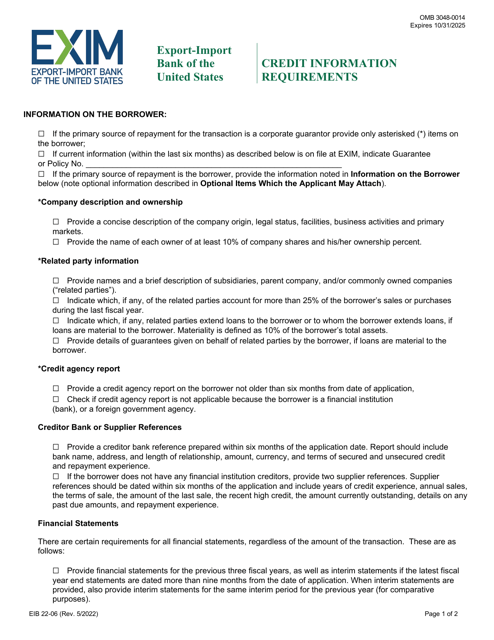

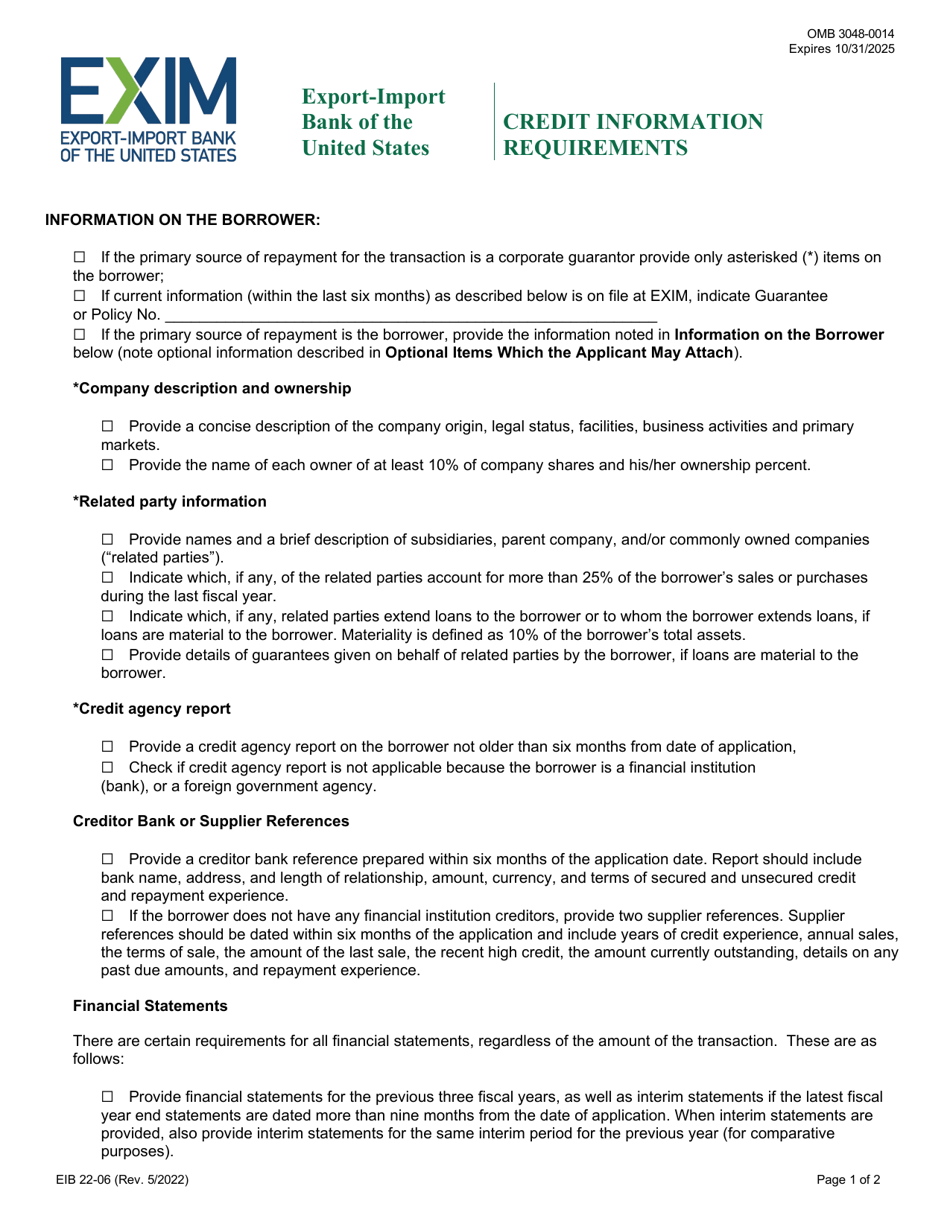

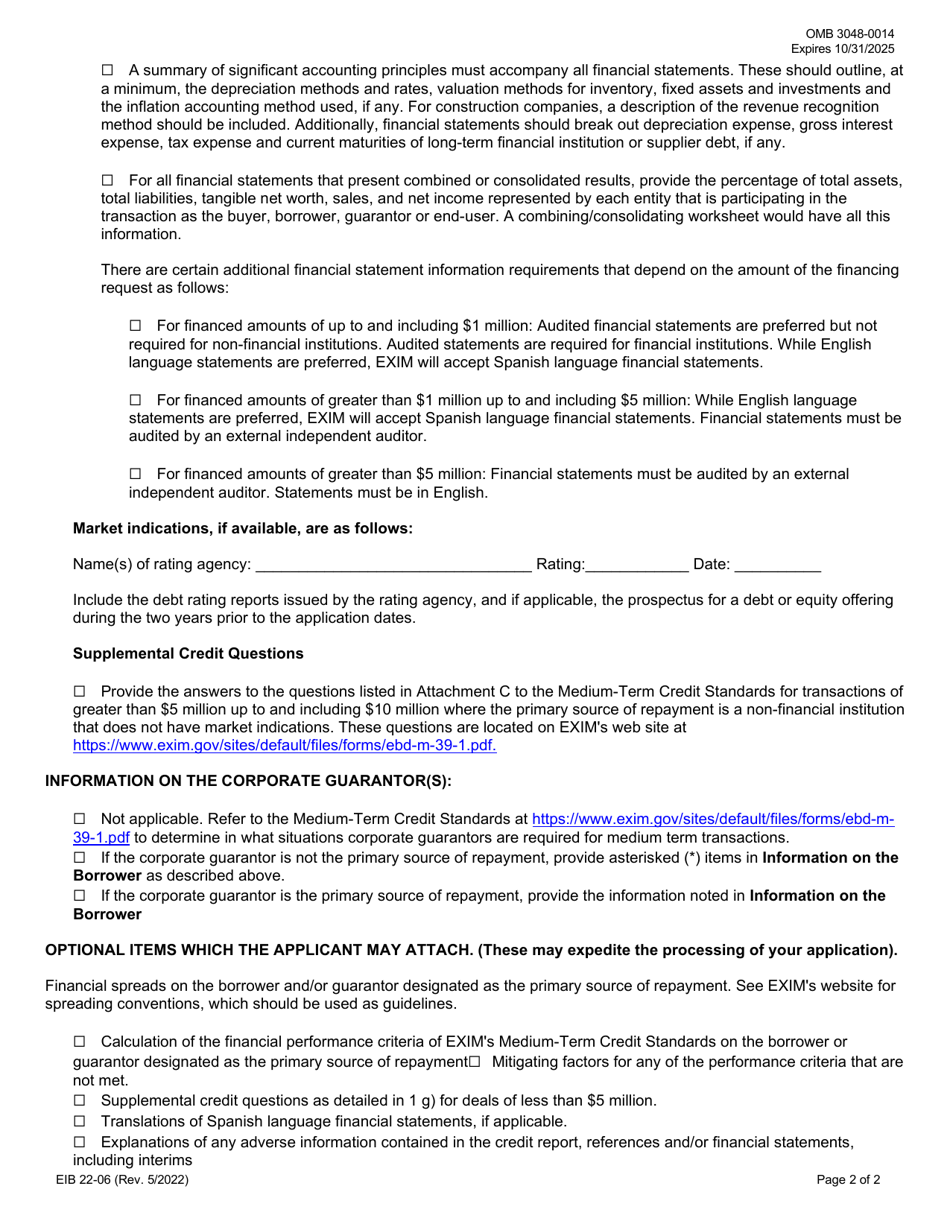

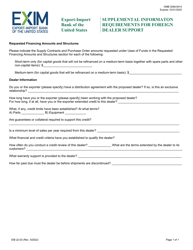

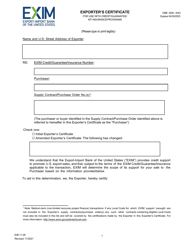

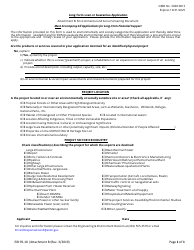

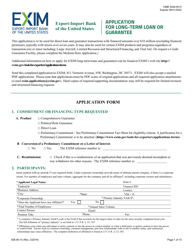

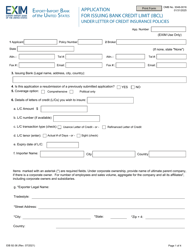

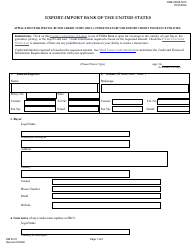

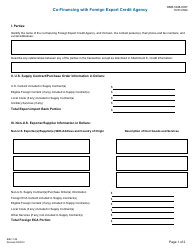

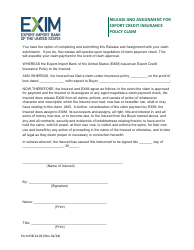

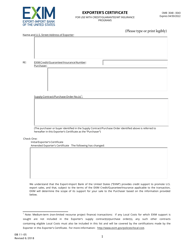

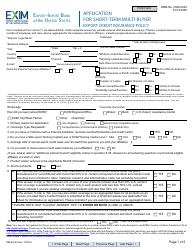

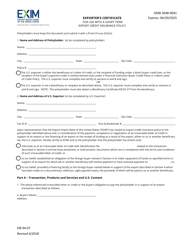

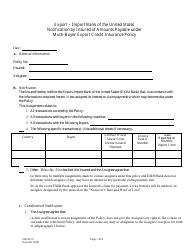

EIB Form 22-06 Credit Information Requirements

What Is EIB Form 22-06?

This is a legal form that was released by the Export-Import Bank of the United States on May 1, 2022 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is EIB Form 22-06?

A: EIB Form 22-06 is a document used to collect credit information.

