This version of the form is not currently in use and is provided for reference only. Download this version of

Form 2441N

for the current year.

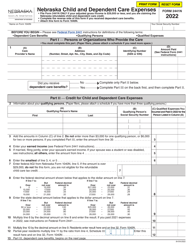

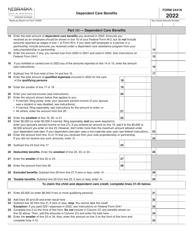

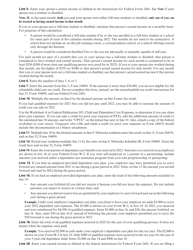

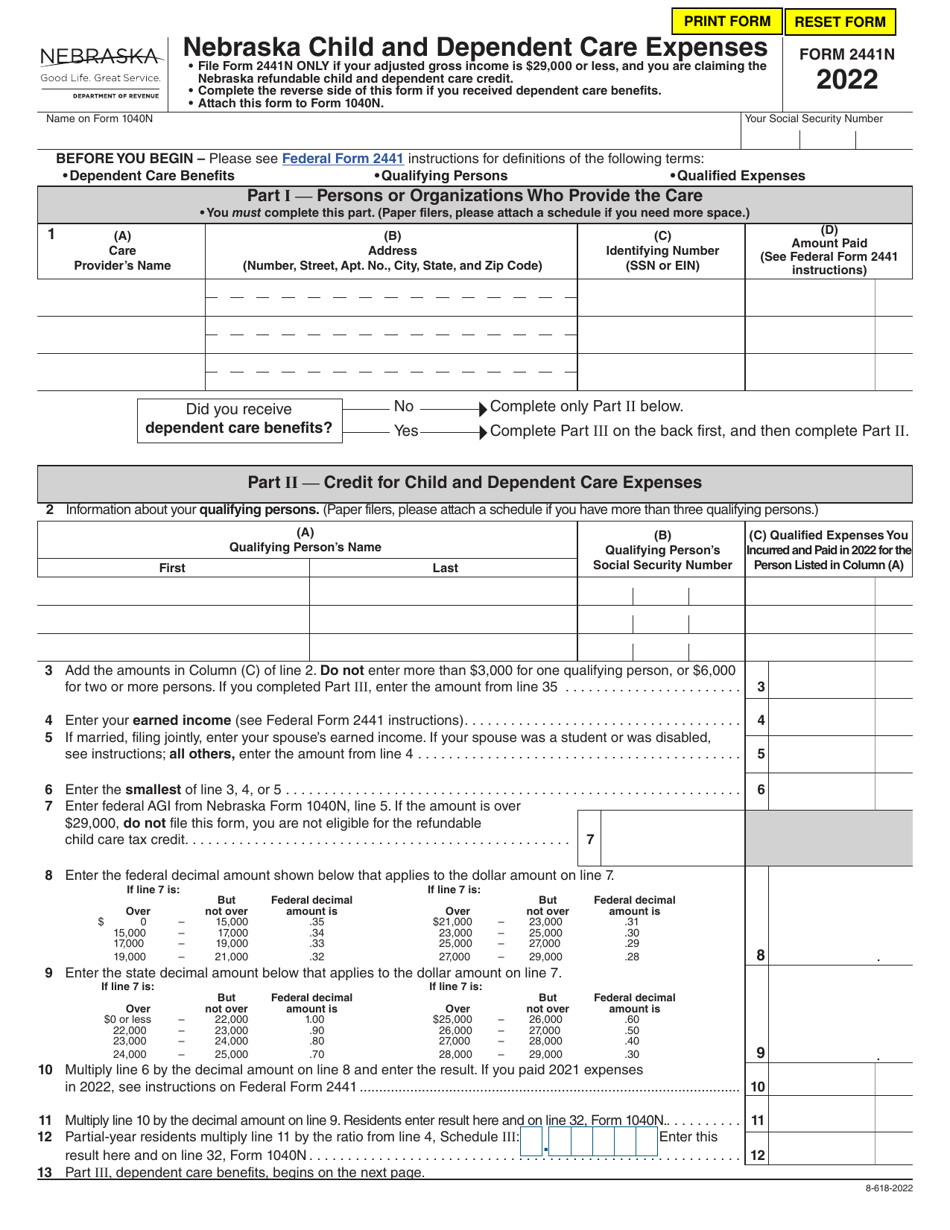

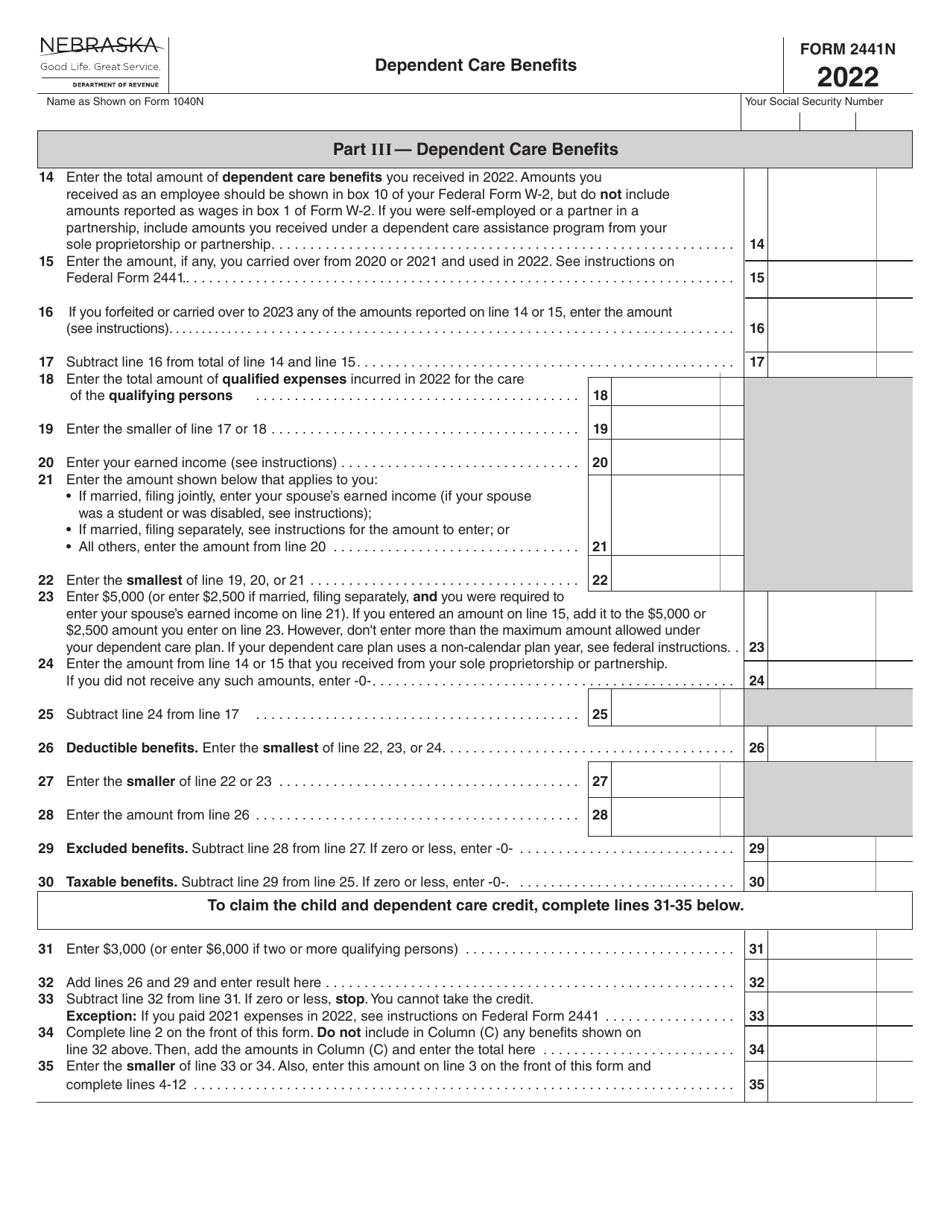

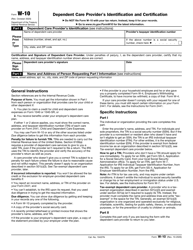

Form 2441N Nebraska Child and Dependent Care Expenses - Nebraska

What Is Form 2441N?

