This version of the form is not currently in use and is provided for reference only. Download this version of

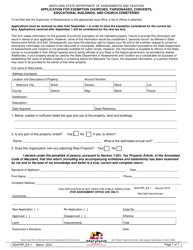

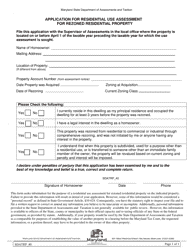

Form SDATRP_EX-6

for the current year.

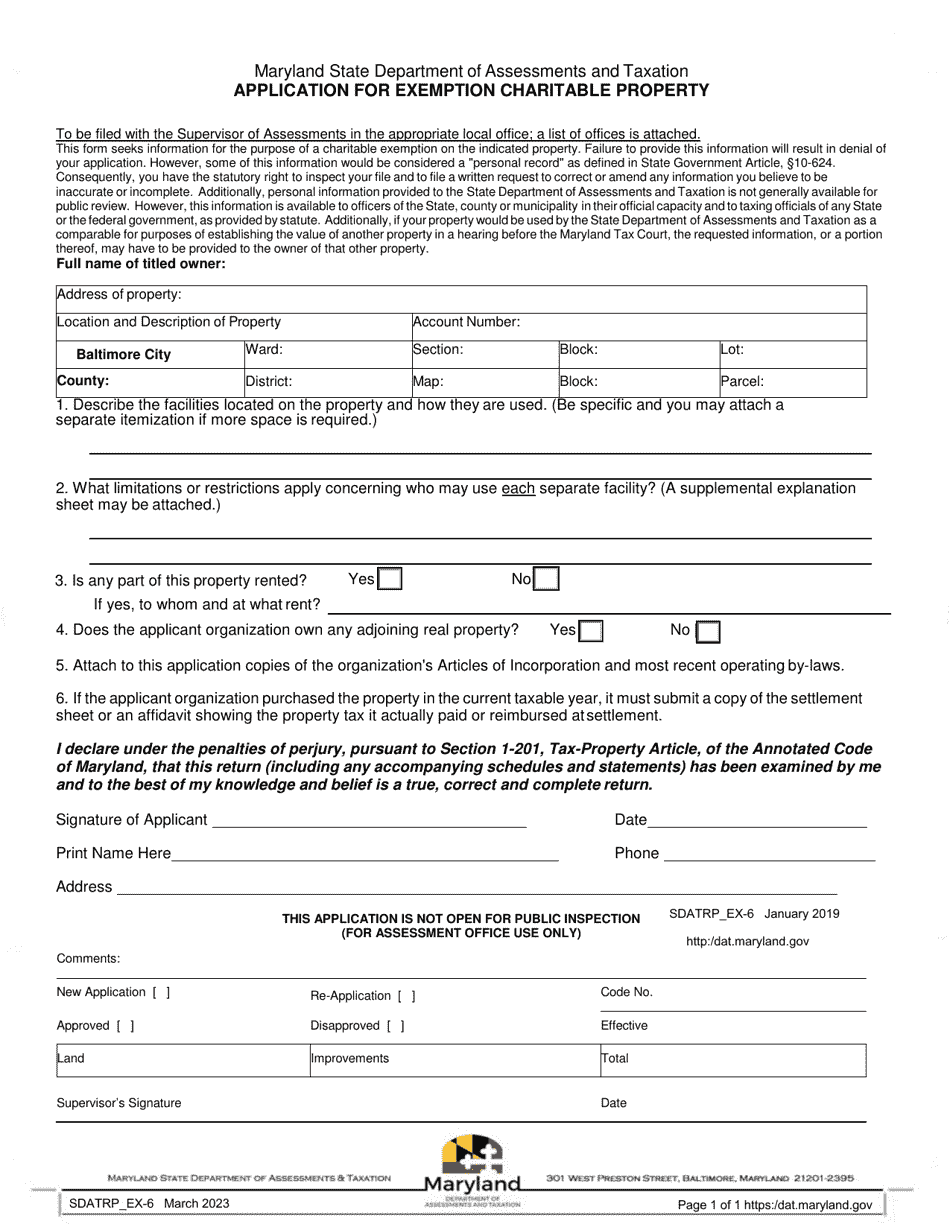

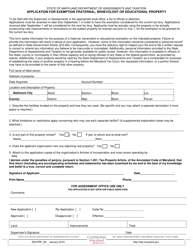

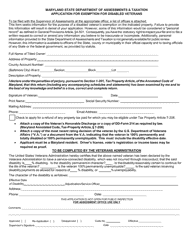

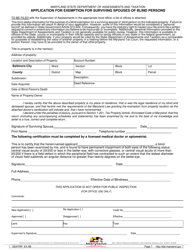

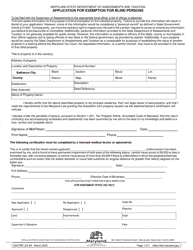

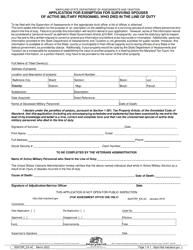

Form SDATRP_EX-6 Application for Exemption Charitable Property - Maryland

What Is Form SDATRP_EX-6?

This is a legal form that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SDATRP_EX-6?

A: SDATRP_EX-6 is an application form for exemption of charitable property in Maryland.

Q: What is the purpose of SDATRP_EX-6?

A: The purpose of SDATRP_EX-6 is to apply for property tax exemption for charitable organizations in Maryland.

Q: Who can use SDATRP_EX-6?

A: Charitable organizations in Maryland can use SDATRP_EX-6 to apply for property tax exemption.

Q: What does the application process involve?

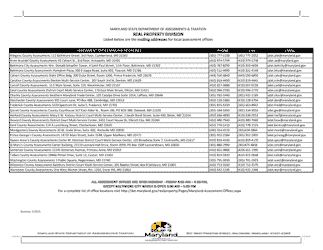

A: The application process involves filling out the SDATRP_EX-6 form and submitting it to the Maryland State Department of Assessments and Taxation.

Q: Are all charitable properties eligible for exemption?

A: Not all charitable properties are eligible for exemption. The eligibility criteria are determined by the Maryland State Department of Assessments and Taxation.

Q: How long does it take to process the SDATRP_EX-6 application?

A: The processing time for the SDATRP_EX-6 application can vary. It is best to contact the Maryland State Department of Assessments and Taxation for more information on the processing timeline.

Form Details:

- Released on March 1, 2023;

- The latest edition provided by the Maryland Department of Assessments and Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SDATRP_EX-6 by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.