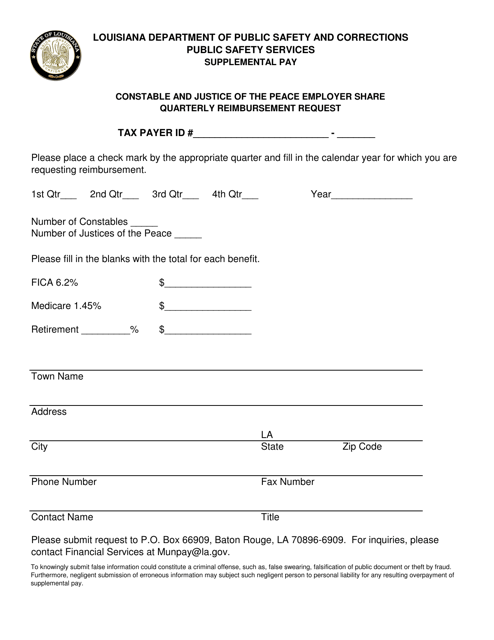

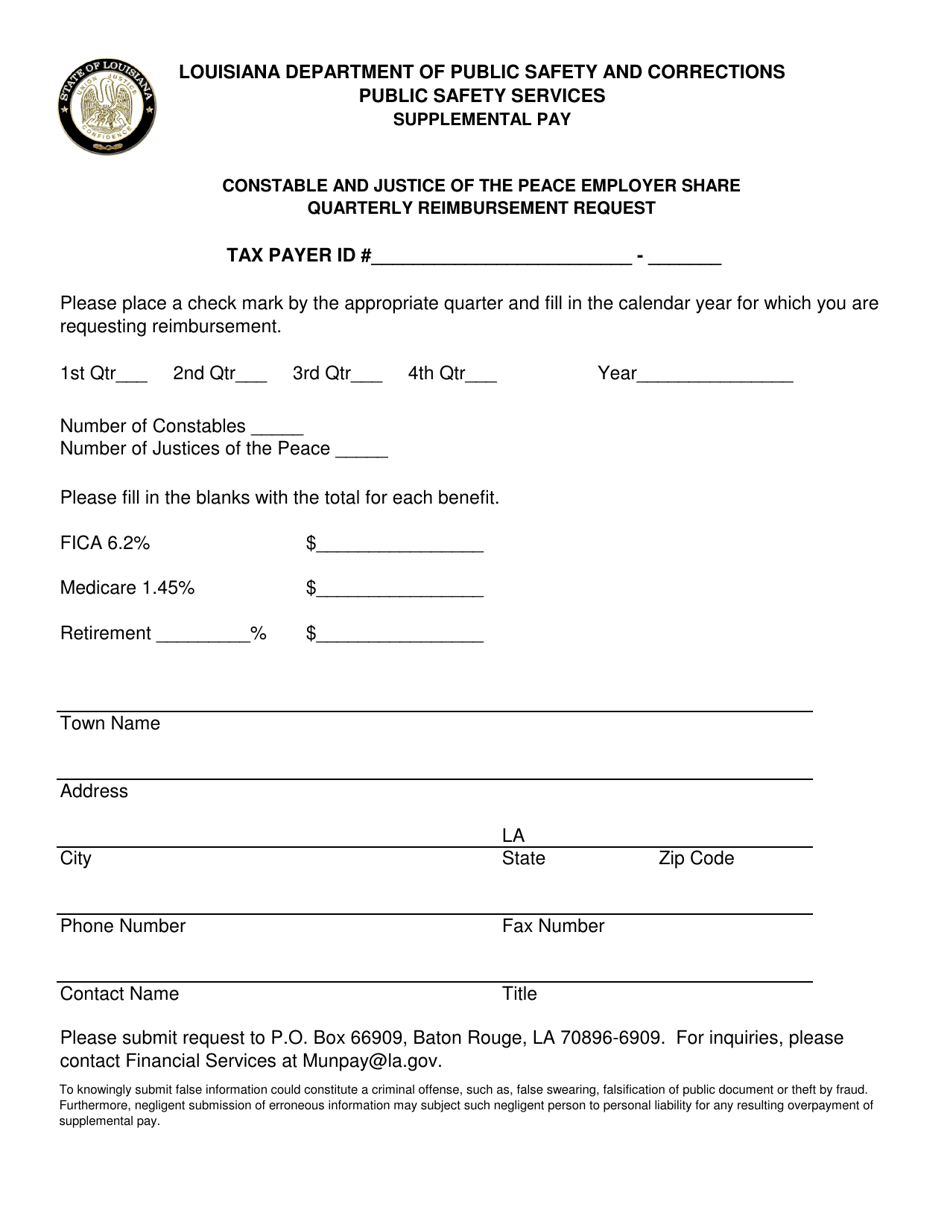

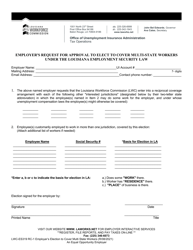

Constable and Justice of the Peace Employer Share Quarterly Reimbursement Request - Louisiana

Constable and Justice of the Peace Employer Share Quarterly Reimbursement Request is a legal document that was released by the Louisiana Department of Public Safety & Corrections - a government authority operating within Louisiana.

FAQ

Q: What is the Constable and Justice of the Peace Employer Share Quarterly Reimbursement Request?

A: The Constable and Justice of the Peace Employer Share Quarterly Reimbursement Request is a form in Louisiana used to request reimbursement for employer share of Social Security and Medicare taxes for Constables and Justices of the Peace.

Q: Who can use the Constable and Justice of the Peace Employer Share Quarterly Reimbursement Request?

A: Constables and Justices of the Peace in Louisiana can use the form to request reimbursement for employer share of Social Security and Medicare taxes.

Q: What is the purpose of the reimbursement request?

A: The purpose of the reimbursement request is to offset the employer's share of Social Security and Medicare taxes for Constables and Justices of the Peace in Louisiana.

Q: Is there a deadline for submitting the reimbursement request?

A: Yes, the reimbursement request must be submitted on a quarterly basis, following the end of each quarter.

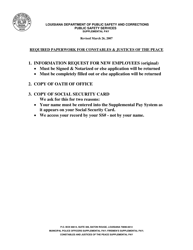

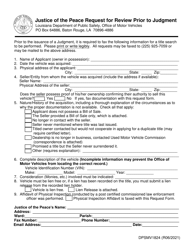

Q: What documents should be included with the reimbursement request?

A: The reimbursement request should include supporting documents such as payroll records and tax forms.

Q: Who should I contact for more information about the Constable and Justice of the Peace Employer Share Quarterly Reimbursement Request?

A: For more information, you can contact the Louisiana Department of Revenue or your local tax office.

Form Details:

- The latest edition currently provided by the Louisiana Department of Public Safety & Corrections;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Louisiana Department of Public Safety & Corrections.