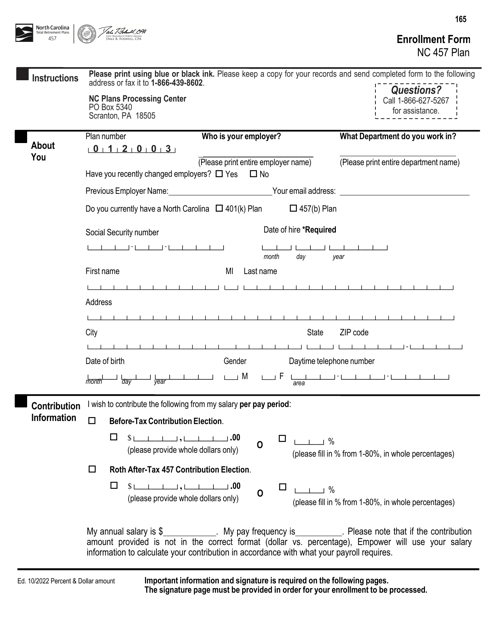

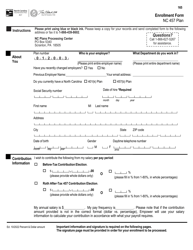

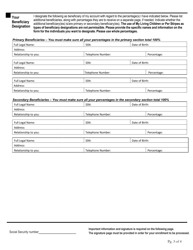

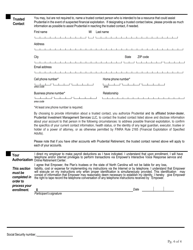

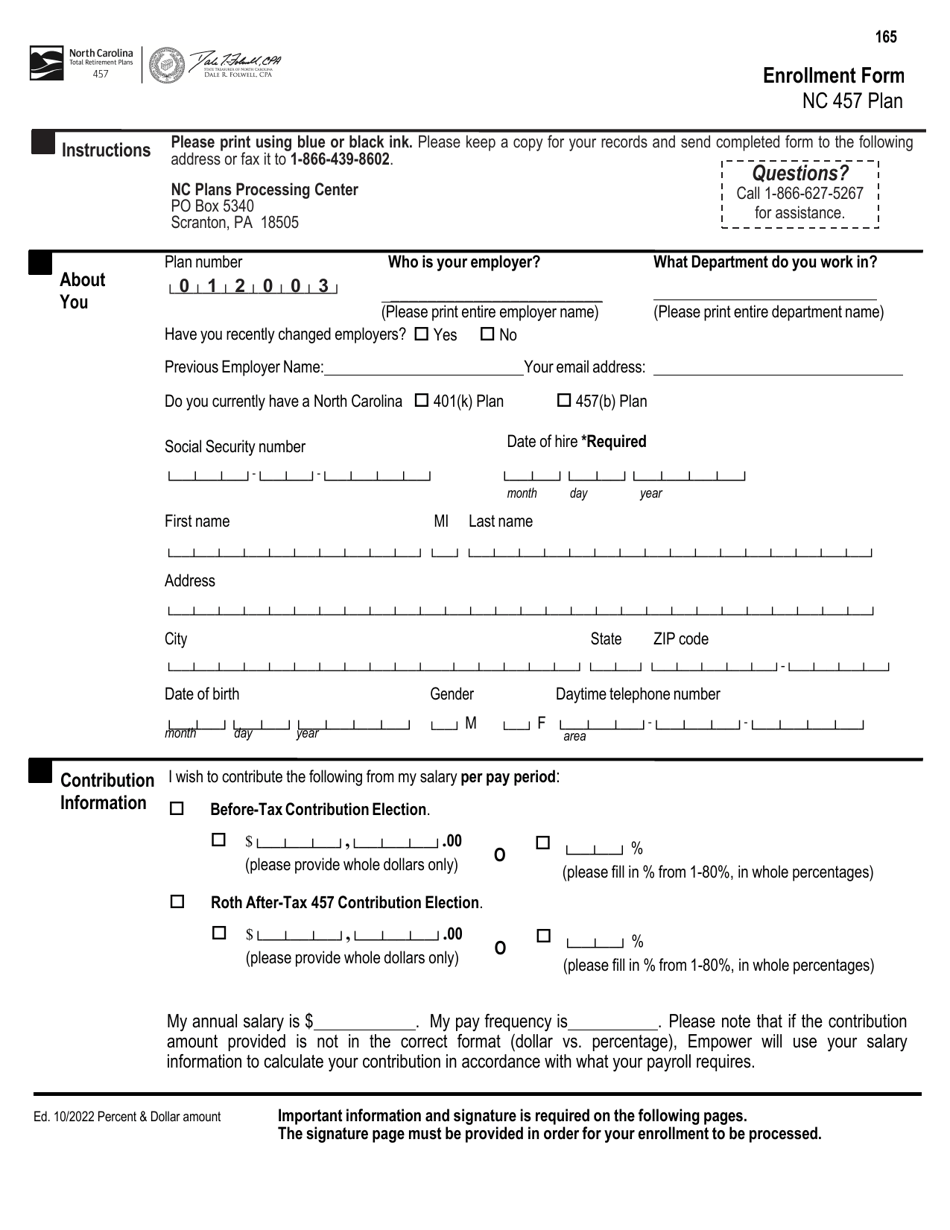

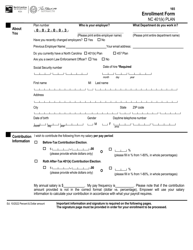

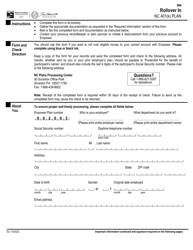

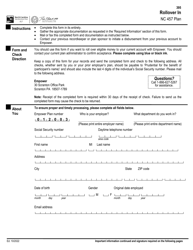

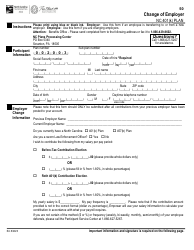

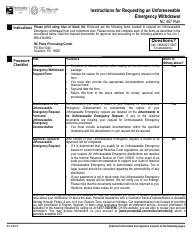

Enrollment Form - Nc 457 Plan - North Carolina

Enrollment Form - Nc 457 Plan is a legal document that was released by the North Carolina Department of State Treasurer - a government authority operating within North Carolina.

FAQ

Q: What is the Nc 457 Plan?

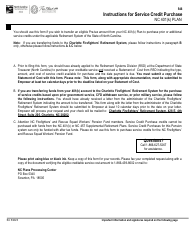

A: The Nc 457 Plan is a retirement savings plan offered in North Carolina.

Q: Who is eligible to enroll in the Nc 457 Plan?

A: Eligibility to enroll in the Nc 457 Plan may vary, but generally it is available to employees of state agencies, local governments, and public schools in North Carolina.

Q: How does the Nc 457 Plan work?

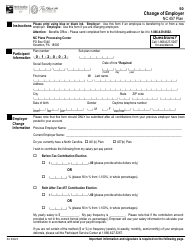

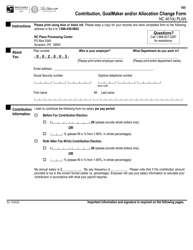

A: The Nc 457 Plan allows employees to contribute a portion of their salary to a retirement account. These contributions are typically made on a pre-tax basis, meaning they are not subject to income taxes until withdrawn.

Q: Are there any contribution limits for the Nc 457 Plan?

A: Yes, there are contribution limits for the Nc 457 Plan. For 2021, the annual contribution limit is $19,500.

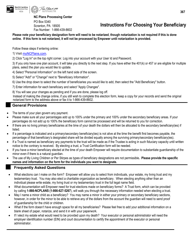

Q: What are the potential benefits of participating in the Nc 457 Plan?

