This version of the form is not currently in use and is provided for reference only. Download this version of

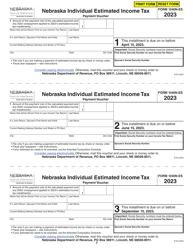

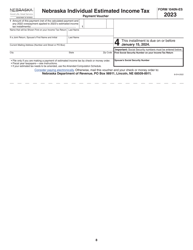

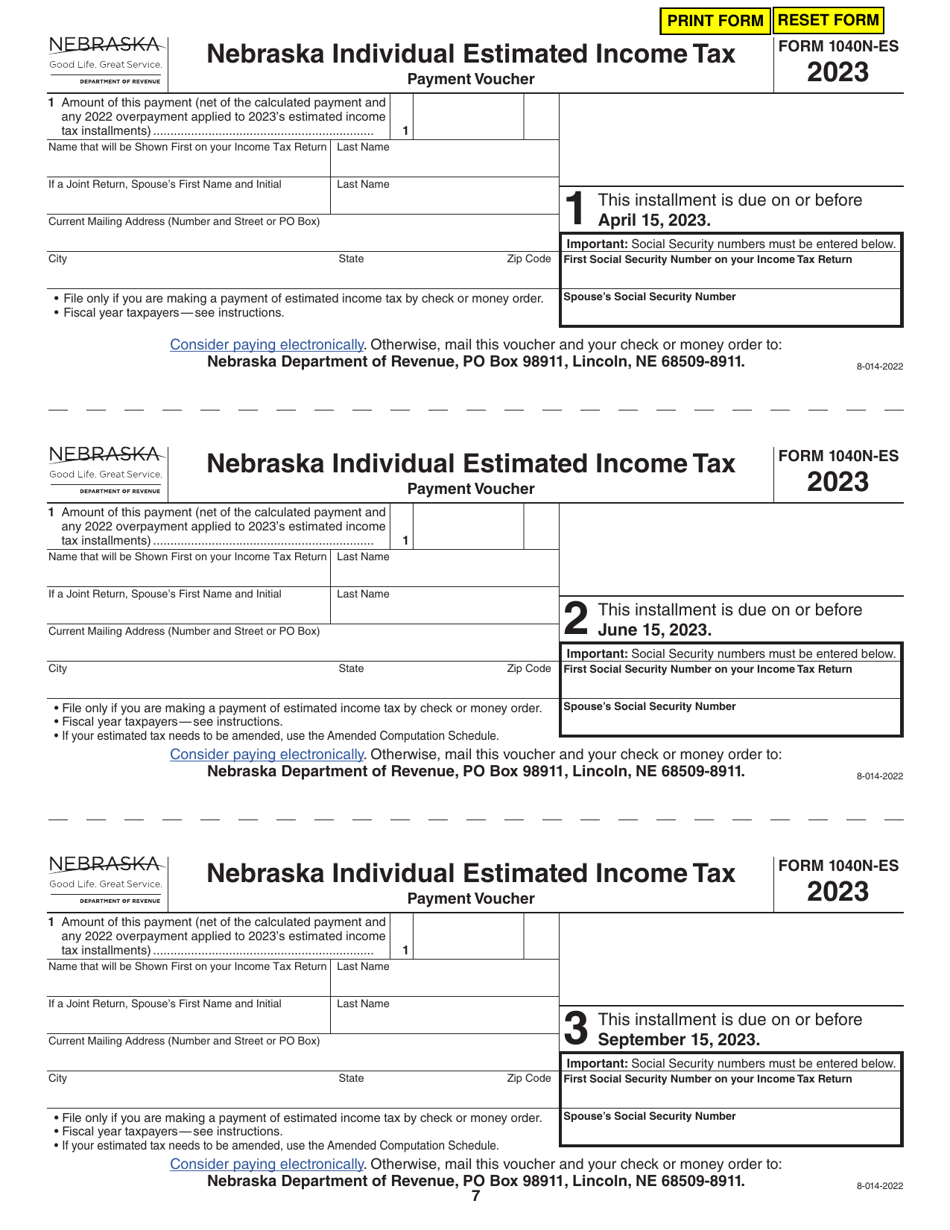

Form 1040N-ES

for the current year.

