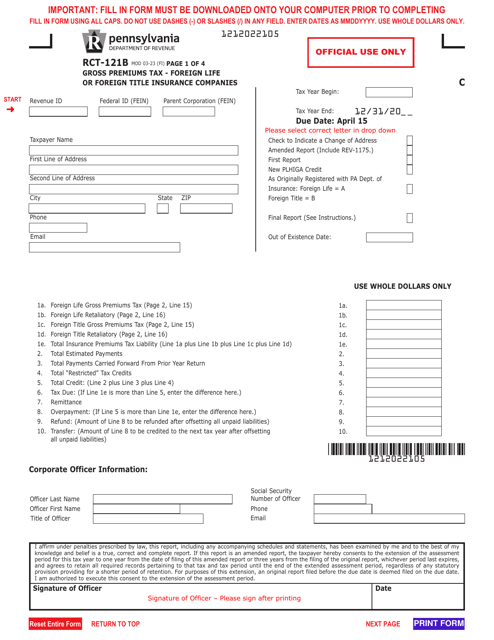

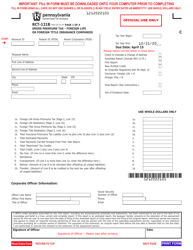

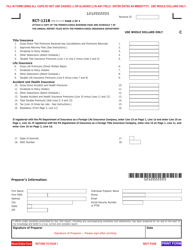

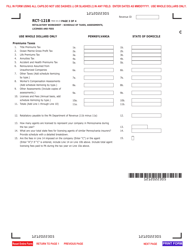

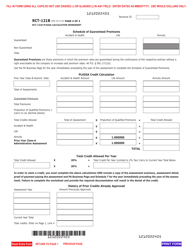

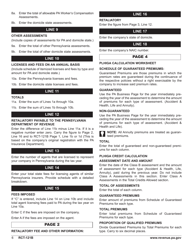

