This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

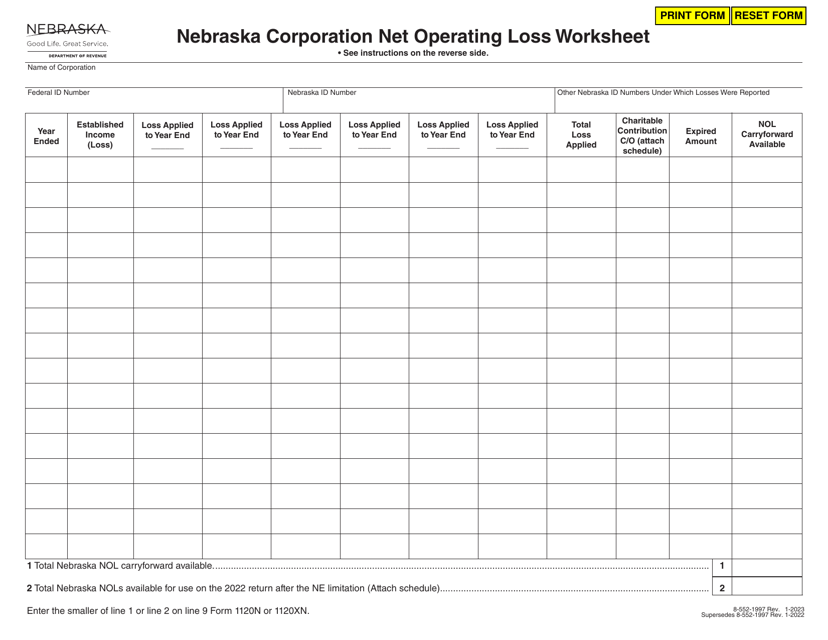

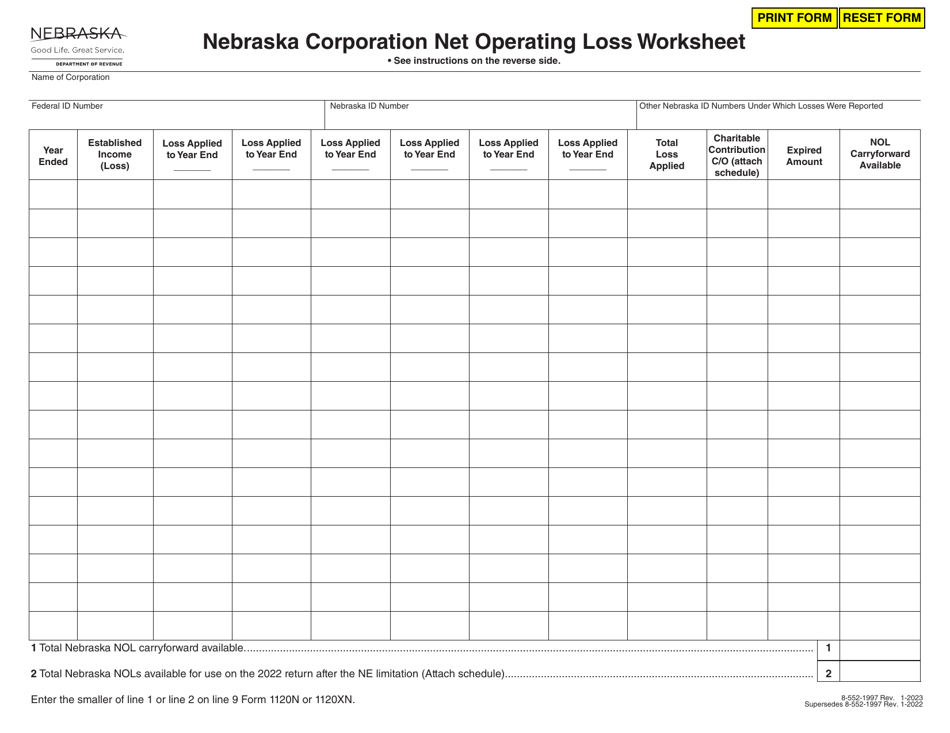

Nebraska Corporation Net Operating Loss Worksheet - Nebraska

Nebraska Corporation Net Operating Loss Worksheet is a legal document that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska.

FAQ

Q: What is the Nebraska Corporation Net Operating Loss Worksheet?