Form 1040N-ES Nebraska Individual Estimated Income Tax - Nebraska

What Is Form 1040N-ES?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1040N-ES?

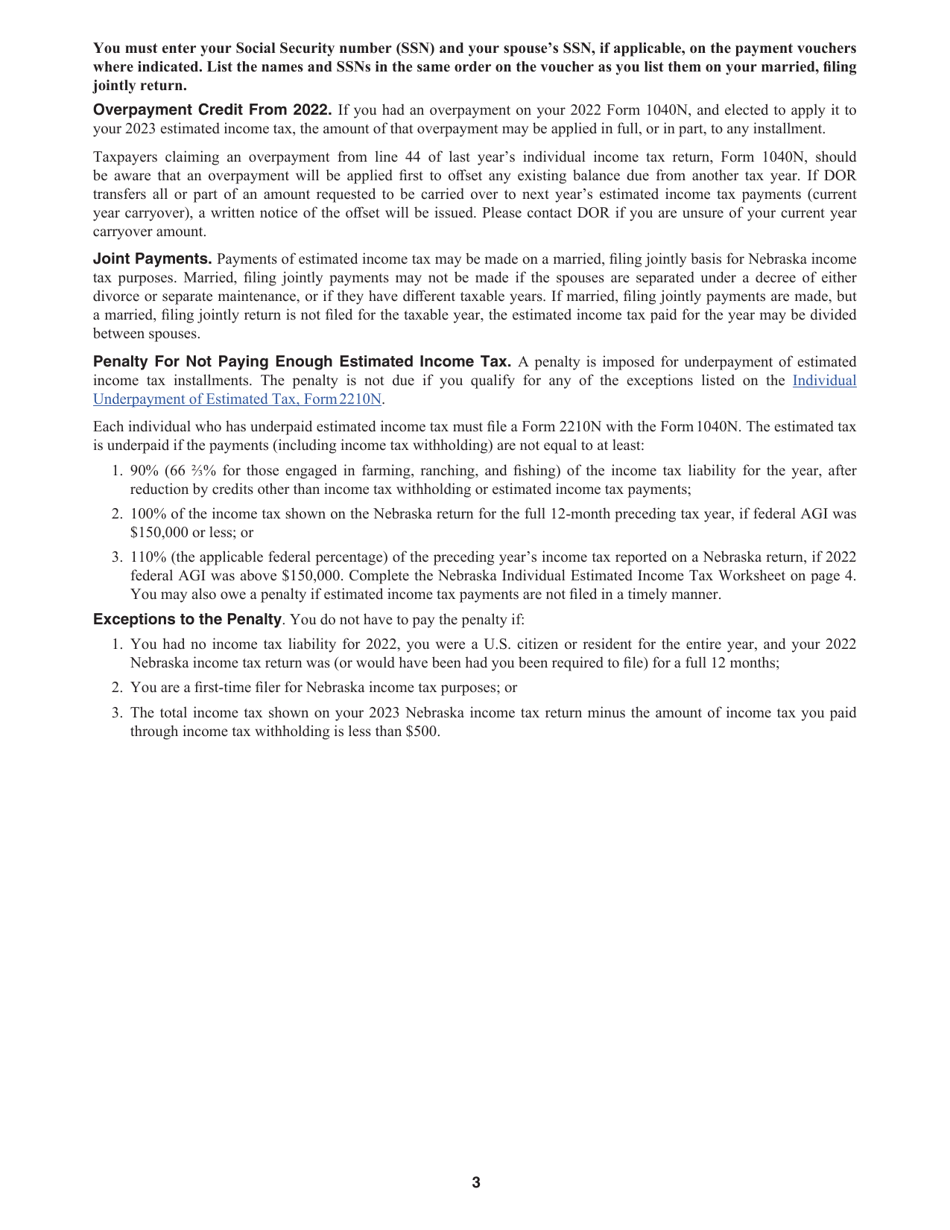

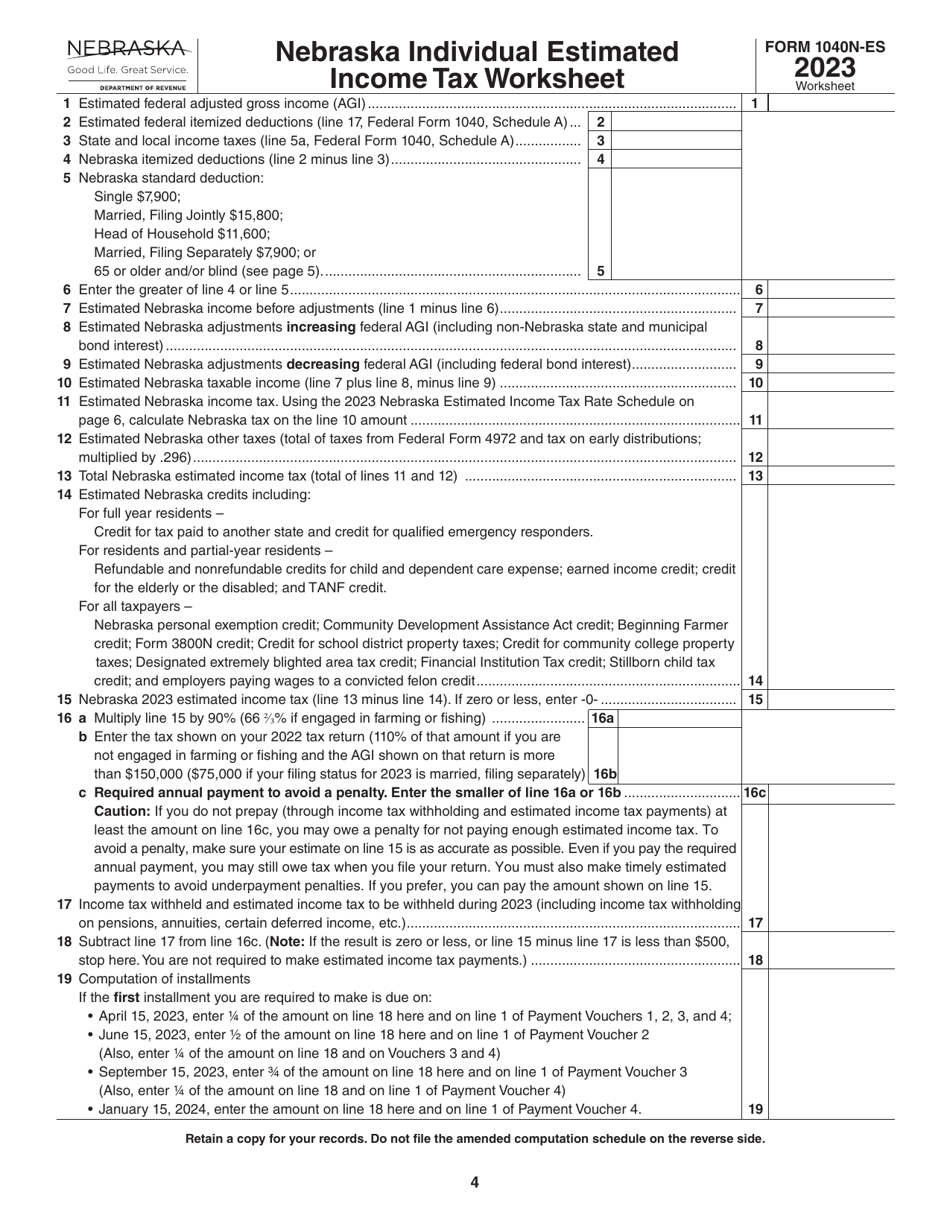

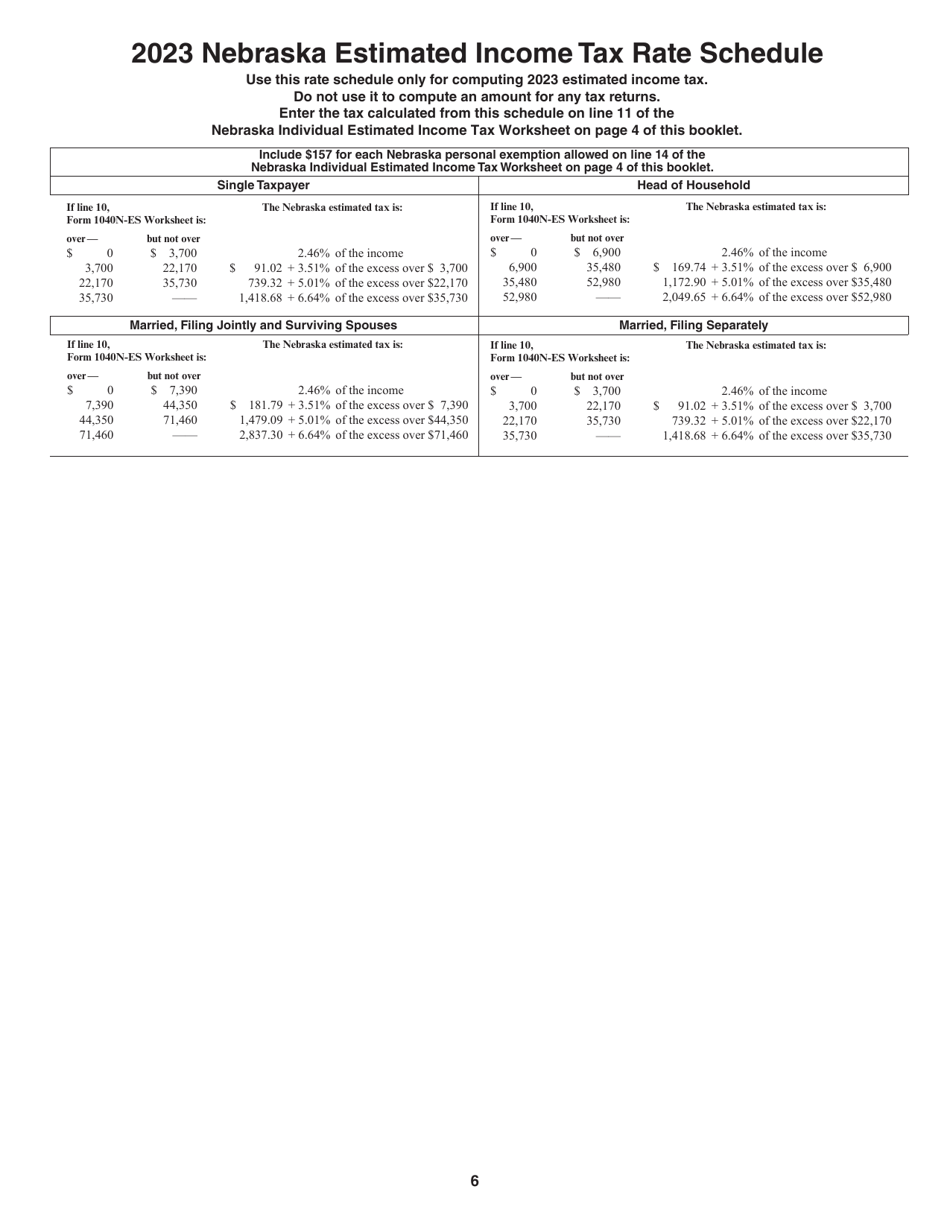

A: Form 1040N-ES is the Nebraska Individual Estimated Income Tax form that residents use to calculate and pay their estimated state income tax.

Q: Who needs to file Form 1040N-ES?

A: Individuals who expect to owe more than $500 in Nebraska state income tax for the year are required to file Form 1040N-ES to make estimated tax payments.

Q: What is the purpose of Form 1040N-ES?

A: The purpose of Form 1040N-ES is to help individuals pay their Nebraska state income tax on time and avoid penalties for underpayment.

