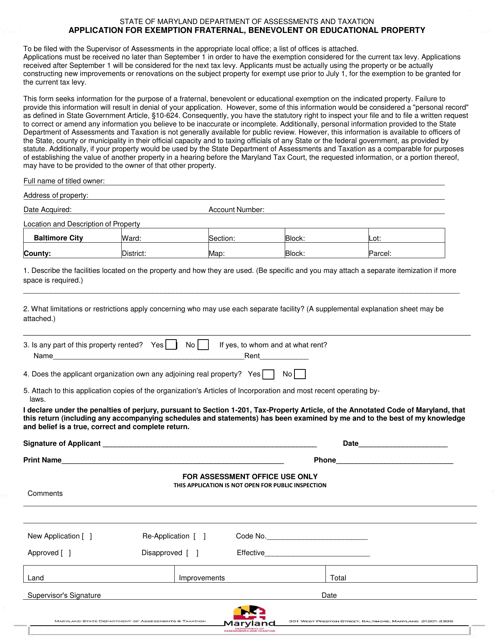

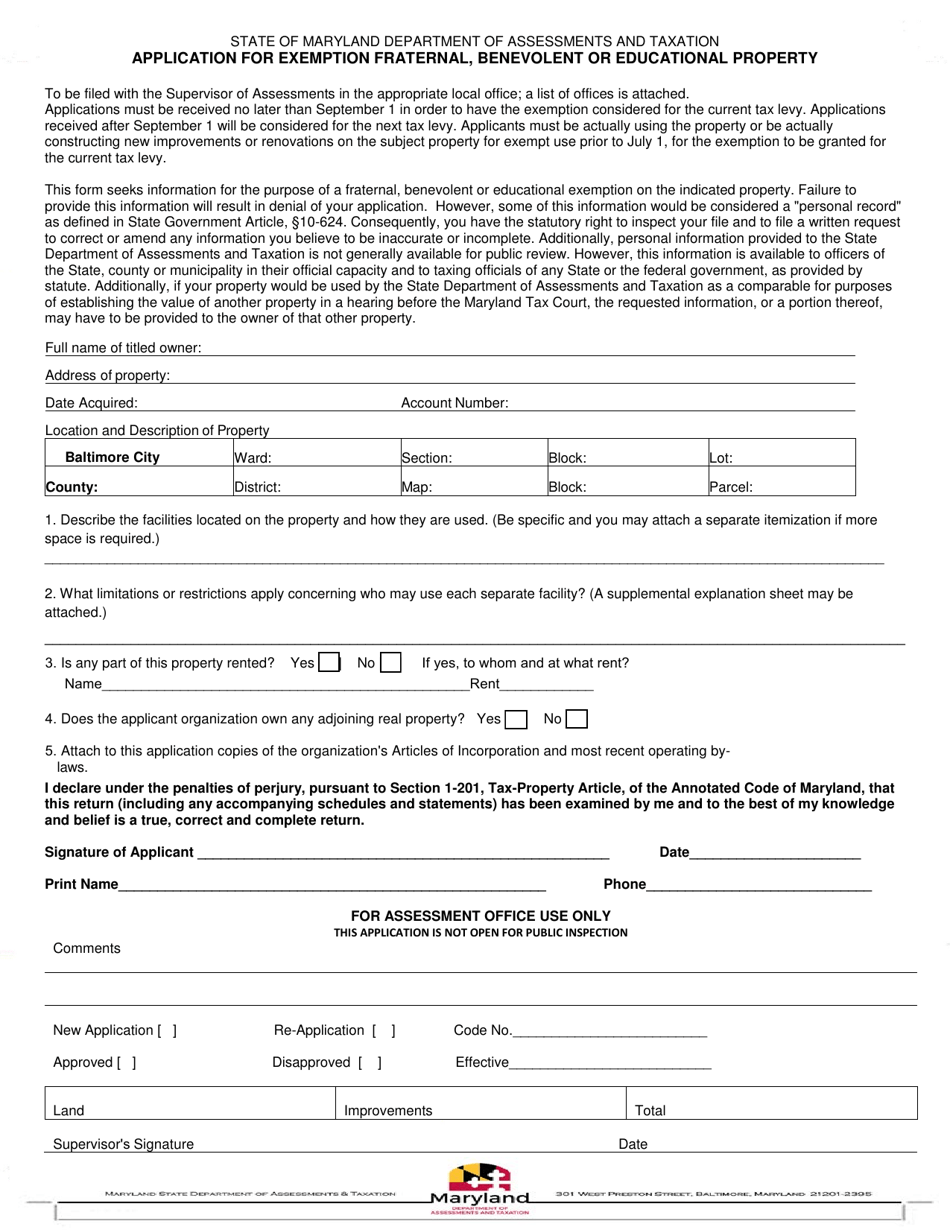

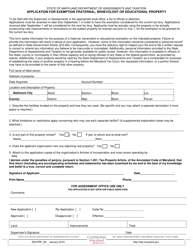

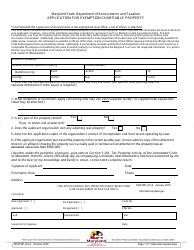

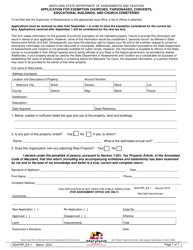

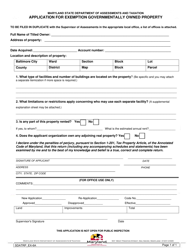

Application for Exemption Fraternal, Benevolent or Educational Property - Maryland

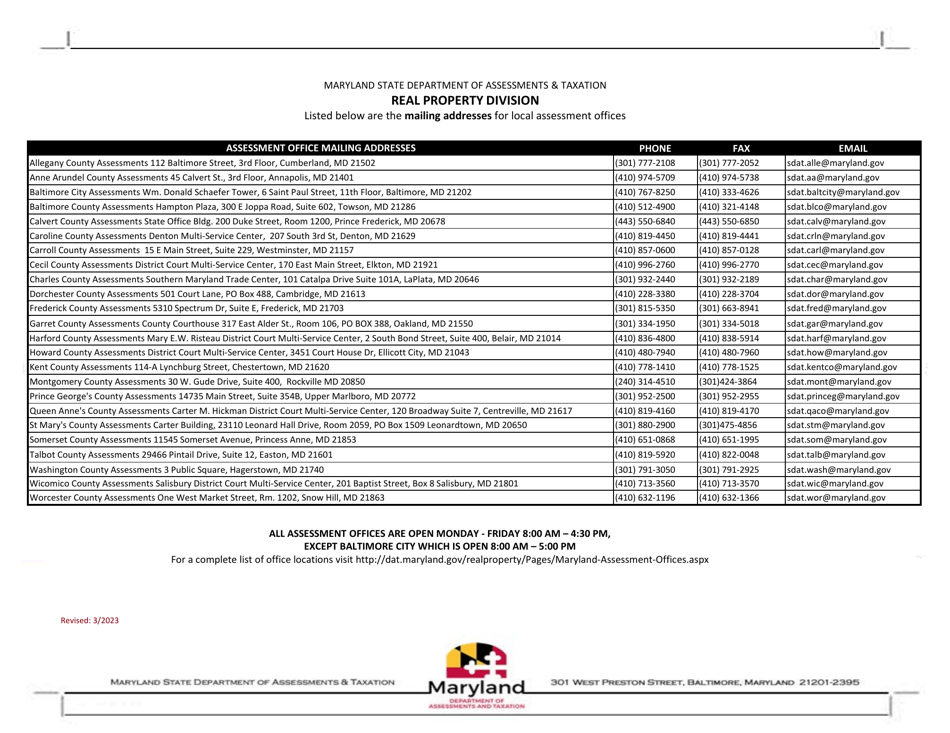

Application for Exemption Fraternal, Benevolent or Educational Property is a legal document that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland.

FAQ

Q: What is an exemption for Fraternal, Benevolent or Educational Property in Maryland?

A: It is a type of property tax exemption for organizations that meet certain criteria.

Q: Who is eligible for this exemption?

A: Fraternal, benevolent, or educational organizations may be eligible.

Q: What are the criteria for eligibility?

A: The organization must meet specific requirements set by the state of Maryland.

Q: What is the purpose of this exemption?

A: The purpose is to provide tax relief for certain types of organizations that benefit the community.

Q: How can an organization apply for this exemption?

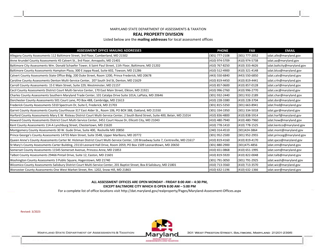

A: The organization needs to submit an application to the Maryland Department of Assessments and Taxation.

Q: Are there any fees associated with the application?

A: Yes, there is an application fee that must be paid.

Q: Is this exemption granted indefinitely?

A: No, the exemption is reviewed periodically and may not be granted indefinitely.

Q: Are all fraternal, benevolent, or educational organizations eligible for this exemption?

A: Not all organizations qualify for this exemption. It depends on meeting specific criteria.

Form Details:

- Released on March 1, 2023;

- The latest edition currently provided by the Maryland Department of Assessments and Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.