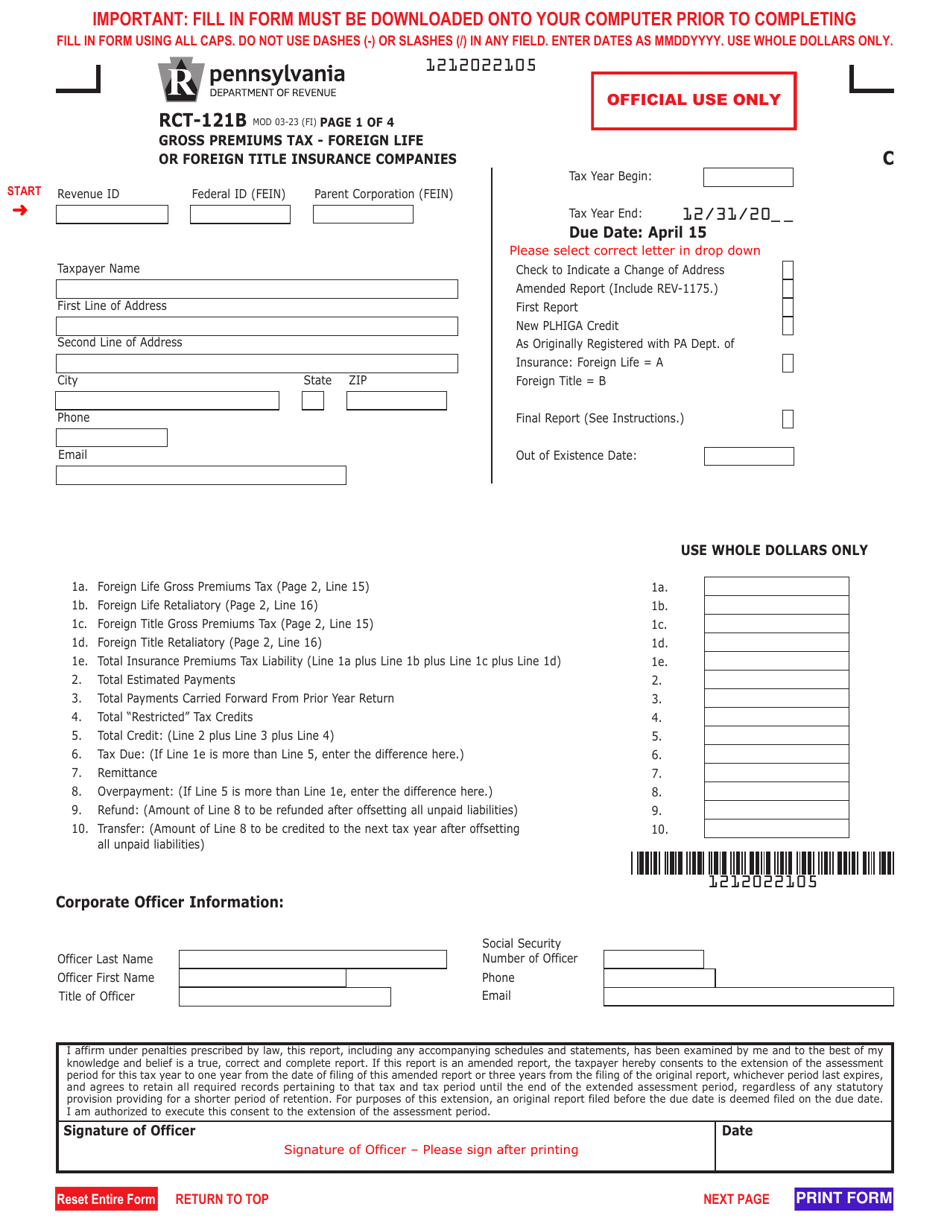

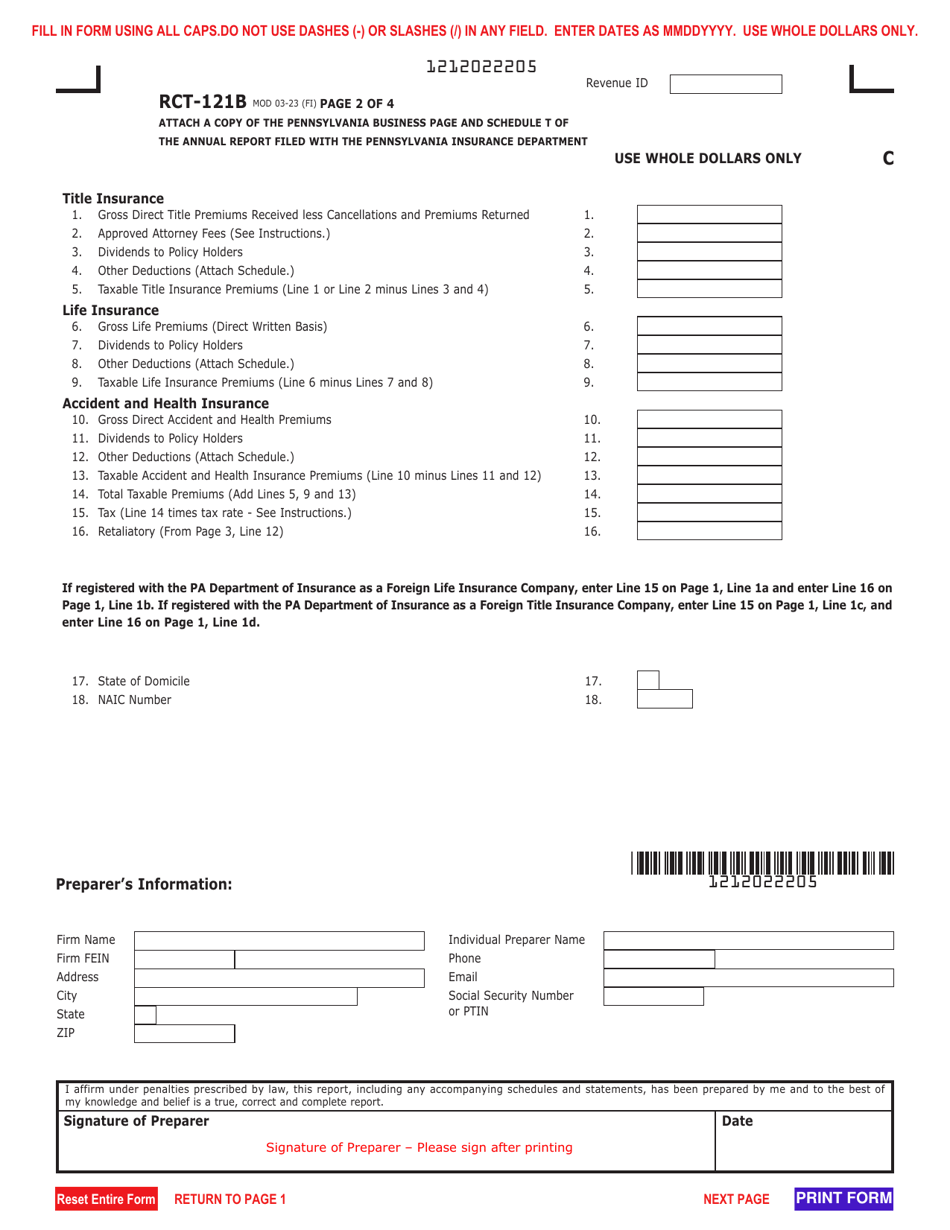

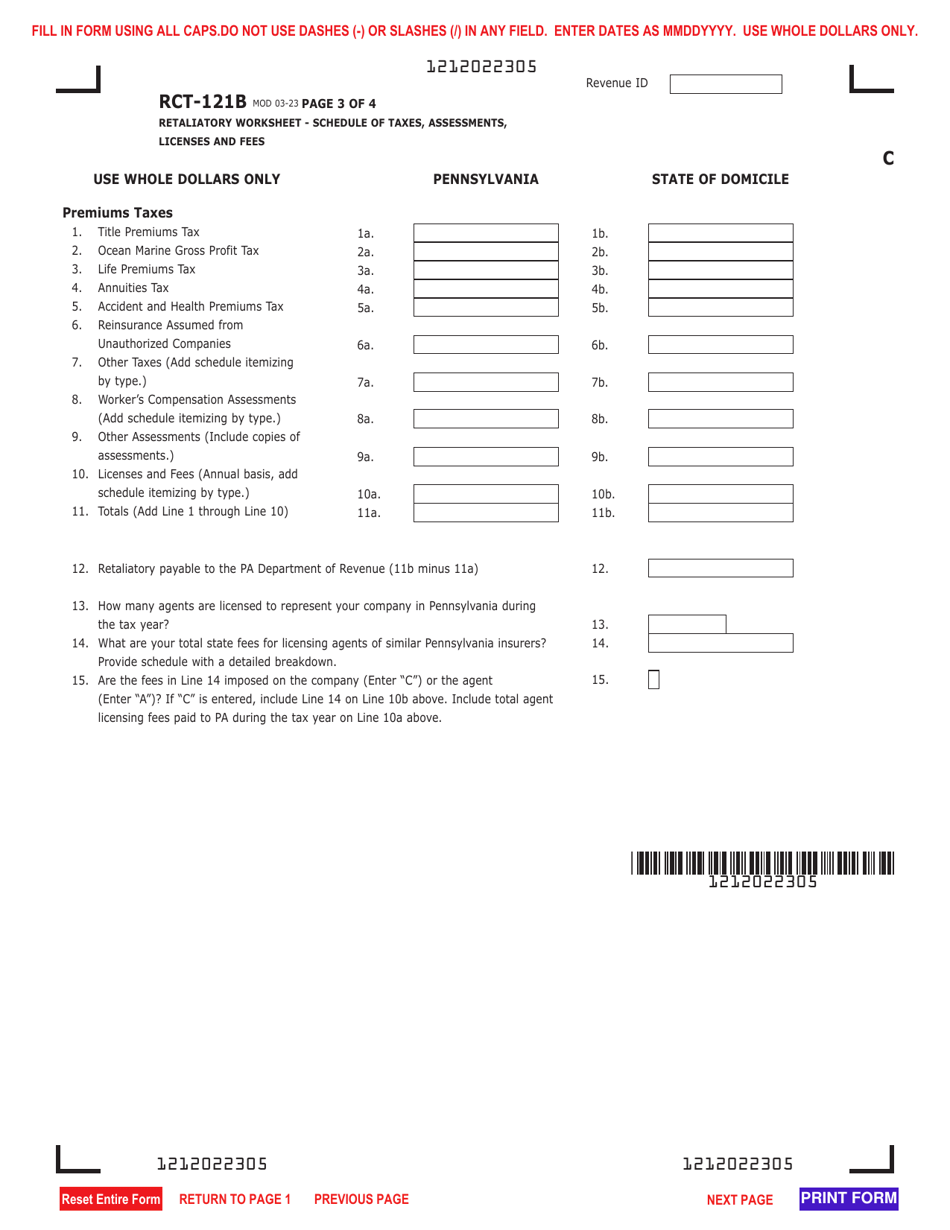

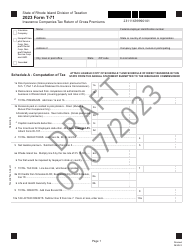

Form RCT-121B Gross Premiums Tax - Foreign Life or Foreign Title Insurance Companies - Rhode Island

