This version of the form is not currently in use and is provided for reference only. Download this version of

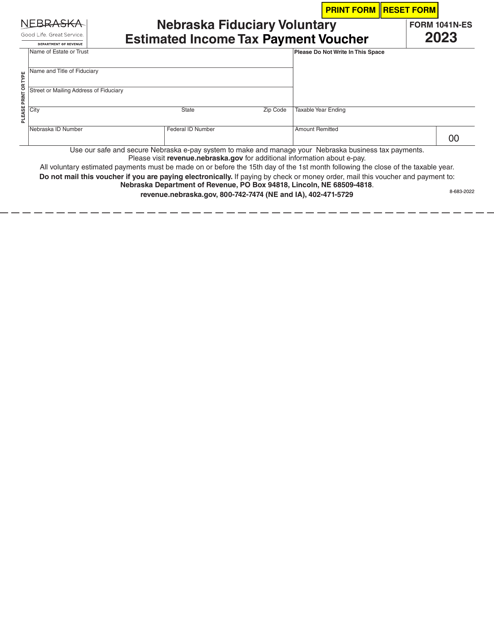

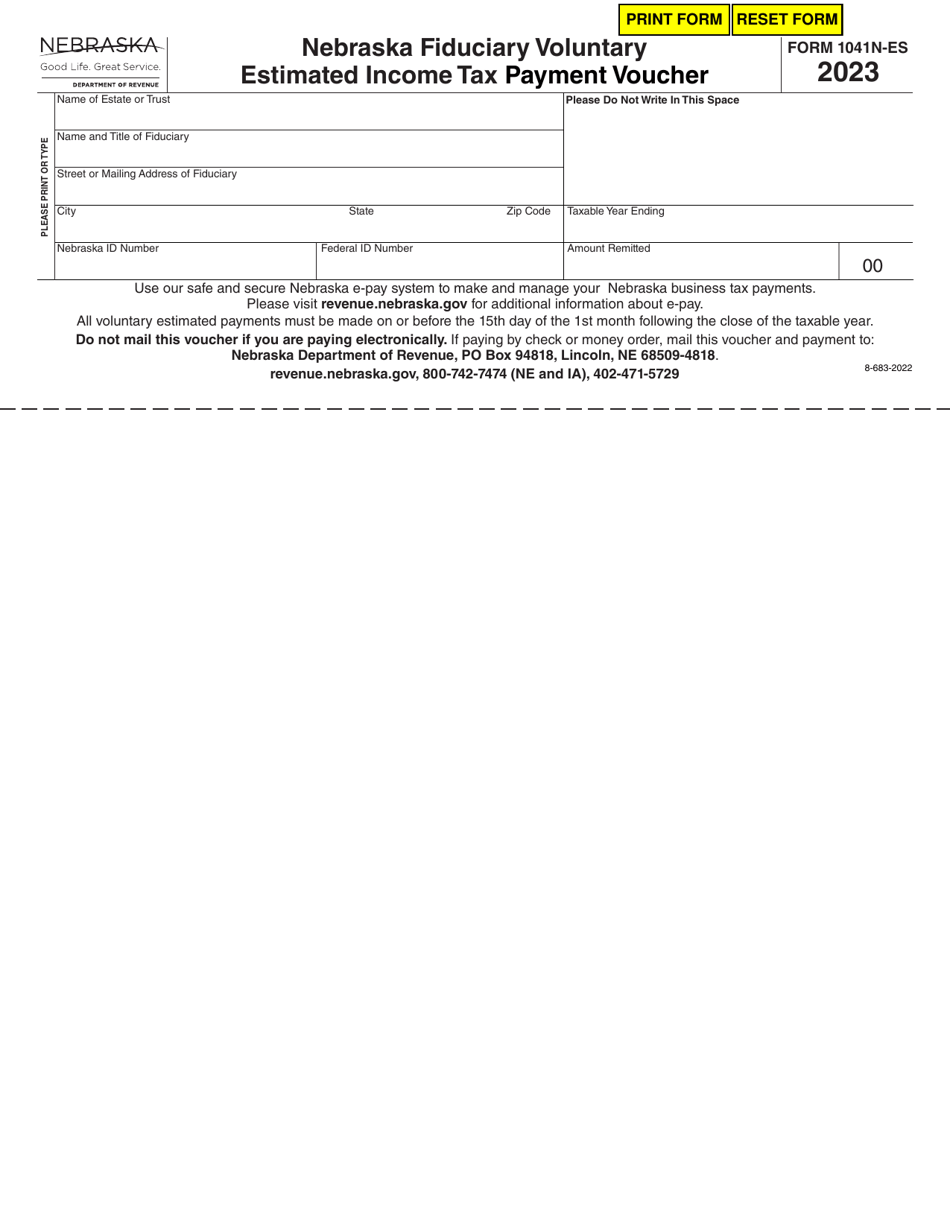

Form 1041N-ES

for the current year.

Form 1041N-ES Nebraska Fiduciary Voluntary Estimated Income Tax Payment Voucher - Nebraska

What Is Form 1041N-ES?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1041N-ES?

A: Form 1041N-ES is the Nebraska Fiduciary Voluntary Estimated Income Tax Payment Voucher.

Q: Who should use Form 1041N-ES?

A: Form 1041N-ES should be used by fiduciaries in Nebraska to make voluntary estimated income tax payments.

Q: What is a fiduciary?

A: A fiduciary is a person or entity that holds legal or financial responsibility for managing assets on behalf of another person or entity.

Q: Why would a fiduciary use Form 1041N-ES?

A: A fiduciary may use Form 1041N-ES to make estimated income tax payments throughout the year to avoid underpayment penalties.

Q: What is an estimated income tax payment?

A: An estimated income tax payment is a payment made in advance of filing a tax return based on an estimation of the tax liability.

Q: Is Form 1041N-ES mandatory?

A: Form 1041N-ES is voluntary and not mandatory, but it can help fiduciaries avoid underpayment penalties by making timely estimated tax payments.

Form Details:

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1041N-ES by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.