This version of the form is not currently in use and is provided for reference only. Download this version of

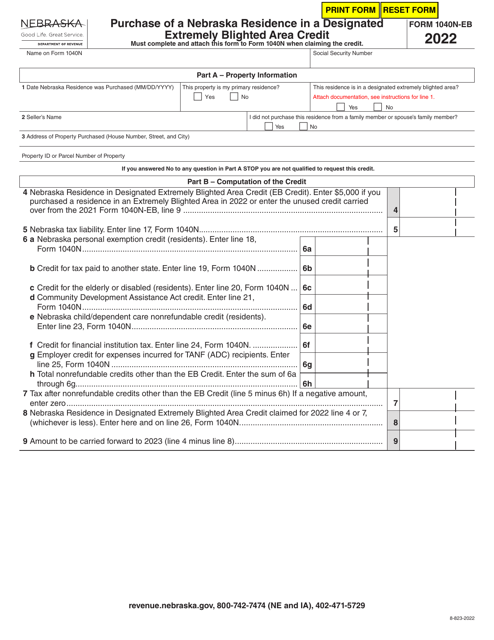

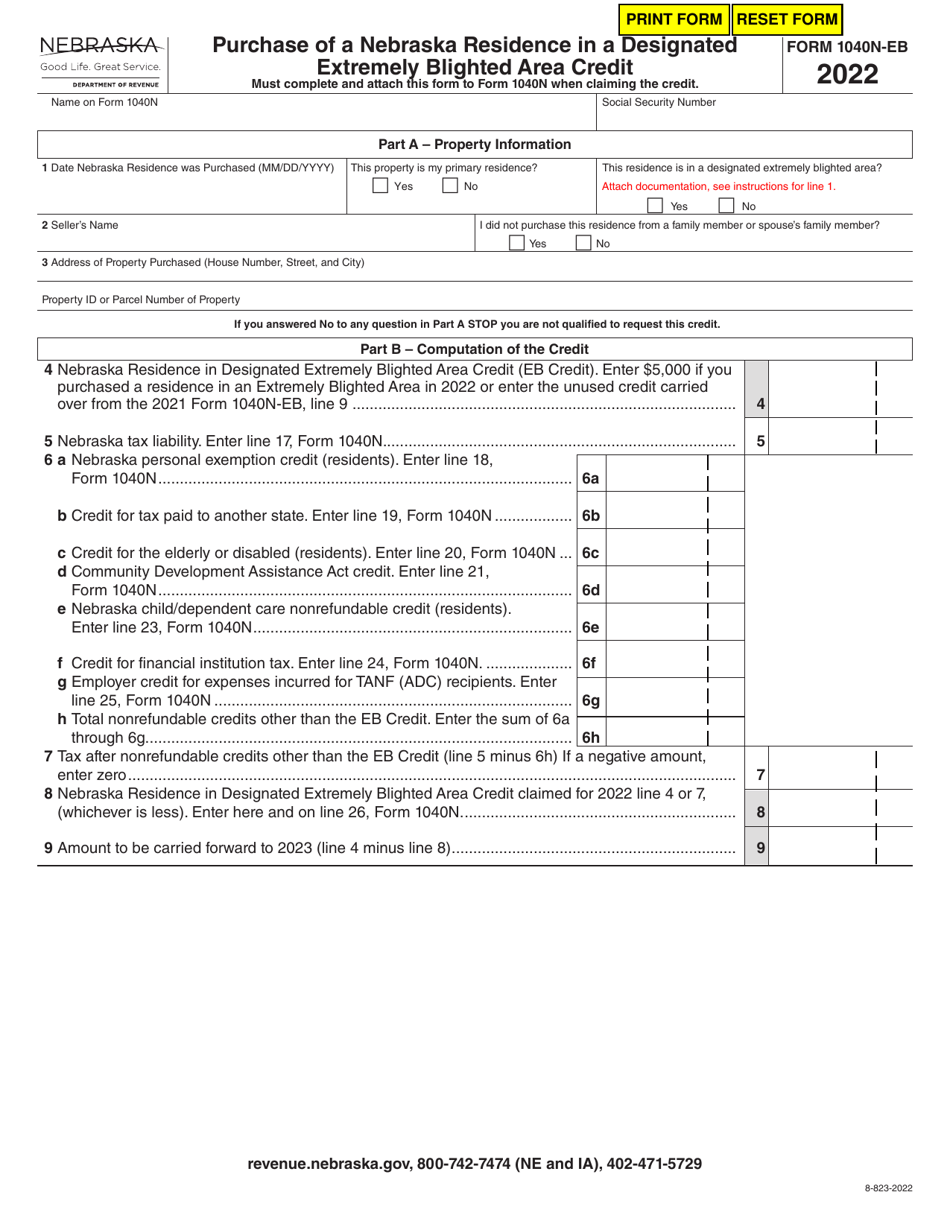

Form 1040N-EB

for the current year.

