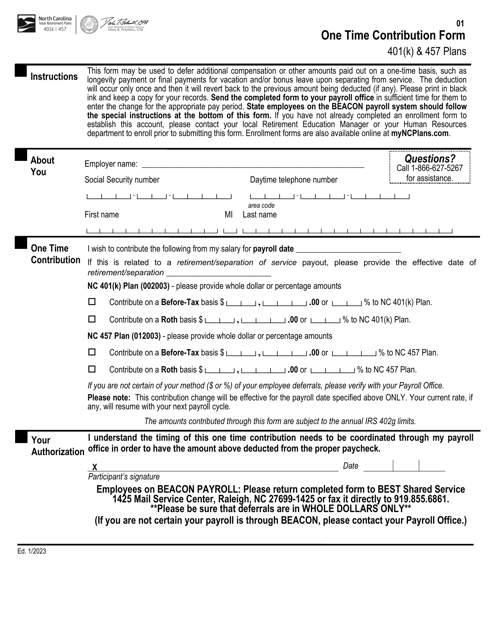

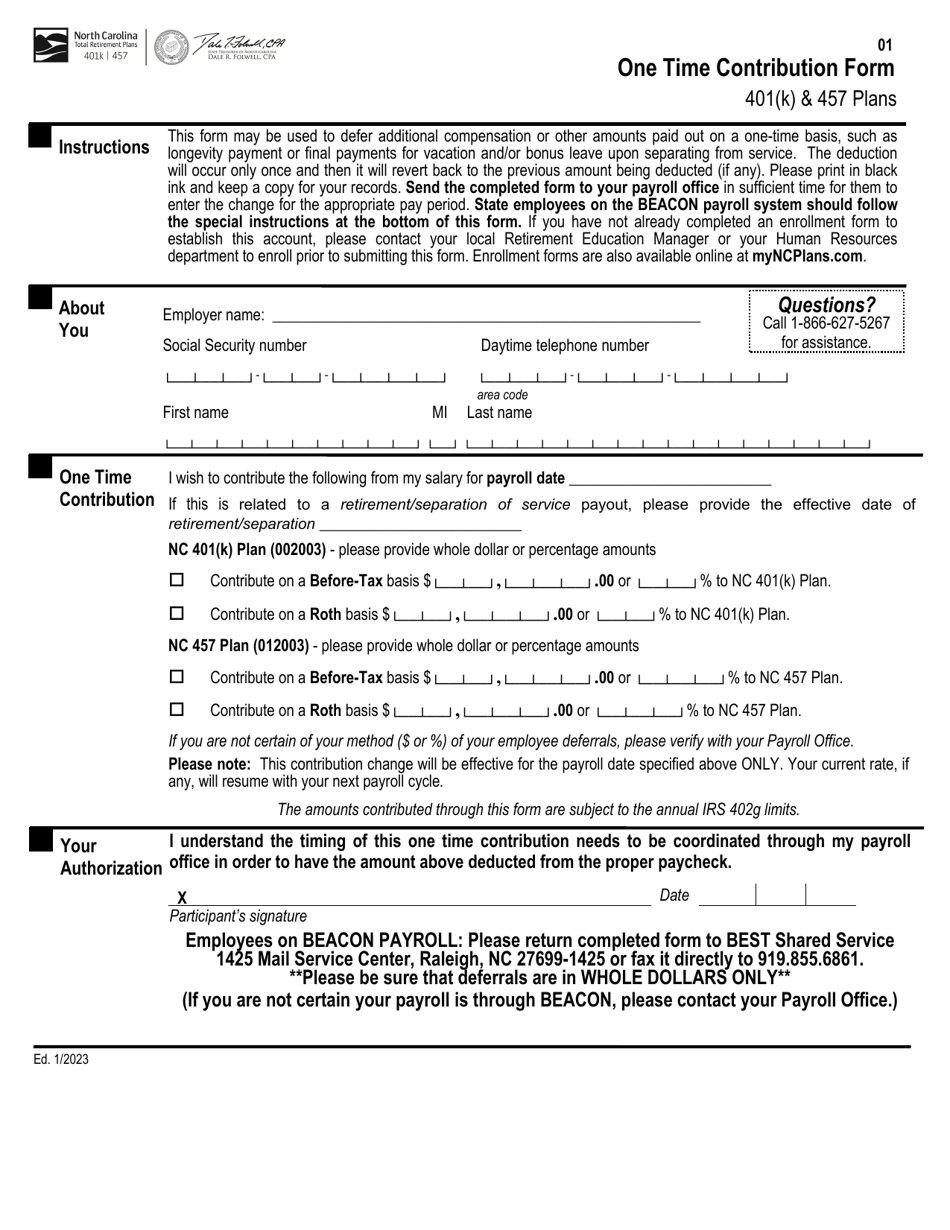

One Time Contribution Form - 401(K) & 457 Plans - North Carolina

One Time Contribution Form - 401(K) & 457 Plans is a legal document that was released by the North Carolina Department of State Treasurer - a government authority operating within North Carolina.

FAQ

Q: What is a one-time contribution form?

A: A one-time contribution form is a form that allows you to make a single contribution to your 401(k) or 457 plan in North Carolina.

Q: Can I make a one-time contribution to my 401(k) or 457 plan?

A: Yes, you can make a one-time contribution to your 401(k) or 457 plan in North Carolina.

Q: How do I fill out a one-time contribution form?

A: To fill out a one-time contribution form, you will typically need to provide your personal information, such as your name and employee ID, along with the contribution amount and any specific instructions.

Q: Are there any limitations on the amount I can contribute through a one-time contribution form?

A: The limitations on one-time contributions to 401(k) and 457 plans may vary depending on factors such as your age and plan rules. It is best to consult with your plan administrator or financial advisor to determine the specific limitations for your situation.

Q: Is there a deadline for making a one-time contribution?

A: The deadline for making a one-time contribution to your 401(k) or 457 plan may vary depending on your plan and any applicable tax regulations. It is important to check with your plan administrator to determine the deadline for your specific situation.

Q: Can I make a one-time contribution to both my 401(k) and 457 plans?

A: Yes, you can make a one-time contribution to both your 401(k) and 457 plans in North Carolina, as long as you meet the eligibility requirements and any contribution limits set by each plan.

Q: Will making a one-time contribution affect my future contributions?