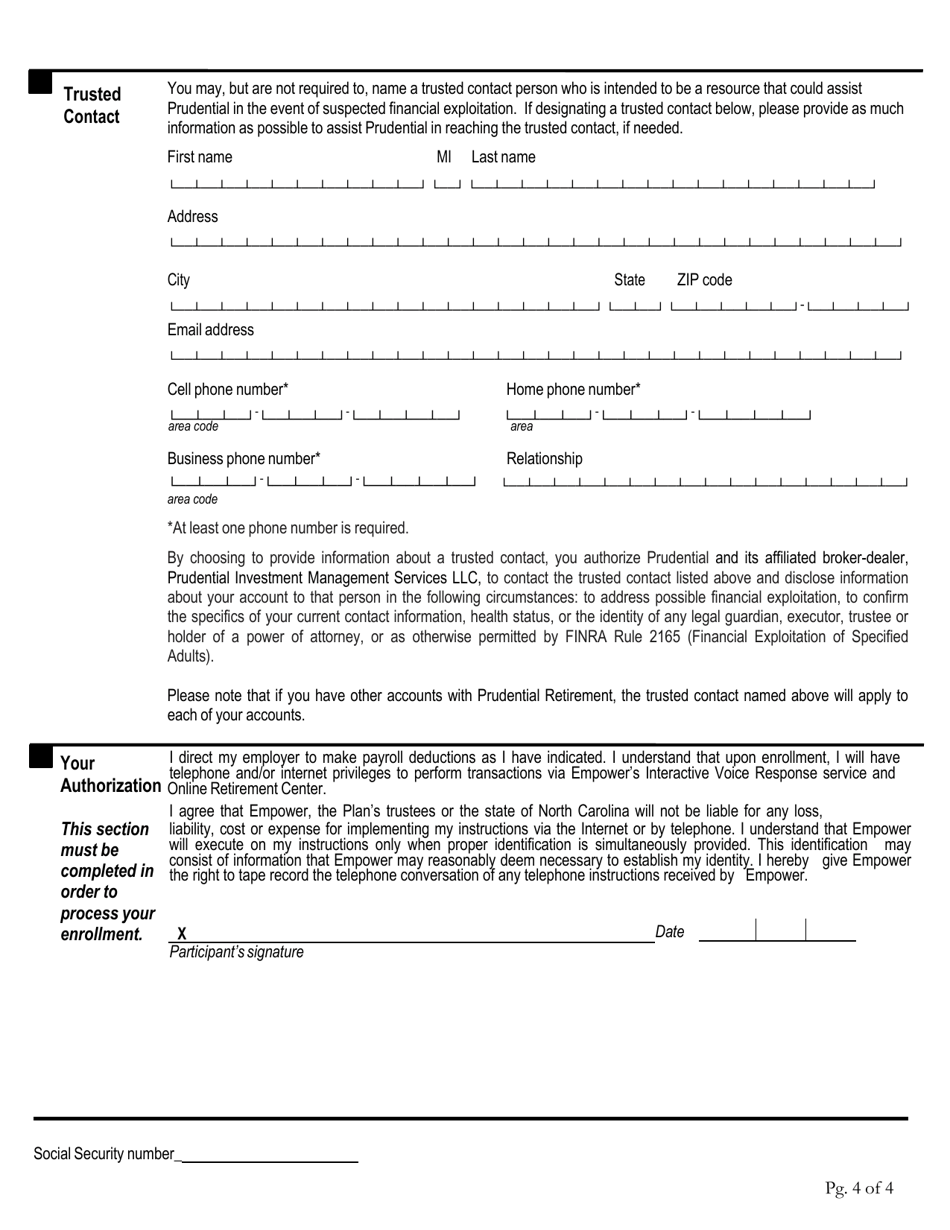

A: Participating in the Nc 457 Plan can provide individuals with a way to save for retirement in a tax-advantaged manner. It also allows for potential employer matching contributions in some cases.

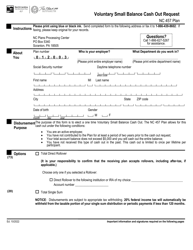

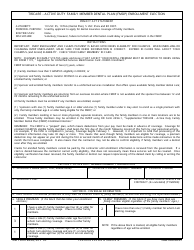

Q: Can I withdraw money from the Nc 457 Plan before retirement?

A: In general, withdrawals from the Nc 457 Plan are allowed upon reaching a certain age (usually 59 1/2) or upon separation from service. However, early withdrawals may be subject to taxes and penalties.

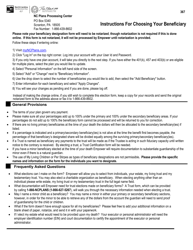

Q: How can I enroll in the Nc 457 Plan?

A: To enroll in the Nc 457 Plan, you will need to contact your employer or the plan administrator for enrollment materials and instructions.

