This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

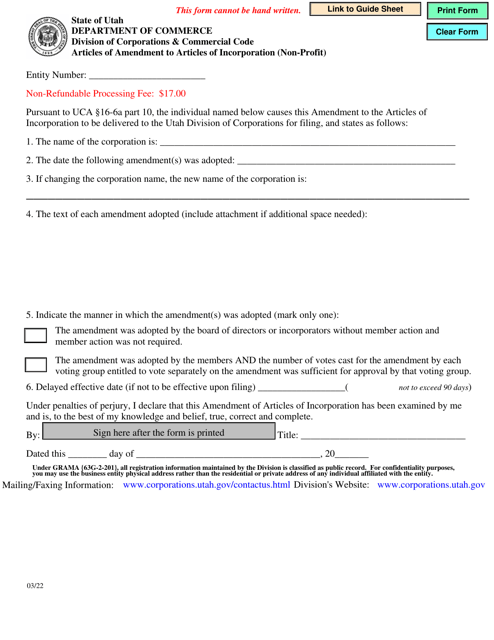

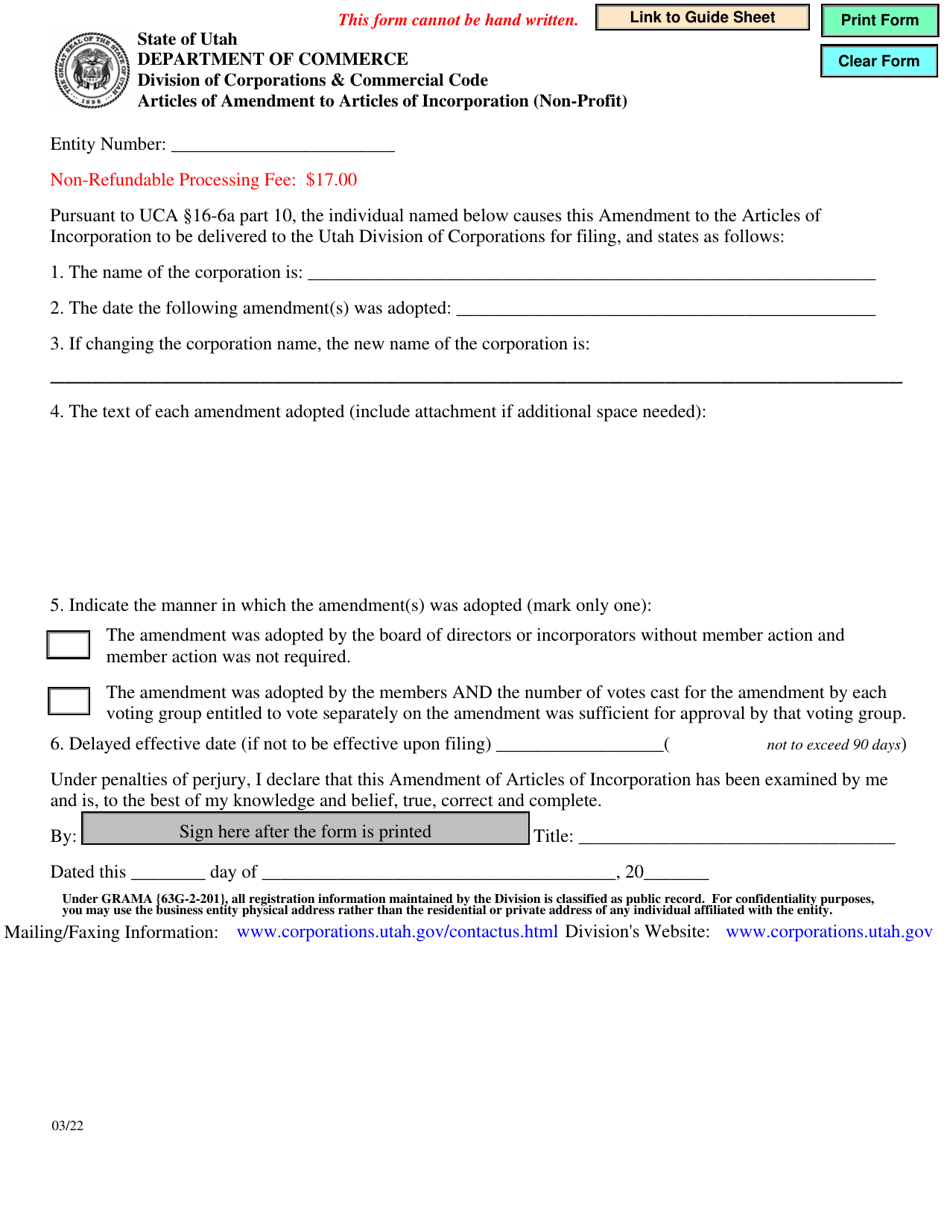

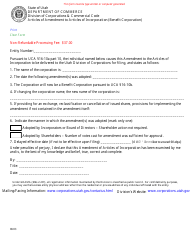

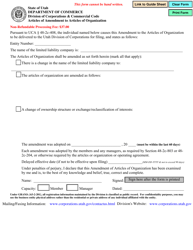

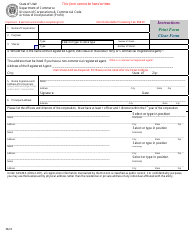

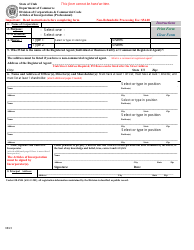

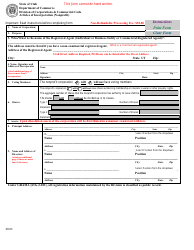

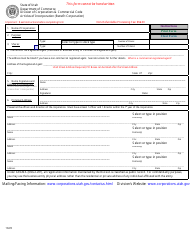

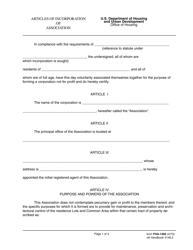

Articles of Amendment to Articles of Incorporation (Non-profit) - Utah

Articles of Amendment to Articles of Incorporation (Non-profit) is a legal document that was released by the Utah Department of Commerce - a government authority operating within Utah.

FAQ

Q: What are Articles of Amendment?

A: Articles of Amendment are official documents used to make changes or amendments to the original Articles of Incorporation of a non-profit organization.

Q: What is the purpose of filing Articles of Amendment?

A: The purpose of filing Articles of Amendment is to update or modify information in the original Articles of Incorporation of a non-profit organization.

Q: How do I file Articles of Amendment for a non-profit organization in Utah?

A: To file Articles of Amendment for a non-profit organization in Utah, you need to complete the required form and submit it to the Utah Division of Corporations and Commercial Code.

Q: What changes can be made through Articles of Amendment?

A: Through Articles of Amendment, you can make changes to the non-profit organization's name, purpose, duration, membership structure, or other important details.

Q: Are there any fees for filing Articles of Amendment?

A: Yes, there are fees associated with filing Articles of Amendment for a non-profit organization in Utah. The amount may vary, so it is best to check with the Utah Division of Corporations and Commercial Code.

Q: Do I need to notify the IRS about the amendments made through Articles of Amendment?

A: Yes, if the non-profit organization has received tax-exempt status from the IRS, you will need to notify them about the amendments made through Articles of Amendment.

Q: Are Articles of Amendment public record?

A: Yes, Articles of Amendment are public record and can be accessed by anyone who wishes to review them.

Q: Can I make multiple changes in a single set of Articles of Amendment?

A: Yes, you can make multiple changes in a single set of Articles of Amendment as long as they are all valid and comply with the laws and regulations governing non-profit organizations.

Q: Is it necessary to consult legal counsel before filing Articles of Amendment?

A: While it is not legally required, it is often recommended to consult legal counsel before filing Articles of Amendment to ensure compliance with all applicable laws and regulations.

Form Details:

- Released on March 1, 2022;

- The latest edition currently provided by the Utah Department of Commerce;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Utah Department of Commerce.