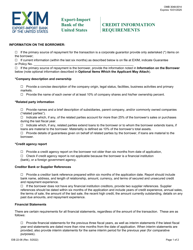

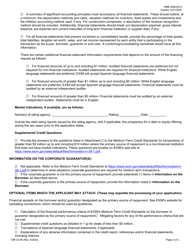

Q: What are the credit information requirements?

A: The credit information requirements are the specific details and documents that need to be provided in the EIB Form 22-06.

Q: Why is credit information important?

A: Credit information is important for assessing the borrower's creditworthiness and determining their ability to repay a loan.

Q: Who uses EIB Form 22-06?

A: Lenders, financial institutions, and the European Investment Bank (EIB) use EIB Form 22-06 to gather credit information from borrowers.

Q: What are some common items included in credit information requirements?

A: Common items may include financial statements, credit history, income verification, and business plans, depending on the purpose of the loan.

Q: How long does it take to complete EIB Form 22-06?

A: The time it takes to complete EIB Form 22-06 depends on the complexity of the borrower's financial situation and the availability of the required documents.

Q: Can I use EIB Form 22-06 for personal loans?

A: EIB Form 22-06 is primarily used for business loans, but some lenders may use similar forms for personal loans.

Q: What happens after submitting EIB Form 22-06?

A: After submitting EIB Form 22-06, the lender or financial institution will review the credit information and make a decision on whether to approve the loan.

Q: Are there any fees associated with EIB Form 22-06?

A: There may be application or processing fees associated with the submission of EIB Form 22-06, depending on the lender or financial institution.

Form Details:

- Released on May 1, 2022;

- The latest available edition released by the Export-Import Bank of the United States;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of EIB Form 22-06 by clicking the link below or browse more documents and templates provided by the Export-Import Bank of the United States.