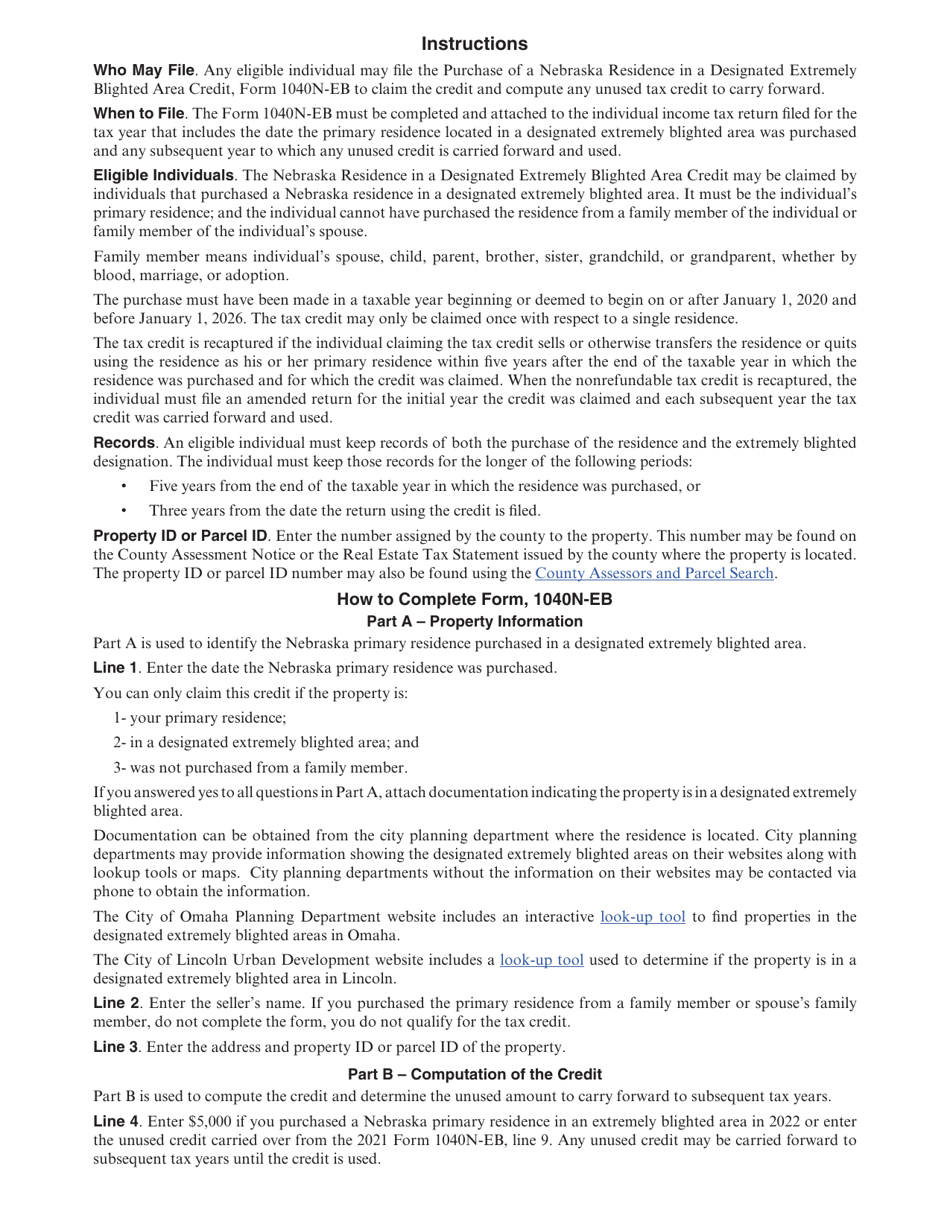

Form 1040N-EB Purchase of a Nebraska Residence in a Designated Extremely Blighted Area Credit - Nebraska

What Is Form 1040N-EB?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1040N-EB?

A: Form 1040N-EB is a Nebraska tax form.

Q: What is the Purchase of a Nebraska Residence in a Designated Extremely Blighted Area Credit?

A: The Purchase of a Nebraska Residence in a Designated Extremely Blighted Area Credit is a tax credit provided by the state of Nebraska.

Q: What is the purpose of the credit?

A: The purpose of the credit is to encourage the purchase of residential properties in extremely blighted areas of Nebraska.

Q: Who is eligible for the credit?

A: Individuals who have purchased a residence in a designated extremely blighted area in Nebraska are eligible for the credit.

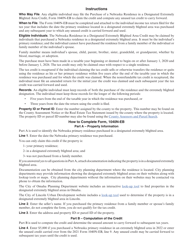

Q: How much is the credit?

A: The credit is equal to a percentage of the purchase price of the residence, up to a maximum amount set by the state.

Q: How do I claim the credit?

A: To claim the credit, you need to complete Form 1040N-EB and submit it with your Nebraska state tax return.

Q: Is there a deadline for claiming the credit?

A: Yes, the credit must be claimed within 2 years from the date of the purchase of the residence.

Q: Are there any limitations or restrictions on the credit?

A: Yes, there are certain income limitations and restrictions on the credit. It is recommended to refer to the instructions of Form 1040N-EB or consult a tax professional for more information.

Form Details:

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1040N-EB by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.