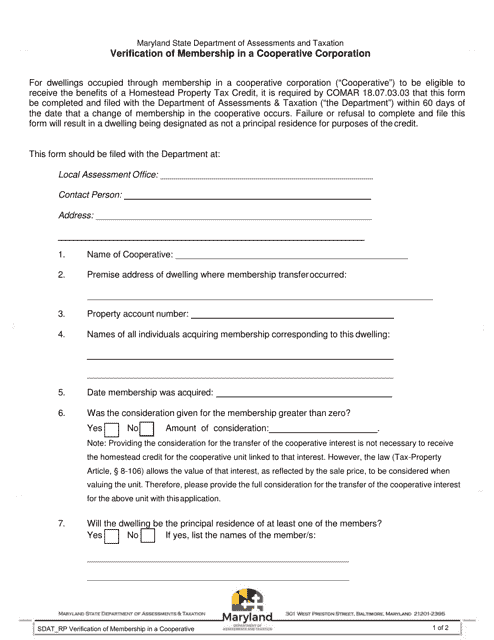

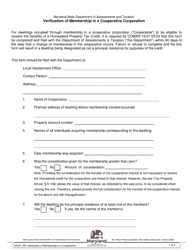

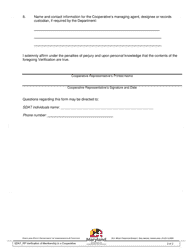

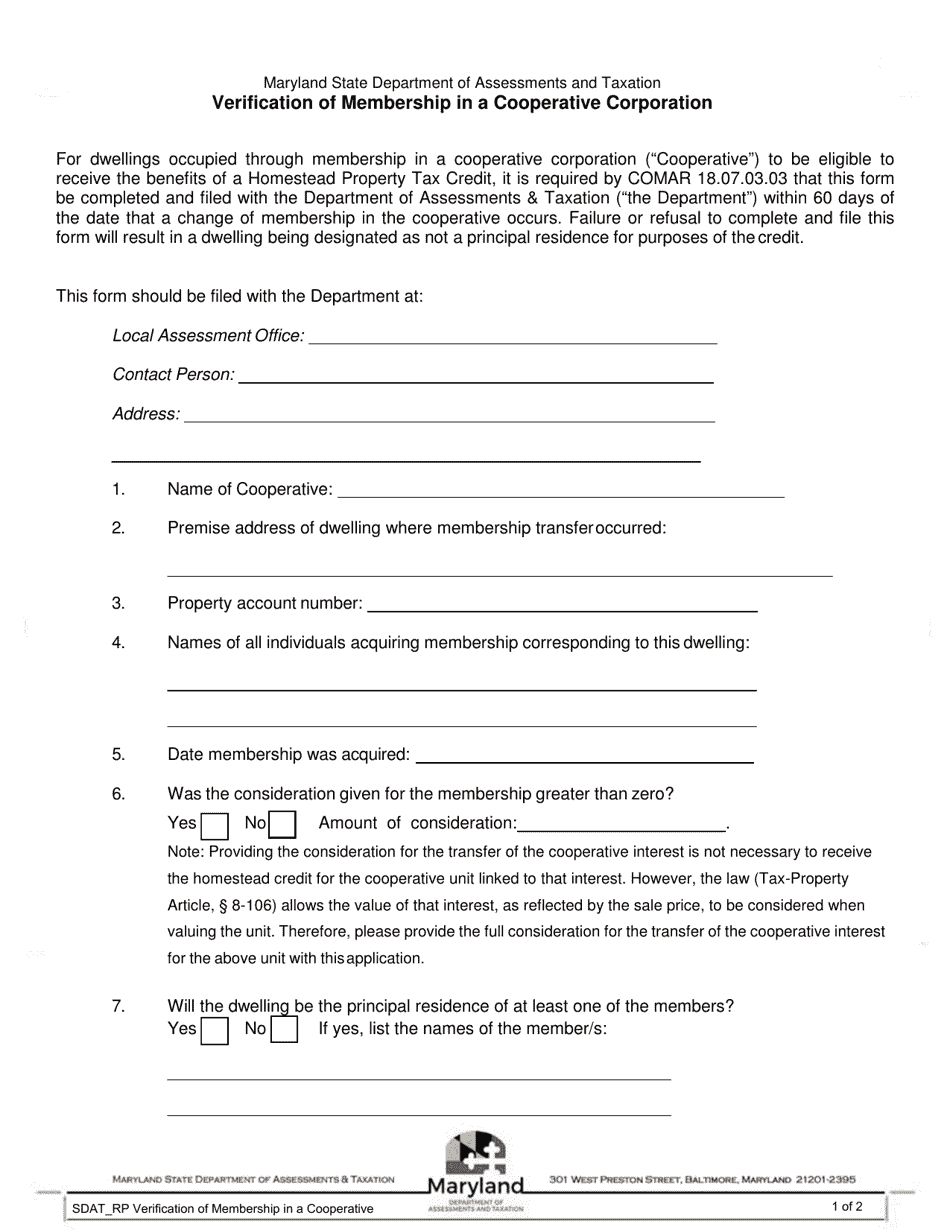

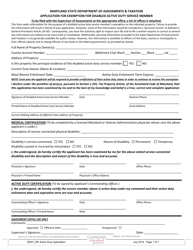

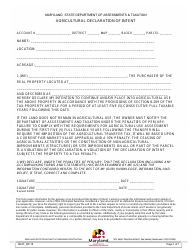

Form SDAT_RP Verification of Membership in a Cooperative Corporation - Maryland

What Is Form SDAT_RP?