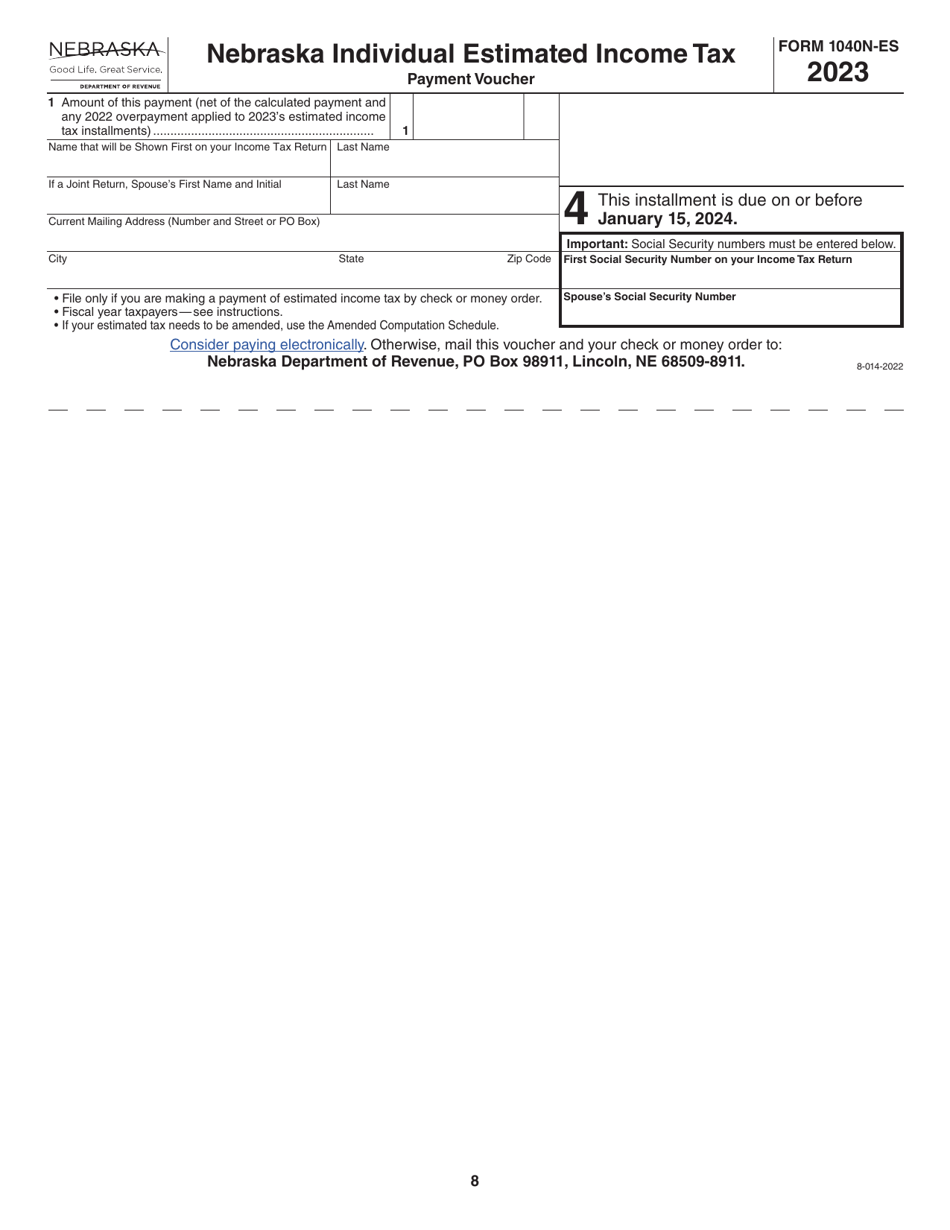

Q: When is Form 1040N-ES due?

