This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

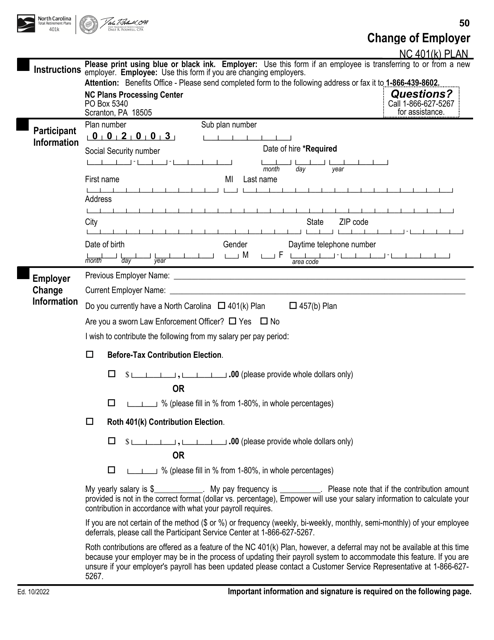

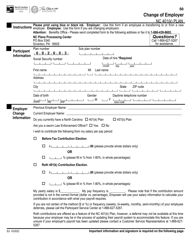

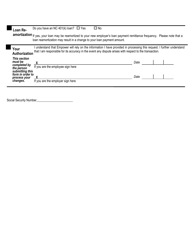

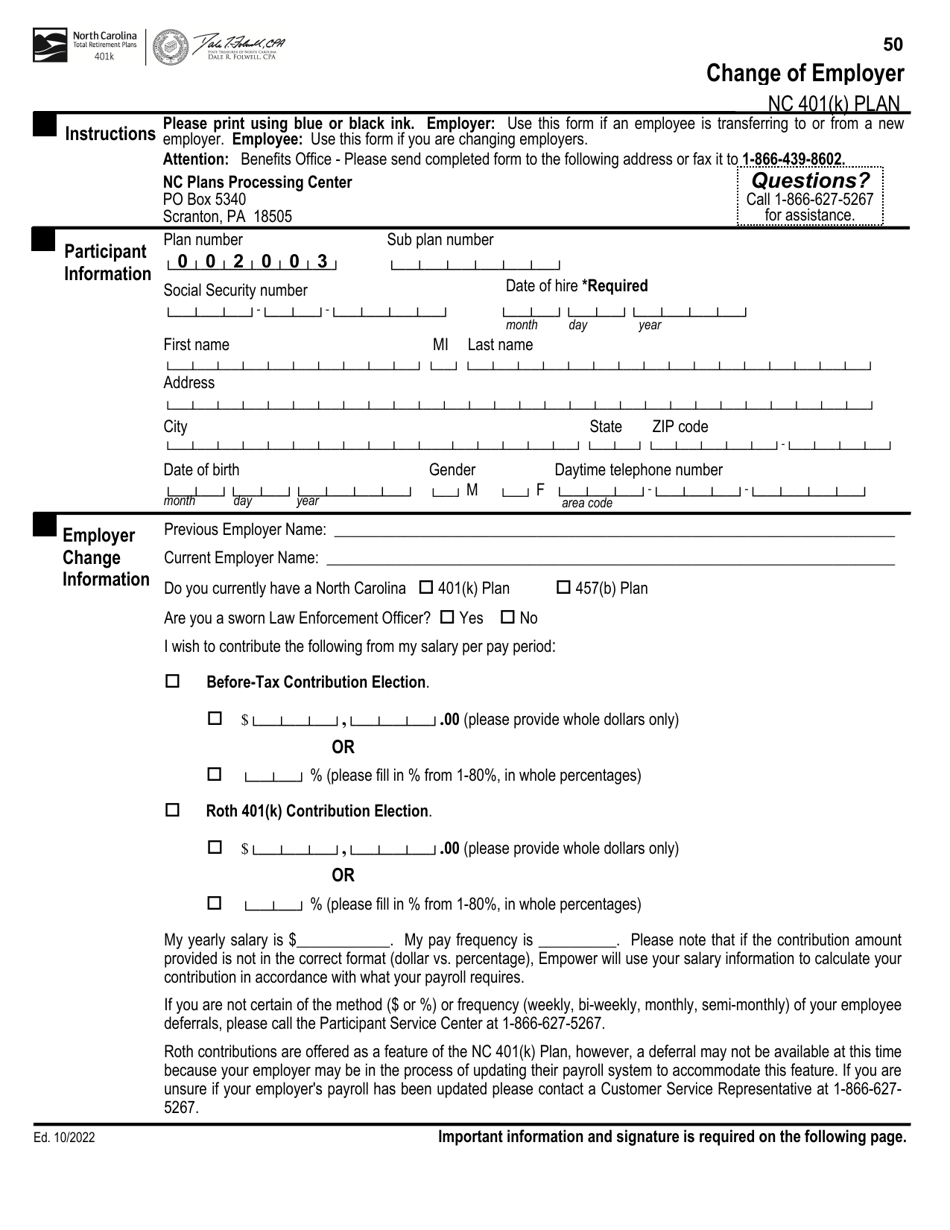

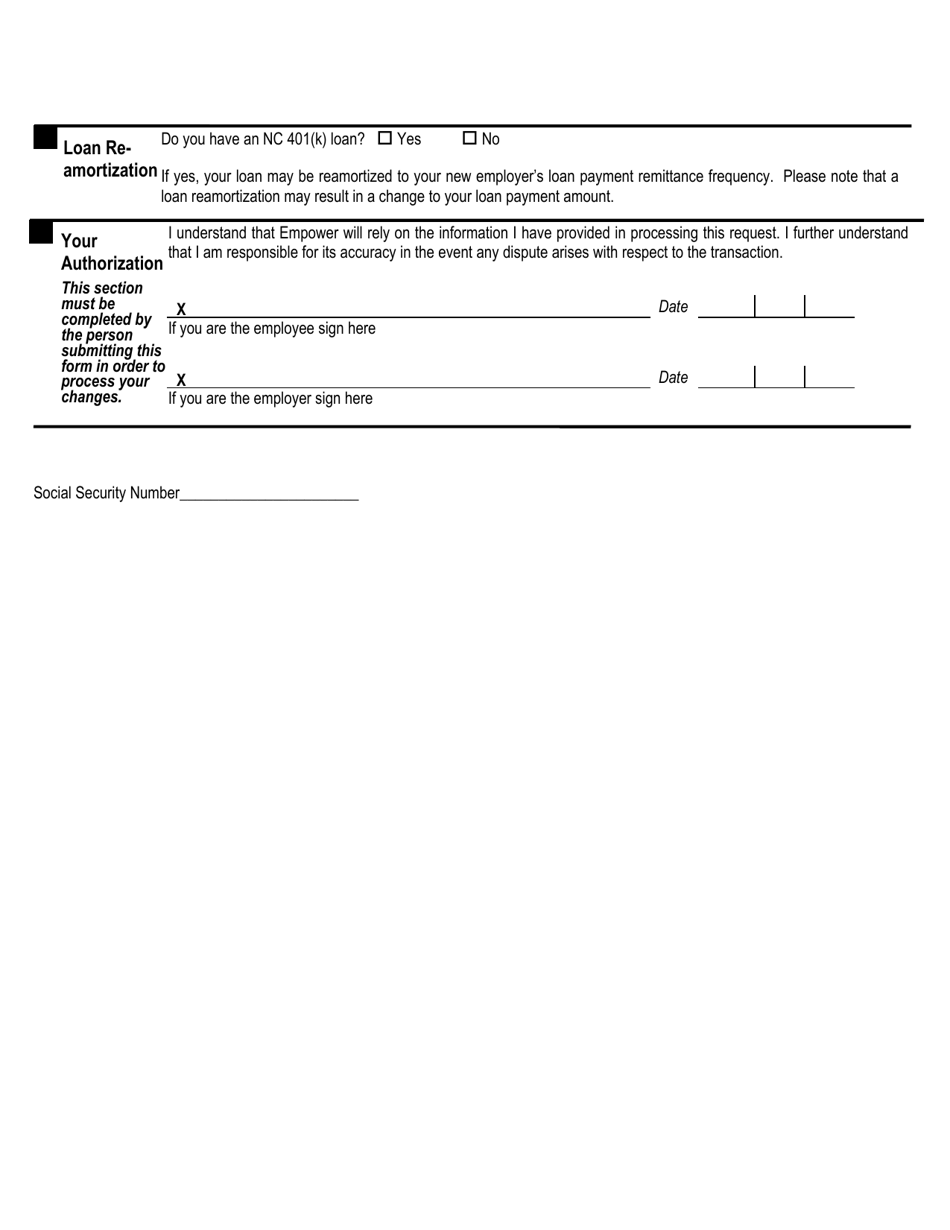

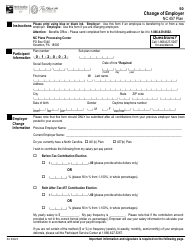

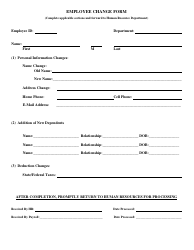

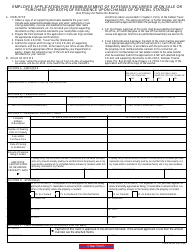

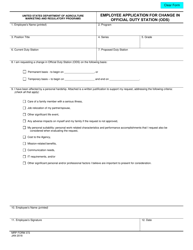

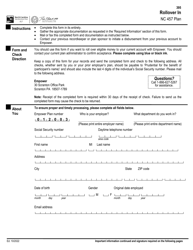

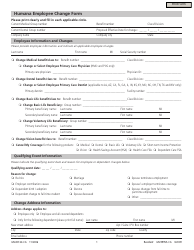

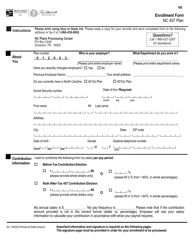

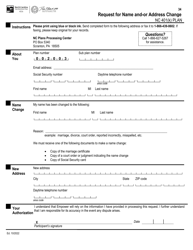

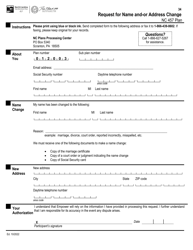

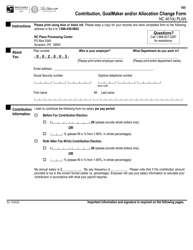

Change of Employer - Nc 401(K) Plan - North Carolina

Change of Employer - Nc 401(K) Plan is a legal document that was released by the North Carolina Department of State Treasurer - a government authority operating within North Carolina.

FAQ

Q: What is a Change of Employer?

A: A Change of Employer refers to switching jobs or leaving one employer for another.

Q: What is an NC 401(K) Plan?

A: An NC 401(K) Plan is a retirement savings plan offered by employers in North Carolina.

Q: Can I transfer my NC 401(K) Plan if I change employers?

A: Yes, you can transfer your NC 401(K) Plan to a new employer's retirement plan or roll it over into an Individual Retirement Account (IRA).

Q: What happens to my NC 401(K) Plan if I leave my job?