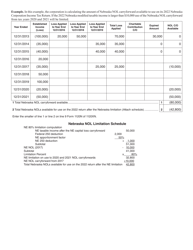

A: The Nebraska Corporation Net Operating Loss Worksheet is a form used by corporations in Nebraska to calculate their net operating loss.

Q: How do corporations use the Nebraska Corporation Net Operating Loss Worksheet?

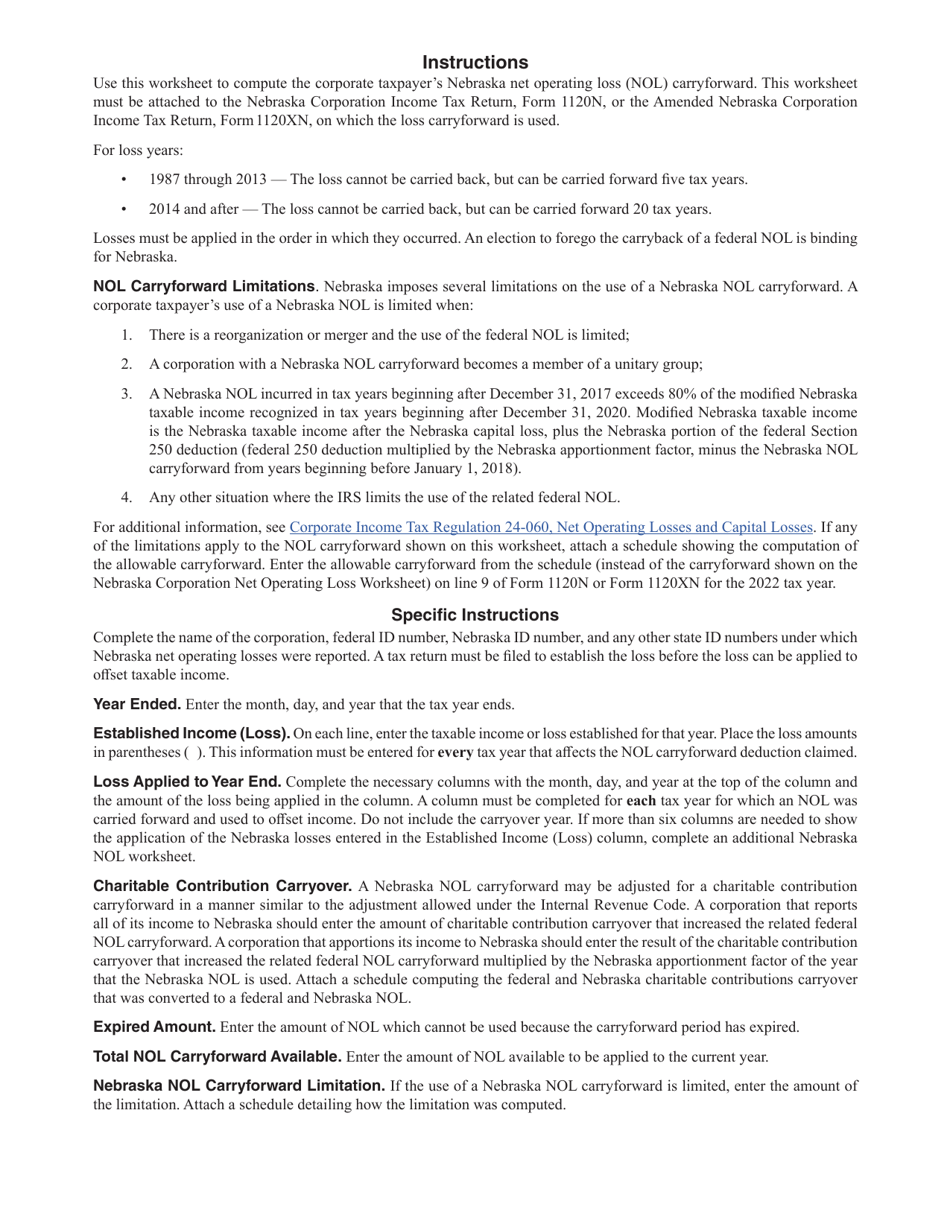

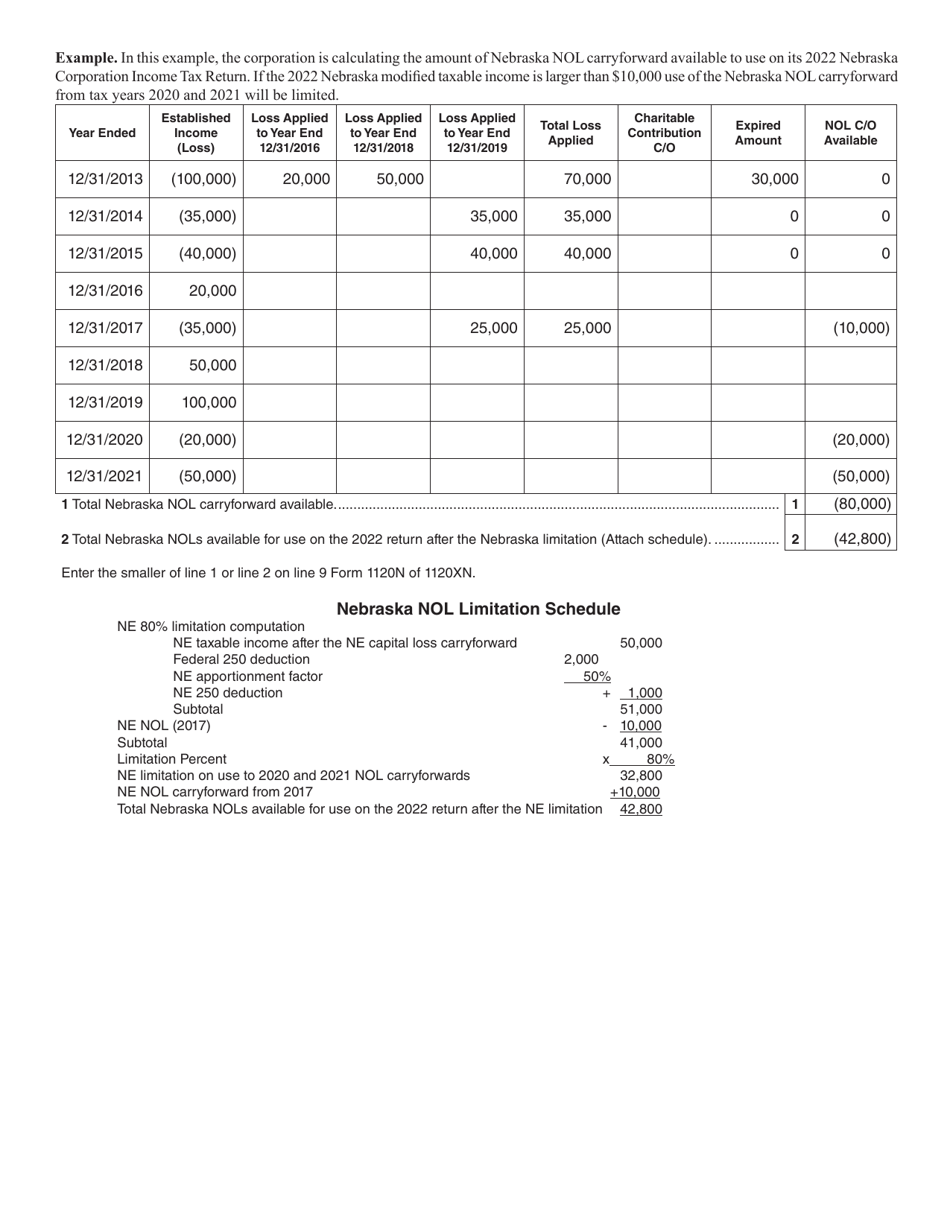

A: Corporations use this worksheet to determine the amount of their net operating loss that can be carried forward to future years for tax purposes.

Q: What is a net operating loss?

A: A net operating loss occurs when a corporation's allowable deductions for a given year exceed its gross income.

Q: Why is it important for corporations to calculate their net operating loss?

A: Calculating the net operating loss is important for corporations because it allows them to offset future profits and reduce their tax liability.

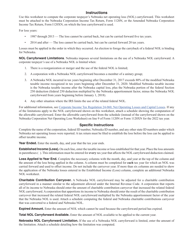

Q: Are there specific rules or limitations for carrying forward the net operating loss in Nebraska?

A: Yes, there are specific rules and limitations set by the Nebraska Department of Revenue regarding the carryforward of net operating losses.

Form Details:

- Released on January 1, 2023;

- The latest edition currently provided by the Nebraska Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.