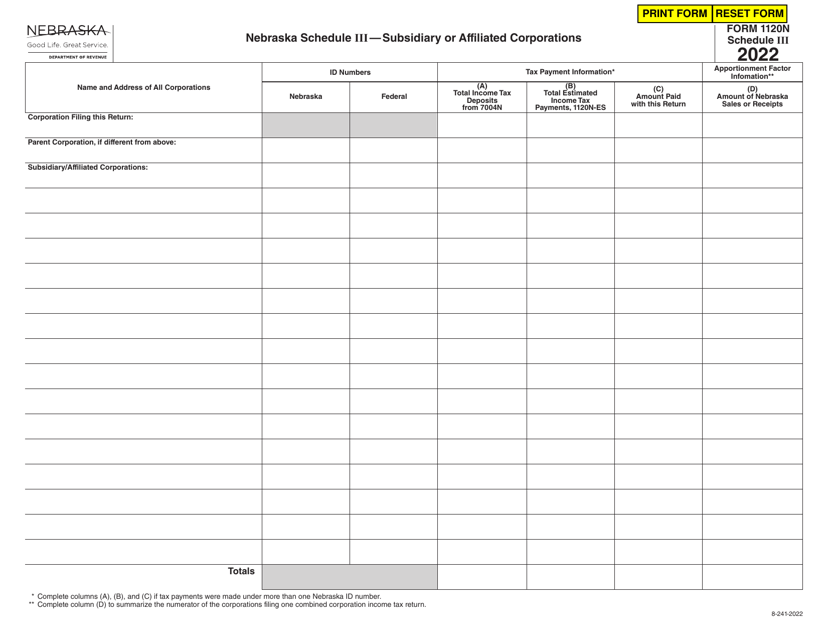

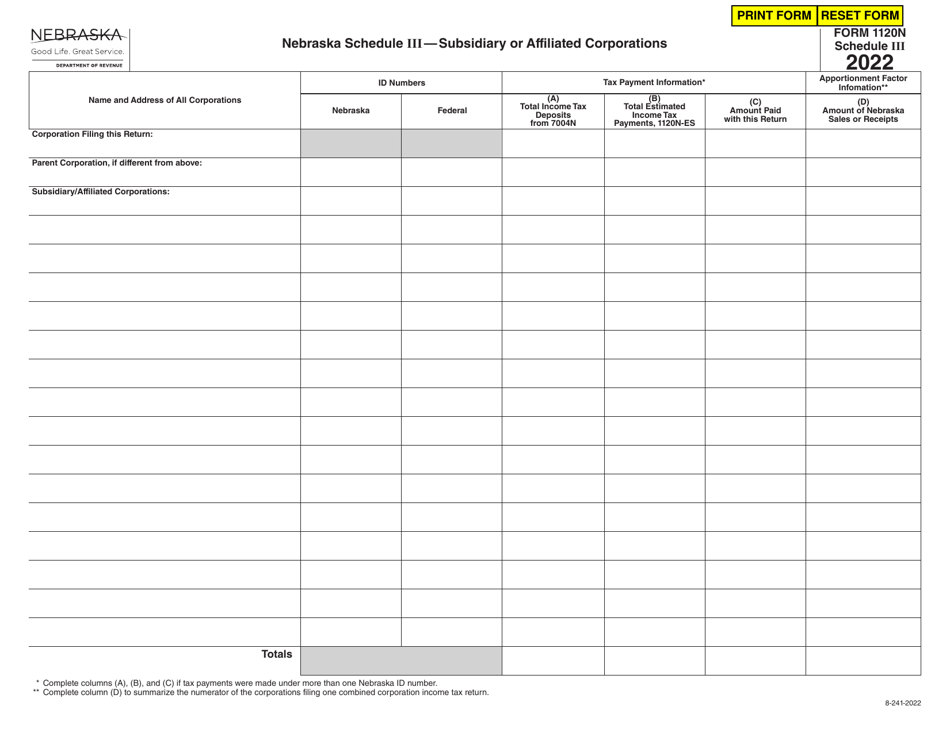

Form 1120N Schedule III Subsidiary or Affiliated Corporations - Nebraska

What Is Form 1120N Schedule III?

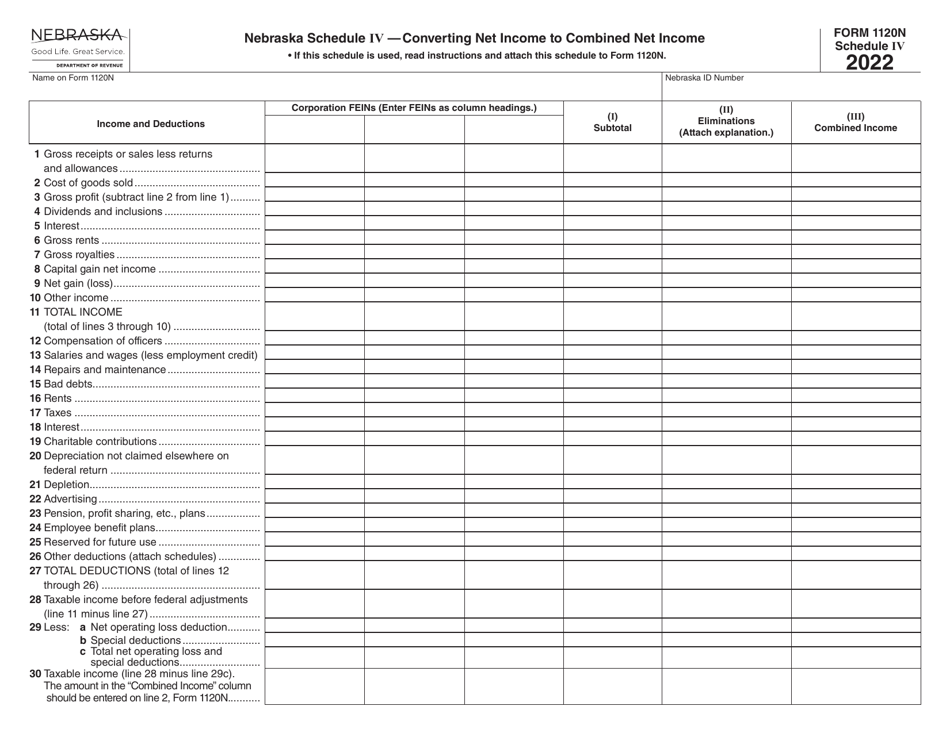

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska.The document is a supplement to Form 1120N, Nebraska Corporation Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1120N Schedule III?

A: Form 1120N Schedule III is a tax form used by businesses in Nebraska to report information about their subsidiary or affiliated corporations.

Q: Who needs to file Form 1120N Schedule III?

A: Businesses in Nebraska that have subsidiary or affiliated corporations need to file Form 1120N Schedule III.

Q: What information is required on Form 1120N Schedule III?

A: Form 1120N Schedule III requires businesses to provide details about their subsidiary or affiliated corporations, including their names, EINs, and ownership percentages.

Q: When is Form 1120N Schedule III due?

A: Form 1120N Schedule III is due on the same date as the business's Nebraska income tax return, which is generally April 15th.

Q: Are there any penalties for not filing Form 1120N Schedule III?

A: Yes, businesses may face penalties for not filing Form 1120N Schedule III, including late filing fees and interest on any unpaid taxes.

Form Details:

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1120N Schedule III by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.