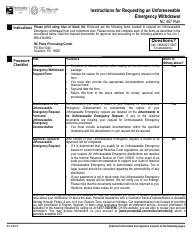

Rollover in - Nc 457 Plan - North Carolina

Rollover in - Nc 457 Plan is a legal document that was released by the North Carolina Department of State Treasurer - a government authority operating within North Carolina.

FAQ

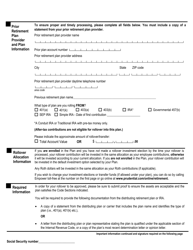

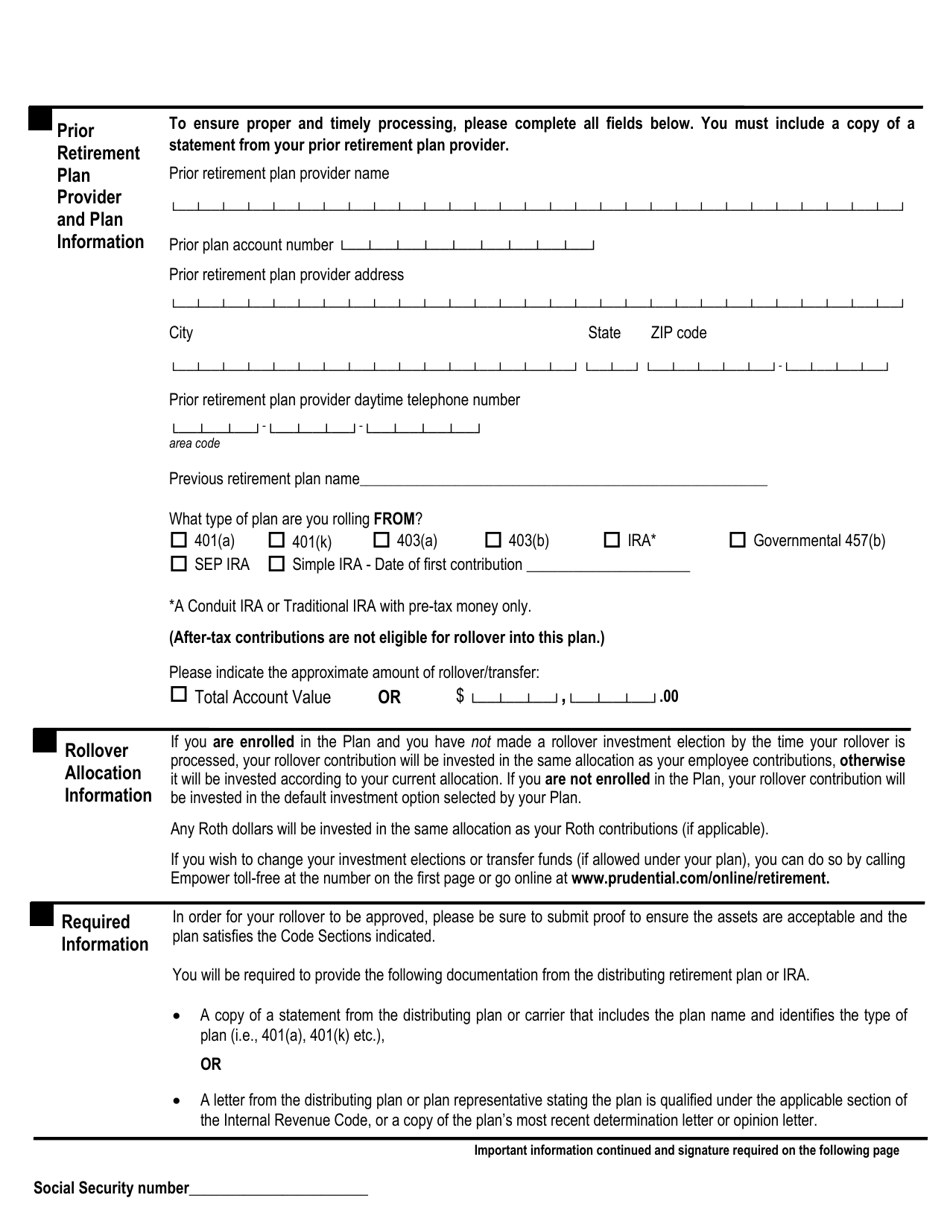

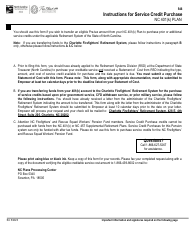

Q: What is a rollover in a North Carolina 457 plan?

A: A rollover in a North Carolina 457 plan refers to moving funds from one qualified retirement plan to another, such as transferring money from a 401(k) or another 457 plan into the North Carolina 457 plan.

Q: Is it possible to rollover funds from a 401(k) into a North Carolina 457 plan?

A: Yes, it is possible to rollover funds from a 401(k) into a North Carolina 457 plan.