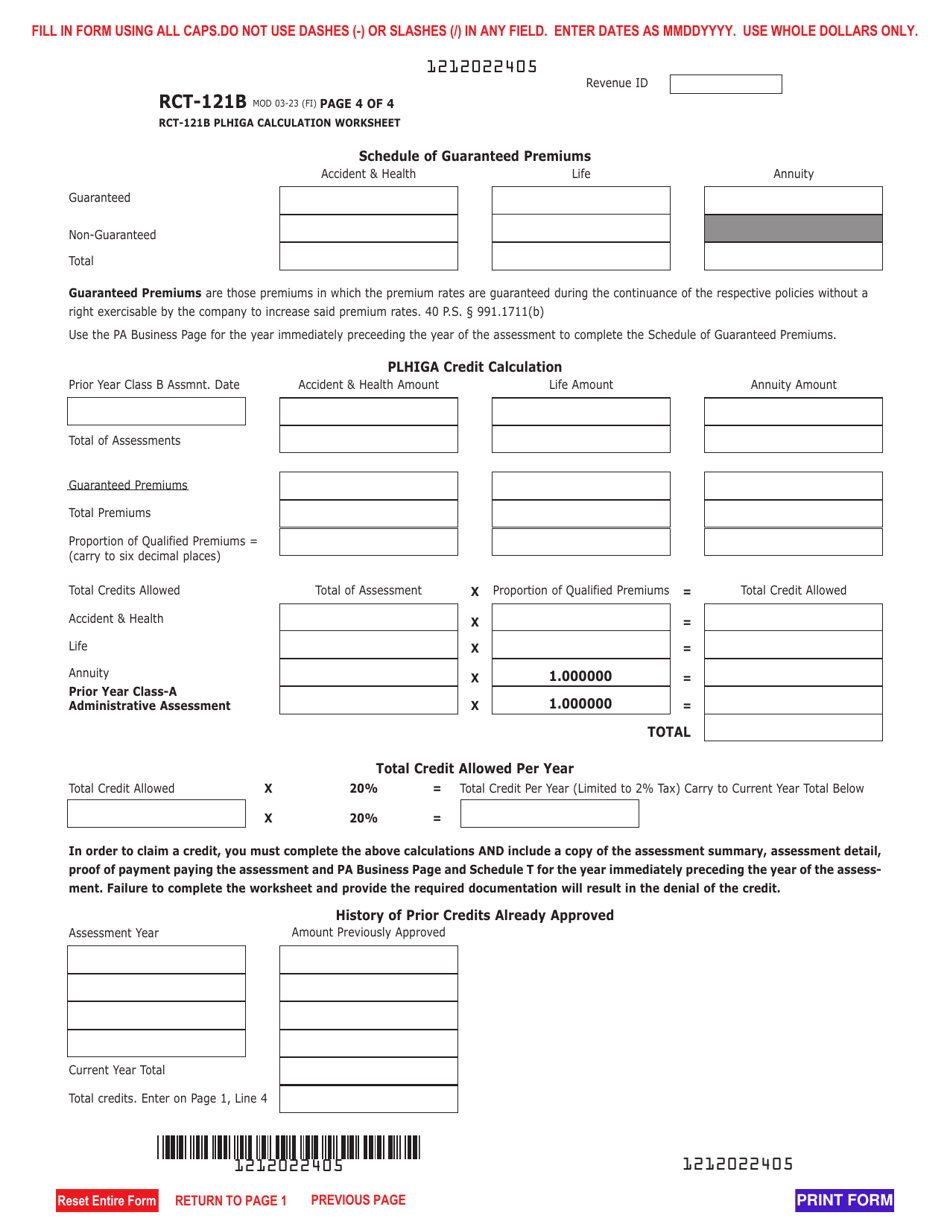

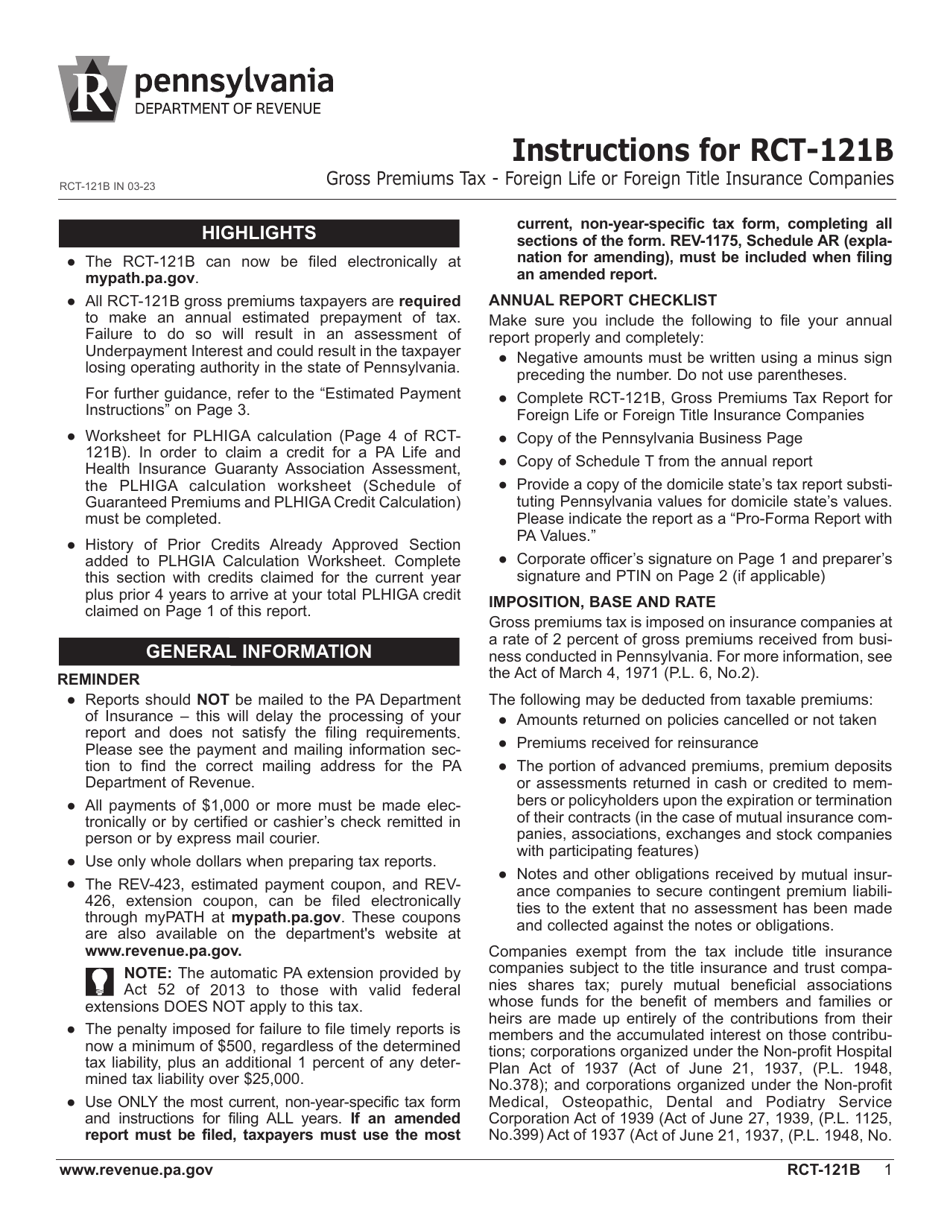