A: Making a one-time contribution to your 401(k) or 457 plan should not typically affect your ability to make future contributions. However, it is important to review your plan's rules and consult with your plan administrator or financial advisor for specific information.

Q: Are there any tax implications associated with a one-time contribution?

A: There may be tax implications associated with making a one-time contribution to your 401(k) or 457 plan. It is recommended to consult with a tax professional or financial advisor to understand the potential tax consequences.

Q: Can I change or cancel a one-time contribution?

A: The ability to change or cancel a one-time contribution may depend on the rules of your 401(k) or 457 plan. It is advisable to contact your plan administrator for guidance on how to make changes to your one-time contribution.

Q: Can I make a one-time contribution if I am no longer employed?

A: The ability to make a one-time contribution to your 401(k) or 457 plan if you are no longer employed may depend on the rules of your specific plan. You should consult with your plan administrator or financial advisor for guidance.

Q: Are there any penalties for making a one-time contribution?

A: There are generally no penalties for making a one-time contribution to your 401(k) or 457 plan. However, it is important to review your plan's rules and consult with your plan administrator or financial advisor for specific information.

Q: Who should I contact if I have questions about a one-time contribution form?

A: If you have questions about a one-time contribution form for your 401(k) or 457 plan in North Carolina, you should contact your plan administrator or human resources department for assistance.

Form Details:

- Released on January 1, 2023;

- The latest edition currently provided by the North Carolina Department of State Treasurer;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the North Carolina Department of State Treasurer.