Q: Can I rollover funds from another 457 plan into the North Carolina 457 plan?

A: Yes, you can rollover funds from another 457 plan into the North Carolina 457 plan.

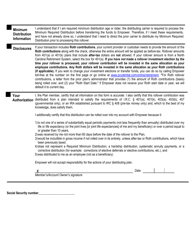

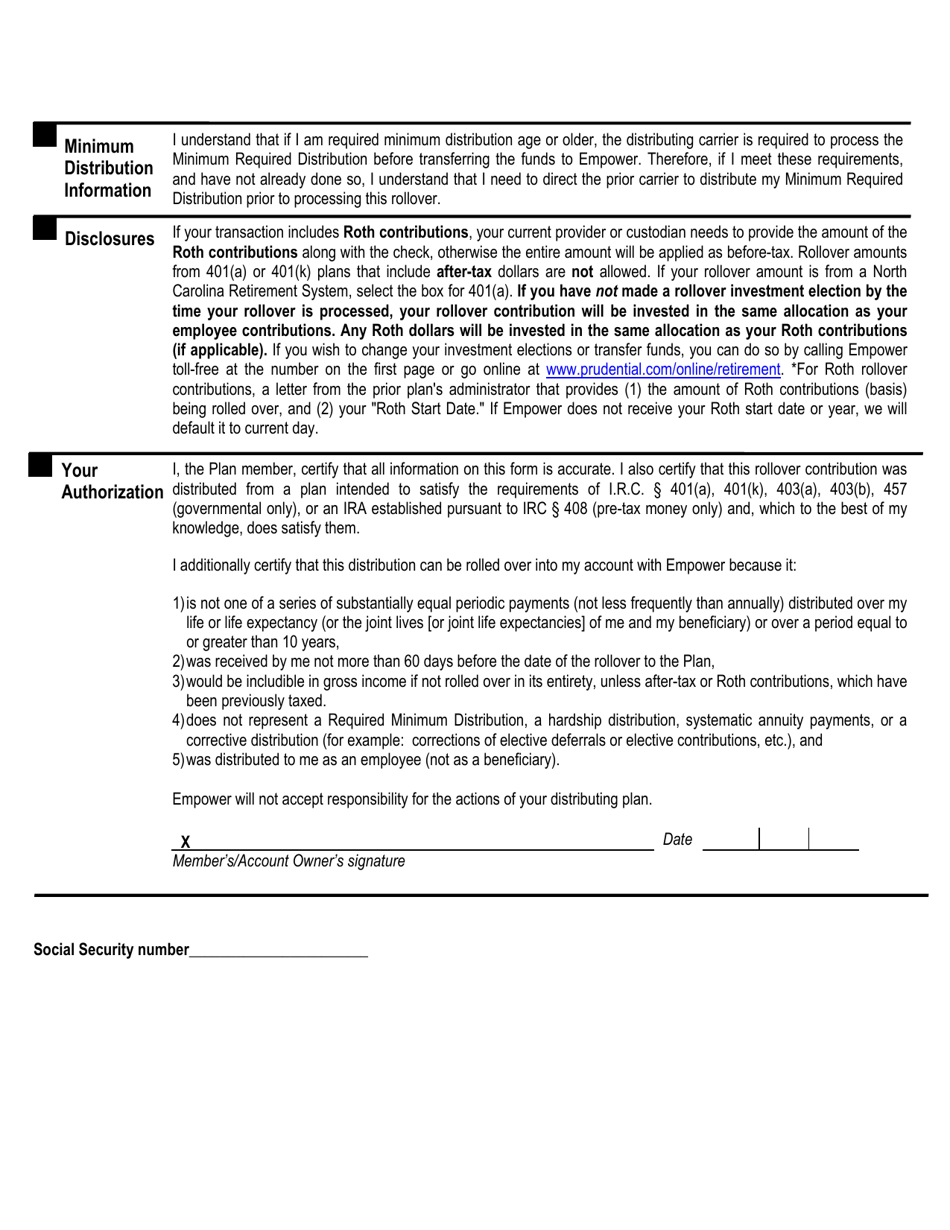

Q: Are there any tax consequences for rollovers in a North Carolina 457 plan?

A: Generally, rollovers from qualified retirement plans, including a North Carolina 457 plan, are tax-free as long as the funds are deposited into another eligible retirement plan within 60 days.

Q: What are the benefits of doing a rollover in a North Carolina 457 plan?

A: The benefits of doing a rollover in a North Carolina 457 plan include consolidating retirement savings, potentially taking advantage of better investment options, and avoiding taxes and penalties if done correctly.

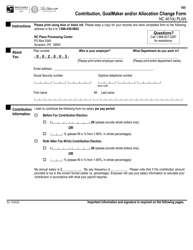

Form Details:

- Released on October 1, 2022;

- The latest edition currently provided by the North Carolina Department of State Treasurer;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the North Carolina Department of State Treasurer.