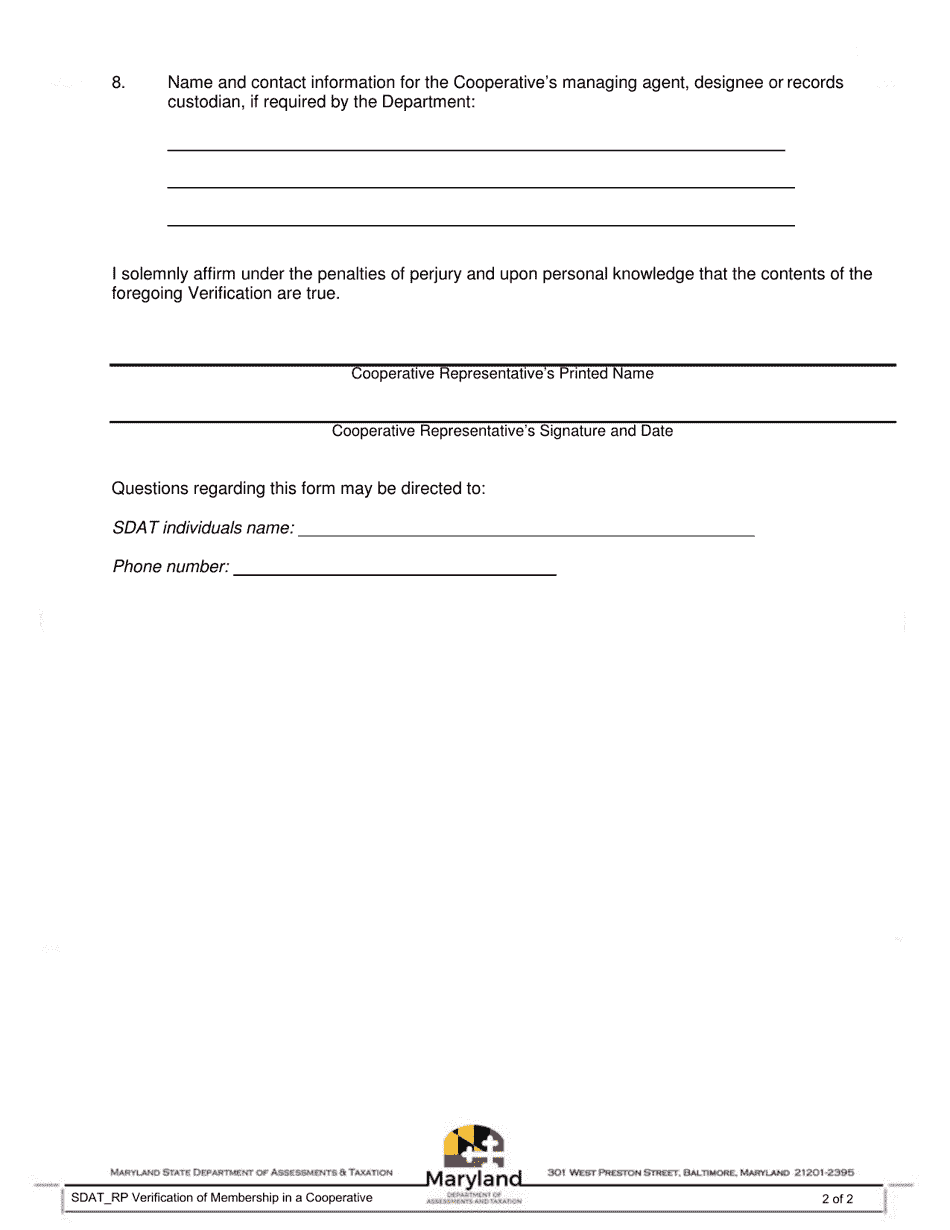

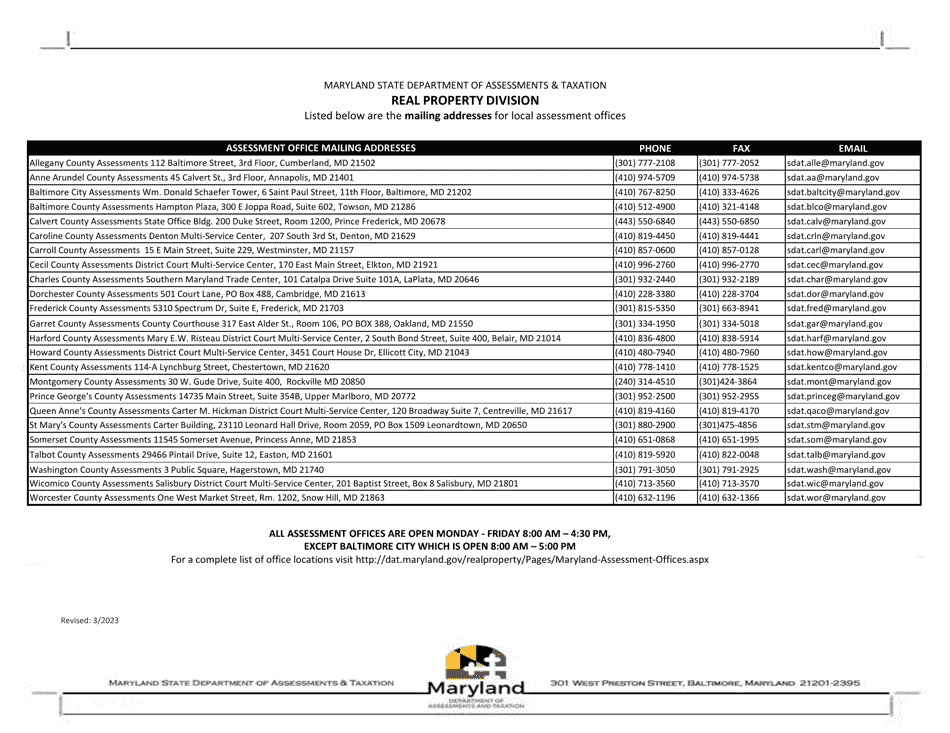

This is a legal form that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form SDAT_RP?

A: The Form SDAT_RP is a document used to verify membership in a cooperative corporation in Maryland.

Q: What is a cooperative corporation?

A: A cooperative corporation is a type of business organization owned and operated by its members for their mutual benefit.

Q: Who needs to file the Form SDAT_RP?

A: Members of a cooperative corporation in Maryland need to file the Form SDAT_RP to verify their membership.

Q: What information is required on the Form SDAT_RP?

A: The Form SDAT_RP requires basic information such as the name of the cooperative corporation, the name and contact information of the member, and the date of membership.

Q: Is there a filing fee for the Form SDAT_RP?

A: No, there is no filing fee for submitting the Form SDAT_RP.

Q: What is the deadline for filing the Form SDAT_RP?

A: The Form SDAT_RP should be filed within 60 days of becoming a member of the cooperative corporation.

Form Details:

- Released on March 1, 2023;

- The latest edition provided by the Maryland Department of Assessments and Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SDAT_RP by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.