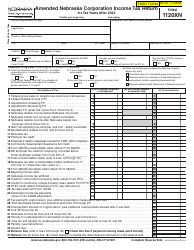

This version of the form is not currently in use and is provided for reference only. Download this version of

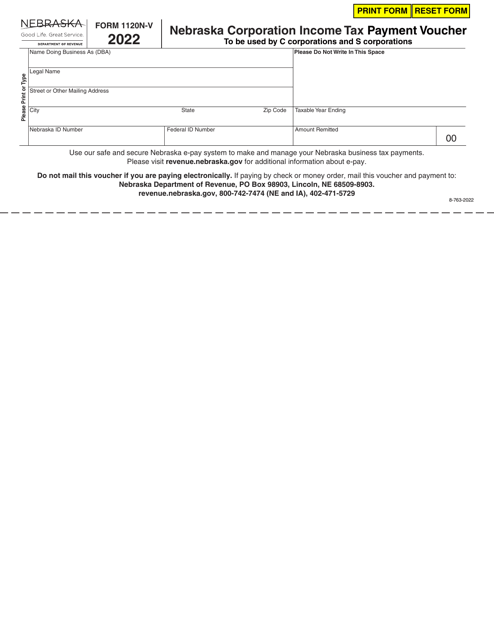

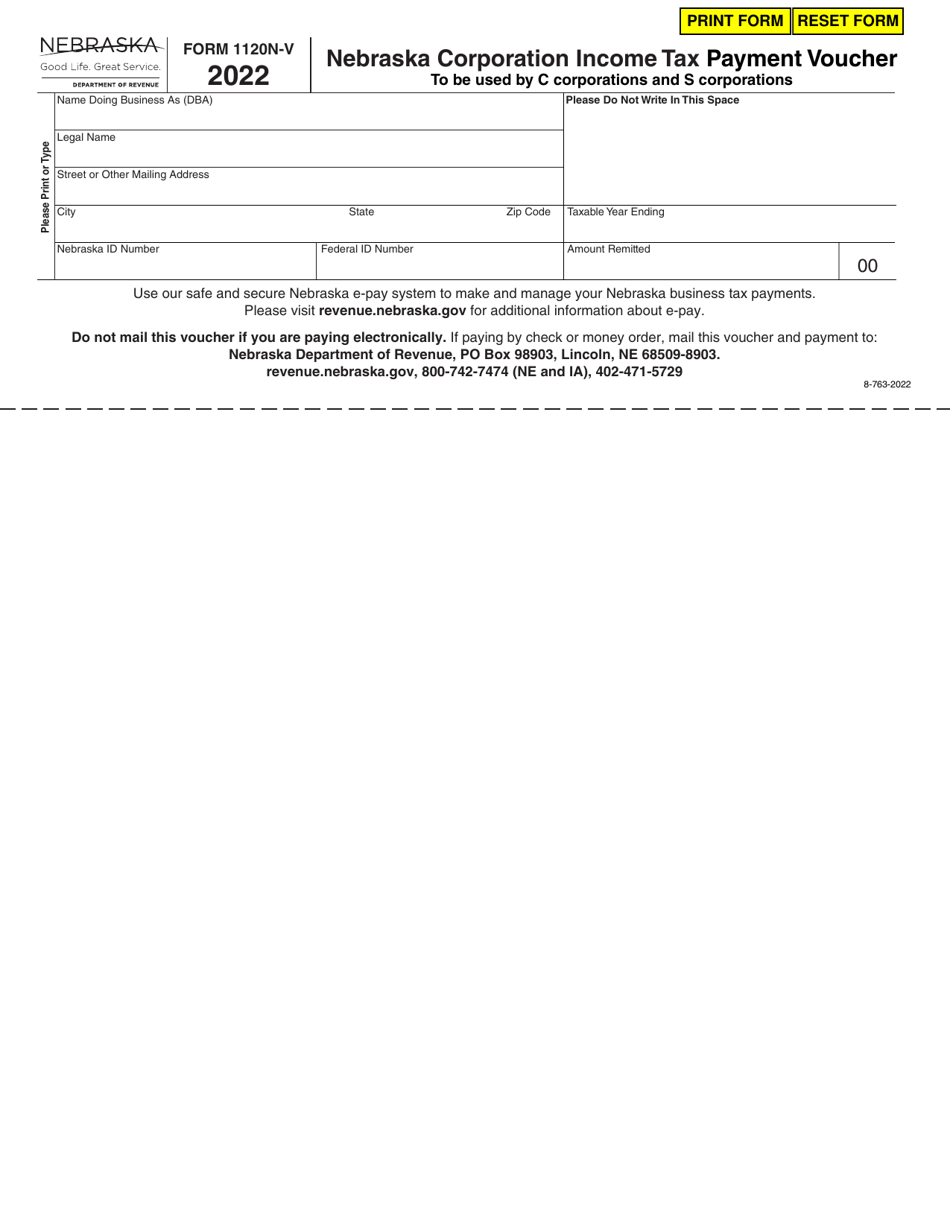

Form 1120N-V

for the current year.

Form 1120N-V Nebraska Corporation Income Tax Payment Voucher - Nebraska

What Is Form 1120N-V?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

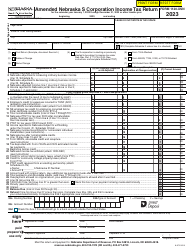

Q: What is Form 1120N-V?

A: Form 1120N-V is the Nebraska Corporation Income Tax Payment Voucher.

Q: Who needs to use Form 1120N-V?

A: Nebraska corporations who need to make income tax payments should use Form 1120N-V.

Q: What is the purpose of Form 1120N-V?

A: The purpose of Form 1120N-V is to submit income tax payments for Nebraska corporations.

Q: Do I need to attach Form 1120N-V to my tax return?

A: No, Form 1120N-V is a separate voucher used only for making income tax payments. It does not need to be attached to your tax return.

Form Details:

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1120N-V by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.