A: If you leave your job, you have several options for your NC 401(K) Plan, including leaving it with your former employer, transferring it to a new employer's plan, rolling it over into an IRA, or cashing it out.

Q: Are there any tax implications for transferring my NC 401(K) Plan?

A: There may be tax implications for transferring your NC 401(K) Plan, depending on how you choose to handle the funds. It's best to consult with a financial advisor or tax professional for guidance.

Q: What should I consider before making any changes to my NC 401(K) Plan?

A: Before making any changes to your NC 401(K) Plan, you should consider factors such as your new employer's retirement plan options, fees, investment options, and the potential impact on your retirement savings goals.

Q: Can I access the funds in my NC 401(K) Plan while still employed?

A: In most cases, you cannot directly access the funds in your NC 401(K) Plan while still employed. However, there may be exceptions for hardships or other qualifying events. Contact your plan administrator for more information.

Q: What are the advantages of keeping my NC 401(K) Plan with my former employer?

A: Keeping your NC 401(K) Plan with your former employer can provide continued tax-advantaged growth potential and convenience, as you won't need to make any immediate decisions about transferring or rolling over the funds.

Q: Are there any disadvantages to leaving my NC 401(K) Plan with my former employer?

A: There may be disadvantages to leaving your NC 401(K) Plan with your former employer, such as limited investment options, higher fees, and potential difficulty in managing multiple retirement accounts. It's important to weigh these factors against the benefits before making a decision.

Q: Should I cash out my NC 401(K) Plan when changing jobs?

A: Cashing out your NC 401(K) Plan when changing jobs is generally not recommended, as it can result in taxes, penalties, and the loss of potential long-term growth. It's advisable to explore other options, such as transferring or rolling over the funds.

Q: Can I contribute to my new employer's NC 401(K) Plan if I had one with my previous employer?

A: Yes, you can contribute to your new employer's NC 401(K) Plan even if you had one with your previous employer. However, each employer's plan may have different contribution limits and rules, so it's important to review the details of the new plan.

Q: How can I ensure a smooth transition of my NC 401(K) Plan when changing employers?

A: To ensure a smooth transition of your NC 401(K) Plan when changing employers, it's recommended to communicate with both your former and new employer's plan administrators, follow their instructions for transferring or rolling over the funds, and keep track of any paperwork or documentation throughout the process.

Form Details:

- Released on October 1, 2022;

- The latest edition currently provided by the North Carolina Department of State Treasurer;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the North Carolina Department of State Treasurer.