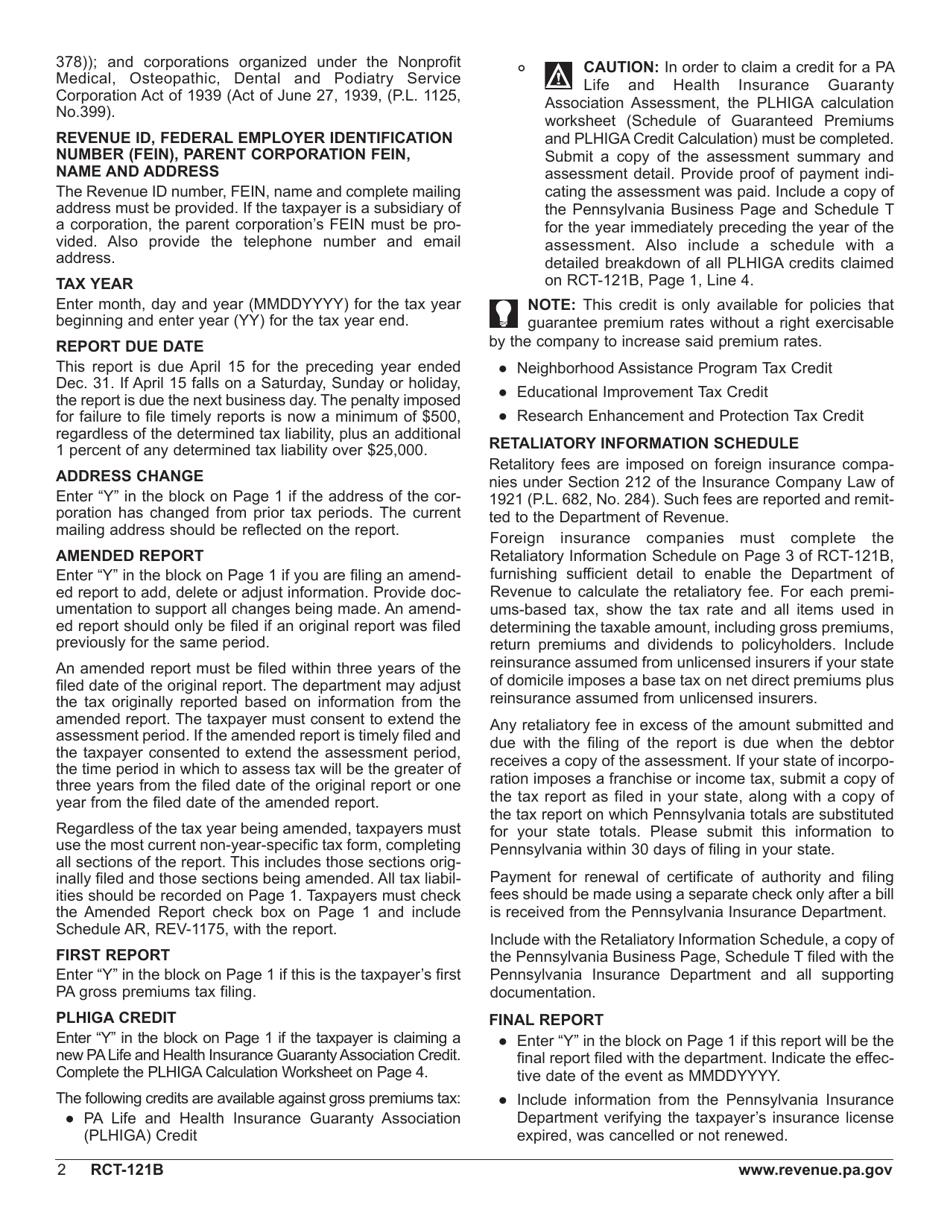