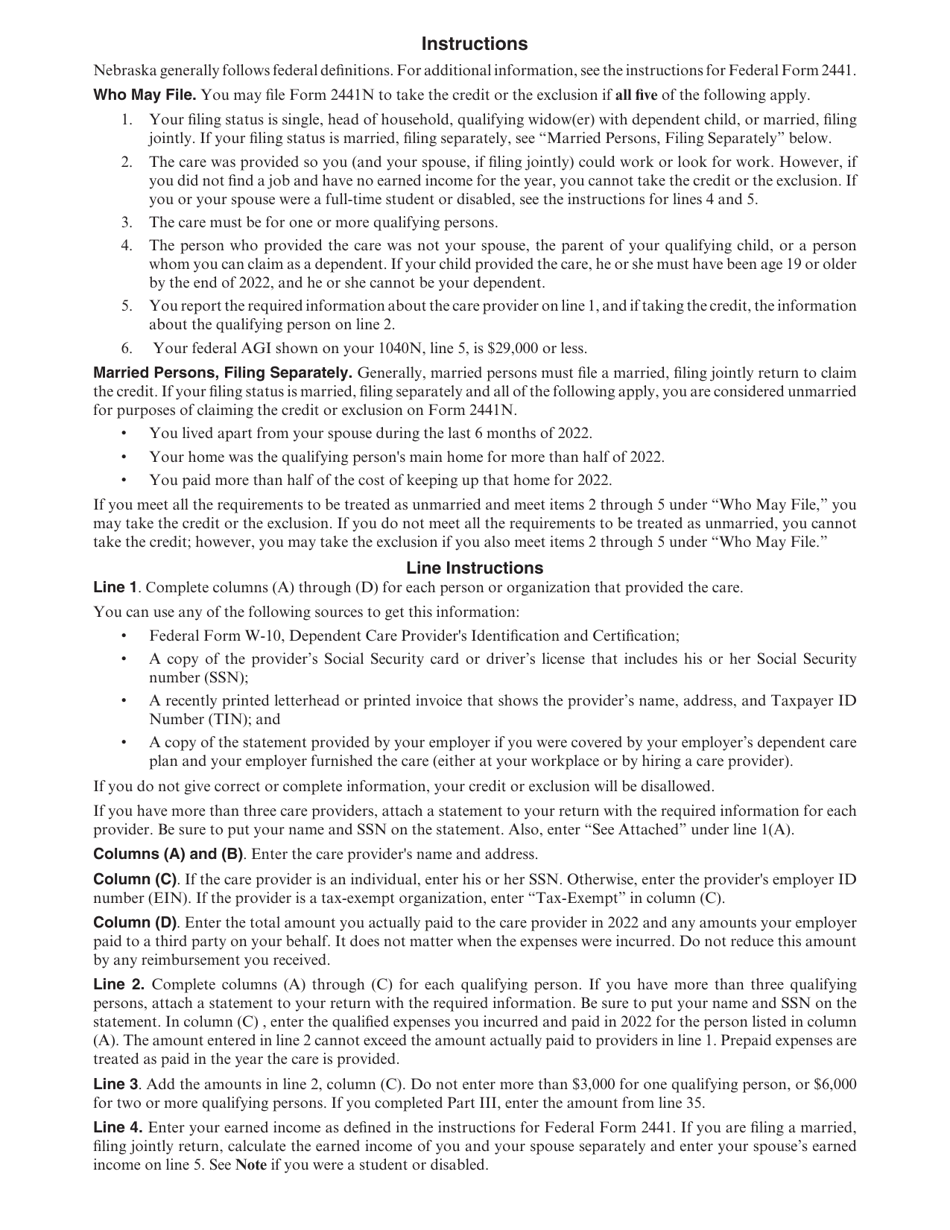

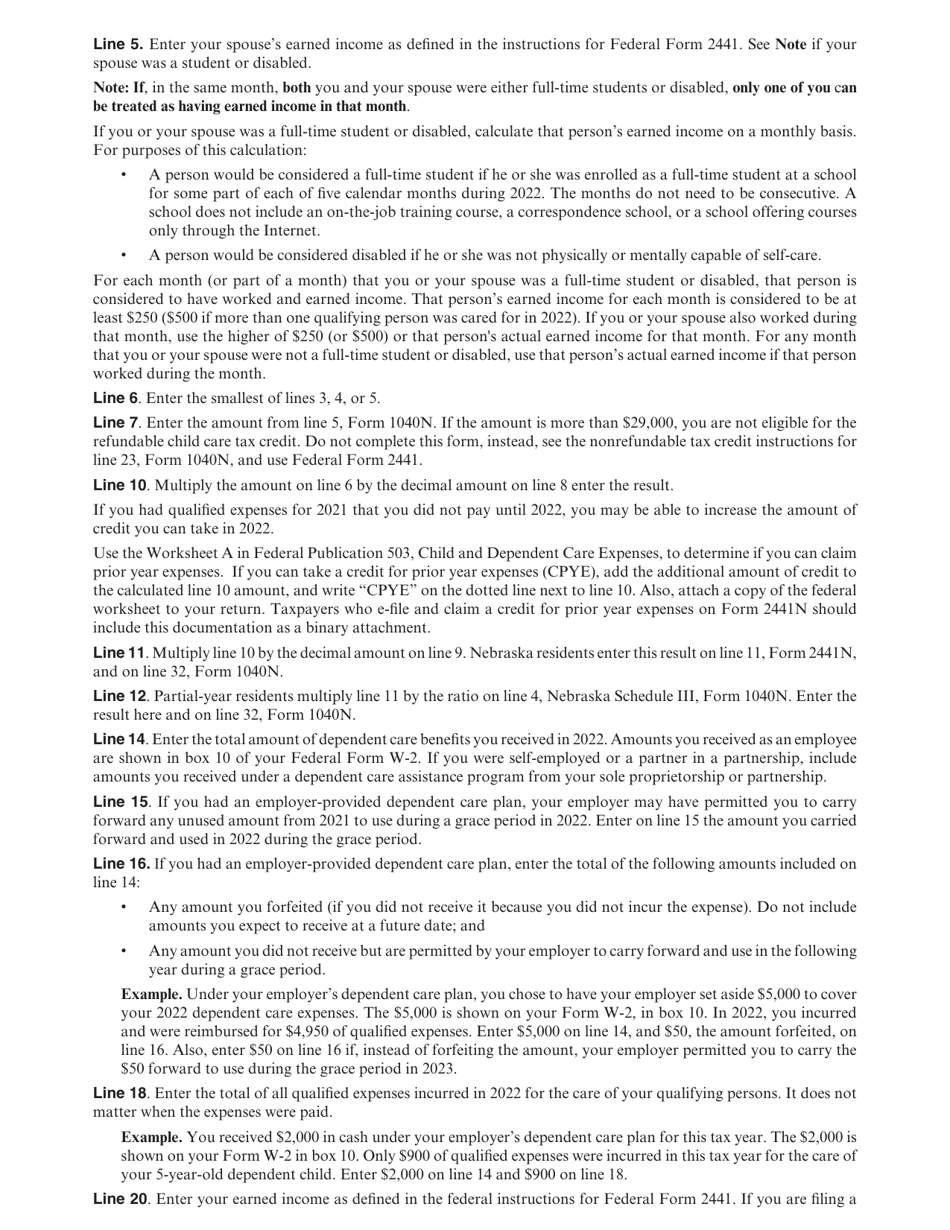

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2441N?

A: Form 2441N is Nebraska Child and Dependent Care Expenses form.

Q: Who needs to file Form 2441N?

A: Nebraska residents who have child and dependent care expenses may need to file Form 2441N.

Q: What are child and dependent care expenses?

A: Child and dependent care expenses include expenses for the care of qualifying children or dependents while you work or look for work.

Q: What information is required on Form 2441N?

A: Form 2441N requires information about the care provider and the amounts paid for child and dependent care expenses.

Q: When is Form 2441N due?

A: Form 2441N is due on or before April 15th of the following year.

Q: Can I e-file Form 2441N?

A: Yes, you can e-file Form 2441N if you are eligible for e-filing.

Q: Are there any eligibility requirements for claiming child and dependent care expenses?

A: Yes, there are eligibility requirements such as having earned income and the care expenses being necessary for you to work or look for work.

Q: Can I claim child and dependent care expenses if I use a babysitter or nanny?

A: Yes, you can claim child and dependent care expenses if you use a babysitter or nanny, as long as they are not your spouse or someone you can claim as a dependent.

Q: What documentation do I need to support my child and dependent care expenses?

A: You will need to keep records of the care provider's name, address, and taxpayer identification number, as well as proof of payment for the expenses.

Form Details:

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2441N by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.