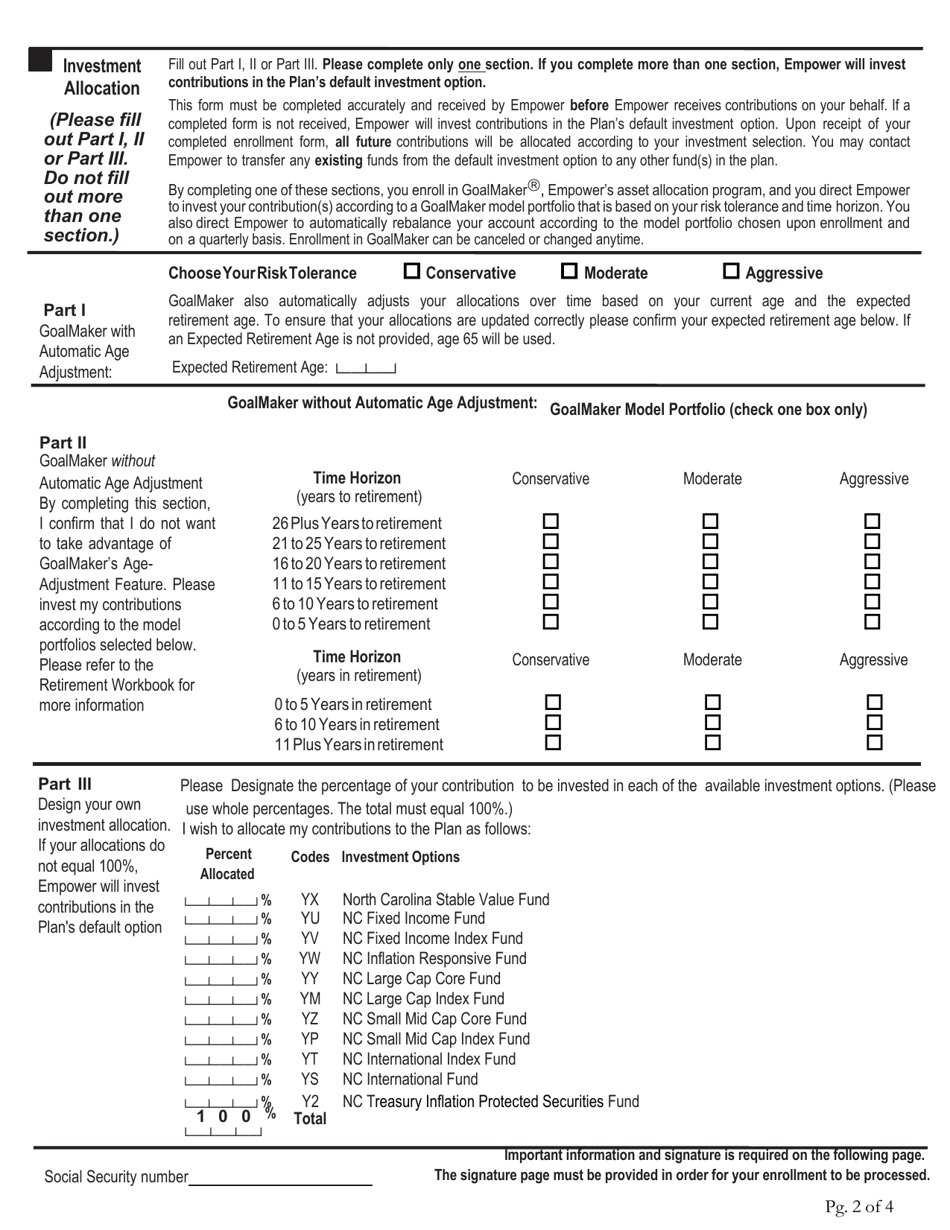

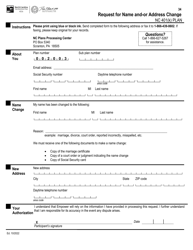

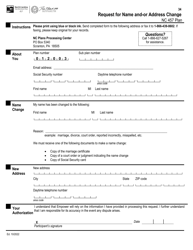

Q: Can I change my contribution amount or investment options in the Nc 457 Plan?

A: Yes, you can generally make changes to your contribution amount and investment options in the Nc 457 Plan. Consult the plan materials or contact the plan administrator for more information.

Q: Are there any fees associated with the Nc 457 Plan?

A: There may be fees associated with the Nc 457 Plan, such as administrative fees or investment fees. It's important to review the plan documents or speak with the plan administrator to understand any applicable fees.

Q: Is the Nc 457 Plan the same as a 401(k) plan?

A: No, the Nc 457 Plan is not the same as a 401(k) plan. While they are both retirement savings plans, they have different rules and regulations governing them.

Form Details:

- Released on October 1, 2022;

- The latest edition currently provided by the North Carolina Department of State Treasurer;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the North Carolina Department of State Treasurer.