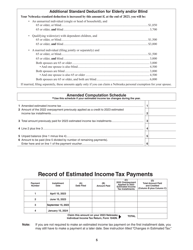

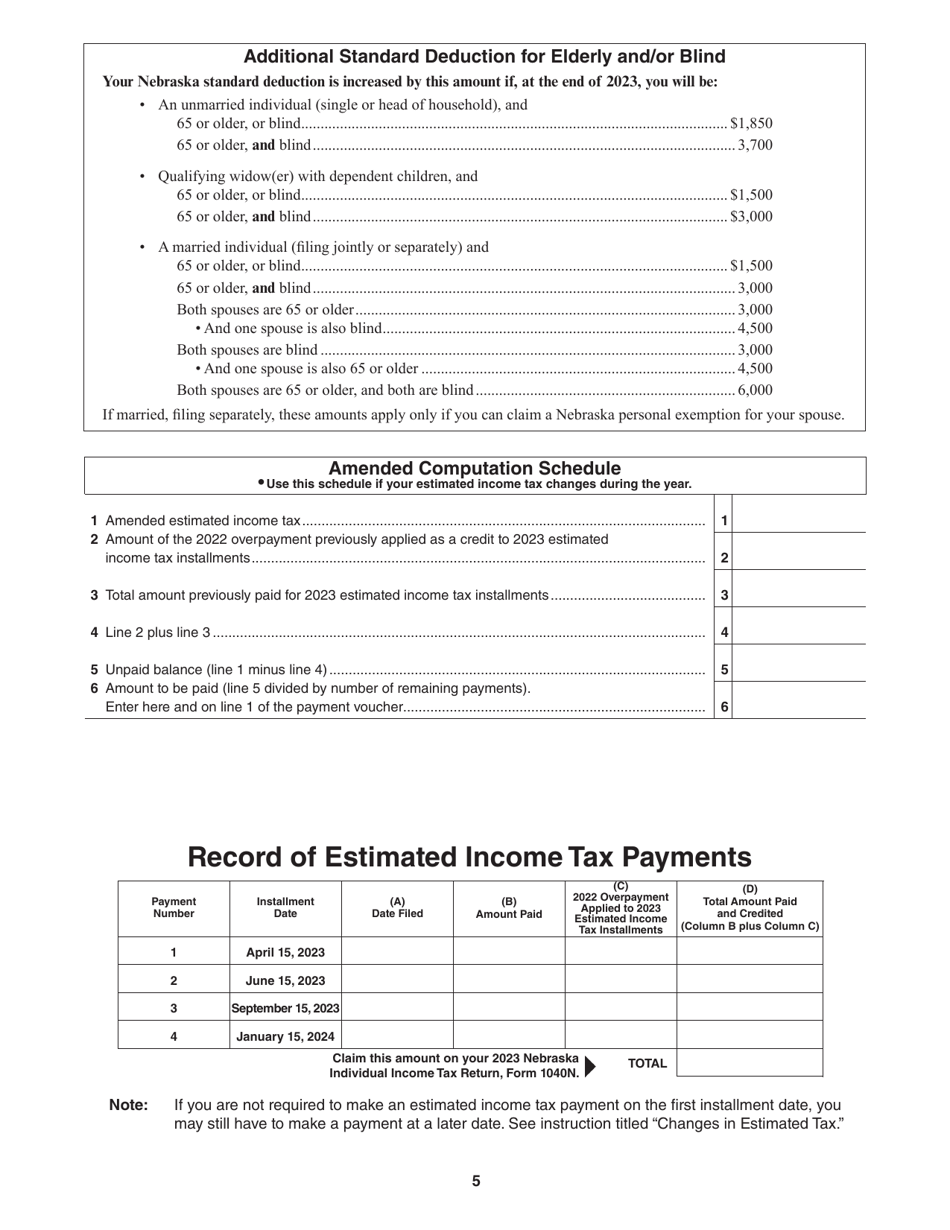

A: The due dates for Form 1040N-ES are April 15th, June 15th, September 15th, and January 15th of the following year.

Q: What happens if I don't file Form 1040N-ES?

A: If you are required to file Form 1040N-ES and fail to do so, you may be subject to penalties and interest on the underpaid tax amount.

Q: Do I need to fill out Form 1040N-ES if I receive a refund from Nebraska state taxes?

A: No, you do not need to file Form 1040N-ES if you expect to receive a refund from Nebraska state taxes. This form is only for individuals who anticipate owing tax.

Q: Can I use the same form to make estimated tax payments for both Nebraska and federal taxes?

A: No, Form 1040N-ES is specifically for Nebraska state income tax. You will need to use a separate form, such as Form 1040-ES, to make estimated payments for federal income tax.

Form Details:

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1040N-ES by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.