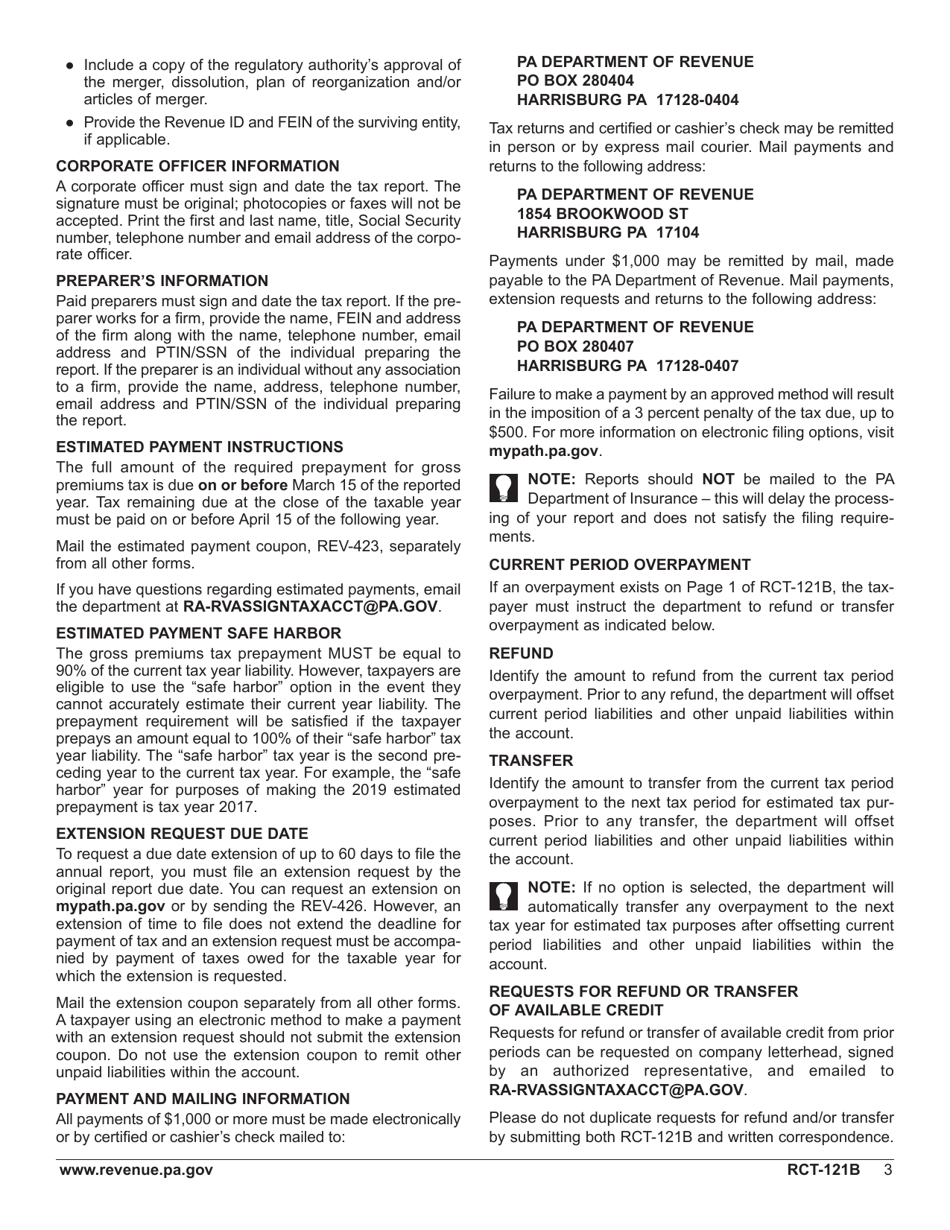

What Is Form RCT-121B?

