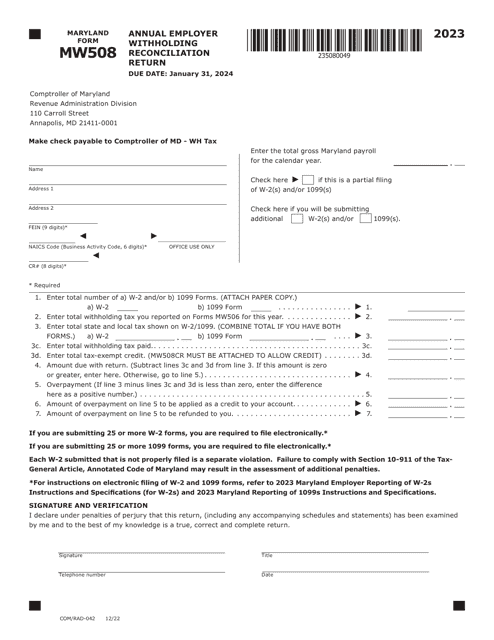

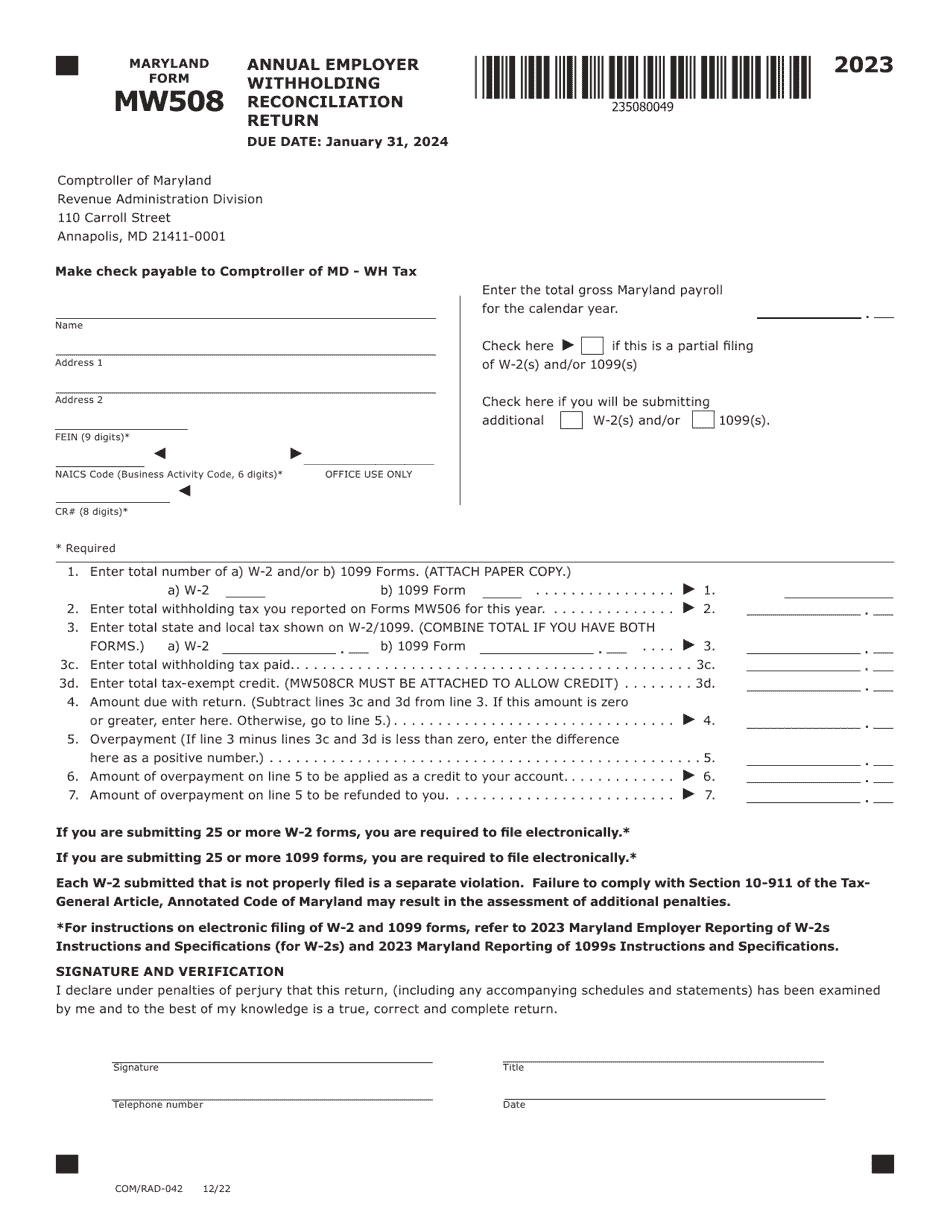

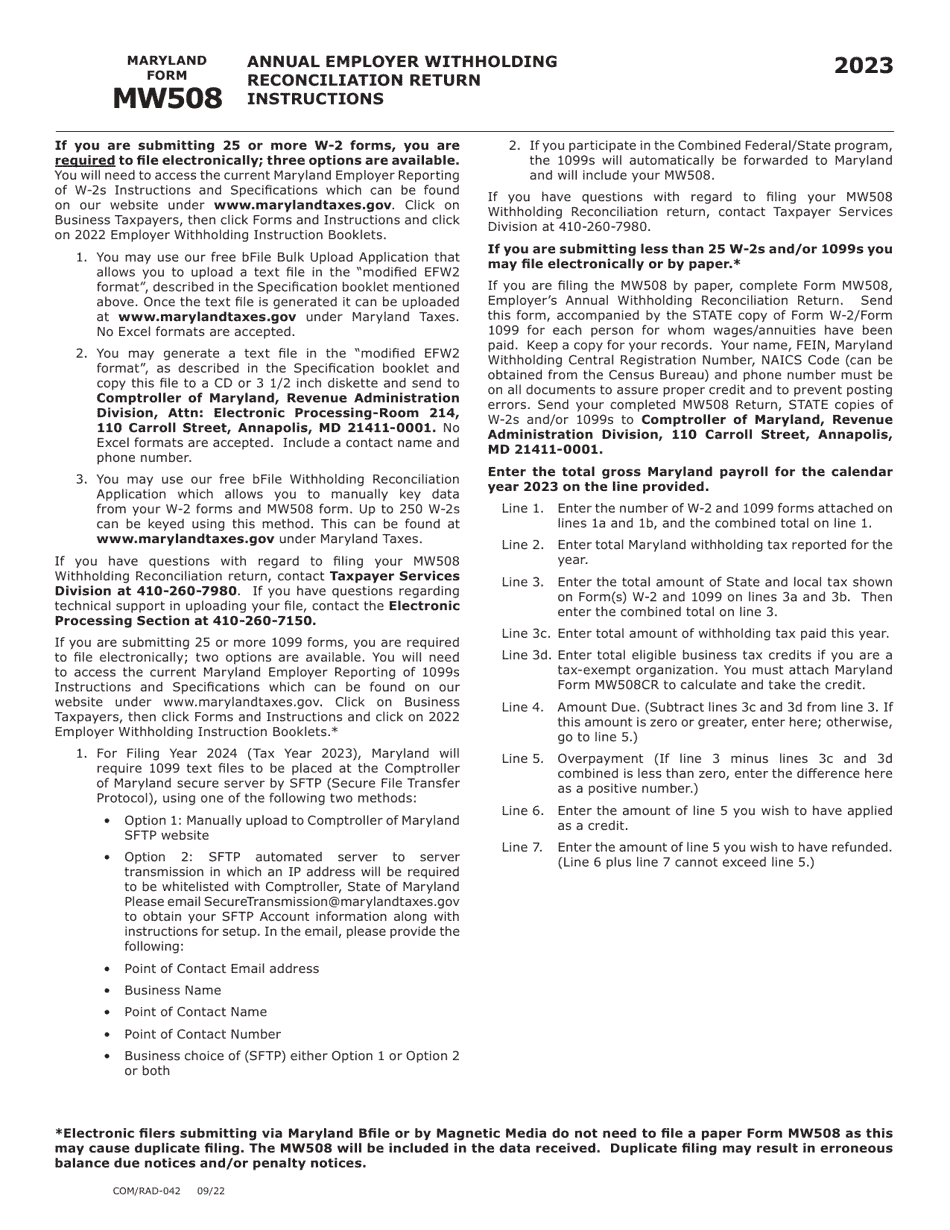

Maryland Form MW508 (COM / RAD-042) Annual Employer Withholding Reconciliation Return - Maryland

What Is Maryland Form MW508 (COM/RAD-042)?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form MW508?

A: Form MW508 is the Annual Employer Withholding Reconciliation Return for the state of Maryland.

Q: Who needs to file Form MW508?

A: Employers in Maryland who have withheld income tax from employee wages must file Form MW508.

Q: What is the purpose of Form MW508?

A: The form is used to reconcile the total amount of income tax withheld from employees and the total amount of income tax deposited with the state.

Q: When is Form MW508 due?

A: Form MW508 is due on or before January 31st of the following year.

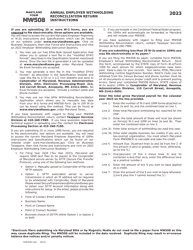

Q: Is Form MW508 to be filed electronically?

A: Yes, the Maryland Comptroller's Office encourages employers to file Form MW508 electronically.

Q: What happens if I do not file Form MW508?

A: Failure to file Form MW508 or filing the form late may result in penalties and interest.

Q: Are there any additional forms or schedules that need to be attached to Form MW508?

A: No, there are no additional forms or schedules that need to be attached to Form MW508.

Q: Can I make corrections to a previously filed Form MW508?

A: Yes, you can make corrections to a previously filed Form MW508 by submitting an amended form with the correct information.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Maryland Form MW508 (COM/RAD-042) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.