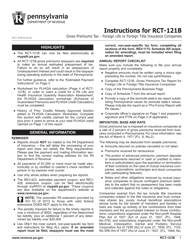

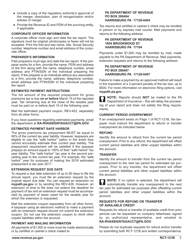

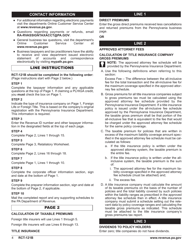

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

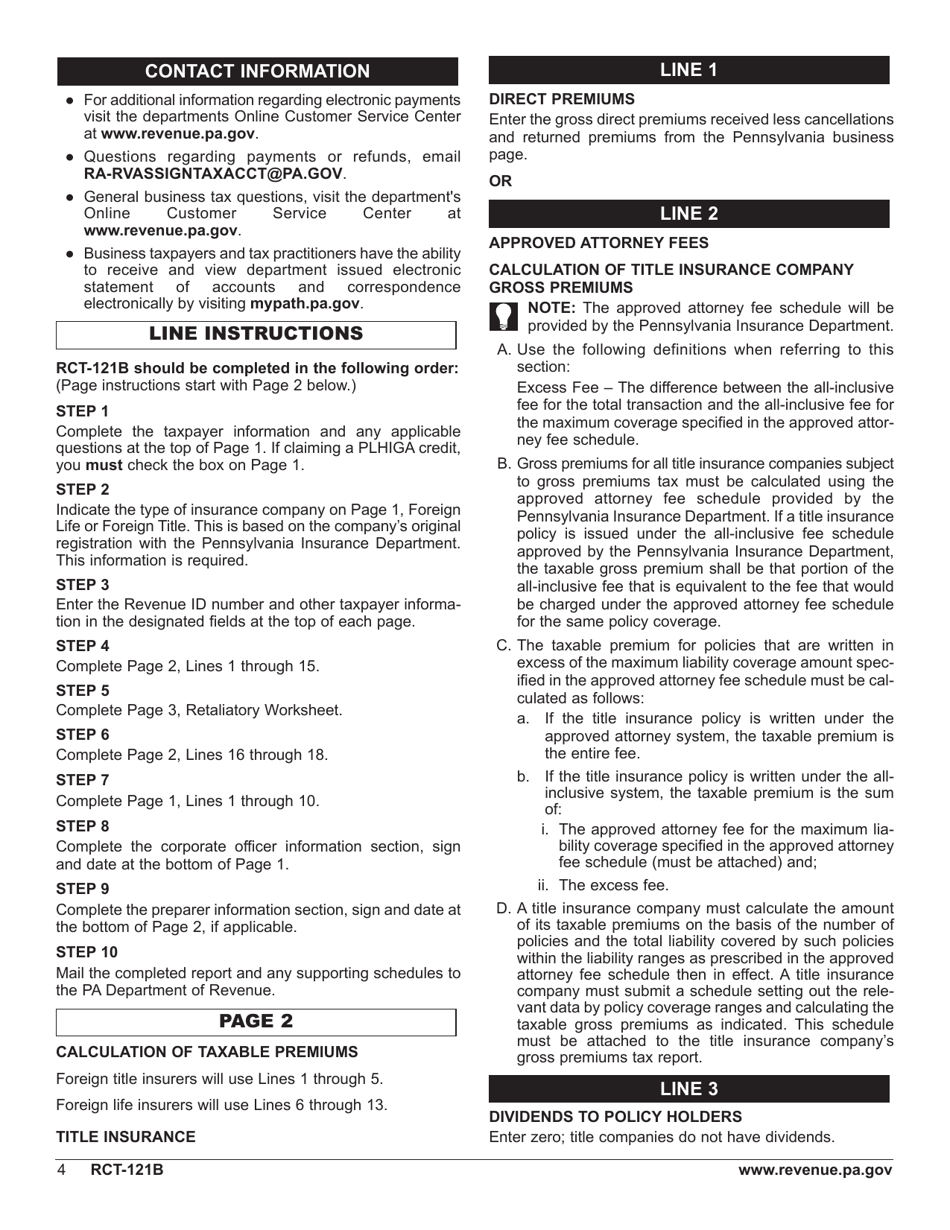

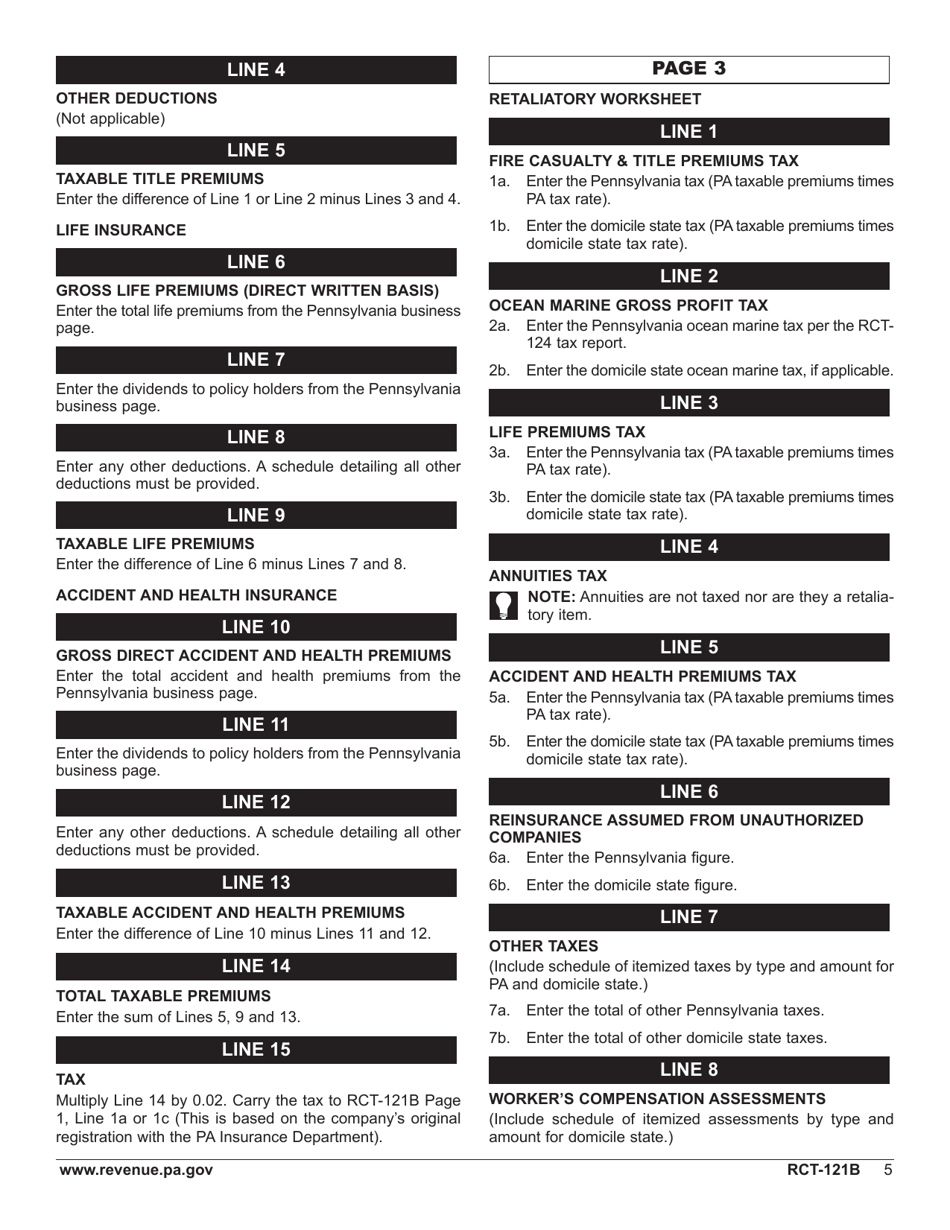

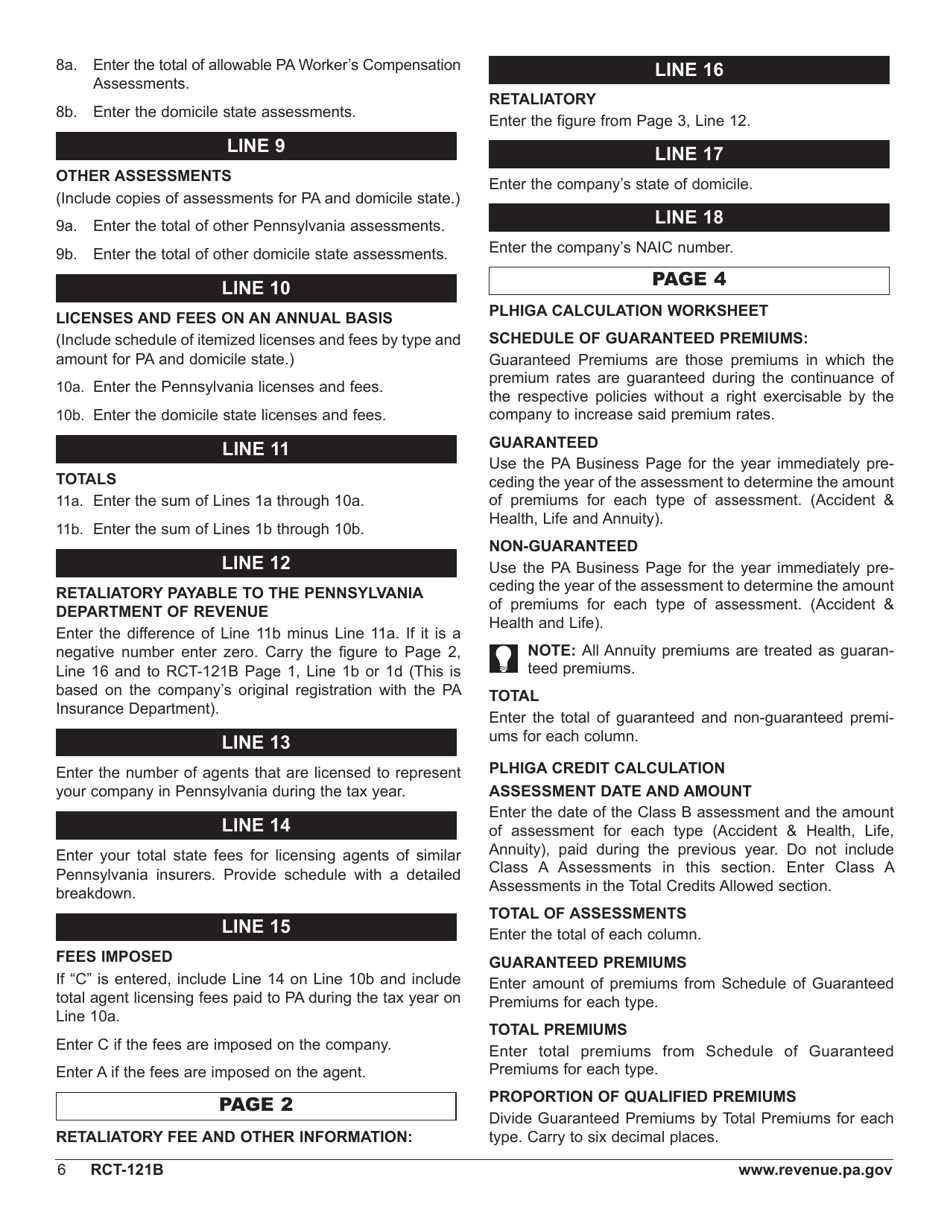

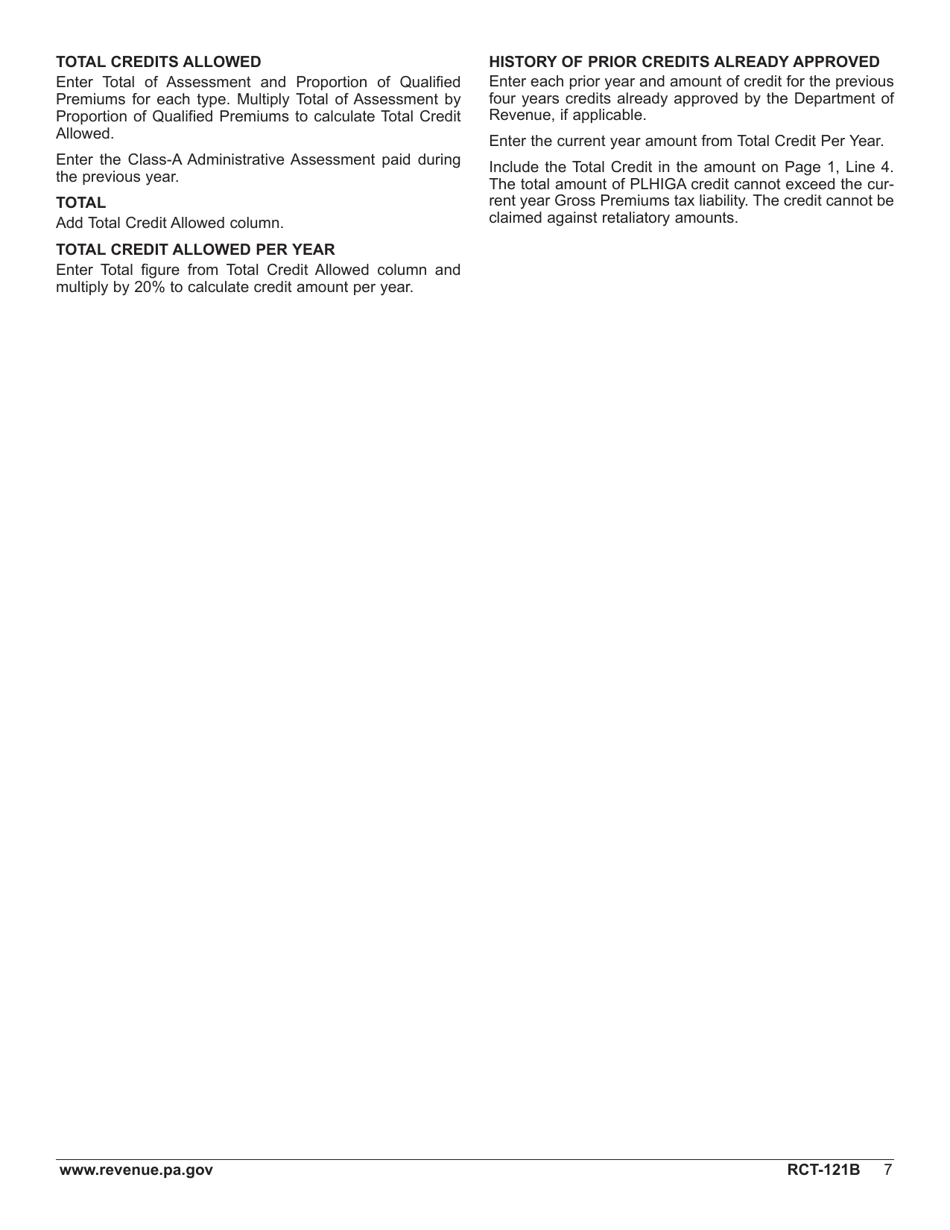

Q: What is RCT-121B Gross Premiums Tax?

A: RCT-121B Gross Premiums Tax is a tax form in Rhode Island that is used by foreign life or foreign title insurance companies to report and pay taxes on their gross premiums.

Q: Who needs to file RCT-121B Gross Premiums Tax?

A: Foreign life or foreign title insurance companies operating in Rhode Island need to file RCT-121B Gross Premiums Tax.

Q: What is the purpose of RCT-121B Gross Premiums Tax?

A: The purpose of RCT-121B Gross Premiums Tax is to collect tax revenue from foreign insurance companies operating in Rhode Island.

Q: When is the deadline to file RCT-121B Gross Premiums Tax?

A: The deadline to file RCT-121B Gross Premiums Tax is determined by the Rhode Island Division of Taxation, and it is usually due on an annual basis.

Form Details:

- Released on March 1, 2023;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RCT-121B by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.